Approximately 44% of Colorado’s eligible households with subpar or no internet access are primed to get satellite broadband service from a company that doesn’t offer it yet: Amazon.

Amazon’s Project Kuiper, which is in the process of sending 3,200 satellites to low earth orbit, was preliminarily awarded $25.4 million in federal funds from the Colorado Broadband Office in a final proposal submitted last week. It’s part of the $42.5 billion Broadband, Equity, Access and Deployment program, which Congress approved in 2021 as part of the Infrastructure Act.

A United Launch Alliance Atlas V rocket with a payload of Amazon’s Project Kuiper internet satellites lifts off from Launch Complex 41 at the Cape Canaveral Space Force Station, Monday, April 28, 2025, in Cape Canaveral, Fla. (AP Photo/John Raoux)

A United Launch Alliance Atlas V rocket with a payload of Amazon’s Project Kuiper internet satellites lifts off from Launch Complex 41 at the Cape Canaveral Space Force Station, Monday, April 28, 2025, in Cape Canaveral, Fla. (AP Photo/John Raoux)

Officials from Amazon declined to comment. But they shared a letter sent to the National Telecommunications Information Administration last fall about why its low earth orbit, or LEO, internet service should be a viable option at a time states were in the process of picking fiber-internet companies for their BEAD program.

“Because satellite operators need not lay miles of fiber to connect customers in remote areas, a defining advantage of LEO broadband is that it costs little more to deliver service to remote corners of Montana than to a customer standing in Times Square,” said the letter signed by Kuiper Sysftems’ corporate counsel Christopher Cook.

That lower cost to serve rural Americans ignored by internet providers is what new Trump administration officials asked for in early June when they changed the rules, requiring all states to start over in the so-called Benefit of the Bargain round. At the time, states like Colorado were more than a year into the process and had even awarded preliminary contracts to internet service providers, or ISPs.

With final proposals from 36 out of 56 states and territories submitted as of Friday, the NTIA said in a news release the projected savings so far was at least $13 billion.

That includes savings in Colorado.

Brandy Reitter, executive director of the Colorado Broadband Office, had originally hoped to award the bulk of the state’s $826.5 million BEAD dollars to subsidize fiber technology.

But the requirement to consider the lowest-price bid no matter what the technology reduced the final BEAD subsidy to $420 million in Colorado.

That leaves about $258 million that the state hopes it will be able to use to rewire broadband lines in older apartments, provide internet options like public Wi-Fi and invest in middle-mile infrastructure redundancy.

Whether the state will get to use its remaining allocation will be up to the NTIA, which also has 90 days to approve Colorado’s submission.

So far, Colorado ranks 2nd for satellite’s share

Amazon and rival SpaceX, which already offers Starlink satellite internet in Colorado, were granted 50% of the state’s 90,000 eligible households, or those with internet speeds slower than 100 megabits per second down and 20 mbps up.

At 50%, Colorado’s allocation of BEAD locations to the LEO services was also the second highest rate in the nation, next to Montana, which awarded 62.5% of its locations to LEOs, according to an analysis by Connected Nation, a nonprofit advocate for the expansion of broadband technology.

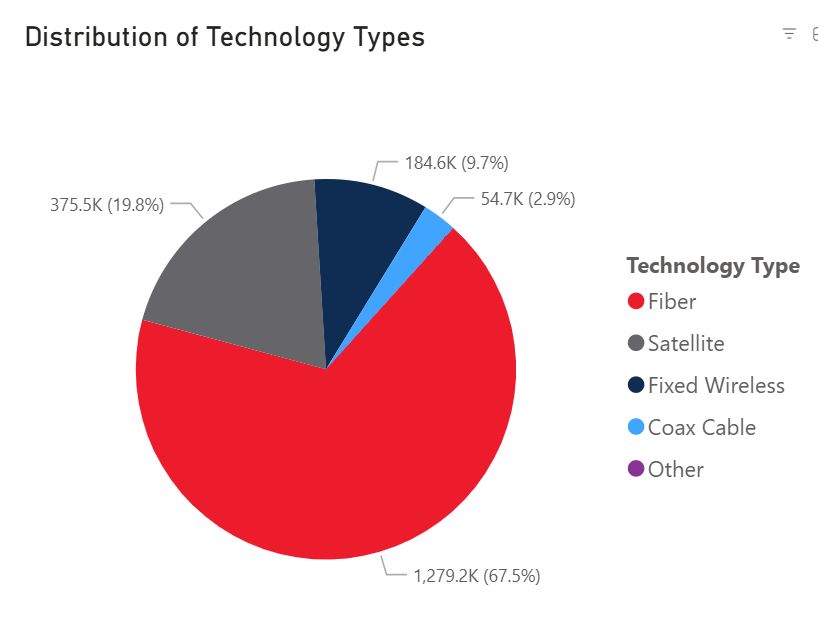

According to Connected Nation’s analysis of BEAD awards submitted by 35 states, fiber dominated the types of technology states picked to use their federal Broadband, Equity, Access and Deployment program dollars. Satellite services from Starlink and Amazon were 19.8% of the awarded locations. (Screenshot)

According to Connected Nation’s analysis of BEAD awards submitted by 35 states, fiber dominated the types of technology states picked to use their federal Broadband, Equity, Access and Deployment program dollars. Satellite services from Starlink and Amazon were 19.8% of the awarded locations. (Screenshot)

Those rates are much higher than the 35 proposals analyzed as of Wednesday. On average, states that submitted final BEAD proposals granted 19.8% of their locations to satellite services, 67.5% to fiber, 9.7% to fixed wireless and 2.9% to coax cable.

However, large states like California, Texas and New York have not submitted their proposals yet, said Colin Reilly, Connected Nation’s vice president of data strategy and technical services.

“I would have expected to see less fiber and more LEO satellites,” Reilly said. “But I think there’s been consistency across the board. There are certainly outliers (like Colorado) but the percentage going to LEO is roughly 10 to 12% for a lot of states. … Many states wanted a higher percentage of fiber because I think they feel that’s a better solution for their constituents. But the overall deciding factor was the lowest cost.”

Executive Director of the Colorado Broadband Office, Brandy Reitter, works from her home office in Eagle, Nov. 1, 2022. (Hugh Carey, The Colorado Sun)

Executive Director of the Colorado Broadband Office, Brandy Reitter, works from her home office in Eagle, Nov. 1, 2022. (Hugh Carey, The Colorado Sun)

Reitter said in an email that the high rate of LEO awards wasn’t unexpected “given CO’s geographical, topographical, excessive cost thresholds, and lack of fiber middle mile infrastructure challenges that limit fiber and fixed wireless broadband expansion.”

She has expressed disappointment that BEAD won’t be able to build fiber infrastructure for all underserved Coloradans, but will offer them wireless or satellite services already available to them. But the cost of satellite was just so much lower, at an average of $561 per location.

“None of our local fiber and especially fixed wireless companies (could) compete with Amazon and SpaceX,” Reitter said. “Amazon bid on nearly every location in CO whereas other states might have had a different result because of who applied to their programs.”

In the data shared by the Broadband Office, Amazon’s proposed cost to add capacity in its satellites for underserved Coloradans is $600 per location. Starlink’s is $1,700.

Fiber installations will get up to $13,000 per location in BEAD subsidies, with tribal locations slightly higher.

In Colorado’s submission to the NTIA, the LEOs were awarded $34.5 million, or 8.2% of the BEAD subsidy. They had originally requested $363 million.

The bulk of the $420 million was granted to fiber-technology companies, which had asked for $464 million.

Colorado’s BEAD winners

The state Broadband Office never publicly shared its preliminary picks before the Benefit of the Bargain round forced the office to redo everything. But several ISPs had confirmed that they were told their bids were preliminary approved.

Matt Larsen, CEO of Vistabeam, which bid in both rounds, found out in December that some of its bids in Larimer and Weld counties were successful, at least preliminarily. But in the Benefit of the Bargain round, there was a big reduction to its BEAD subsidy.

“The original awards were about 45% higher than the post-BOB round,” Larsen said in an email. “When we looked at what changed, the biggest change had to do with locations that were taken out of the BEAD project areas due to new broadband deployment in those areas. The number of locations dropped considerably in some places.”

Reitter confirmed that the latest BEAD revisions had removed 43,000 locations in Colorado, because they already had access to fixed wireless internet service.

In the final round, Loveland-based Hilltop Broadband was awarded $12.8 million to install fiber internet to 1,058 locations in Custer County. The BEAD subsidy comes to just more than $12,000 per location.

The higher cost, at least compared to the LEOs, is because ISPs now need to design the plans, hire staff and do the actual construction and installation. The LEOs just provide capacity on existing satellites.

And in most cases, the last households in the state with mediocre or no internet were the areas ISPs skipped in the past because they were too challenging to install or had limited financial return.

For Hilltop, the BEAD funds will help the company install a 6-mile stretch of fiber to connect service to communities in Westcliffe and Silver Cliff, said Eric Ryplewski, who founded the company in 2013 for the same reason many local ISPs get started: “the lack of internet availability in the area I lived in west of Berthoud.”

Facing rocky and mountainous terrain, Hilltop plans to use aerial construction instead of busting up rocks. That means installing new poles to string fiber to the targeted communities, or leasing space on existing poles owned by Xcel or other rural electric coops. All of that ups the price for installing fiber.

After winning some awards earlier, Hilltop fared worse in the revised round. They’d changed some of their bids to add in fixed wireless internet in order to reduce their prices. Those lost to the LEOs, he said.

“We thought the rules were going to tilt that way,” he said. “We didn’t have as much success on the wireless side. Most of our wins (in the revised round) were on the fiber side for us.”

Conduit, a plastic pipe for fiber optic cables, line up to be buried in a trench along Highway 12 south of La Veta on November 22, 2021. (Hugh Carey, The Colorado Sun)

Conduit, a plastic pipe for fiber optic cables, line up to be buried in a trench along Highway 12 south of La Veta on November 22, 2021. (Hugh Carey, The Colorado Sun)

Most states that met the Sept. 4 deadline are now waiting on the NTIA to approve their proposals, which should happen by early December.

Amazon has publicly said that its satellite internet service will launch to consumers in late 2025. Rajeev Badyal, the head of Project Kuiper, shared a post on social media last week that in network tests of internet speeds, the service was hitting above 1 gigabit, which is close to fiber internet speeds and more than 10-times faster than Starlink’s advertised speed.

Larsen, at Vistabeam, said the company can’t move forward until the subcontracts with the state are signed. After that, design and permitting will take six to nine months. If all goes as planned, fiber construction could start “in late summer of 2026 and take about three years to complete,” he said.

The first customers can typically get online six months after construction starts, he added.

Ryplewski estimated that potential Hilltop fiber customers in Custer County could look forward to service within two years after construction begins.

“I think the state did the best they could to really prioritize fiber and make sure there’s a good, solid connection, giving these people in rural areas an opportunity to have just as good or better service to what you’re going to get back in the metropolitan areas,” Ryplewski said.