Michael Siluk/Alamy

The new wave of weight-loss drugs has taken the world by storm. From Novo Nordisk’s Ozempic and Wegovy to Eli Lilly’s Mounjaro and Zepbound, these blockbuster medications are shrinking appetites and transforming industries.

Racking up tens of billions of dollars in sales, their ripple is already being felt across supermarket aisles, restaurants, fashion chains, gyms, airlines, and more, redefining how people spend their money and forcing businesses to adapt to a new normal.

As the juggernaut rolls on, read on to discover how these wonder drugs are changing the global economy.

All dollar amounts in US dollars.

Vaclav Sebek/Shutterstock

For decades, pharmaceutical companies poured everything into developing one of the holy grails of medicine: a weight-loss drug that actually works. Early attempts delivered modest results, so enthusiasm faded as fast as the headlines.

The breakthrough came with GLP-1 receptor agonists, a class of diabetes medicines that emerged in the noughties, which have their origin in the venom of the gila monster lizard, believe it or not. Doctors were amazed to discover patients were losing huge amounts of weight on the niche drugs. The astonishing side effect stunned the medical field and wowed the drug firms eager for the next big hit.

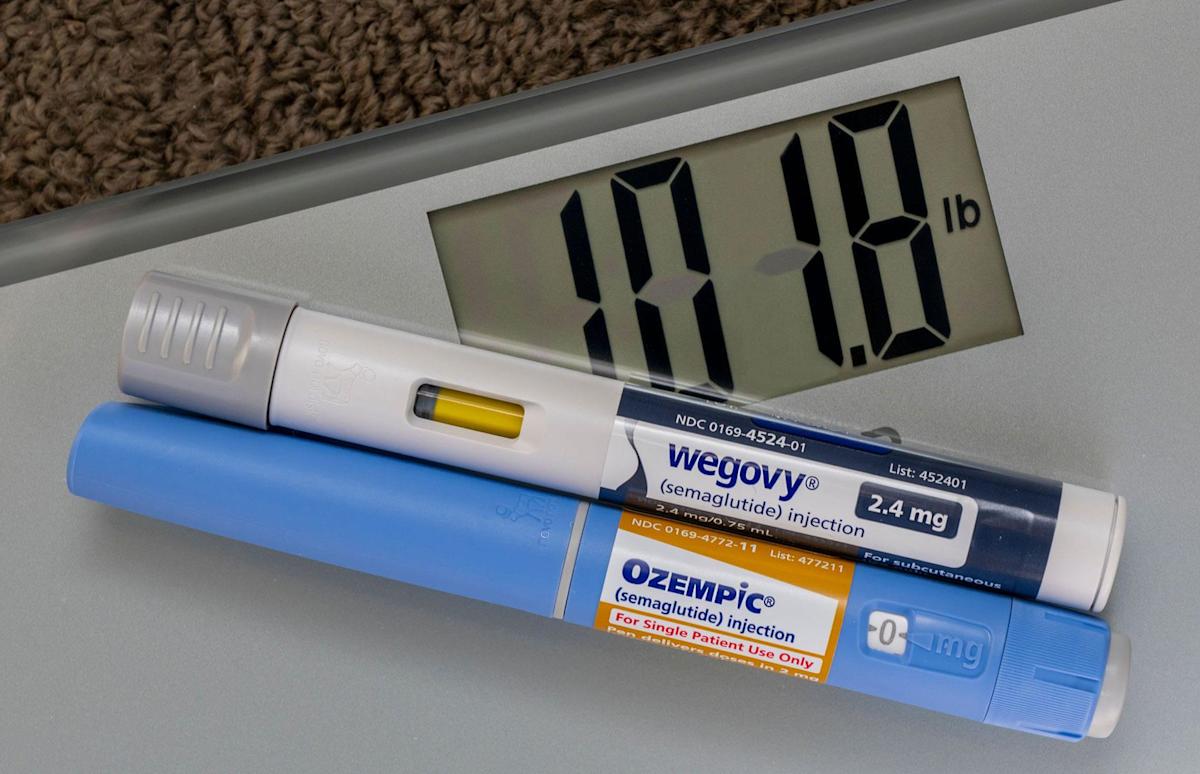

Michael Siluk/Alamy

In 2014, Novo Nordisk’s Saxenda became the first GLP-1 medication approved in the US specifically for weight loss. But Ozempic, the Danish drugmaker’s diabetes treatment that got the go-ahead in 2017, ended up stealing the spotlight, thanks to better results and weekly dosing.

Weight-loss-specific Wegovy arrived in 2021 and the drugs started going mainstream, buoyed along by celebrity uptake, influencer hype, glowing news stories, and a star turn on The Dr. Oz Show.

ole999/Alamy

Novo Nordisk’s American arch-rival Eli Lilly won US approval for its Mounjaro GLP-1 diabetes drug in 2022, and its weight-loss sibling Zepbound landed in 2023.

America moved first, but the EU, UK, Australia, China, Japan, and other major markets haven’t been far behind. By 2024, the drug class had gone truly global and sales hit the roof. As per the latest data, 12% of Americans have already taken a GLP-1 drug, as has one in 10 Brits, with other major markets likely seeing similar numbers.

MADS CLAUS RASMUSSEN/Ritzau Scanpix/AFP via Getty Images

Last year, Novo Nordisk’s Ozempic and Wegovy, which are brand names for its GLP-1 drug (called semaglutide), generated bumper global sales of $25.9 billion (£19.2bn).

The bonanza was instrumental in growing the Danish firm’s overall revenues by an impressive 25.5%, with the total for 2024 coming in at $42.1 billion (£31.3bn).

Kittyfly/Shutterstock

The company’s sensational success has had an outsized effect on the Danish economy. Incredibly, its game-changing weight-loss drugs saved the nation from zero growth in 2023.

Last year, Novo Nordisk’s revenues represented a whopping 10% of Denmark’s GDP – and for much of 2023 and 2024, the business was worth more than the nation’s annual output, reigning as Europe’s most valuable enterprise.

JarTee/Shutterstock

Growth has slowed in 2025 as Novo Nordisk loses market share to Eli Lilly’s alternatives and cheaper copycats. Its share price has tanked as a result. But the consensus seems to be that the downturn is more a blip than a long-term trend.

Considering semaglutide’s potential to treat an array of conditions from Alzheimer’s disease to substance addiction and high blood pressure, not to mention the promise of new obesity treatments on the horizon, Novo Nordisk is in a strong position, despite the growing competition.

Katherine Welles/Shutterstock

Playing catch-up, Eli Lilly saw even more impressive growth in 2024 of 32%, mainly off the back of Mounjaro and Zepbound, which are the brand names for its market-disrupting tirzepatide drug. Crucially, there is some evidence to suggest the drug can be slightly more effective than Novo Nordisk’s semaglutide.

Eating into the Danish competitor’s market share, the medications pulled in $16.5 billion (£12.3bn), pushing Eli Lilly’s revenues to $45 billion (£33.4bn). This year, growth is expected at a stellar 34.3%, while Novo Nordisk’s predicted growth stands at 16.4%.

heliopix/Shutterstock

Eli Lilly has been battling it out with Novo Nordisk to be the first drug company to bring to market the next game-changer: a widely available weight-loss drug in pill form.

Eli Lilly is betting big on its orforglipron pill. But Novo Nordisk’s oral Wegovy has been shown to be marginally more effective in trials of the drugs and is slated to garner US approval later this year, while orforglipron isn’t expected to get the all-clear until next year. That said, the Eli Lilly drug may turn out to be cheaper, which could give it a distinct advantage.

Peter Dazeley via Getty Images

Meanwhile, Eli Lilly is at risk of losing market share in the UK. In August, the company announced it would be hiking the price of Mounjaro for private patients in the country to align it more closely with prices in the US and parts of Europe.

With patients jumping ship to Novo Nordisk’s Ozempic and Wegovy in their droves, Eli Lilly has since watered down the increase by offering UK pharmacies a discount. But whether it can win back its lost customers is open to question.

Mongkolchon Akesin/Shutterstock

While both weight-loss drug giants have their share of challenges, the future looks incredibly bright. As we’ve mentioned, GLP-1 medications are showing promise as treatments for a myriad of conditions and are also being improved with newer, more effective formulations that have fewer side effects, with Novo Nordisk and Eli Lilly at the vanguard of research and development. And the financial rewards are set to be even more breathtaking.

By 2030, the global market for these drugs is expected to be worth $100 billion (£74bn), a number expected to increase during the 2030s with new approvals and expanded use.

Zamrznuti tonovi/Shutterstock

The economic ripple effect of the weight-loss drug revolution is leaving few industries untouched. Supermarkets in the US and elsewhere are losing billions of dollars as appetite-suppressed GLP-1 users slash spending on food and drink. A massive $6.5 billion (£4.8bn) has already been shaved off US grocery spending, according to Big Chalk Analytics. And no wonder.

Research from Cornell University has revealed that the typical GLP-1 user spends 5.5% less on groceries in the first six months on the medication, while higher-income users cut back by 8.6%. Savoury snacks see the biggest drop, with expenditure on these calorific treats down over 10%.

Courtesy Nestlé

Big Food isn’t taking the threat to its bottom line lying down. The majors have started to scale back their unhealthier ranges and pivot their offerings to include GLP-1-friendly products, such as ready meals and shakes aimed at people coming off the drugs who want to maintain their weight loss.

Nestlé has led the way. Last year, the Swiss multinational rolled out Vital Pursuit, a line of portion-controlled frozen foods for GLP-1 users high in protein, fibre, and micronutrients. Nestlé has also launched a website highlighting products for the GLP-1 weight-loss journey, such as vitamins, probiotics, and electrolytes.

PJ McDonnell/Shutterstock

Hot on Nestle’s heels, Conagra Brands has introduced an industry first. The US food titan has slapped GLP-1-friendly stickers on 26 products in its Healthy Choices range, directing shoppers towards options high in protein and fibre, and low in calories.

The company is well-positioned for the pivot, with several ranges aimed at health-conscious shoppers. These include its better-for-you frozen meals, which have seen an 8% sales uptick courtesy of GLP-1 users. Other major firms like PepsiCo and Kellogg’s are adapting by adding more protein and fibre to their products.

Ground Picture/Shutterstock

Meal delivery services are also rising to the challenge. A slew of providers have expanded their menus to include subscription plans specially adapted for people taking weight-loss medications.

GLP-1 users in the US and Canada are spoilt for choice, with Trifecta, FitEx, MealPro, BistroMD, and Daily Harvest offering meals and drinks catered to their needs. But the rest of the world is catching up. By way of example, the UK’s Field Doctor now has a GLP-1-friendly range, as does Australia’s Youfoodz.

Deo Tree/Shutterstock

Surveys suggest GLP-1 users are dining out less and ordering lighter: think half portions, protein-first plates, and shareable small dishes. Restaurants are going all out to accommodate their needs, but the hospitality industry is reeling as it faces significantly lower revenues.

As you might imagine, fast food chains are likely to struggle most as the weight-loss drug revolution gathers pace. McDonald’s for instance is forecast to lose 28 million customer visits a year in the US alone, and its stock has taken a battering as analysts fret over its future.

Robert Evans/Shutterstock

Restaurants are often reliant on alcohol sales but they too are being impacted by GLP-1 drugs, presenting a double-whammy for the industry. These medications can turn users off alcohol as well as food, with many going teetotal. Global alcoholic beverages leader Diageo is feeling the pain and its share price is suffering as a result.

Bars and pubs, which are at the sharp end, are doing even worse. In January, a wine bar in Dallas shut its doors forever, with the owner partly blaming the rise of Ozempic and other GLP-1 drugs. Looking ahead, it’s likely that drinks manufacturers and hospitality venues will offer more low and zero-alcohol beverages as they seek to adapt and offset their losses.

MilanMarkovic78/Shutterstock

The weight-loss drug revolution is proving both a blessing and a curse for the fitness industry. On one hand, gyms are cashing in from GLP-1 users keen to preserve muscle mass by offering tailored strength-training workouts and lifestyle advice.

On the other, the industry is reporting lower footfall overall. Gen Z in particular are increasingly opting to take weight-loss drugs over working out. Plus, the nausea a lot of users experience can make strenuous physical activity difficult or unappealing.

JHVEPhoto/Alamy

The weight-loss drugs boom is upending the fashion industry. The biggest casualty is the plus-sized clothing market, which is shrinking fast. Standalone chains that cater exclusively to larger customers are bearing the brunt.

With fewer fuller-figured shoppers, they’re having to cut ranges and close stores. For instance, US chain Torrid is in the process of shuttering 180 locations. And with customers gravitating towards smaller sizes, general clothing retailers are quietly axing the biggest sizes.

Victor Boyko/Getty Images

The Ozempic effect is even more striking in the realm of high fashion. As per Vogue Business, plus-sized looks made up a minuscule 0.3% of the ensembles on Autumn/Winter ’25 catwalks, down from (a still minuscule) 0.8% the previous season.

Worryingly, it appears ultra-thin is back and size inclusivity is out. Super-skinny models are being feted again from Paris to New York, social media has been abuzz with ‘slim-arm’ and ‘shrinking girl summer’ content, while the number of ads banned for featuring underweight models has mushroomed.

Rawpixel.com/Shutterstock

On a positive note, the fashion industry is benefitting from GLP-1 users embarking on shopping sprees to refresh their wardrobes. Private shoppers are rushed off their feet right now.

Athleisure clothing and revealing body-con styles are selling especially well, while the resale market is positively flourishing as GLP-1 users offload the pieces that no longer fit them. Tailors are also doing a roaring trade altering the garments users want to hold on to.

Stockbroker/Alamy

The weight-loss drugs boom is proving a boon for the cosmetic surgery industry too. Shedding the pounds rapidly often causes skin laxity. To combat this, GLP-1 users are flocking to clinics for everything from complexion-tightening and fat transfer procedures to breast enhancement and deep-plane face-lifts.

Forget the Mommy Makeover; the Ozempic Makeover is now the hottest trend in cosmetic surgery.

Heorshe/Shutterstock

The makeover treats the dreaded ‘Ozempic Face’, a gaunt, hollowed-out and jowly look that some GLP-1 users develop. But there are plenty of non-surgical options out there too.

The skincare industry is now offering a new crop of anti-Ozempic Face products. They range from a dedicated SkinCeuticals serum to Image Skincare’s VOL.U.LIFT GLP-1 4D Skin Rebound Complex. Meanwhile, Nestlé is launching collagen peptide supplements specifically formulated to deal with the problem.

New Africa/Shutterstock

Old-school treatments for obesity have been taking a backseat to the GLP-1 drugs. Take bariatric surgery. While the procedure is actually more effective for sustainable weight loss, surgeries declined by 25% in the US from 2022 to 2023 and continued the slump in 2024.

The procedure has, however, made something of a comeback this year, with its superior results drawing in patients, particularly those who can’t deal with the nausea and other side effects that GLP-1 drugs can cause.

Sundry Photography/Shutterstock

The traditional diet industry is in the midst of a major disruption brought about by the weight-loss drug revolution. WeightWatchers, the global market leader, has been shedding subscribers. It was dealt a bitter blow last year when Oprah Winfrey exited the board after revealing she was using GLP-1 medications to drop the pounds. And earlier this year, the company filed for bankruptcy to restructure its debts. But WeightWatchers is fighting back.

It’s now offering weight-loss drugs in the US via a new online clinic, as well as a comprehensive GLP-1 Weight-Loss Program, which is also available in overseas markets.

Matej Kastelic/Shutterstock

The impact of the weight-loss drug boom on the travel industry is shaping up to be profound. For airlines, lighter passengers should mean lower fuel costs, which could translate to cheaper fares. Active and adventure travel providers are also among the winners. Ditto all-inclusive hotels and cruise lines, which should see overheads fall as guests eat and drink less of the complimentary food on offer.

The losers are likely to be companies that rely on food and drink as a key source of revenue, as well as firms providing foodie-oriented packages.

QualityHD/Shutterstock

Food and drink bankrolls much of the entertainment industry, from cinemas to theme parks. With profit margins typically slim, businesses are hugely reliant on these concessions, so the GLP-1 revolution spells trouble for the sector.

It’s ailing as moviegoers on weight-loss meds eschew the XXL popcorn buckets and soft drinks, and Ozempic-taking theme park attendees split meals and forgo calorific snacks. In addition to offering healthier options, companies may choose to offset the losses by raising ticket prices, as well as focusing more on retail offerings and upsells like priority seating and skip-the-line passes.

Yankovsky88/Shutterstock

The economic impact of the weight-loss drug revolution is still unfolding, but it’s already significant. And beyond the more direct effects, these medications could help people lead healthier, longer lives, resulting in less work absenteeism, less pressure on healthcare systems, and a generally fitter, more productive and socially engaged society.

With the world getting slimmer, the balance is tilting and only those businesses that can adapt will thrive.

Now discover the supersized costs of living in a larger body