A new report highlights a striking divide in how U.S. employers and employees view retirement readiness.

PNC Bank’s annual Financial Wellness in the Workplace Report found that while 78 percent of employers believed their workers were prepared for retirement, 45 percent of employees felt the same.

That gap reflects a broader shift in the U.S.’s retirement landscape. Over the past few decades, the responsibility for securing a financially stable retirement has moved away from employers and toward workers themselves. While companies measure readiness by the existence of benefit offerings, employees are more focused on whether those savings will be enough to cover decades of living expenses.

In the United States, most retirement saving happens through employer-sponsored plans. The most common is the 401(k), where employees set aside pretax or Roth contributions, often with an employer match. Nonprofit organizations and schools typically provide 403(b) plans, while state and local governments use 457(b) plans.

Federal employees have access to the Thrift Savings Plan. Some unionized and government jobs still offer traditional pensions that guarantee fixed monthly payments, though these are now rare in the private sector. Smaller businesses often choose SIMPLE or SEP individual retirement accounts because they are easier to administer, and some companies provide alternatives such as profit-sharing plans, hybrid cash balance plans or employee stock ownership plans.

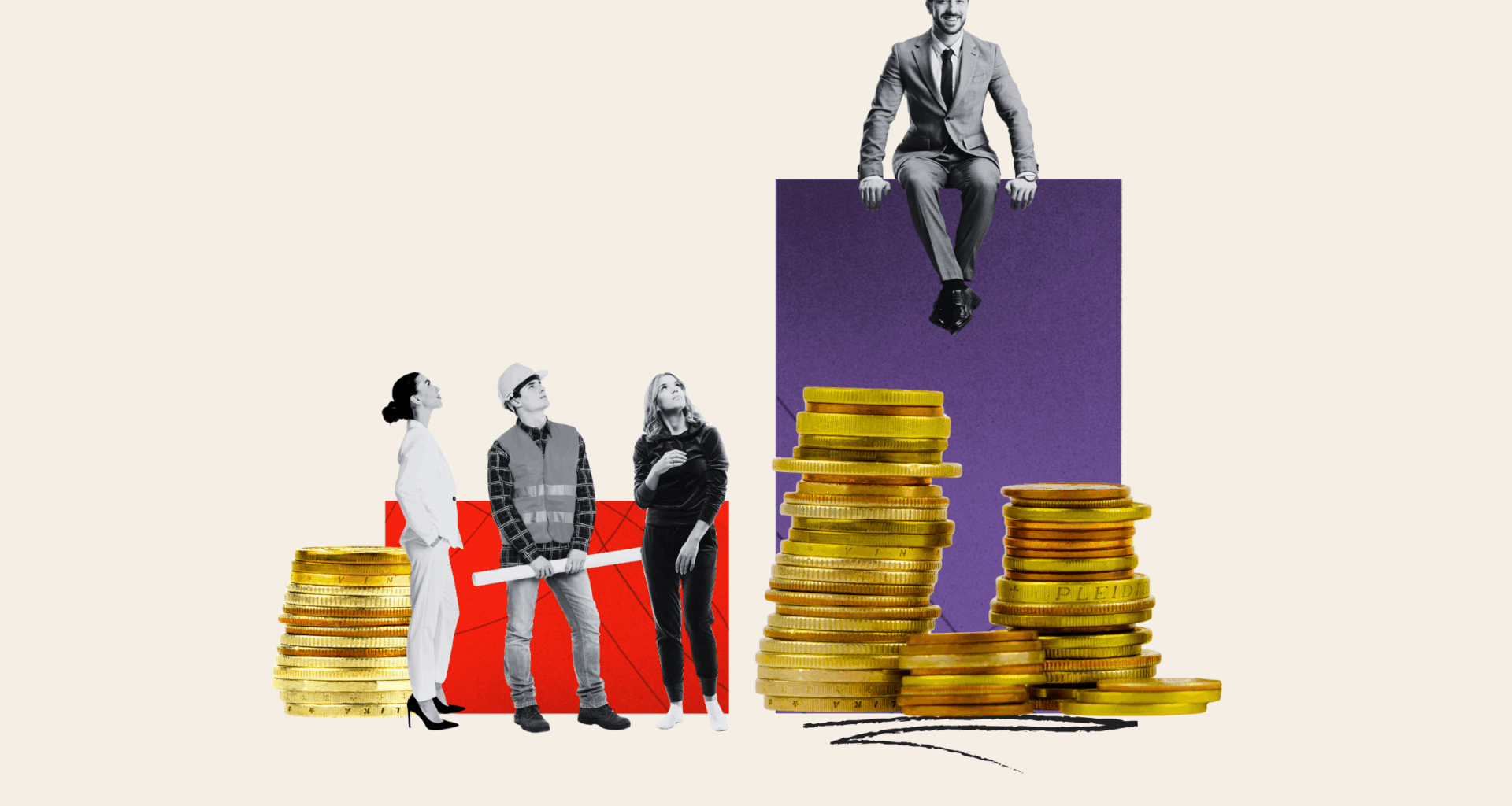

A composite image illustrating the retirement gap between American workers and their employers.

A composite image illustrating the retirement gap between American workers and their employers.

Newsweek Illustration/Getty Images/Canva

Financial Woes

Despite this range of options, many Americans remain uneasy about their prospects for life after the workforce—if there are any at all.

A 2023 Pew Research Center report found that about one in five Americans aged 65 and older were still working, almost double the share from 35 years ago. Longer life expectancies, inflation and higher living costs mean more workers feel unable to leave the workforce when they’d like.

“Employers tend to equate retirement readiness to the benefits being offered—a 401(k), an employer match or contribution, and possibly their investment in planning tools as well,” Kelsey Szamet, a partner at Kingsley Szamet Employment Lawyers, told Newsweek. “Employees’ perception is far different, and they can see their stagnant wages, rising cost of living and competing financial obligations.”

She added that participation in a plan does not guarantee security: “Employers see employee participation, so they assume employees are ready. However, there are many employees who simply cannot contribute enough to be secure.”

Lack of Awareness

Megan Yost, a senior vice president of thought leadership and insights at Segal, said many employers have added automatic enrollment and escalation features to plans to boost savings. Yet awareness remains a challenge.

“Employees may lack awareness of what’s available to them and may not take full advantage of their entire benefits package,” Yost told Newsweek.

She added that companies often did not see the full financial picture—debt, child care costs or other competing priorities—that shaped employee confidence. “While employers provide tools to help employees plan for retirement, many employees bear the responsibility for figuring out how to make it happen,” Yost said.

Psychological Restraints

The psychological weight of retirement planning is another overlooked factor. Kristina Muller, a workplace mental health therapist, explained that offering tools was not always enough.

“Employers offer more tools than ever before, but we need to make sure these tools are matched with the skills of an aging workforce who may not know how or where to use them,” she told Newsweek.

Muller argued that retirement planning could feel daunting because it brought up fundamental anxieties about the future.

She said, “It brings up our primal fears around mortality and the end as we know it, and in many ways, retirement can feel like a very real first step toward it.”