A quarter century after an F3 tornado nearly leveled the then-Bank One Tower downtown, the building now known as The Tower has done more than just replace the plywood that once earned it the nickname “Plank One.”

Nearly 28,000 square feet of new restaurants and retail — including Polanco, Reata and Bella Gente — are now part of the two-building, mixed-use project of The Tower and 500 Taylor.

The Tower, at 500 Throckmorton, is a 37-story high-rise condo with 287 upscale residences and retail and restaurant space.

Named for its address, 500 Taylor, has a total of 111,000-square-feet of Class-A office space. Corporate real estate advisory firm Citadel Partners handles the exclusive leasing of the office project, with efforts led by Cullen Donohue.

“Downtown Fort Worth continues to thrive as a hub for both business and lifestyle, and the addition of the premier dining at The Tower strengthens that momentum,” said Donohue.

500 Taylor has 68,136 square feet of available office space, including a full top-floor suite with panoramic views. Following a $4 million renovation in 2024, the property features modern, light-filled workspaces and 6,686 square feet of available ground-floor retail. Building naming and signage rights are available, said Citadel’s Breck Besserer.

The previous tenant at 500 Taylor was Dickies, which relocated its headquarters to California in November 2024.

“The Tower and 500 Taylor represent one of the most compelling opportunities in downtown Fort Worth,” said Besserer. “With limited options available for office tenants needing 60,000 square feet or more, these buildings stand out by pairing rare large-block office space with unmatched access to dining, retail and residential amenities right at your doorstep.”

Reata returned to its original home at The Tower in July 2024, but instead of its original 35th-floor location where it was a sitting duck during the tornado, it is ensconced on the ground floor at the corner of Throckmorton and 4th Street. Bella Gente, also calling The Tower home, is a casual, authentic Italian focaccia and pizza restaurant, and restaurant tenant Polanco specializes in authentic, upscale Mexican cuisine.

Fort Worth market returning to balance

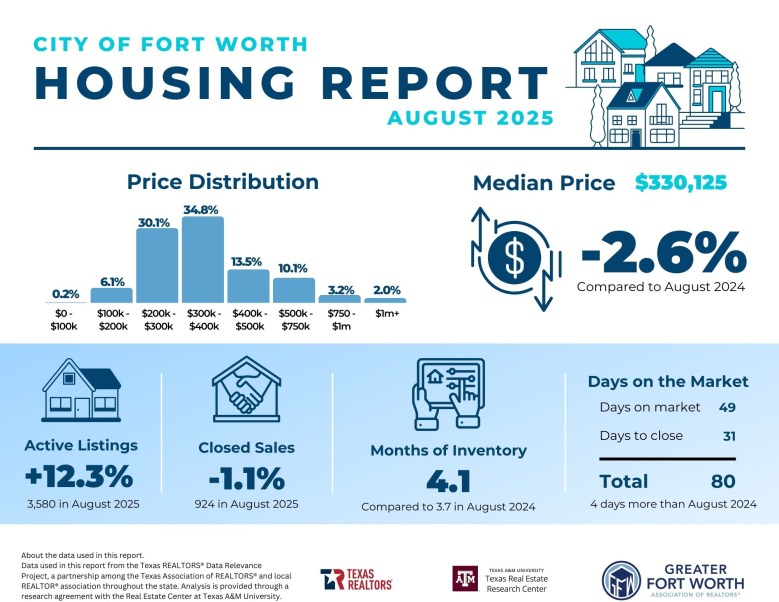

City of Fort Worth Housing Report August 2025. (Courtesy image | Greater Fort Worth Association of Realtors)

City of Fort Worth Housing Report August 2025. (Courtesy image | Greater Fort Worth Association of Realtors)

Fort Worth continues to move toward a more balanced market between buyers and sellers, according to data from the Greater Fort Worth Association of Realtors.

With 4.1 months of inventory, up 0.4 months from August 2024, and active listings up 12.3%, Fort Worth remains one of the most affordable cities in the region. More than 60% of Fort Worth’s closed sales were in the $200,000 to $400,000 range and its median price stands at $330,125, down 2.6% from August 2024.

“We are pleased to see the region shift to a more balanced market,” said Paul Epperley, president of the association and a Realtor at Hallowed Homes. “Having more inventory allows families to upgrade their homes and leaves room for first-time homebuyers to enter the market with a bit more negotiating power.”

Parker County is experiencing a more balanced market with 5.9 months of inventory. It is also the highest-priced county in the region, with the median home price at $470,000. Johnson County reported 5.3 months of inventory, down 0.2 months year over year, and most homes sold were in the $200,000 to $400,000 price range, with a median price of $330,000.

Communities around the region with notable year-over-year statistics include Aledo, with its closed sales up 500%; Burleson’s closed sales are up 13.3%; and Granbury is showing momentum with a 25.7% increase in active listings and 92.9% increase in closed sales.

Fort Worth firm acquired

Fort Worth-based Crestline Management L.P., an alternative investment manager with approximately $17 billion in assets under management, has been acquired by New York-based Rithm Capital Corp., a global alternative asset manager.

The acquisition expands Rithm’s capabilities across direct lending, fund liquidity solutions, insurance and reinsurance which adds to its asset-based finance, real estate, structured and corporate credit, and energy and infrastructure strengths.

Rithm’s combined platform, including Crestline, will be comprised of $98 billion in investable assets, consisting of $45 billion of assets on balance sheet and approximately $53 billion in assets under management, and will offer institutional investors a broad suite of innovative strategies across asset classes and return profiles — powered by over 200 seasoned investment professionals.

Founded in 1997, Crestline is a fully integrated platform offering private credit and alternative investment strategies across direct lending, opportunistic credit, and fund liquidity solutions. It also manages investment strategies on behalf of its wholly owned insurance company and affiliated reinsurer. Since 2018, the firm has tripled its assets under management.

Upon closing of the transaction, Crestline’s investment team, committees and strategies will remain unchanged, and the firm will maintain its existing offices in Fort Worth, New York, Toronto, Tokyo and London.

“We are excited to be joining Rithm, an industry-leading alternative asset manager with deep expertise in asset-based strategies and a shared focus on building innovative solutions that deliver alpha to investors,” said Doug Bratton, founding partner and CEO of Crestline. The transaction is expected to close in the fourth quarter 2025, subject to customary regulatory approvals and closing conditions.

Pinstripes rolls an 11, a Chapter 11

Bowling, dining and event space Pinstripes has closed its Clearfork location. The closing comes as the company’s parent company, based in Northbrook, Illinois, filed for Chapter 11 bankruptcy. Pinstripes also closed its Houston location.

Do you have something for the Bob on Business column? Email Bob Francis, business editor for the Fort Worth Report, at bob.francis@fortworthreport.org.At the Fort Worth Report, news decisions are made independently of our board members and financial supporters. Read more about our editorial independence policy here.

Related

Fort Worth Report is certified by the Journalism Trust Initiative for adhering to standards for ethical journalism.

Republish This Story

Republishing is free for noncommercial entities. Commercial entities are prohibited without a licensing agreement. Contact us for details.