A protester brandishes a smoke flame by a barricade on fire during a demonstration part of the “Bloquons tout” (“Let’s block everything”) protest movement, in the south east of Paris, on September 10, 2025. The broad anti-government campaign, dubbed “Bloquons tout” (“Let’s block everything”), calls for a ahutdown of France on September 10 with a string of protest actions and civil disobedience around the country.

Alain Jocard | Afp | Getty Images

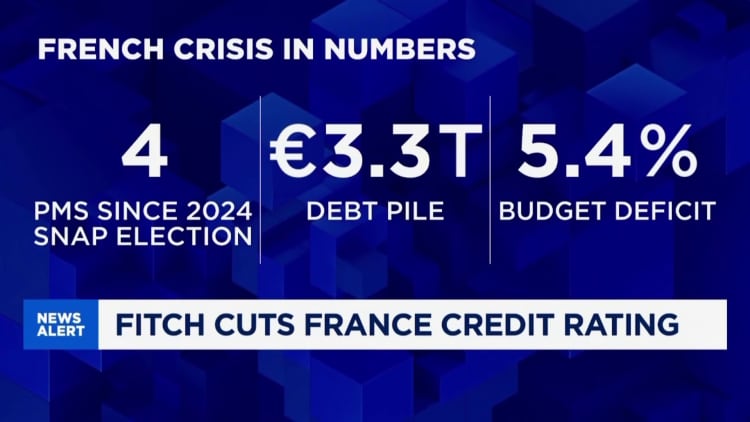

France’s borrowing costs ticked higher on Monday as traders reacted to Fitch’s decision Friday to downgrade the country’s credit rating amid ongoing uncertainty over the country’s political leadership.

Fitch downgraded France’s credit rating from ‘AA-‘ to ‘A+’ with a stable outlook, citing a “high and rising debt ratio” and warning that “political fragmentation” was hindering fiscal consolidation.

On Monday morning, the yield on France’s benchmark 10-year government bond initially moved 7 basis points higher to 3.5132% at 7.40 a.m. London time, whereas the yield on the 30-year bond, or OATs as they’re called in France, rose 8 basis points to 4.3351%.

Both yields have since retreated in early deals, and were broadly flat around 9:13 a.m. London time, perhaps reflecting the fact that credit rating downgrades were expected in the days after the collapse of former Prime Minister Francois Bayrou’s government on Monday following a confidence vote.

Cognisant of the wary and weary eyes of investors — who have followed more than a year of tumult in French politics amid stark disagreements about the 2026 budget — French President Emmanuel Macron quickly elected a new prime minister, France’s fifth in less than two years.

Whether his ally, former Defense Minister Sebastien Lecornu, will fare any better as PM remains to be seen, with analysts predicting he will face the same opposition to spending cuts and tax rises (Bayrou had targeted 44 billion euros, or $51.5 billion, worth of cuts), necessary to reduce France’s budget deficit.

There was no honeymoon period for Lecornu, with protests erupting on the day he was sworn in as PM, and more union-backed demonstrations due this week, with major disruption expected on Thursday.

For its part, Fitch projected that France’s fiscal deficit would stand at 5.5% of gross domestic product in 2025, down from 5.8% of GDP in 2024, but warned this was still high compared with the projected euro zone median deficit of 2.7%.

In addition, Fitch forecast that French debt would increase to 121% of GDP in 2027 from 113.2% in 2024, “without a clear horizon for debt stabilisation in subsequent years.”

Worrying for France, Fitch’s latest appraisal of France’s credit-worthiness was the first of several rating reviews on the horizon. Moody’s is due to announce its latest review of the risks associated with investing in the nation’s debt on Oct. 24, and Standard and Poor’s (S&P) is expected on Nov. 28.

Analysts note that while Fitch’s downgrade was largely priced into French debt markets, future downgrades are expected.

“French sovereign bonds have been trading at spreads to swap rates consistent with multiple downgrades,” analysts at ING said in a note Monday.

“It is no surprise then that French debt and the euro have not reacted too much to Friday evening’s decision by Fitch to downgrade France one notch to A+. Locally, the focus is on how quickly, if at all, new French Prime Minister Sébastien Lecornu can focus the minds of a disparate National Assembly on the unpopular but essential path of fiscal consolidation,” they added.

One of Lecornu’s first moves has been to abandon plans to eliminate two public holidays, ING noted, as the new PM tries to dispel some of the political wrath targeted at his predecessor’s proposal — just one part of Bayrou’s unpopular cost-cutting plans.

ING told investors to expect foreign exchange market players to keep one eye on French debt, though it caveated that with its “core view … that this is not going to broaden into another euro zone crisis.”