Exclusive: A former mining worker has been forced to reverse his retirement and become a truck driver after losing his entire nest egg in a devastating superannuation collapse.

Phil Mazitelli, 61, was about to live the good life travelling Australia in a caravan.

A cold-call two years ago which convinced him to swap his super has ruined those plans.

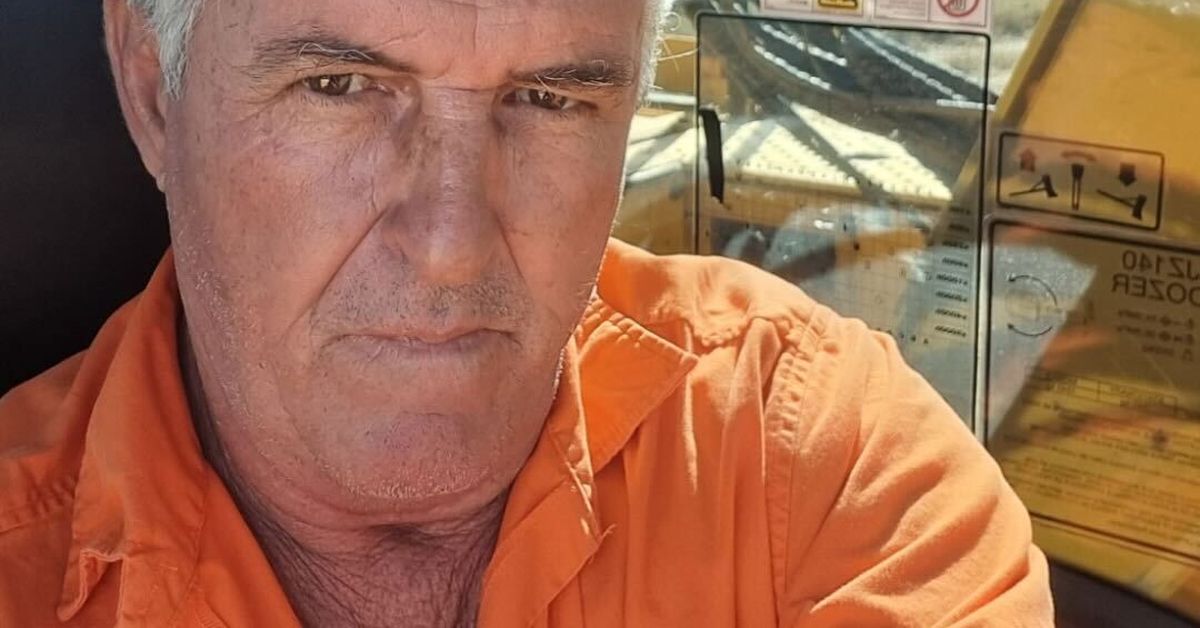

Phil Mazitelli says $240,000 of his superannuation has been frozen. (Supplied)

Phil Mazitelli says $240,000 of his superannuation has been frozen. (Supplied)

Mazitelli had just finished a 30-year career in mining in Queensland’s north and finally wanted to enjoy the fruits of his back-breaking labour.

“I turned 60, wanted to retire and spend a bit of money on myself,” Mazitelli told 9news.com.au.

“In 2023 I was online and I saw this advertisement which said ‘you can improve your super’, I filled out a form and before I knew it I got a call.”

Mazitelli was told he’d be able to secure his retirement with better returns, so he transferred his money to Australian Practical Super, known as AusPrac.

He heard nothing more and assumed everything was OK.

After a year, it was time for Mazitelli to hang up his boots and retire.

He had a healthy nest egg of just over $240,000 to enjoy in his twilight years.

When he went to pull it out, the nightmare began.

He couldn’t access a single cent.

“Then I saw that First Guardian had gone into liquidation and my money had been frozen,” Mazitelli said.

Like many Australians stung by First Guardian’s collapse, Mazitelli said he’d never heard of this fund.

The former mining worker said he wanted to retire at 60 but had to pause his plans. (Supplied)

The former mining worker said he wanted to retire at 60 but had to pause his plans. (Supplied)

Around 6000 people who are missing some or all of their superannuation after the collapse of First Guardian Master Trust, which went into liquidation and is under investigation by corporate regulator ASIC.

ASIC began investigating First Guardian’s responsible entity Falcon Capital and First Guardian.

AusPrac, also known as Australian Practical Superannuation, is operated by parent company Sequoia Financial Group.

Diversa is the trustee for AusPrac.

In a statement to impacted members, Diversa said it understands AusPrac members who invested in a First Guardian Master Fund may be experiencing “stress, anxiety and feelings of uncertainty in response to significant financial losses”.

9news.com.au has contacted Sequoia for comment but is yet to receive a reply.

Nine.com.au is not suggesting any wrongdoing by AusPrac.

The long and complicated process of trying to win back even a fraction of Mazitelli’s nest egg has been going on for 12 months.

Retirement is now out of the question and he has been forced to return to work as a truck driver.

He’s looking at another 10 years of work at the very least.

The emotional burden of losing his financial freedom has taken a toll too.

Mazitelli is now among 12,000 Australians waiting for answers. (Supplied)

Mazitelli is now among 12,000 Australians waiting for answers. (Supplied)

“If I make it to 70… that’s probably how long I’ll be working,” he said.

“My life has now changed because I wanted to get away and do stuff, I can’t anymore. It’s had a huge impact.

“At my age I shouldn’t cry but I do, I am angry a lot… now it’s just each day wondering and hoping for a resolution.”

Mazitelli has joined a Facebook group of 1300-strong people who have also lost their superannuation.

Around 12,000 Australians are missing a combined total of $1.2 billion after the collapse of First Guardian and Shield Master Trust.

Members of the group are supporting and counselling each other as the ASIC investigation takes place.

Victims of both collapses are demanding government action – and fast.

“The government needs to intervene now… to safeguard and watch every superannuation fund so that this doesn’t happen to anyone else,” Mazitelli said.

“We are all just normal and hardworking Australians who did nothing wrong.”

Hundreds of victims have lodged complaints with The Australian Financial Complaints Authority (AFCA).

Mazitelli has contacted his local member Andrew Wilcox, the MP for Dawson in north Queensland, who said he will advocate on his behalf.

A Change.org petition has also been started to ask the government to establish a victims’ trust.

ASIC has an ongoing investigation in relation to First Guardian Master Fund and Falcon Capital.

Following concerns raised by ASIC, the Federal Court appointed liquidators to Falcon Capital and ordered the wind-up of First Guardian and its related funds in April.

The court also restrained David Anderson, a director of Falcon, from dealing with his assets and appointed a receiver to his personal property.

ASIC’s investigation suggests that potential consumers were called and referred to personal financial advice providers who advised consumers to roll their superannuation assets into a retail choice superannuation fund, and then to invest part or all of their superannuation into First Guardian.

While ASIC’s investigation is ongoing, the Federal Court has made interim travel restraint orders against Falcon Capital director David Anderson on ASIC’s application. The Court also made interim orders freezing the assets of another Falcon director, Simon Selimaj and restraining his travel.

Those orders are in place until 27 February 2026. We understand the circumstances surrounding First Guardian are distressing for those affected and it is one of ASIC’s priorities to investigate what has happened and to preserve as much of investors’ funds as possible while our investigation is continuing.

So far, ASIC has had more than 40 court appearances on matters related to First Guardian and Shield. We have taken a range of enforcement action with respect to these matters including:

-

stop orders to prevent ongoing consumer harm,

-

commencing court proceedings to preserve assets and restrict travel of persons of interest,

-

appoint receivers and liquidators with the aim of securing investor funds

-

executing numerous search warrants with the assistance of the Australian Federal Police.

-

cancelled licences and banned certain financial advisers.

Readers seeking support can contact Lifeline on 13 11 14 or beyond blue on 1300 22 4636.