SINGAPORE – The Republic’s start-up ecosystem is set to gain fresh momentum as the entrepreneurial arm of the National University of Singapore (NUS) injects new capital into its venture support programmes.

With two new co-investment partnerships and a collaboration with Stanford University, NUS Enterprise is expanding support for its innovation and entrepreneurship programmes and offering students more global learning opportunities.

SG Growth Capital – the investment arm of Singapore’s Economic Development Board and Enterprise Singapore – will co-invest with NUS Enterprise in selected start-ups and venture funds.

Separately, Lotus One Investment, along with NUS Enterprise, have committed $20 million to back NUS spin-offs and selected funds, with returns reinvested into NUS innovation initiatives.

Together, these co-investments will boost the NUS Venture Capital Programme, which currently manages $150 million in funds. Launched in July, the programme supports deep tech start-ups – companies developing advanced technologies such as robotics, artificial intelligence and biotechnology.

NUS Enterprise also launched a $2 million pilot collaboration with Stanford University, supported by the Khetan Foundation. The collaboration allows students from the NUS College of Design and Engineering to gain hands-on experience in international teams, to tackle real-world industry challenges.

Students, with guidance from faculty from both universities, will work with firms including Meta and Venture Corporation to gain practical exposure and develop innovation skills.

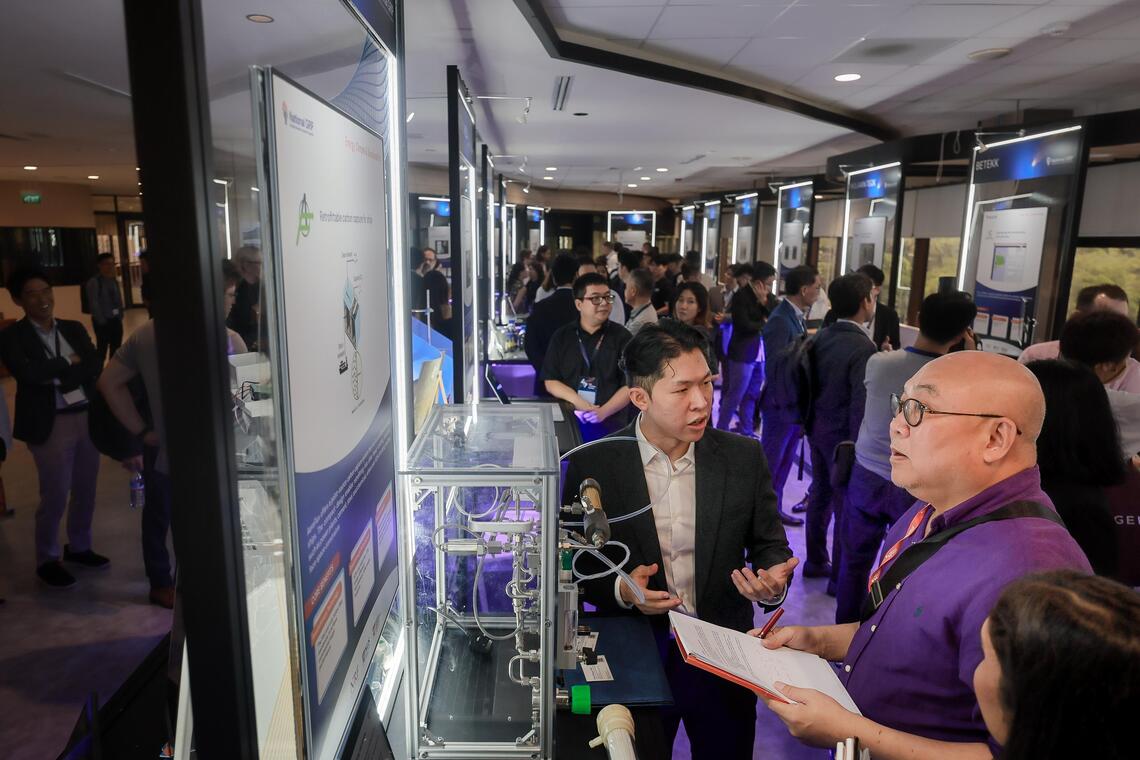

The announcements were made at the opening on Sept 16 of NUS’ new i3 building, which serves as the central hub for NUS innovation. The building brings research, education, start-up creation and funding under one roof, offering incubation support, mentorship and a collaborative environment.

Deputy Prime Minister Gan Kim Yong, who was guest of honour at the opening ceremony, said NUS’ new venture capital programme was a “timely initiative” that helps to fill a funding gap for start-ups to move beyond proof of concept to commercial markets.

Deputy Prime Minister Gan Kim Yong speaking at the official opening of the NUS i3 building on Sept 16.

ST PHOTO: GAVIN FOO

“We want to cultivate entrepreneurs, people who are willing to take the leap to turn prototypes into products, projects into companies, and ideas into businesses,” he said. “This is never easy, not least at a time when venture capital funding has diminished.”

Therefore, the venture capital programme will help support high-potential ventures within the NUS ecosystem to scale up, he added.

DPM Gan said that aside from entrepreneurship, NUS has also supported innovation with its Graduate Research Innovation Programme, which was incorporated into the National Graduate Research Innovation Programme (Grip) in January.

This programme supports aspiring locally-based researchers and entrepreneurs who have developed innovations in areas such as artificial intelligence, space, smart city and semiconductor technologies.

National Grip aims to support up to 300 start-ups by 2028 and spin off more than 150 companies by 2030, DPM Gan said.

Beyond funding, entrepreneurs will also gain access to global networks through NUS’ Block71 and Enterprise Singapore’s Global Innovation Alliance, which connect start-ups to markets and investors worldwide.

DPM Gan said such initiatives strengthen Singapore’s innovation ecosystem. But ultimately, the aim is to translate entrepreneurship into enterprise, scaling up start-ups that create jobs and opportunities for Singapore.

He noted that Singapore invests about 1 per cent of GDP – or $28 billion – under the current Research, Innovation and Enterprise (RIE) 2025 plan in research, innovation and enterprise.

“We must keep planning and investing in education and research, so that we can raise the quality of our human capital, develop our people to the fullest, and stay globally competitive,” DPM Gan said.

Mr Feb Hillman, chief executive and co-founder of AeroFlux, said continual investment is crucial to prevent deep tech start-ups from falling into what he calls the “belly of death” – the stage where companies struggle to turn research into commercially viable products.

This process requires a lot of capital – to build the prototype and do testing, for example – and funding gives start-ups like his the runway to produce the technology and prove its commercial value to the industry.

“A lot of deep tech start-ups fail because they run out of funding,” he said. “The manpower, building the equipment, the facility, all these require funding support.”

AeroFlux builds compact, affordable and energy-efficient carbon capture systems for industries that produce large amounts of carbon dioxide, many of which have limited space. Carbon capture involves trapping carbon dioxide before it is released into the atmosphere and storing it safely.

However, Mr Hillman said, deep tech start-ups are now receiving greater recognition of their funding needs, and support is improving.

He added that NUS’ i3 building will be a valuable space for founders to connect.

“The journey can be quite lonely,” he said. “It’s good to be able to bounce ideas off other entrepreneurs, because even though we’re working on different ideas, we’re all working in deep tech start-ups and so we face similar challenges.”