A look at the day ahead in European and global markets from Gregor Stuart Hunter:

As Vladimir Lenin had it, just as there are decades where nothing happens, there are weeks where decades happen. The same is broadly true in central banking, with this one towards the busier end of the spectrum.

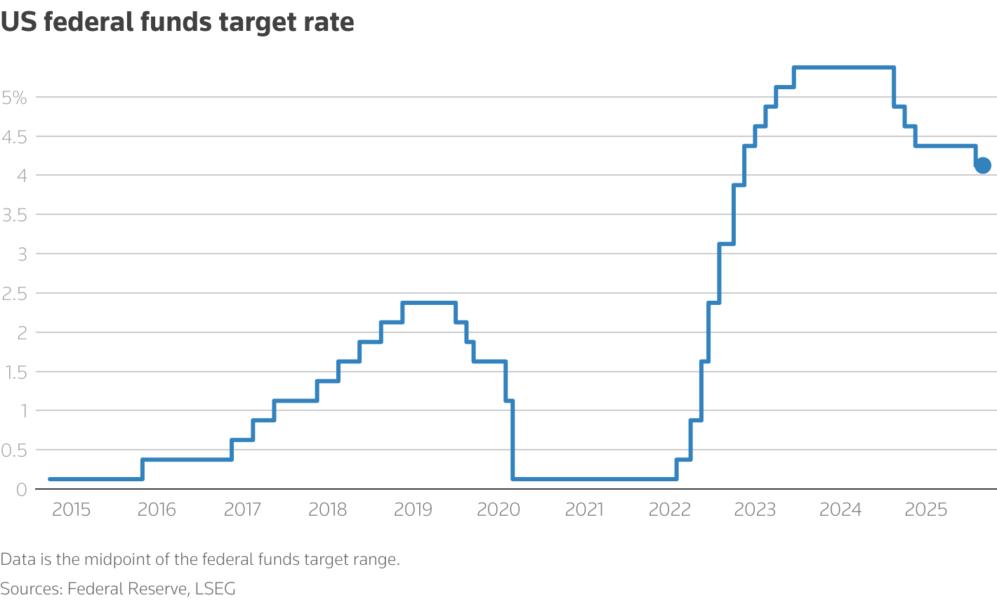

Markets are digesting the U.S. central bank’s moves, which saw the Federal Open Market Committee delivering a widely expected 25 basis point rate cut on Wednesday, with only new Governor Stephen Miran dissenting in favour of a larger 50 bps cut.

Thomson ReutersUS federal funds target rate

Thomson ReutersUS federal funds target rate

For those marking up their scorecard: The Bank of Canada cut, the People’s Bank of China held, the Hong Kong Monetary Authority had no choice but to follow the Fed, the Bank of England is later today, and the Bank of Japan follows tomorrow.

After a stumble on Wall Street, Asian markets bought the dip on Thursday, sending S&P 500 e-minis ES1! up 0.5% and Nasdaq futures

NQ1! 0.7% higher. That risk-on sentiment looks set to follow through to Europe, where pan-region futures

FESX1! are rising 0.6%, German DAX futures

DAX1! have gained 0.7% and FTSE futures

Z1! are 0.2% higher.

Bond markets also rallied after a pullback, with the yield on benchmark 10-year Treasury notes US10Y sliding to 4.068% compared with its U.S. close of 4.076% on Wednesday.

The dollar DXY held steady at 97.024 after recovering from a three-and-a-half-year low. Gold

GOLD fluctuated between gains and losses, hitting an air pocket after scaling a record high on Wednesday, with bullion last trading at $3,659.40 per ounce.

Still, for all the sugar rush of the Fed resuming an easing cycle, growth worries are never far away. New Zealand stocks and the kiwi dollar skidded after worse-than-expected economic data and Australian stocks dropped after the release of weaker-than-expected labour market figures.

Shares in gas producer Santos STO slid as much as 13.6% after a consortium led by Abu Dhabi’s ADNOC scrapped its $18.7 billion bid for the company, saying commercial terms could not be agreed. Brent crude

BRN1! fell 0.2% to $67.84 per barrel.

For all that drama, MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) is trading flat.

Key developments that could influence markets on Thursday:

Corporate earnings:

Auto Trader Group, Embracer Group, Next

Central bank decisions:

UK: Bank of England

Economic data:

UK: GfK Consumer Confidence for Sept

Debt auctions: France: 3-year, 5-year, 8-year, 9-year and 13-year government debt auctions