AC

Aurtus Consulting LLP

More

Aurtus is a full-service boutique firm providing well-researched tax, transaction and regulatory services to clients in India as well as globally. At Aurtus, we strive to live up to our name, which is derived from ’Aurum’ – signifying the gold standard of services and ‘Ortus’ – implying a sunrise of fresh/innovative ideas and thought leadership. We help our clients navigate the complex world of tax and regulatory laws while providing them with thoroughly researched, practical and value-driven solutions. Our solutions and the holistic implementation support, cover not only all the relevant tax and regulatory aspects but also the contemporary trends and commercial realities. Our clients include reputed Indian corporations, MNCs, family offices, HNIs, start-ups, venture capital funds, private equity investors, etc.

India is poised to become one of the world’s next economic

powers. In pursuit of this vision, the country has adopted a dual

strategy of strengthening domestic capabilities while actively

deepening international trade relationships. One of the key tools

employed by India and by many nations n

India

International Law

To print this article, all you need is to be registered or login on Mondaq.com.

Introduction

India is poised to become one of the world’s next economic

powers. In pursuit of this vision, the country has adopted a dual

strategy of strengthening domestic capabilities while actively

deepening international trade relationships. One of the key tools

employed by India and by many nations navigating the complexity of

global commerce is the use of Regional Trade Agreements (RTAs),

which reduce or eliminate tariffs and other trade barriers. For

India, RTAs have become instrumental in establishing stable and

predictable trade partnerships amid global volatility. Notably,

India ranks 10th globally in terms of RTA usage, following leaders

such as the European Union and the United Kingdom, which have long

leveraged such agreements to secure their positions in the

international trading system.

India’s increasing integration into the global economy is

reflected in its active participation in a broad array of RTAs.

These agreements are not merely symbolic; they yield tangible

economic benefits, such as reduced or zero customs duties on

qualifying imports, which help Indian industries access raw

materials at lower costs, strengthen supply chains, and improve

global competitiveness.

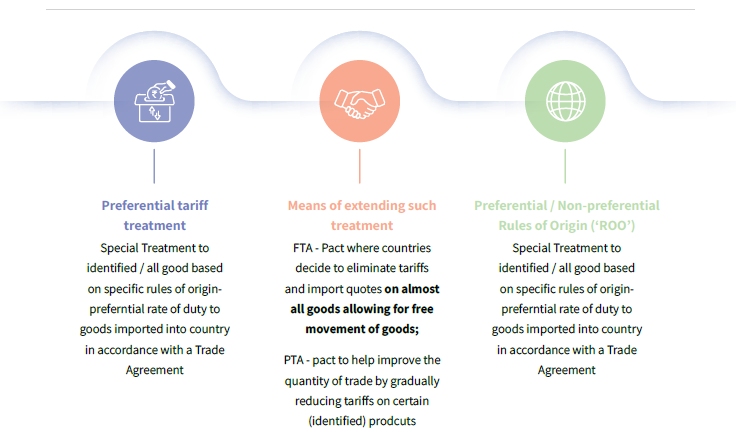

What are RTAs

RTAs are either bilateral (between two countries) or

plurilateral/multilateral (involving more than two countries)

reciprocal trade arrangements entered into by countries across

various regions. These agreements aim to reduce trade barriers and

facilitate smoother movement of goods and services, thereby

promoting deeper economic cooperation. RTAs play a crucial role in

bridging the gap between developed and developing economies. For

developing countries, they offer opportunities to lower trade

costs, enhance exports, and accelerate economic growth. By granting

preferential treatment to signatory countries, RTAs promote mutual

benefit through reduced tariffs, improved market access, and

investment-friendly frameworks.

General Framework of FTAs

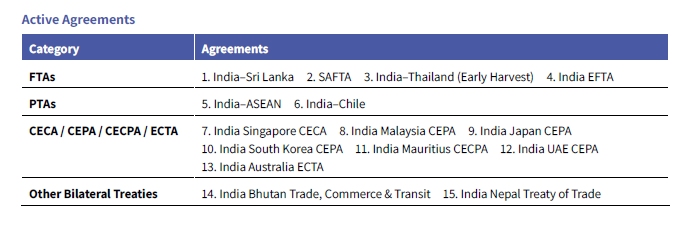

India till now has implemented 15 FTAs and 6 PTAs, and is

negotiating more than 20 new pacts, most notably with the United

Kingdom and the European Union. The latest milestone is the

India‑EFTA Trade & Economic Partnership Agreement (March

2024) with Switzerland, Iceland, Norway and Liechtenstein,

underscoring India’s shift toward high‑standard,

plurilateral deals that lower trade barriers and stimulate

investment.

Core Provisions Shared by Most Indian FTAs

Most Indian FTAs share a core set of provisions aimed at

facilitating trade and investment among partner countries. These

typically include commitments on tariff elimination or reduction,

allowing for preferential access to goods originating from the FTA

partner. Rules of Origin (RoO) play a critical role in determining

eligibility for such preferences, ensuring that only goods with

substantial economic connection to the partner country qualify.

Further, FTAs usually provide for national treatment and

most-favoured nation treatment [MFN], customs cooperation, and

trade facilitation measures to reduce procedural delays at borders.

Many agreements also include dispute settlement mechanisms,

investment protection clauses, and provisions for sanitary and

phytosanitary [SPS] standards and technical barriers to trade

[TBT]. Increasingly, India’s newer FTAs incorporate chapters on

services trade, intellectual property, e-commerce, and sustainable

development, reflecting the evolving priorities of modern trade

policy. Recently, The India-UK CETA has been signed on 24 July 2025

and negotiations were finalised on 6 May 2025 after over three

years and fifteen rounds of talk.

To view the full article please click here.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.