Canada’s gross domestic product for July on Thursday will take center stage as early readings suggest the contraction in Q2 growth was not likely repeated in Q3.

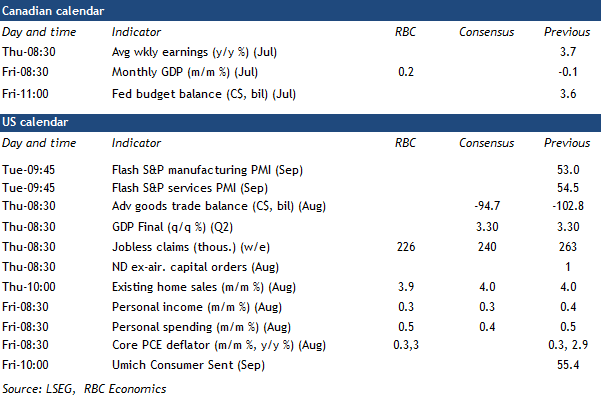

We expect GDP to post a 0.2% increase in July, modestly surpassing Statistics Canada’s preliminary estimate of a 0.1% rise. This would mark a welcome rebound following three consecutive months of declines.

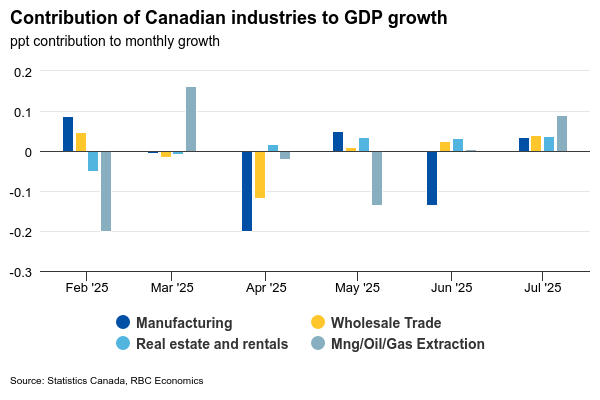

Canadian export and manufacturing sale volumes rose in July by 0.7% and 1.6%, respectively, after declining sharply in Q2. Early data is pointing to another increase in oil production in Alberta as activity continues to recover from wildfire-related disruptions in May.

Wholesale volumes rose for a third straight month in July—up 0.8% from June and 3% from a year ago—and home resales rose almost 4%. Retail sales softened to partially retrace a jump in June but the August advance estimate pointed to a 1% rebound. Overall, service sector production appears to have advanced slightly faster than in the previous month in July.

Employment declined sharply in July (-41,000), but hours worked fell less (-0.2%) and are still tracking above their Q2 averages through August. This aligns with our expectations for modest GDP growth in Q3.

It is highly likely that Bank of Canada policymakers expect that additional interest rate cuts will be needed after reducing the overnight rate for the first time since March in September. But, further reductions are also more contingent than usual on more softness in economic data.

Our tracking for GDP growth in early Q3 is not significantly different than the BoC’s, but its decision to cut again (or not) in October will depend heavily on early October trade and labour market data, as well as the results from the BoC’s Business Outlook Survey.

Week ahead data watch:

U.S. personal spending likely edged up by another 0.5%, following a similar pace in July and consistent with the +0.6% gain in August retail sales. Unit auto sales inched lower during that month, offsetting some of the price-related increases at the pump.

We expect U.S. personal income to rise by 0.3%, slightly slower than the pace in July, largely aligning with the stagnant wage growth reported in the earlier nonfarm payroll report.