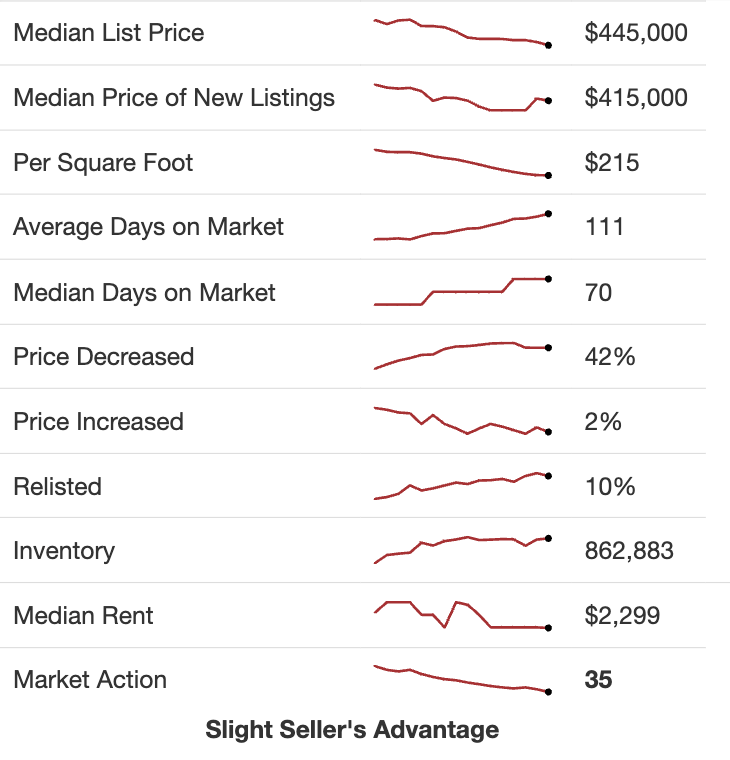

The U.S. residential real estate market continues to display a striking contrast this week. The Altos Market Action Index sits at 33.9, pointing to a seller’s advantage on the 0-100 scale that measures home sales rate versus available housing inventory. Scores of 25-50 indicate seller’s market conditions, confirming property owners maintain control despite mixed signals in the Sept. 2025 housing data.

Yet 42% of residential listings have cut their asking prices. This signals a shift in what homebuyers expect, even as sellers keep their overall edge in the current real estate landscape.

Data Insight

The Market Action Index has decreased slightly from 35 last month to 33.9 currently. This shows sellers still have the upper hand in the housing sector, but their advantage may be softening. With 42% of property listings dropping prices, it’s clear sellers are increasingly responsive to homebuyer feedback in today’s market conditions.

Based on national housing data for the week ending Sept. 19, 2025, there were 862,883 homes listed for sale — equaling 2.7 months of housing supply — and 73,088 single-family home sales across the country. This housing inventory level remains a key metric for real estate professionals monitoring market trends.

The median home price sits at $445,000 nationwide. New property listings entered the market at a median price of $415,000. When sellers cut prices, they typically reduced by 4.1% from original listing prices. Only 2% of residential listings raised prices, with an average bump of 2% in those cases.

Industry context

The current level of 862,883 listed properties represents a slight increase from the 860,219 reported previously in the housing inventory tracker. This maintains a real estate market where sellers have the edge but must be increasingly strategic about their property pricing strategies.

The 10.1% relisting rate shows some residential properties are coming back to the housing market with new plans. This reflects sellers’ willingness to adapt their home selling approach rather than stick to their original price point in the current market environment.

This housing inventory data aligns with recent real estate analysis by HousingWire’s Lead Analyst Logan Mohtashami (Sept. 20, 2025). As noted in that article, “The housing market began to shift in mid-June, and inventory growth slowed significantly,” with year-over-year growth now running at 20% compared to a peak of 33% in the residential property sector.

Price segment performance

The real estate market shows clear patterns across housing price ranges:

Luxury home segment ($1.09 million median): 84 days on market, 7.8% absorption rate in high-end properties

Upper-middle price tier ($549,900 median): 70 days on market, 8.9% absorption rate for these residential properties

Lower-middle housing segment ($369,000 median): 63 days on market, 9.7% absorption rate in this popular price range

Entry-level homes ($219,990 median): 63 days on market, 11.2% absorption rate for first-time homebuyer properties

Industry implications and pricing strategy

For mortgage lenders and real estate professionals, the slightly decreased Market Action Index paired with high price-cut rates signals a housing market in transition. Sellers still have the edge in the residential sector, but the high rate of price cuts shows homebuyers have gained bargaining power in property negotiations.

The housing data shows how vital correct initial pricing has become in today’s real estate environment. With 42% of property listings needing price cuts and a 10.1% relisting rate, proper pricing strategy is key to quick home sales and fewer days on market. The gap between new listing prices ($415,000 median) and overall listing prices ($445,000 median) shows the real estate market is recalibrating to meet current buyer expectations.

HousingWire used HW Data to source this story. To see what’s happening in your own local market, generate housing market reports. For enterprise clients looking to license the same market data at a larger scale, visit HW Data.

Related