Rigetti Computing (RGTI) is suddenly front and center after news broke that the company landed a three-year, $5.8 million contract with the U.S. Air Force Research Laboratory to help develop superconducting quantum networking. The deal sees Rigetti teaming up with Dutch partner QphoX to forge advances that could one day make a quantum internet a reality. This would enable quantum processors to communicate with each other over long distances. For investors, the announcement is not just another government win; it is a high-profile signal that Rigetti’s technology is earning validation from serious institutional players.

This momentum comes during a period of renewed excitement for Rigetti. The stock has soared over 36% in the past year, continuing to ride a wave of positive headlines around its technological progress and government partnerships. Earlier, the company showcased a 36-qubit processor with industry-leading fidelity and outlined its push toward a 100-qubit system. These milestones have contributed to a sense that Rigetti is gaining ground in the quantum computing race, even as skeptics point to ongoing losses and a premium valuation compared to peers.

With shares moving higher on expanded contracts and technical achievements, the real question now is whether Rigetti’s future growth is already reflected in its price or if there is still room for upside. Is there a buying opportunity here, or is the market already looking ahead?

Price-to-Book Ratio of 16.6x: Is it Justified?

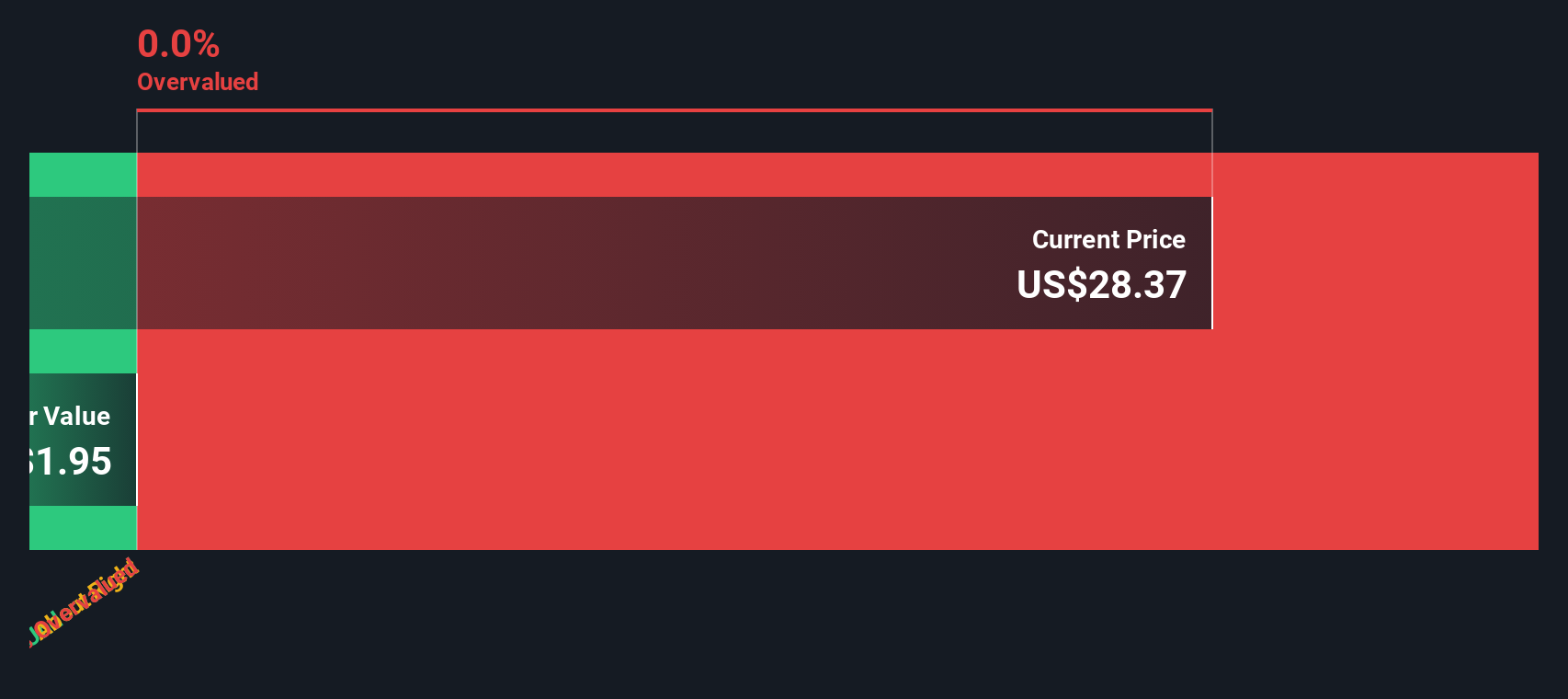

Based on its price-to-book (P/B) ratio, Rigetti Computing currently appears overvalued compared to both its peers and the broader US semiconductor industry.

The price-to-book ratio compares a company’s market value to its book value. This metric offers investors a sense of how much they are paying relative to the company’s net assets. For technology companies like Rigetti, a high P/B may reflect expectations for significant growth or a large intangible asset base. However, it also suggests increased risk if those growth expectations are not met.

With Rigetti’s P/B ratio significantly higher than the peer average and industry norm, investors should carefully consider whether the company’s future prospects justify the premium or if the stock is being priced more on hope than on current fundamentals.

Result: Fair Value of $21.83 (OVERVALUED)

See our latest analysis for Rigetti Computing.

However, investors should be aware that ongoing losses and a lofty valuation could heighten downside risk if future growth does not materialize as expected.

Find out about the key risks to this Rigetti Computing narrative. Another View: Discounted Cash Flow Perspective

Looking from another angle, our DCF model offers a different perspective and compares Rigetti’s future cash flows to today’s price. It suggests the stock’s outlook may not fully align with the optimism implied by its book value. What if this approach reveals a deeper story than just the multiples?

Look into how the SWS DCF model arrives at its fair value.  RGTI Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Rigetti Computing to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

RGTI Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Rigetti Computing to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Rigetti Computing Narrative

Of course, if you have a different outlook or want to dive deeper into Rigetti’s numbers yourself, you can quickly build your own analysis and interpretation using Do it your way.

A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Hundreds of smart investors like you are already using Simply Wall Street to uncover tomorrow’s winners. Don’t let new opportunities slip by while you focus on just one stock. Expand your watchlist with these dynamic investment angles today:

- Power up your portfolio with leading-edge innovation by tapping into AI breakthroughs using AI penny stocks.

- Grow your wealth with steady income streams as you scan for companies offering robust payouts and yields above 3% in dividend stocks with yields > 3%.

- Seize the chance to get into the quantum computing revolution early by pinpointing investors’ hidden gems among quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com