Third Quarter | September 24, 2025

Special Questions

Data were collected September 10–18; 138 oil and gas firms responded to the special questions survey.

All firms

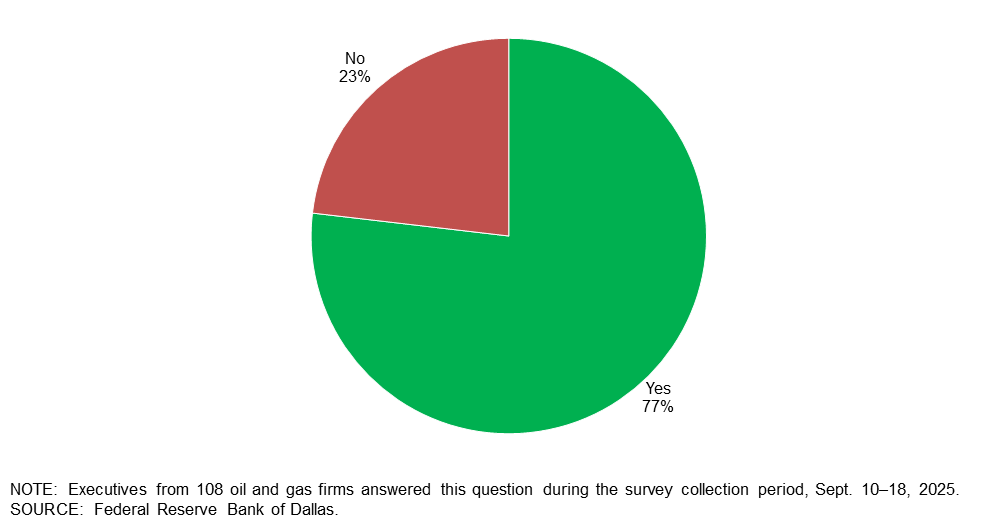

Do you expect shale oil drilling to become commercially viable in international locations outside the United States, Canada and Argentina in the next 10 years?

Seventy-seven percent of executives said they expect shale oil drilling to become commercially viable in international locations outside United States, Canada and Argentina in the next 10 years. The remaining 23 percent don’t expect so.

Exploration and production (E&P) firms

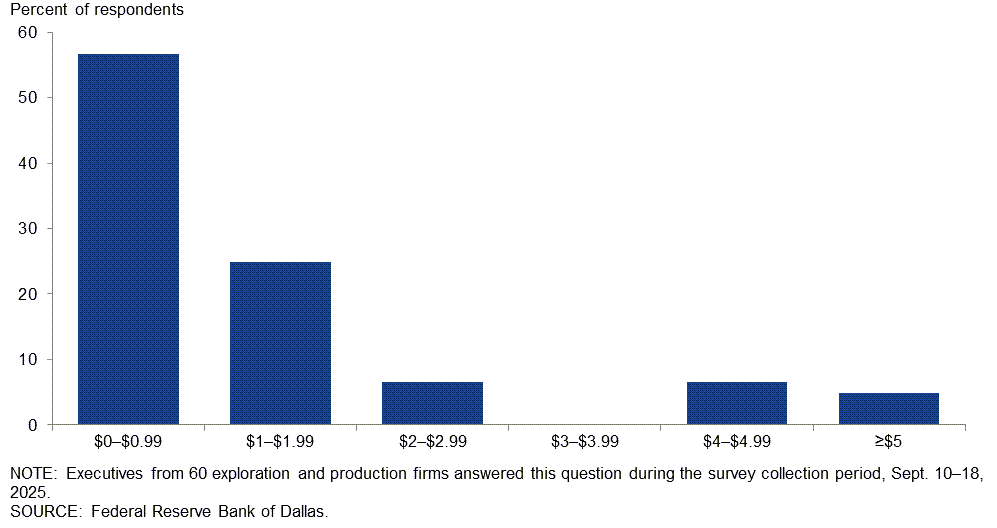

How much do you estimate regulatory changes since January 2025 have reduced your firm’s break-even cost for new wells on a dollar-per-barrel basis?

Most executives, 57 percent, estimate regulatory changes since January 2025 have reduced their firms’ break-even costs for new wells by less than $1 per barrel. An additional 25 percent estimate reductions between $1–$1.99 per barrel.

A breakdown of the data is shown below. Firms were classified as “small” if they produced fewer than 10,000 barrels per day (b/d) and “large” if they produced 10,000 b/d or more. In the U.S., small E&P firms are greater in number, but large E&P firms represent the majority of production (more than 80 percent). Executives from small E&P firms were somewhat more likely to report greater reductions compared to executives at larger E&P firms.

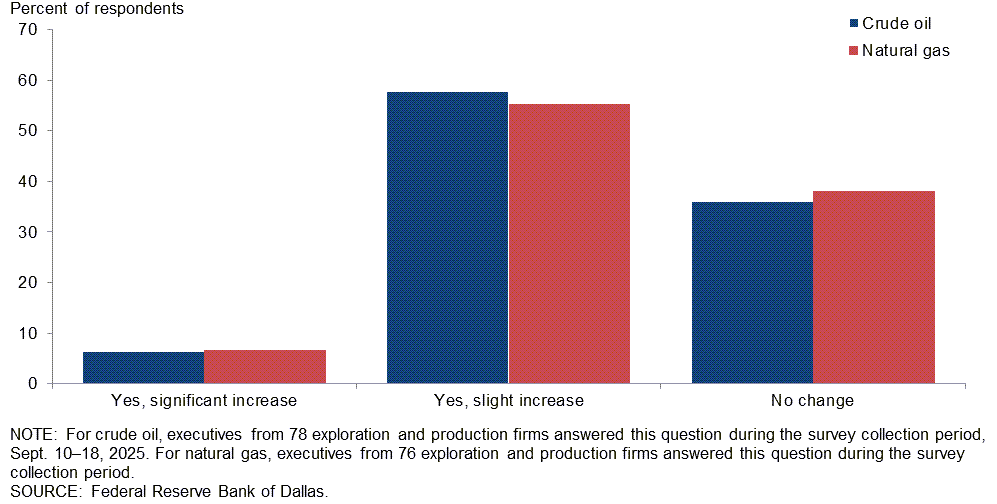

The One Big Beautiful Bill Act lowers federal royalty rates to pre-Inflation Reduction Act levels and increases federal leasing offerings. Do you expect these changes to increase crude oil and/or natural gas production on federal lands over the next five years?

The most selected response was slight increase, chosen by 58 percent of executives for crude oil and 55 percent for natural gas. The next most selected response, for both crude oil and natural gas, was no change while only a small percentage selected significant increase.

Executives at small E&P firms were more likely to expect the changes to lead to slight increases in production on federal lands, whereas the majority of executives at large E&P firms expect no change. A breakdown between firm size and product can be found in the table below.

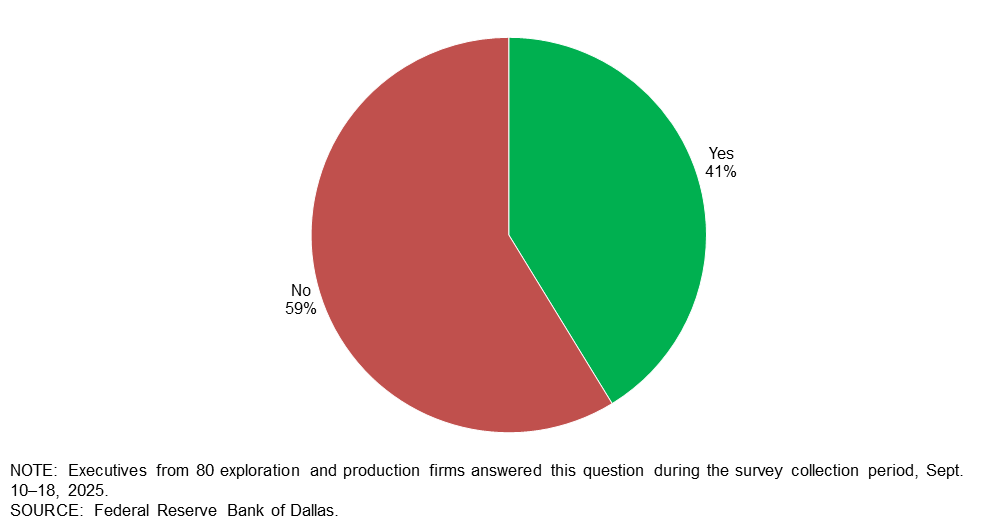

In the past year, have your operations been impacted by theft in the oil field

Forty-one percent of executives said their operations have been impacted by theft in the oil field in the past year. The remaining 59 percent said they have not been impacted.

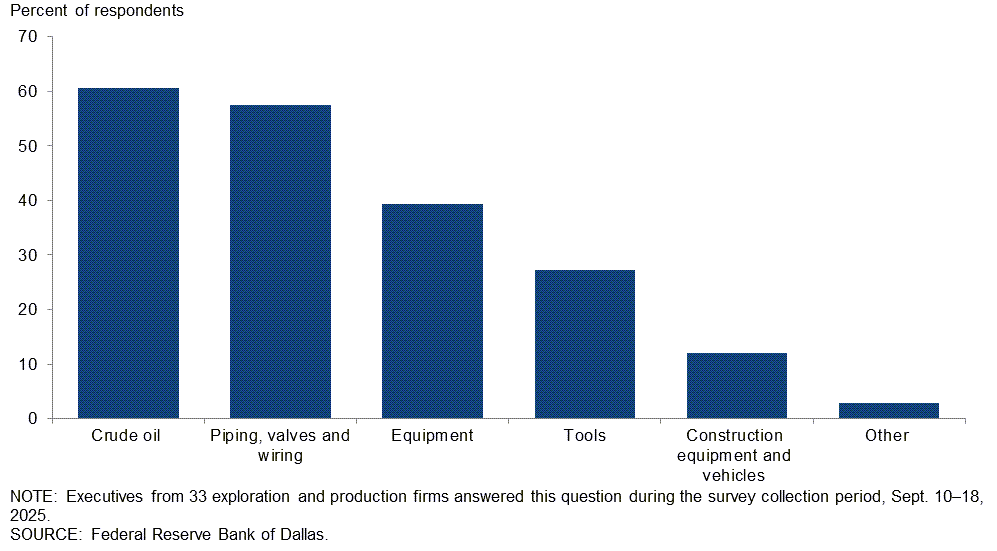

If so, what items have been stolen over the past year? (Check all that apply.)

This question was only posed to E&P executives who said their operations have been impacted by theft in the oil field in the past year. The most selected response was “crude oil” (61 percent of respondents) followed by “piping valves and wiring” (58 percent of respondents) and “equipment” (39 percent of respondents.)

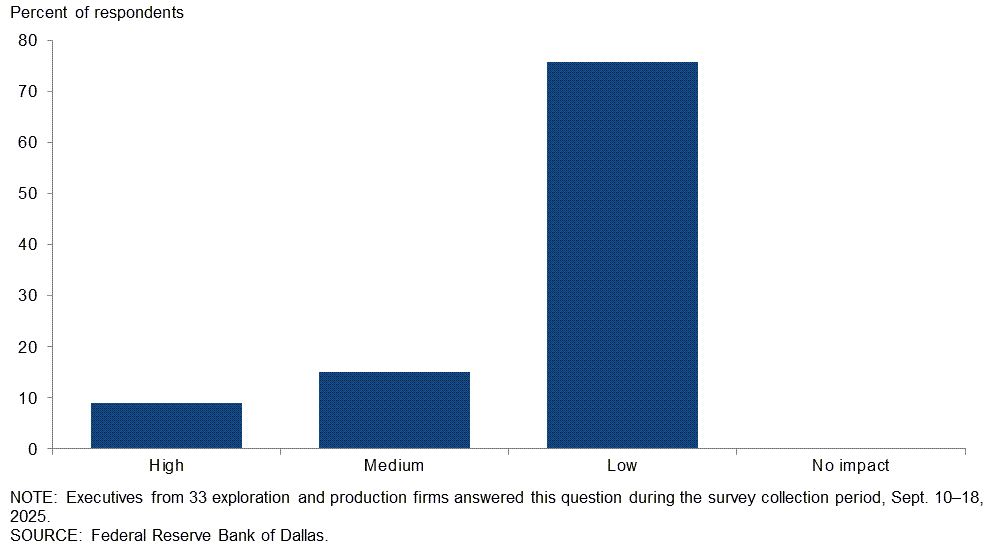

How would you rate the impact of this theft on your firm’s operations?

This question was only posed to E&P executives who said their operations have been impacted by theft in the oil field in the past year. Most executives rated the impact of theft on their firm’s operations as low.

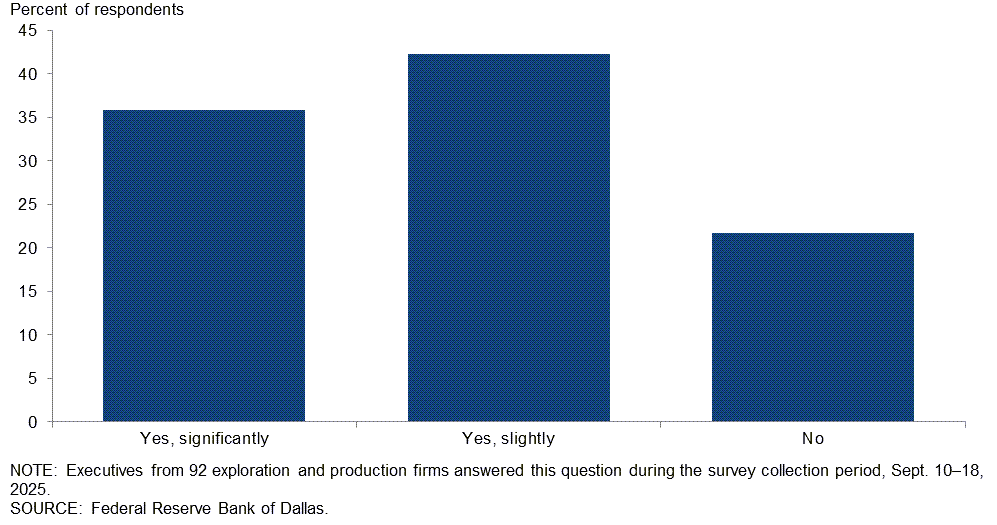

Has your firm delayed investment decisions in response to heightened uncertainty about the price of oil and/or the cost of producing oil?

Most executives report they have delayed investment decisions in response to heightened uncertainty about the price of oil and/or the cost of producing oil. Forty-two percent of executives said they have slightly delayed investment decisions, and 36 percent of executives report they have significantly delayed decisions. Executives at small E&P firms were slightly more likely to report no delay compared with executives at large E&P firms.

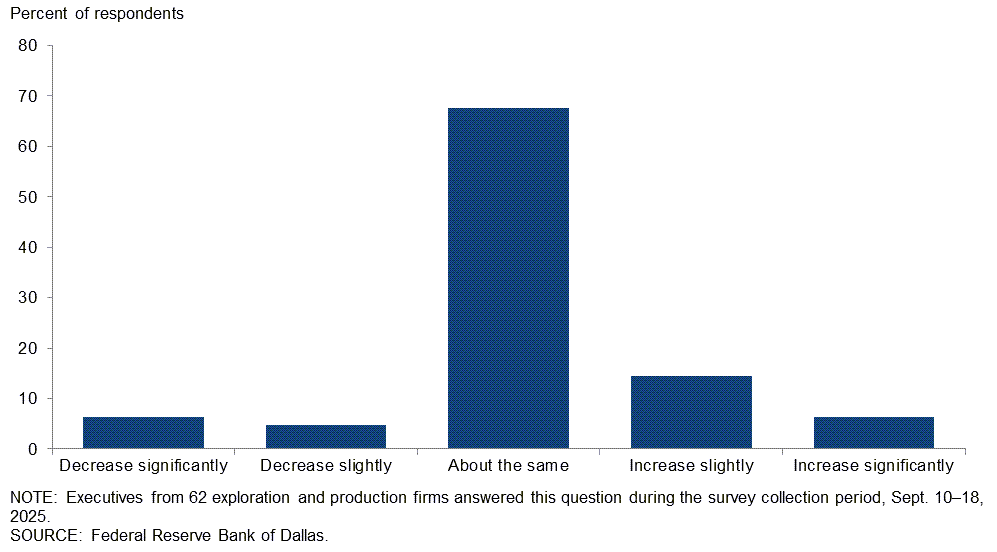

How is your firm changing its hedging activity for 2025 and 2026 compared with 2024?

Most executives said their hedging activity for 2025 and 2026 will be about the same as in 2024.

Oil and gas support services firms

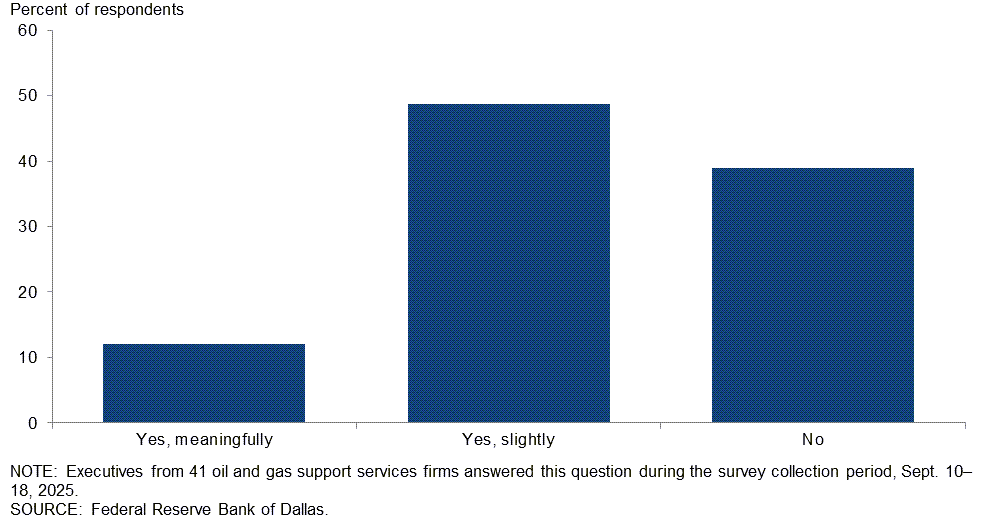

Do you expect artificial intelligence to help increase the average lifespan of your firm’s equipment?

The majority of oil and gas support services executives expect artificial intelligence to help increase the average lifespan of their equipment. A total of 49 percent of executives expect a slight increase, and an additional 12 percent anticipate a meaningful increase. On the other hand, 39 percent don’t expect artificial intelligence to increase the average lifespan of their equipment.

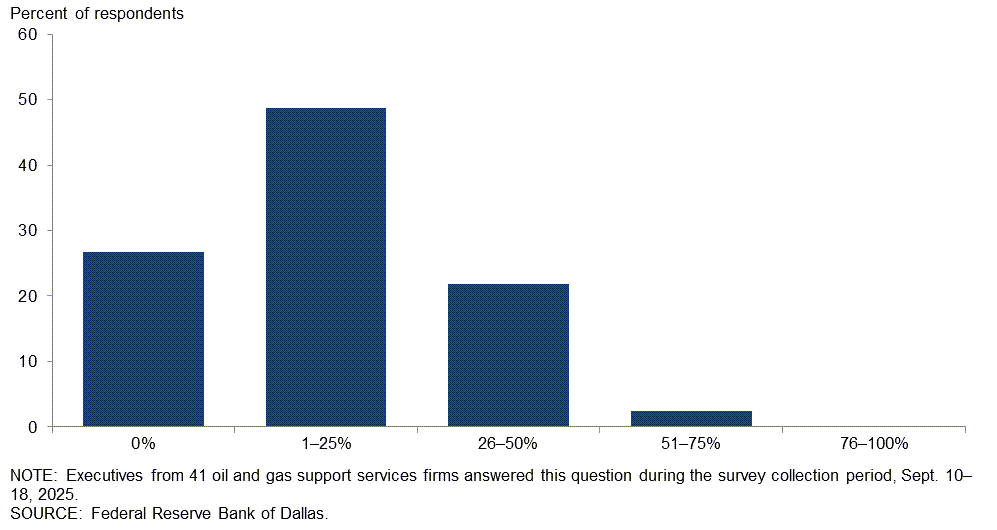

What percentage of your firm’s oilfield equipment do you estimate is directly or indirectly sourced from China?

Almost half of the executives, 49 percent, estimate that up to one-quarter of their oilfield equipment is directly or indirectly sourced from China. Another 22 percent of executives said 26–50 percent was Chinese sourced. An additional 2 percent of executives said Chinese-sourced equipment made up 51–75 percent of holdings. On the other hand, 27 percent of executives said none of their firms’ oilfield equipment is sourced from China.

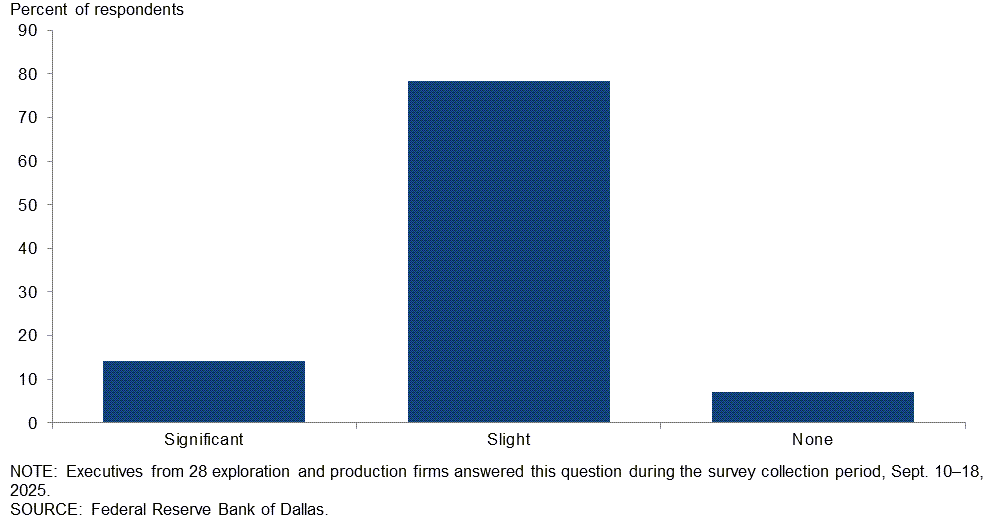

What impact would switching from Chinese suppliers to those in another country have on the cost of the equipment for your firm?

This question was only posed to oil and gas support services executives who estimate some portion of their equipment is directly or indirectly sourced from China. The majority (79 percent) said impact would be slight. An additional 14 percent of executives expect significant impact. The remaining 7 percent said there would be no impact.

Special Questions Comments

Exploration and production (E&P) firms

- We have begun the twilight of shale. Several multibillion-dollar firms that have previously been U.S.-onshore-only are making investments in foreign countries and riskier (waterborne) geologies. The writing is on the wall. Consolidation continues; 50 percent fewer public companies than 10 years ago, and employees are being cut by the tens of thousands. The U.S. isn’t running out of oil, but she sure is running out of $60 per barrel oil. $100 per barrel? $150 per barrel? Price likely must cover for less-than-optimal geology over time. One must wonder—in a country with over a million orphan wells—what happens to that (expensive) plug and abandon liability from the 200,000+ horizontal shale wells over time. We already see some companies that appear to have a business plan of a “bad bank.” Society will not treat us kindly unless we do our part to clean up after we are gone.

- It’s going to be a bleak 3-plus years for the oilpatch. Why would Wall Street want to invest in the worst performing sector of the S&P when artificial intelligence beckons?

- Given the U.S. Energy Information Administration’s forecast for 2026 oil prices averaging $47 per barrel, we are suspending drilling indefinitely after we drill our last well starting this month. After Liberation Day, we cut our drilling budget in half from 10 wells to 5 wells.

- No opinion on hedging as we don’t hedge. It will take quite a while for the “Big Beautiful Bill” to work its way into the economy. The “drill, baby, drill” return isn’t going to happen! Banks, shareholders, bondholders, C-suites, and everybody realizes the prior “drill, baby, drill” boom led to financial disasters and wasted capital, natural resources and human resources. From now on, economic decisions will have to be prudent and well-founded in logic, not hyperbole.

- We are finding it difficult to hedge production at this level. Our belief is crude at $60 per barrel is below replacement cost and will not continue unabated for an extended time. We may see oil drop to the mid $50 per barrel but it should be short lived. Big risk is economic uncertainty around the globe including high debt levels for the major economies, which may crack under higher interest rates and slowing growth. If they do crack, oil prices could drop precipitously for an extended period of time. However, with the recent round of consolidations, the market should be able to adjust significant production down quickly to address the price decline.

- Overall, we feel good about the future of the industry but expect some short-term pain for the next year or so.

- I expect significant non-shale (conventional) exploration increases and expenditures in offshore and foreign frontier basins in the coming years. The recent discovery in offshore Brazil and discoveries in the Orange Basin in offshore Namibia are encouraging. Domestic shale production at the $60 per barrel price point does induce expenditures for tier 2 and tier 3 acreage, which exhibit rapid decline curves.

- Lowering interest rates will spur the economy and drive oil and gas consumption higher. LNG exports will also help our industry.

- I view oil as having far more upside potential than downside. First with the U.S. Strategic Petroleum Reserve being at the lowest it has been since roughly 1984. This could be used to set a price floor and mitigate a potential inventory glut if one does occur. Second is global conflict is not slowing down. The Russians are now actively increasing provocations of NATO Members with flights of drones into Poland, and the administration is calling for Europe to end buying Russian energy. If this shakes out, we could see a massive capital flow into energy as European countries mitigate supply shocks by increasing on-hand inventory.

- The costs for permitting in California are approaching as much as the cost of certain shallow wells, so the political and regulatory bureaucracy is literally out of control, and reforms are needed. California is using imports to undermine in-state operators which is harming the state, harming the operators and workers in the state, and restricting operations on many of the federal lands on the west coast. My improved outlook for the coming year is primarily due to work from Washington D.C. and the U.S. Bureau of Land Management easing certain roadblocks. More quick action is needed and I believe, is ongoing.

- Some upstream oil and gas companies are slashing staff. Many jobs are being replaced due to future use of artificial intelligence. Also, many jobs are not necessary without intense growth. The price of natural gas has been low for years. Only the shale gas players can produce and drill for profits. Much of those profits were based on hedges being fulfilled. Now those are ending, and prices now are far lower. Natural gas production domestically will see higher demand due to tariff issues and build out of more liquefied natural gas (LNG) capacity. Oil prices are not controlled by domestic producers. Shale oil will drop off in volume.

- We are hedging additional natural gas liquids.

Oil and gas support services firms

- A stable and predictable trade regime is critical for business planning.

- U.S. onshore drilling contractors are some of the most patriotic bunch I know. We source all American products when available and financially viable.

- We rely heavily on electrical components and automation to operate our equipment. There has been a noticeable shift in the manufacturing of these products away from China. We are seeing more of these products being assembled in Mexico, India and southeastern Asian countries. Over the course of the past year, tariffs have pushed pricing higher on these products.

- The most notable pieces from China are subcomponents of larger pieces; domestic suppliers are higher in price and lower in availability. Main items are valve and pump components. We expected significant impact on pipe prices, but have not seen impact of any policy at this time.

- Shale drilling in other countries will be controlled by the political climate in those countries.