Alexandria finds itself at the center of a housing market dynamic where federal downsizing has increased the number of residents putting homes on the market, while falling mortgage rates could boost buyer demand.

The White House told federal agencies to prepare for mass layoffs if the government shuts down next week. In a memo released Wednesday night, the Office of Management and Budget instructed agencies to consider “a reduction in force” for programs “not consistent with the President’s priorities,” according to The Associated Press. Unlike previous shutdowns, where workers were furloughed and returned, this would permanently eliminate positions.

Yesterday, ALXnow reported that Alexandria has been hit hardest among Virginia suburbs by federal job cuts, with home listings surging 44% year-over-year as displaced federal workers look to relocate. Now, new research from Realtor.com shows Alexandria is also the most mortgage-sensitive metro area in the nation — meaning falling rates could unleash more pent-up buyer demand here than almost anywhere else.

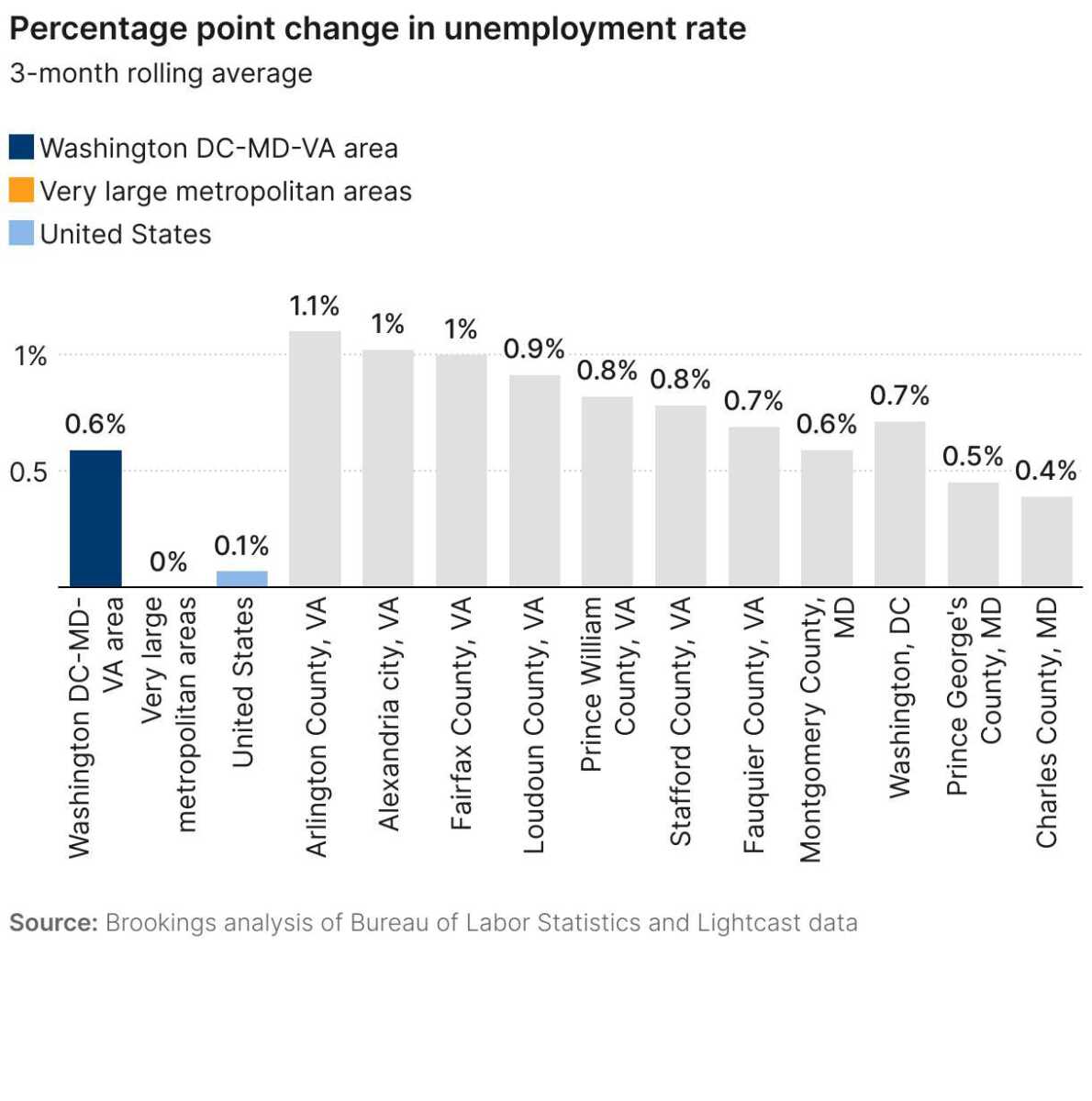

Source: Brookings analysis of Bureau of Labor Statistics and Lightcast data

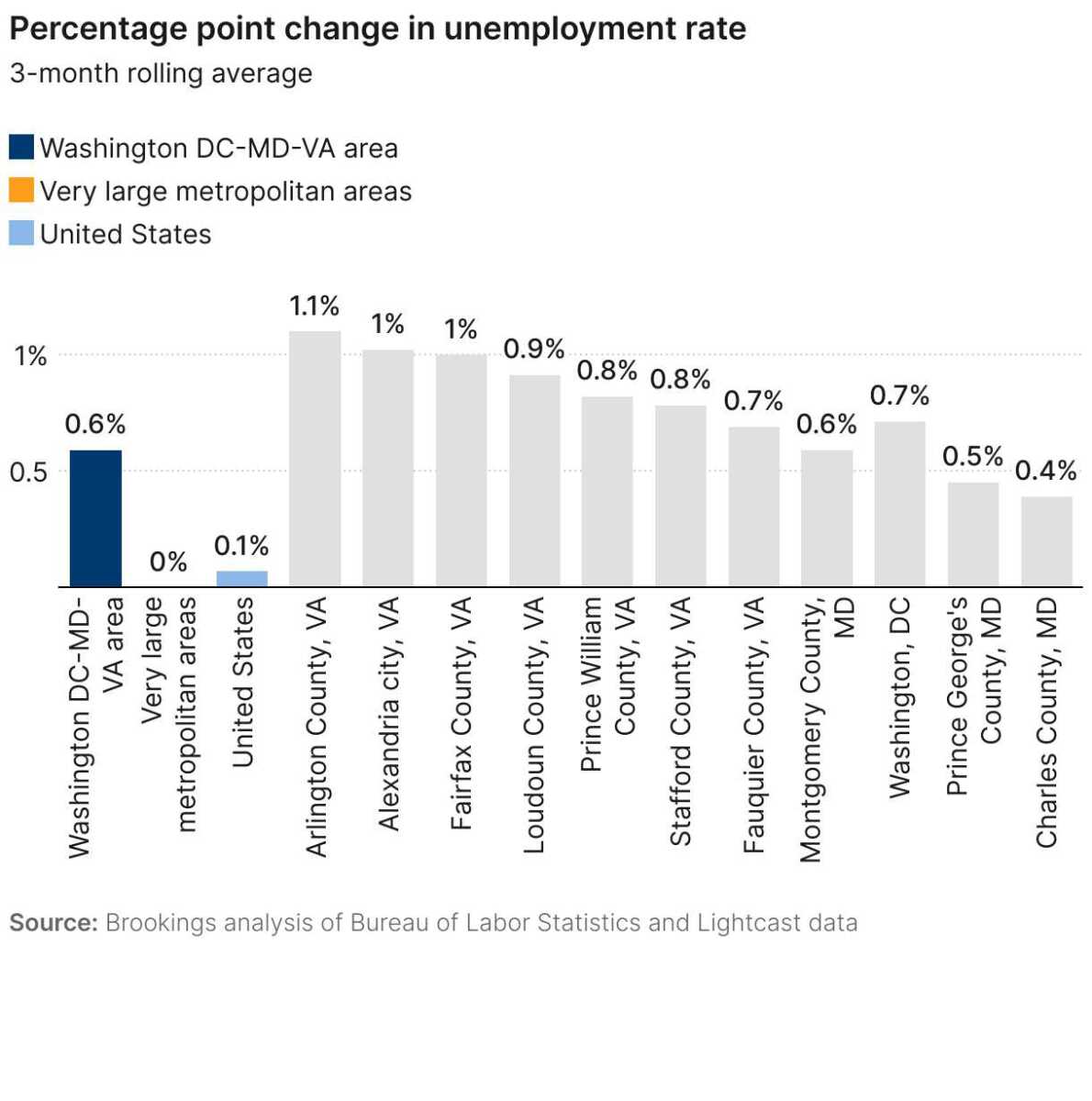

Source: Brookings analysis of Bureau of Labor Statistics and Lightcast data

The scale of the federal impact is clear in regional unemployment data. The Washington metro area saw a 0.6 percentage point increase in unemployment — six times the national average of 0.1 percentage points, according to the Brookings Institution analysis.

The Washington-Arlington-Alexandria metro area leads the country with 73.6% of homeowners carrying mortgages, according to Realtor.com’s analysis of 2024 Census data. That compares to just 59.7% nationally, making local homeowners far more likely to be “rate-locked” — unable or unwilling to move due to higher borrowing costs.

But as mortgage rates approach 6% following the Federal Reserve’s September rate cut, those same homeowners could flood the market as both buyers and sellers.

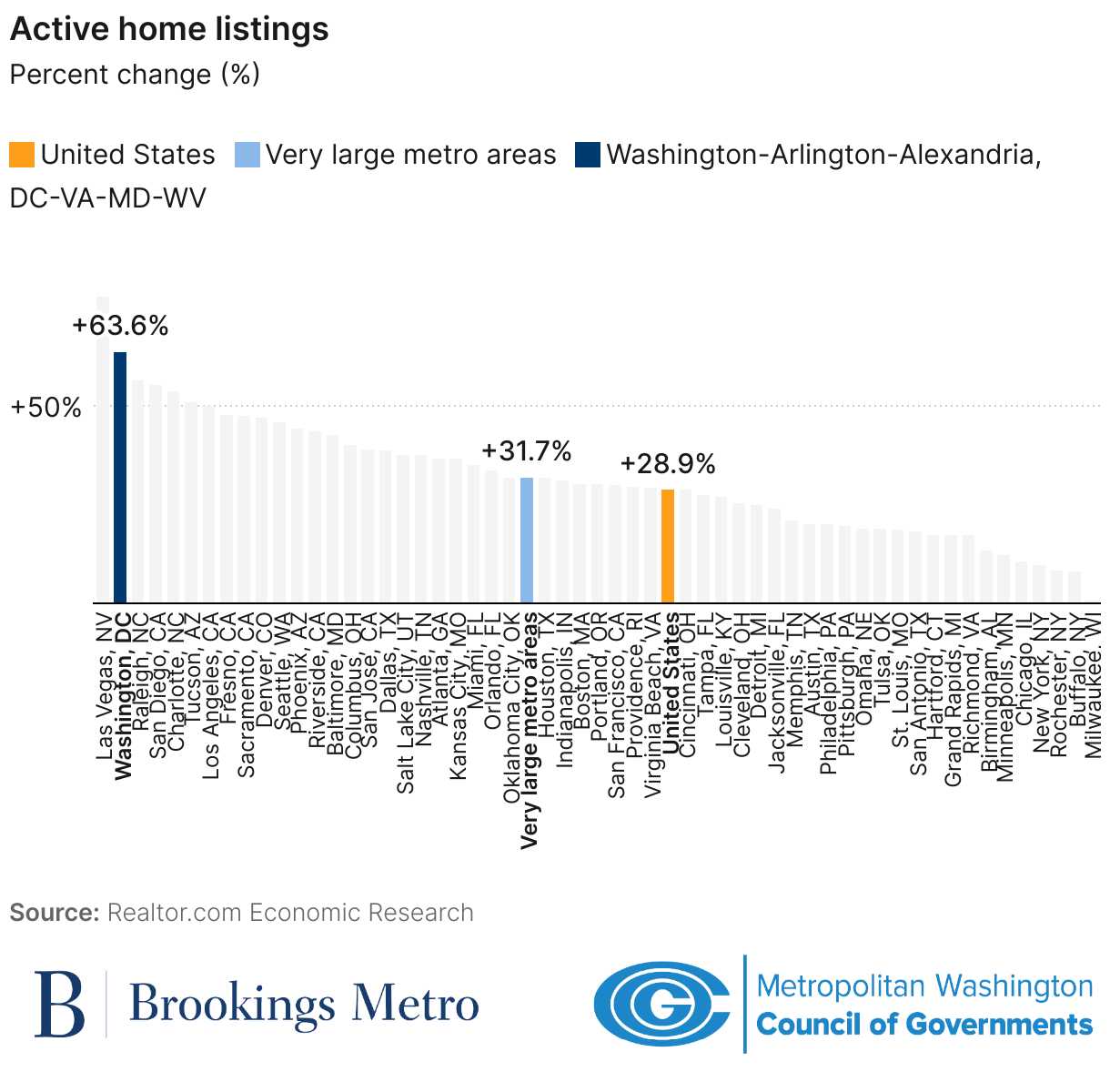

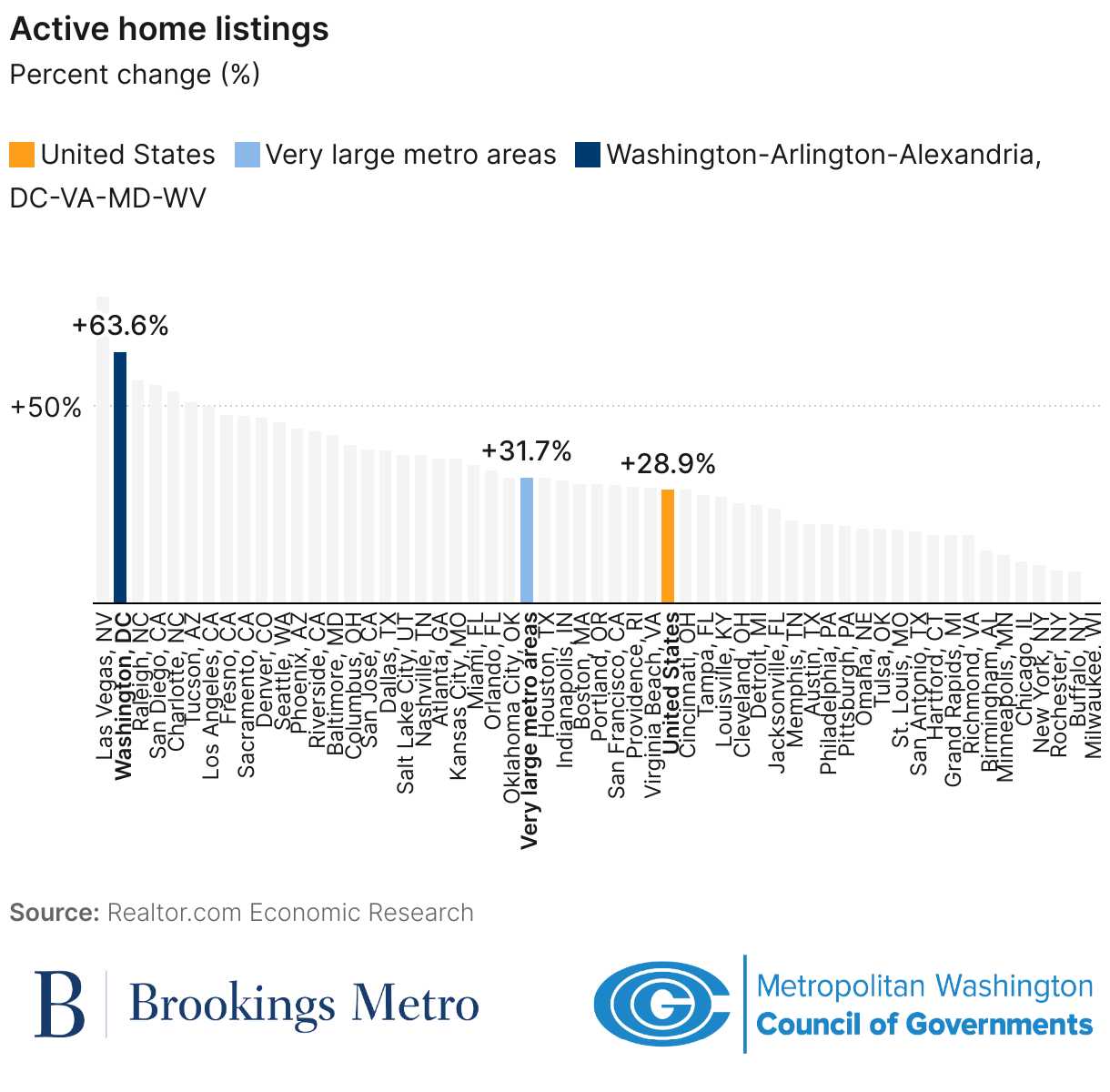

Home listings in the Washington metro area have surged 63.6% since last June, the highest increase among major metropolitan areas. Source: Realtor.com Economic Research/Brookings Institution

Home listings in the Washington metro area have surged 63.6% since last June, the highest increase among major metropolitan areas. Source: Realtor.com Economic Research/Brookings Institution

The collision of these forces is already visible in Alexandria’s housing data. Active home listings surged 44% to 308 properties as of July, driven partly by federal workers leaving the area. Regionally, the Brookings Institution found that homes for sale in the Washington area increased 63.6% since last June — the highest increase among major metropolitan areas and far surpassing the 28.9% national average.

Yet homes still average just 23 days on market with 44% selling within 10 days. Median sales prices rose 5.38% year-over-year, even as inventory increased.

More than 13,000 federal workers call Alexandria home, according to WTOP, many of whom may be considering relocating as the Trump administration continues what researchers call the most significant government downsizing in modern history.

The intersection of these trends could present opportunities for buyers, with increased inventory meeting lower borrowing costs.

Realtor.com researchers expect mortgage rates to remain in the low 6% range through year-end. The analysis notes that 81% of existing mortgages nationally have rates at 6% or lower, meaning many current homeowners could be “unlocked” to make moves they’ve been deferring as rates approach that threshold.

In Alexandria’s case, that buyer pool could be particularly deep given the area’s high mortgage usage.

Alexandria’s situation reflects broader regional trends, but the area’s high concentration of mortgage holders suggests strong underlying demand once rates make moving more attractive.

City Manager Jim Parajon cautioned in September that local unemployment figures “really don’t reflect the early buyouts, administrative leave and the federal layoffs that are not fully reflected in the unemployment data yet,” suggesting more housing market disruption may lie ahead.

For Alexandria residents, the competing forces create both opportunities and uncertainties. Buyers may find more inventory to choose from, combined with improved affordability from lower rates. Sellers face a market with more competition but potentially strong demand from rate-motivated buyers. Current homeowners considering moves may find this a unique window when both selling and buying conditions align.

With a Sept. 30 deadline approaching when most deferred federal resignations take effect, additional housing inventory could hit the market just as mortgage rate relief draws in new buyers.

“Uncertainty continues at the national level,” Parajon told council members in September. “Anytime there’s uncertainty, there’s a question of whether you should invest or not invest, whether you should buy or sell, whether you should move or stay.”

For Alexandria, the answer may depend on whether the city’s unique position as the nation’s most mortgage-sensitive market proves stronger than the disruption from federal downsizing.