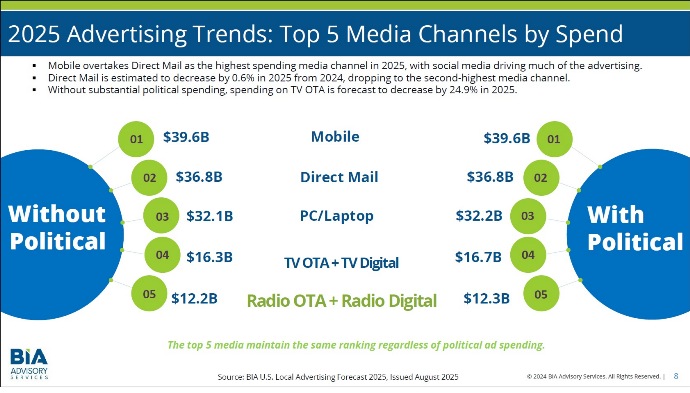

Total local advertising spending is projected to reach $168.2 billion in 2025 (ex. political), with local radio as the fifth-largest media in terms of ad spending. That’s according to BIA’s latest forecast, which finds local radio will generate $12.3 billion in 2025, with $2.3 billion coming from Radio Digital.

“Finish 2025 Strong; Kickstart 2026 with Momentum,” the latest ad revenue outlook from BIA Advisory Services, was discussed Wednesday at an RAB Live Presentation. The event’s panelists included BIA Advisory Services’ Celine Matthiessen, VP of Insights and Analytics; and Senan Mele, VP of Forecasting and Data Analysis. RAB Senior VP of Professional Development Jeff Schmidt moderated the session.

BIA says with the end of 2025 approaching, it will be key to maximize opportunities and work toward 2026. With shifts in consumer behavior and spending across key local business categories, having insights into the current and future marketplace will be key advantages to driving growth.

Among other key highlights from the webinar:

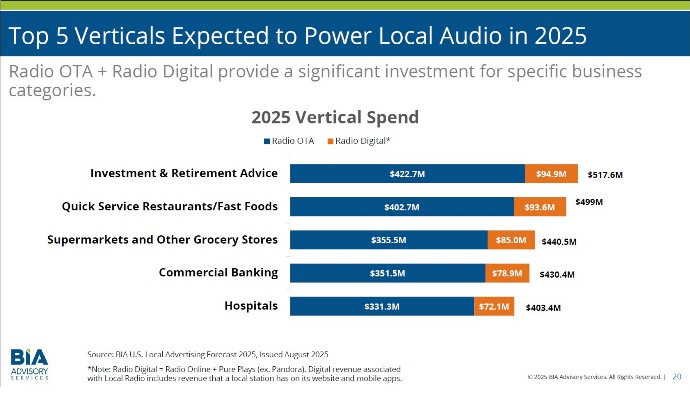

In 2025, the traditionally radio-focused advertising verticals are expected to lead the way: Investment & Retirement Advice, Quick Service Restaurants (QSRs) and Fast Food, Supermarkets, Commercial Banking and Hospitals.

Radio Digital, meanwhile, will see ad spending increases in Real Estate Development (up 8.2% YoY), Mattress and Sleep Centers (up 2.3% YoY), as well as Direct Life Insurance Carriers (up 2.2% YoY). These categories will want to tap into radio’s digital assets to grow their businesses.

With the expanding landscape of Connected TV and OTT, new avenues for local radio will appear. CTV and video ads will be used to complement traditional spot radio ads. This trend is allowing advertisers to bundle radio and CTV ads through radio stations, enhancing advertiser reach.

The research also identifies key spenders. It finds Tier 2 Local Auto Dealer Associations, Direct Health & Medical Insurance and Clothing Stores are just a few of the spenders that will potentially boost the end of 2025.

Matthiessen, looking to the fourth quarter, sounded a positive note about the auto dealer associations. “They’re going to get new cars in,” she said. “There is still advertising going on. EVs, there’s still a big push for them. Certain brands, they’re still going to be spending. So make sure you get what you can from the local auto dealers.”

Other key insights from BIA highlight how AI is influencing local radio and include an early analysis of business categories that look strong for 2026. As an organization focused on zeroing in on marketplace factors that impact revenue in the local marketplace, BIA believes that radio’s strength is always in focusing on its OTA content while also maximizing key digital strategies to increase revenue and growing sales for local businesses.

“The main takeaway, in terms of trends from all of that information, is that radio is still a very important ad platform,” Mele said. “Sixty-four percent of U.S. adults listen to traditional radio, and over half of them tune in to AM and FM stations every day, averaging over 12 hours per week.”