Physicians in Connecticut and around the country are sounding the alarm about a new policy by insurers they say could lead to lost revenue and increased administrative burden for providers, but confusion persists about how the policy will be enacted.

On July 1, Cigna announced an update to its reimbursement policy. Beginning Oct. 1, the announcement said, the insurer would review claims for office visits billed at the highest reimbursement rates — “Level 4” and “Level 5.” Cigna would then reduce the rate in cases where the claims suggested the visits didn’t actually meet the appropriate level of complexity, without consulting the physician in advance.

If providers disagreed with the reduction in reimbursement, they could submit medical records substantiating the higher billing code and Cigna would adjust the reimbursement back up.

“This change is designed to reduce overbilling, promote accurate documentation, and align with the American Medical Association coding guidelines,” Justine Sessions, a spokesperson with Cigna, said in emailed comments. “Importantly, this policy change does not lead to more denials or delay care for customers in any way.”

A similar policy by Aetna went into effect in Connecticut in March 2025, Phillip Blando, a spokesperson with the company confirmed. Blando said Aetna’s billing criteria “are based on CMS and American Medical Association guidelines.”

“Evaluating the appropriateness of levels 4 and 5 codes helps us ensure providers are billing for their services consistent with national guidelines,” Blando said in emailed comments.

Reaction from physicians to the July announcement was swift.

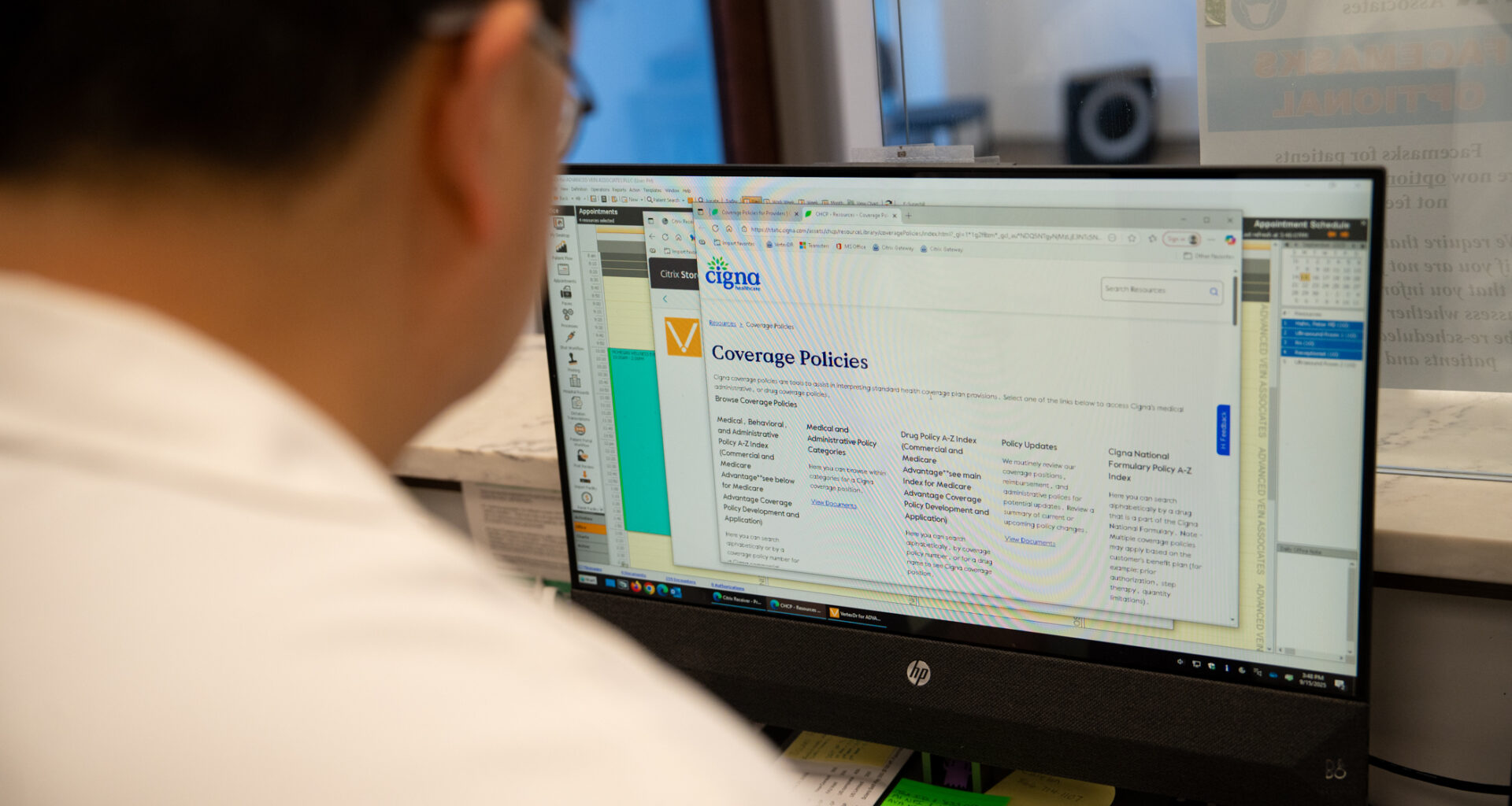

Dr. Peter Hahn, a cardiac electrophysiologist, works on his computer at Advanced Vein Associates in Uncasville on Sept. 15, 2025. Hahn is concerned that a new reimbursement policy announced by Aetna and Cigna will result in lost revenue and increased administrative burden for his private practice. Credit: Dana Edwards / CT Mirror

Dr. Peter Hahn, a cardiac electrophysiologist, works on his computer at Advanced Vein Associates in Uncasville on Sept. 15, 2025. Hahn is concerned that a new reimbursement policy announced by Aetna and Cigna will result in lost revenue and increased administrative burden for his private practice. Credit: Dana Edwards / CT Mirror

“My understanding, and the understanding of everyone who’s been rallying the cry about this is, the new policy just says they’re going to downcode everybody and it’s up to us to go back and fight and prove we’re not doing it inappropriately,” said Peter Hahn, a cardiologist in Uncasville. “Only then, after we file the appeal, can we get paid for the services rendered.”

The concern from providers even caught the attention of U.S. Sen. Richard Blumenthal, who wrote a letter to Cigna calling for the policy’s reversal.

“If allowed, this new policy will significantly increase administrative burdens and costs for physicians while jeopardizing patient care. I urge you to reverse this decision and instead work closely with physicians to address any billing concerns,” Blumenthal wrote in the Sept. 11 letter.

But two days before Blumenthal sent his letter, Cigna had issued a clarification on Sept. 9 stating that the change was actually narrower in scope than the worst-case scenario Hahn and others had assumed was true.

Cigna said it will only review claims by roughly 1% of doctors in its network who “records indicate as having a consistent pattern of coding at a higher [level] for routine visits compared to their peers,” including those who, for example, bill diagnoses such as “earache” or “sore throat” as Level 4 or 5 visits.

Cigna’s initial announcement did not contain details about the scope of the new policy, like how many providers would be impacted and what share of visits would be downcoded.

Hahn said that lack of detail caused panic and confusion, particularly among small, independent providers, like himself. Hahn estimates he already spends “probably a full day a week” devoted to “fighting with insurance companies,” and worries the policy would only exacerbate that burden.

Cigna has already sent notifications to any provider that will be impacted by the new policy, Sessions, the company’s spokesperson, confirmed. Sessions did not respond to a question about how many doctors in Connecticut would be impacted.

Blando, the spokesperson for Aetna, declined to respond to questions regarding details about the scope of the policy similar to the details provided by Cigna.

Hahn said that as of Sept. 19, he had not received direct communication from Cigna that his claims would get reviewed under the new policy.

David Eagle, an oncologist based in New York, said that while the September announcement provided clarification, he still finds the policy problematic. Eagle agreed that insurers are perfectly within their rights to audit physician billing practices. But, he said, there’s a right way to do it, and this isn’t it.

Cigna is making reimbursement decisions based on claims filed, which don’t contain all the information necessary to appropriately assess the complexity of a visit, Eagle said. Instead, the company should be using medical records.

“You’re just using the wrong information set. And then it’s the problem of the physician to fight back, claim by claim, visit by visit, to get paid appropriately,” Eagle said.

Eagle said insurers have a responsibility to ensure their auditing policies are designed correctly because denials cause more work for physicians and delays in care for patients.

When faced with prior authorization requests from insurers, “everybody has to scramble on the medical side after the fact to explain and justify treatment for cancer patients, so it causes delays in treatments. And so much extra work,” Eagle said.

Mark Camel, a retired neurosurgeon and co-founder of the Greenwich-based Orthopaedic and Neurosurgery Specialists, said it’s also important that, when determining which physicians to include in the policy, Cigna compares providers to peers in the same speciality. An oncologist who sees a complex patient base and is more likely to have Level 4 or 5 visits shouldn’t be compared to an orthopedic surgeon, whose patients include people who come in with knee pain, Camel said.

Camel said the policy is “okay as long as each physician is compared within their specialty because of the variation of types of visits.”

A representative from the Connecticut State Medical Society provided comment regarding Cigna’s initial policy but could not be reached for follow-up comment regarding the insurer’s updated policy.

In a statement, the Connecticut Hospital Association also called for the reversal of the policies.

“We have concerns that these new policies will create uncertainty for providers and patients and add significant administrative burden and cost. They should be rescinded. Clear, transparent policies are essential to supporting fair reimbursement and ensuring patients’ continued access to care,” Nicole Rall, a CHA spokesperson, stated in emailed comments.