Market Size & Trends

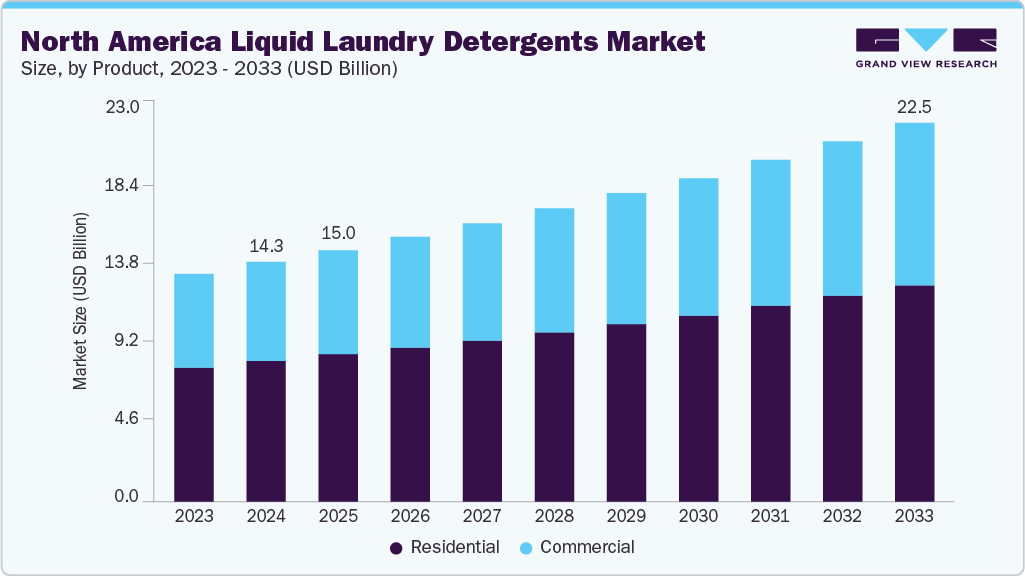

The North America liquid laundry detergents market size was estimated at USD 14.26 billion in 2024 and is expected to reach USD 22.55 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The market growth is driven primarily by increasing consumer preference for convenience and effectiveness. Liquid detergents dissolve quickly, including in cold water, making them compatible with modern washing machines and appealing to consumers seeking time-saving and hassle-free laundry solutions. Their ready-to-use formats eliminate the need for measuring and reduce spillage, which enhances user convenience and drives adoption.

Technological advancements and product innovation have also played a significant role. Manufacturers are introducing concentrated formulas, eco-friendly and organic variants, and multifunctional products that combine stain removal with fabric conditioning and pleasant fragrances. These innovations meet the evolving consumer demand for specialized, sustainable, and high-performance laundry products, fueling the expansion of the North America liquid laundry detergents industry.

Rising awareness about hygiene and cleanliness, especially due to global health concerns, has increased demand for effective detergents. Liquid detergents are often marketed as superior in removing bacteria and tough stains, attracting health-conscious consumers focused on maintaining household hygiene. This trend is powerful, particularly in the U.S., where consumers increasingly prioritize health and safety in their purchasing decisions.

Urbanization and lifestyle changes have further contributed to market growth. With more people living in urban areas and leading fast-paced lives, there is a growing need for convenient and efficient household products. The proliferation of automatic and high-efficiency washing machines in North America supports the preference for liquid detergents, which perform well in these appliances and align with modern laundry habits.

Environmental and health concerns are shaping consumer choices, with a rising demand for natural, organic, and skin-friendly liquid detergents that avoid harsh chemicals. This has encouraged manufacturers to develop biodegradable, eco-friendly products and sustainable packaging options. The market, characterized by increasing eco-consciousness, is witnessing strong growth in this segment as consumers seek effective and environmentally responsible products.

The expanding commercial and institutional demand from the hospitality, healthcare, and textile sectors adds to the growth momentum. These sectors require efficient and reliable cleaning solutions, and liquid detergents effectively meet these needs. Combined with rising disposable incomes and household spending, these factors collectively drive the robust growth of the North America liquid laundry detergents market.

The North American liquid detergent market faces several notable challenges that could impact its growth trajectory. One of the primary obstacles is the market’s maturity, especially in the United States, where high adoption rates and brand loyalty limit opportunities for rapid expansion and make it difficult for new entrants to gain significant market share. This maturity also means that growth largely depends on product innovation and differentiation, which requires substantial investment in research and development. Additionally, fluctuations in raw material prices, particularly those derived from petroleum, can increase production costs and squeeze profit margins for manufacturers. The market is also subject to stringent environmental and safety regulations, compelling companies to continually adapt their formulations and packaging to comply with evolving standards, which can be costly and time-consuming.

Supply chain disruptions represent another significant challenge for the North American market. Global events, such as geopolitical tensions or pandemics, can interrupt the flow of raw materials and finished goods, leading to inventory shortages and increased operational costs. The increasing bargaining power of large retail chains and e-commerce platforms also pressures manufacturers to offer competitive pricing and promotional deals, which can further erode margins. Furthermore, the shift in consumer preference toward eco-friendly and organic products necessitates continuous innovation and can increase production complexities and costs. Companies must also contend with moderate substitution risks from alternative cleaning methods and products, requiring ongoing consumer education and marketing efforts to maintain brand loyalty and market share.

Application Insights

The residential segment dominates the North America liquid laundry detergents industry with a revenue share exceeding 60% in 2024, mainly driven by changing consumer lifestyles and increasing demand for convenience. Modern households increasingly rely on automatic and high-efficiency washing machines, which work best with liquid detergents due to their quick dissolving properties and compatibility with cold water washes. Consumers prefer liquid detergents for their ease of use, precise dosing, and ability to prevent residue buildup on clothes and machines. Additionally, the growing awareness of hygiene and cleanliness, especially following the COVID-19 pandemic, has led to more frequent laundry cycles and a preference for detergents that offer superior stain removal and antibacterial properties.

Moreover, the residential segment benefits from evolving consumer preferences towards sustainable and health-conscious products. There is a rising demand for eco-friendly, biodegradable, and hypoallergenic liquid detergents that are gentle on both the environment and sensitive skin. Manufacturers have responded by innovating with plant-based ingredients, reduced chemical content, and recyclable packaging, which appeals to environmentally aware consumers. The convenience of online shopping and subscription services also makes it easier for households to access a variety of liquid detergent options, further driving market growth in this segment.

The commercial segment of the North America liquid laundry detergents market is expanding due to increasing demand from industries such as hospitality, healthcare, and textile services. These sectors require large volumes of detergent that deliver consistent, high-performance cleaning to maintain hygiene standards and fabric care. Hotels, hospitals, and laundromats often use industrial washing machines that need specialized liquid detergents formulated to work efficiently under heavy loads and varying water conditions. The emphasis on sanitation and infection control, particularly in healthcare facilities, has heightened the need for detergents with strong antibacterial and stain-removal capabilities, boosting demand in this segment.

Furthermore, commercial buyers are increasingly prioritizing sustainability and cost-efficiency. Many businesses are adopting green cleaning protocols and seeking detergents that reduce environmental impact without compromising cleaning power. Innovations such as concentrated formulas that reduce water and packaging waste are particularly attractive in commercial settings with high volume use. The growth of the commercial laundry sector, supported by rising disposable incomes and expanding hospitality and healthcare infrastructure, continues to drive the demand for liquid detergents tailored to meet the rigorous requirements of these industries.

Regional Insights

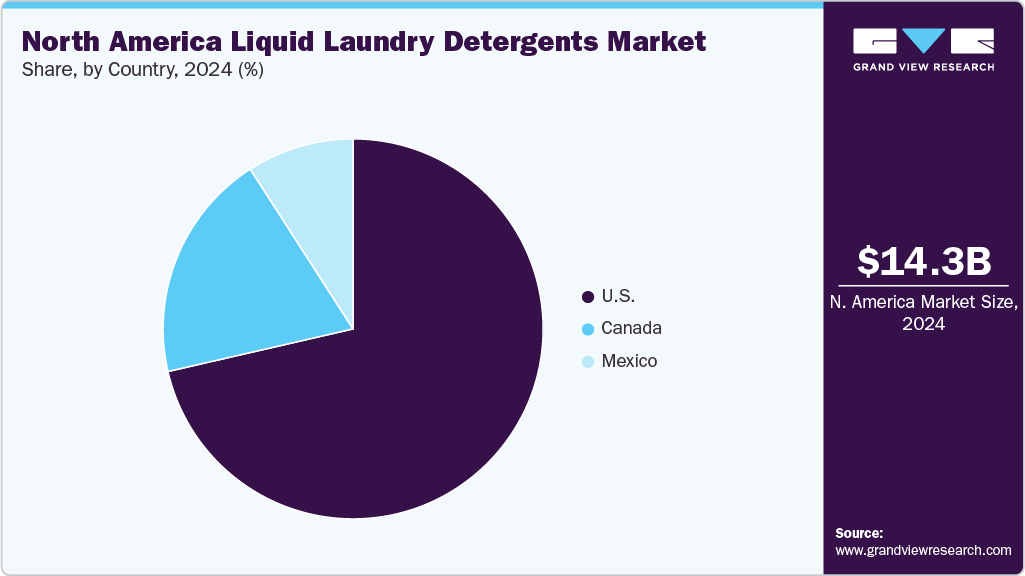

The growth of the U.S. liquid detergent industry is primarily driven by high consumer demand for convenience, advanced product innovation, and the widespread adoption of automatic washing machines. American consumers increasingly prefer liquid detergents due to their ease of use, faster dissolving properties, and compatibility with both standard and high-efficiency washers. The market is further propelled by a heightened awareness of hygiene and cleanliness, particularly after the COVID-19 pandemic. This has led to more frequent laundry routines and a greater focus on effective cleaning solutions. Leading brands continually innovate with concentrated, plant-based, and eco-friendly formulations that appeal to health-conscious and environmentally aware consumers.

Additionally, the U.S. market benefits from strong distribution networks, including online sales channels, supermarkets, and convenience stores, making a wide range of liquid detergent products easily accessible. The presence of major players investing in research and development ensures a steady stream of new product launches tailored to evolving consumer preferences. Rising disposable incomes, urbanization, and the trend toward sustainable living have further fueled demand for premium and green liquid detergent options, supporting robust market growth in the country.

Similar trends influence the growth of the liquid detergent market in Canada, emphasizing sustainability and environmental responsibility. As awareness of environmental issues and personal health rises, Canadian consumers increasingly seek eco-friendly, hypoallergenic, and phosphate-free liquid detergents. The country’s regulatory environment, which encourages sustainable product development and responsible marketing, has prompted manufacturers to introduce bio-based and biodegradable detergent options that cater to these preferences.

Moreover, the growing urban population and the rising penetration of washing machines in Canadian households contribute to increased demand for liquid detergents. The commercial sector, particularly hospitality and healthcare, also adopts high-performance, environmentally safe cleaning solutions. As a result, the Canadian market is experiencing steady growth, supported by consumer education campaigns, innovations in green chemistry, and the availability of a diverse range of liquid detergent products through various retail channels.

In Mexico, the liquid detergent market is expanding rapidly due to rising urbanization, increasing disposable incomes, and the growing adoption of modern appliances like washing machines. Mexican consumers are shifting from traditional bar and powder detergents to liquid formats, attracted by the convenience, superior cleaning performance, and suitability for various water conditions. The influence of global brands and aggressive marketing campaigns has also raised awareness of the benefits of liquid detergents, accelerating their uptake in both urban and semi-urban areas.

Additionally, the Mexican market is witnessing growth in demand for affordable, multi-purpose, and concentrated liquid detergents that offer value for money. As environmental awareness grows, there is a gradual but noticeable shift toward eco-friendly and less harsh formulations, although price sensitivity remains a significant factor in purchasing decisions. Expanding modern retail infrastructure, including supermarkets and online platforms, has further facilitated access to a broader range of liquid detergent products, supporting continued market growth in Mexico.

Key North America Liquid Laundry Detergent Company Insights

The competitive landscape of the North American liquid detergent market is characterized by the dominance of a few major multinational players, a mature retail infrastructure, and a strong focus on innovation and sustainability. Leading companies such as Procter & Gamble (with brands like Tide and Gain), Henkel, Unilever, The Clorox Company, and Church & Dwight command significant market share, leveraging extensive research and development capabilities to introduce a wide range of products tailored to evolving consumer preferences. These companies consistently invest in product innovation, launching concentrated, hypoallergenic, eco-friendly formulations and convenient formats like pods and unit dose products to maintain consumer interest and loyalty. Strong brand loyalty, particularly in the United States, further consolidates the market position of these established players, making it challenging for new entrants to gain traction.

The region’s advanced distribution networks and sophisticated retail infrastructure facilitate widespread product availability in physical stores and through rapidly growing e-commerce channels. North American consumers display a high proclivity for premium and specialized laundry care products, driving demand for innovations that offer superior cleaning, fabric protection, and sustainability benefits. Environmental regulations and rising consumer awareness about eco-friendly products push manufacturers to develop greener, biodegradable, and less chemically intensive detergents. While the U.S. is the largest and most mature market, Mexico is emerging as the fastest-growing segment, driven by urbanization and rising disposable incomes, with manufacturers expanding their product portfolios and distribution reach to capture this growth. The North America liquid laundry detergents industry remains highly competitive, innovation-driven, and responsive to shifting consumer and regulatory trends.

Key North America Liquid Laundry Detergents Companies:

- Procter & Gamble (P&G)

- Unilever

- Henkel

- Church & Dwight

- The Clorox Company

- Reckitt Benckiser

- Colgate-Palmolive

- Amway

- Phoenix Brands

- RGA Enterprises, Inc.

- Tropical Products, Inc.

- Carroll Clean

Recent Developments

-

In 2024, Henkel launched Persil® Activewear Clean, a first-of-its-kind detergent specifically designed for athletic wear. This product addresses the growing demand for products that effectively remove body oil, sweat, and odors while maintaining the shape and stretch of performance fabrics. This product was recognized as a 2025 Product of the Year USA Award winner, reflecting its popularity and innovation in meeting the needs of consumers with active lifestyles.

-

In 2023, ARM & HAMMER™ Power Sheets Laundry Detergent was launched, an eco-friendly sheet format, and all® free clear ultra-concentrated liquid detergent with 100% recycled plastic bottles, as well as a broader trend toward hypoallergenic, dermatologist-tested, and smart detergents compatible with advanced washing machines.

North America Liquid Laundry Detergents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.00 billion

Revenue forecast in 2033

USD 22.55 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Actuals

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Procter & Gamble (P&G); Unilever; Henkel; Church & Dwight; The Clorox Company; Reckitt Benckiser; Colgate-Palmolive; Amway; Phoenix Brands; RGA Enterprises, Inc.; Tropical Products, Inc.; Carroll Clean

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Liquid Laundry Detergents Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and analyzes the latest industry trends and opportunities in each sub-segment from 2021 to 2033. Grand View Research has segmented the North America liquid laundry detergents market report by application and region:

-

Application Outlook (Revenue, USD Billion, 2021 – 2033)

-

Country Outlook (Revenue, USD Billion, 2021 – 2033)