This article is sponsored by Principal Asset Management

Cloud computing and now the meteoric rise of artificial intelligence are driving data center returns to new heights, outpacing supply and leading the sector to become one of the most in-demand asset classes, say Matt Hackman, portfolio manager, and Sebastian Dooley, senior fund manager with Principal Asset Management. Just a decade ago, data centers were widely considered little more than an emerging infrastructure play, but have now transformed into a core sector of the commercial real estate market.

What role is the emergence of AI playing in driving demand for data centers?

Matt Hackman

Matt Hackman

Matt Hackman: In the US, we have seen a multitude of headlines announcing bigger and bigger AI training model deployments. Hyperscale companies continue increasing their capex targets, showing commitment to AI growth. High-intensity AI training workloads require dense server deployments with liquid-cooled and hybrid designs, enabling effective heat exchange and operational efficiency.

AI inference is equally crucial. While AI training can occur in more remote locations with access to cheap electricity, inference typically requires lower latency and proximity to the population base of end users. Most cloud-based facilities already occupy these locations, increasing demand in major markets nationwide.

Sebastian Dooley

Sebastian Dooley

Sebastian Dooley: Most of the world’s largest data centers are located in the US, given population and demand drivers, although there are major hubs globally. From a European perspective, we are seeing the large-scale generative AI model training deployment lag behind that in the US, and there is skepticism if it will reach the same relative scale. Inference, however, should reach the same relative scale across Europe, and we expect to see that demand continue to come through.

Beyond AI, what other structural or cyclical forces are shaping demand for data center assets?

SD: The majority of demand for data centers has been through cloud usage and connectivity usage. These have been demand drivers for the last decade or so and have much more mature business models compared with the AI use cases. As we see the general adoption of generative AI pick up and inference become more mainstream, this is pushing for additional demand in cloud- and connectivity-focused assets.

In so-called availability zones, or geographical areas where hyperscalers set up their cloud-focused data centers, we are seeing hyperscalers increasingly design and fit out buildings to be able to do both cloud and AI inference. This is pushing demand in these locations and, therefore, pushing rents.

What does effective execution of a data center investment strategy look like in today’s market?

MH: Data centers are complex developments that require significant experience and relationships for an effective execution. When targeting an opportunity, market selection and timing of power availability are paramount. Without correct site selection, the investment opportunity may be destined for failure.

Power demands have shifted significantly as increased utility power has put a strain on many providers nationwide. These utilities are now focused on additional generation, transmission, substations and distribution. Strong relationships with utility providers are now crucial to development. The same applies to equipment vendors and general contractors experienced in data center construction, and relationships with tenants remain critical. Delivering on time and on budget drives repeat leasing opportunities.

Examples include flexible enterprise solutions, high-interconnection opportunities, pulling stranded power into existing data centers to increase capacity and building hyperscale campuses. These diverse partnerships enable investments across all data center types.

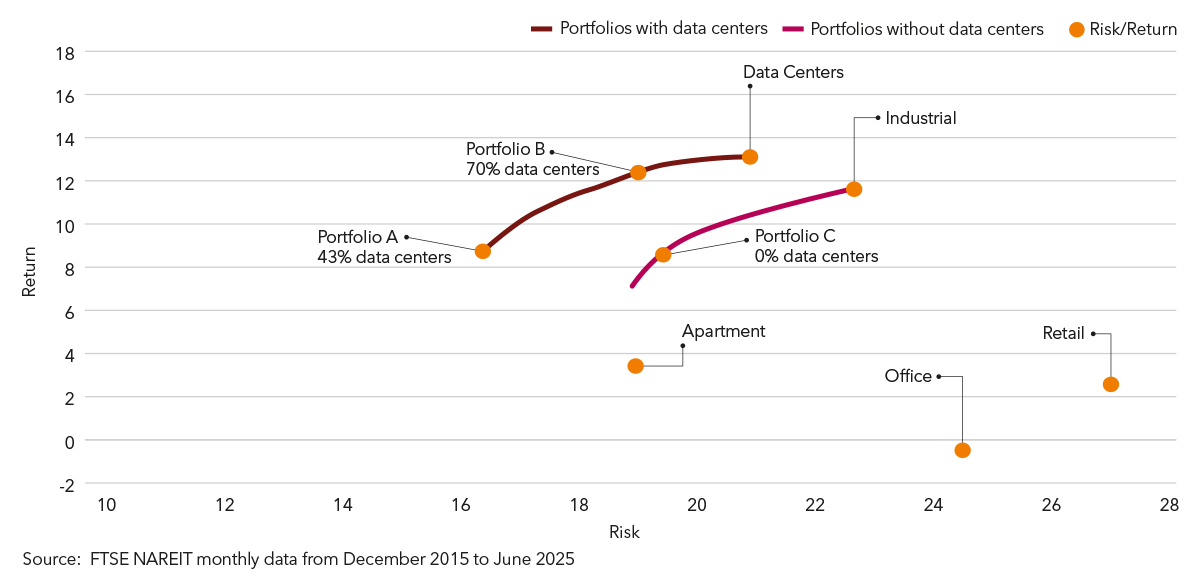

Optimal REIT portfolios with data centers generate higher returns for the same level of risk (%)

Click to enlarge

Click to enlarge

Which geographic markets are the most significant for data centers?

MH: Ten years ago, Northern Virginia and Silicon Valley here in the US dominated data center growth, but as power challenges intensify in primary markets, absorption continues shifting to regions with fewer land and power constraints. While these markets continue to grow, development has expanded to Atlanta, Chicago, Dallas and Phoenix, and now further to emerging tier-two markets like Austin, Texas; Columbus, Ohio; and Reno, Nevada.

SD: Here in Europe, the FLAP-D markets of Frankfurt, London, Amsterdam, Paris and Dublin are the data center hubs. Power constraints and securing power transmission infrastructure are difficult, which has led to expansion in Madrid, Milan, Zurich and Berlin, among other locations.

We are also seeing some Nordic cities, such as Copenhagen and Stockholm, draw increased demand, although construction in these markets is not a given. Madrid is getting tight, and Zurich has natural barriers to entry, given that mountains surround it. There is still some runway in those markets for further growth, though.

Access to power is often cited as the biggest bottleneck in data center development these days. There are also significant cooling needs. How are managers and developers navigating those challenges?

MH: Access to power gates data center development. Public utilities are facing amplified demand; hence, increased dialogue with utilities is required. Large deposits are often required to facilitate infrastructure requirements for power delivery. To expedite power, we may provide land to the utility for a substation or look to build the substation ourselves. Beyond local utilities, we explore potential on-site generation opportunities for deployment timing and scalability.

These options are often driven by tenant timing and redundancy requirements. Near term, natural gas solutions offer viability in locations with access to the expansive network of pipelines in place. Long term, small modular reactors may play a role if regulatory and public perception hurdles can be navigated.

SD: We are increasingly working with partners with a good, granular understanding of the local markets that they are looking to develop in. As execution becomes tougher, whether from production of power or transmission, understanding the requirements and challenges of the local economy and population is key to being able to propose solutions that work with utility companies and local governments to find solutions while enabling data center development.

What are the other challenges or risks in executing data center strategies?

MH: With increasing demand for data centers, the supply chain has struggled to keep up with critical equipment. Lead times for generators, switchgear and transformers can exceed two years. Without pre-established vendor relationships and contracts in place prior to construction, project timelines face significant delays. Another critical factor in successful delivery is having the right general contractor in place. These are very specialized builds that require a significant level of expertise.

How does allocating to data centers affect the overall risk-return profile of an investment portfolio?

SD: In short, data center inclusion in a REIT portfolio has historically improved overall returns. In the US, we looked at 10 years of data from NCREIF, which shows that portfolios without data center investment average a 9 percent return, whereas portfolios that do include data centers – assuming the same amount of risk – average a return rate just below 13 percent. Historically, data centers have not been a large investment sector, but demand has increased, with capital raising for data center investment on the rise.

What trends do you anticipate will most shape the data center investment landscape over the next three to five years?

MH: I expect average rack densities to continue to rise in new developments, especially those supporting AI, driving the need for advanced cooling solutions to become a central focus. Increasing power demands will make energy procurement, whether through utility partnerships or on-site generation, a critical priority as well.

Data centers are evolving into highly strategic assets, offering attractive return potential while serving as essential infrastructure for societal growth and the ongoing digitization of our world. Twenty years ago, facilities supported websites and e-mail; a decade ago, mobile services; today, they power AI, autonomous vehicles and complex intelligence systems.

The scale of demand is unprecedented. Approximately 90 percent of all existing data has been created in just the past two years. The amount of data creation is exponential, and with AI, data is creating more data.

SD: We also expect to see the capital markets continue to evolve. Generally, the data center market has grown to the scale it has in a world of readily available and cheap debt, and most of the equity capital raised has had a cost of capital associated with development-style risks. Higher interest rates and more stabilized assets have created demand for new sources of capital.

Given the long-term, high-credit-quality nature of the income that stabilized data centers have, we expect to see core capital start to move to the sector, which will change the nature of capital markets.