(Bloomberg) — The looming US government shutdown is a clear risk for the dollar.

The threatened shutdown is adding to a number of challenges that have kept the dollar under pressure this year — including a new cycle of US interest-rate cuts that kicked off this month and attacks on the Federal Reserve’s independence by the Trump administration.

Most Read from Bloomberg

“The likelihood of the potential for a government shutdown is relatively high,” said Bill Campbell, a global bond portfolio manager at DoubleLine. A protracted closure could weigh on the dollar, he added.

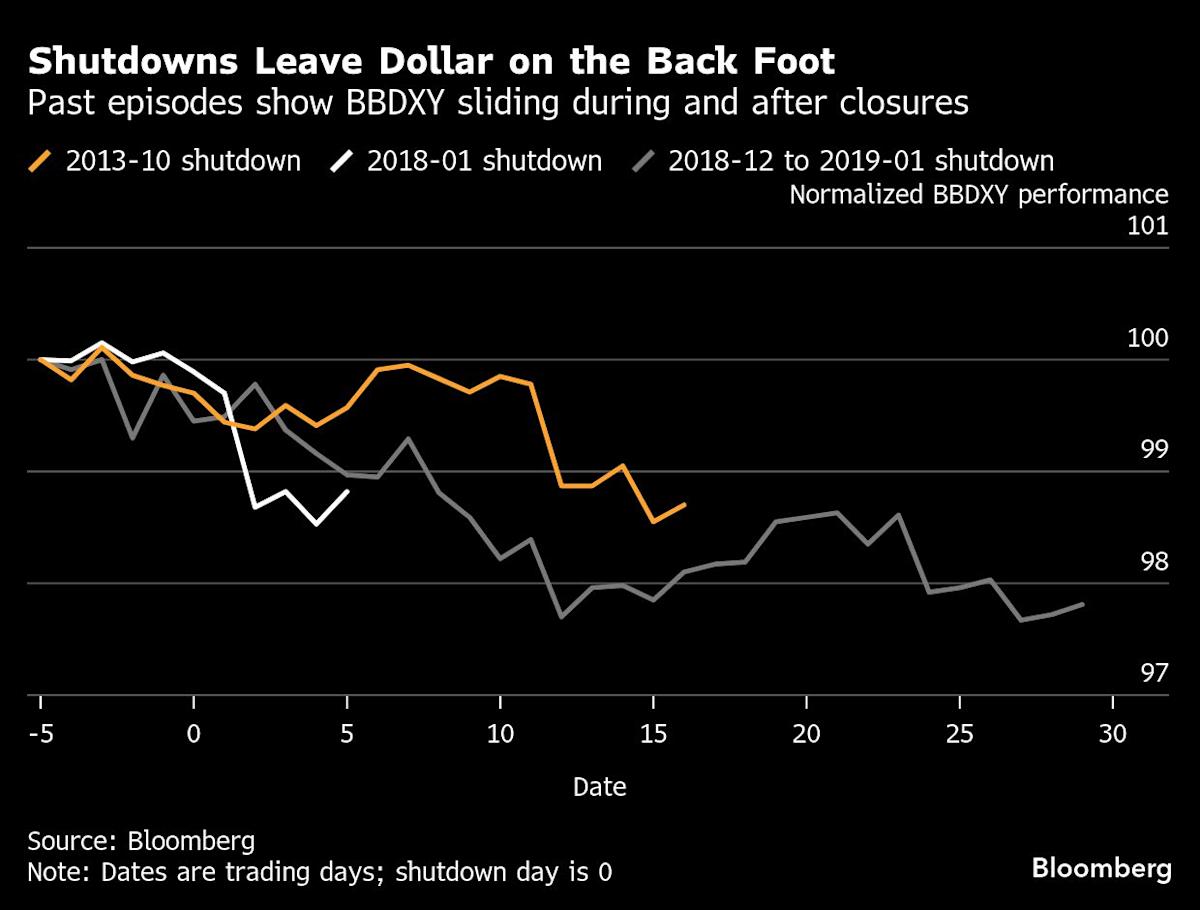

In the three most recent episodes — in 2013, early 2018 and late 2018 into 2019 — the Bloomberg Dollar Spot Index drifted lower both during the impasse and in the immediate aftermath. The 35-day closure of federal operations that began in December 2018 delivered the most pronounced bout of dollar weakness — showing the dollar would suffer more the longer the shutdown lasted. The greenback fell by around 2% during that shutdown period.

This time around, the US currency capped a third straight daily decline, down 0.7% over the period. Bloomberg’s dollar gauge is down more than 8% this year and fell less than 0.1% in September.

Implied volatility in euro-dollar options tends to rise ahead of shutdowns, underscoring that traders are quick to price in disruption risks. But realized swings tell a different story.

In 2013, spot volatility lagged and only briefly spiked once the shutdown began. In January 2018, expectations and delivery lined up, with realized volatility tracking implied almost one-on-one. By contrast, during the prolonged 2018/19 closure, options priced in turbulence that never fully materialized, as realized volatility stayed subdued through much of the impasse.

It’s no surprise that options sentiment over the next month has shifted back to neutral on the dollar, erasing last week’s modest bullish bias.

“Given greater market sensitivity to US political developments, we would expect modest dollar weakness against the yen, Swiss franc, and euro should a shutdown materialize,” Citigroup strategists Daniel Tobon, Brian Levine and Osamu Takashima wrote in a Sept. 29 note. “However, a quick resolution to the shutdown could lead to limited follow-through, keeping us in similar ranges to recent months.”

By Tuesday afternoon, a shutdown appeared increasingly likely. That would delay the release of key economic indicators, including the monthly employment report scheduled for Friday.

At JPMorgan, strategist Patrick Locke said that the possible shutdown gives “an added layer of significance” to other economic data, including Conference Board, job openings, ISM and ADP figures. August job openings released Tuesday were little changed while hiring was dampened, signaling a steadily slowing demand for workers.

–With assistance from Carter Johnson, Anya Andrianova and George Lei.

(Updates with prices as of month-end close.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.