According to Towards

Healthcare data, the global liquid

filtration for pharmaceuticals market is

growing quickly and is expected to generate hundreds of millions in revenue

between 2025 and 2034. This growth is being driven by rising investments,

continuous innovation, and increasing demand from multiple industries.

Several factors contribute to

market growth, including the increasing development of biologics and targeted therapy, and advancements in manufacturing

technologies. The demand for personalized medicines is increasing due to a rise

in chronic disorders and the geriatric population. Government bodies provide funding

for installing advanced manufacturing technologies for pharmaceutical and biotechnology products.

The Complete Study

is Now Available for Immediate Access | Download the Sample Pages of this

Report @ https://www.towardshealthcare.com/download-sample/5934

The Liquid Filtration for Pharmaceutical

Market: Highlights

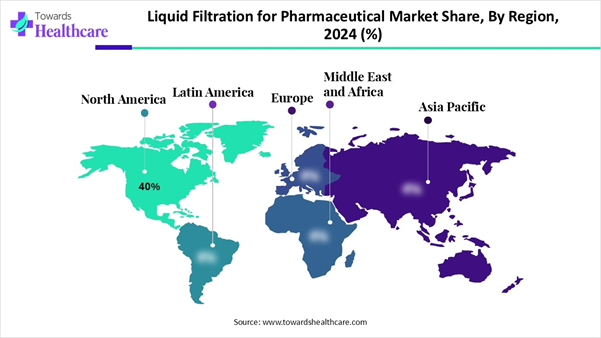

➢ North America dominated the global market share by 40% in

2024.

➢ Asia-Pacific is expected to witness the fastest growth

during the predicted timeframe.

➢ By type of filtration technology, the membrane filtration

segment held a dominant revenue share of the market in 2024.

➢ By type of filtration technology, the ultrafiltration

sub-segment is expected to grow at the fastest CAGR in the market during the

forecast period.

➢ By filter media type, the polyethersulfone (PES) segment

accounted for the highest revenue share of the market in 2024.

➢ By filter media type, the polyvinylidene fluoride (PVDF)

segment is expected to witness the fastest growth in the liquid filtration for

pharmaceutical market over the forecast period.

➢ By application, the sterile filtration segment held a major

revenue share of the market in 2024.

➢ By application, the clarification filtration segment is

expected to expand rapidly.

➢ By end-user, the pharmaceutical manufacturers segment led

the market in 2024.

➢ By end-user, the contract manufacturing organizations

(CMOs) segment is expected to show the fastest growth in the upcoming years.

➢ By filtration equipment type, the filter cartridges segment

contributed the biggest revenue share of the market in 2024.

➢ By filtration equipment type, the filter capsules segment

is expected to grow with the highest CAGR in the market during the studied

years.

What is Liquid Filtration for

Pharmaceuticals?

The liquid filtration for

pharmaceutical market refers to the development and distribution of special

filters to remove impurities from pharmaceutical products during manufacturing.

Filters eliminate contaminants, such as bacteria, viruses, dust, dirt, and

other debris, to improve product quality. The various types of filters used in

the pharmaceutical industry include membrane, depth, cartridge, bag, and

activated carbon. The selection of the filters depends on the type of

pharmaceutical to be manufactured.

You can place an

order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Advanced Membrane Technologies:

Major Potential

Advancements in membrane

technologies have emerged as a major potential in developing innovative filters

with greater efficacy and reduced complexity. Nanofiltration and membrane

filtration provide superior filtration efficiency as they are semi-permeable

filters with extremely fine pores. They offer numerous benefits, such as

increased durability, fouling resistance, and higher permeability.

Additionally, scientists develop novel filter materials like polyethersulfone

(PES) and polyvinylidene fluoride (PVDF) to optimize the filtration process.

High Cost: Major Limitation

The installation and maintenance

of filter materials for liquid filtration, especially at large-scale

operations, are highly expensive. Innovative filter materials are more costly

than conventional filter materials. This limits the affordability of numerous

pharmaceutical and biotech companies from low- and middle-income countries, restricting market growth.

The Liquid Filtration for

Pharmaceutical Market: Regional Analysis

North America held a major revenue

share of the market by 40% in 2024. The market in North America is driven by

the strong presence of leading pharmaceutical and biotech companies and a

robust healthcare infrastructure. Government organizations provide funding for

installing advanced filter systems. Favorable regulatory policies and

increasing collaborations among key players propel market growth. Furthermore,

the demand for personalized medicines and the increasing number of contract development and

manufacturing organizations (CDMOs) foster the market.

The U.S. is home to over 5,000

pharmaceutical companies and 3,000 biotechnology companies that deliver

high-quality products. Key players, such as Eli Lilly and Company, Pfizer,

Inc., and AbbVie, Inc., are major contributors to the pharmaceutical sector in

the U.S. The filtration system should comply with the Food and Drug

Administration (FDA) and the United States Pharmacopoeia (USP) guidelines.

The Canadian pharmaceutical sector

ranks sixth globally, with a 2.1% share of the global market. This is due to increasing

manufacturing activities, burgeoning drug sales, and expanding trade policies

with foreign nations. In 2023, the total drug sales in Canada were $42.1

billion, including patented and non-patented drugs.

Asia-Pacific is expected to

grow at the fastest CAGR in the market during the forecast period.

The liquid filtration for

pharmaceutical market is experiencing significant expansion, with the

burgeoning pharmaceutical and biotech sector and favorable government support.

Asia-Pacific countries like China, India, and Japan have suitable manufacturing

infrastructure, encouraging foreign players to set up their manufacturing

facilities in these countries. The increasing number of pharmaceutical and

biotech startups and venture capital investments contributes to market growth.

China boasts more than 10,000

pharmaceutical companies. According to the latest J.P. Morgan report, 27% of

the total global big pharma deals with over $50 million originated from China

in 2024. Additionally, around 39% of the total global big pharma funding of

over $50 million was paid to Chinese firms in 2024.

Download the single region market report

@ https://www.towardshealthcare.com/price/5934

The Liquid Filtration for

Pharmaceutical Market: Segmentation Analysis

By Type of Filtration

Technology

The membrane filtration segment

dominated the market in 2024. This segment dominated because membrane filters

have a lower chance of clogging during sterile filtration. Membrane filters are

plastic semi-permeable membranes that separate products using a driving force.

Different types of membrane filtration techniques include ultrafiltration,

nanofiltration, reverse osmosis, and microfiltration. They offer numerous

benefits, including prolonged filtration and high speed.

The ultrafiltration sub-segment is

expected to expand rapidly. The membrane filtration technologies are

categorized based on the pore size of the filters. Ultrafilters have a pore

size of 0.002 to 0.1. They are primarily used to filter microorganisms, humic

materials, and some viruses from pharmaceuticals. The demand for

ultrafiltration is increasing as it does not require pH adjustments or

disinfection.

By Filter Media Type

The polyethersulfone (PES) segment

held the largest revenue share of the liquid filtration for pharmaceutical

market in 2024. This is due to the hydrophilic and low protein-binding ability

of PES. PES membrane filters are commonly used for tissue culture media

sterilization and other life science applications. They are comparatively cost-effective and have a high

retention factor. The hydrophilic nature of the filter allows the media to

provide lower pressure loss, ultimately increasing its shelf-life.

The polyvinylidene fluoride (PVDF)

segment is expected to grow at the fastest CAGR in the market during the

forecast period. PVDF is widely used for filtering gases or ventilation without

moisture blockage. PVDF membrane filters can be either hydrophilic or

hydrophobic, with high chemical compatibility and no protein adsorption. They

are installed to achieve the highest requirements without the need for wetting

agents.

Get the latest insights on life science

industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Application

The sterile filtration segment

held a dominant presence in the liquid filtration for pharmaceutical market in

2024. This is due to the need for highly pure and contamination-free

pharmaceutical products. Products contaminated with microorganisms may cause

serious health problems in patients. Thus, regulatory agencies impose stringent

regulations on the presence of microorganisms in pharmaceuticals. The main

objective of sterile filtration is to maintain product integrity.

The clarification filtration

segment is expected to grow with the highest CAGR in the market during the

studied years. Clarification filtration is a type of prefiltration step to

remove visual impurities that can affect product quality. Prefilters remove the

majority of contaminants from the product and enhance the shelf-life of the

main filters by imposing less load on final filtration. This ultimately saves

the cost of manufacturers.

By End-User

The pharmaceutical manufacturers

segment contributed the biggest revenue share of the liquid filtration for

pharmaceutical market in 2024. Pharmaceutical companies have a favorable

manufacturing infrastructure to conduct in-house manufacturing of

pharmaceuticals. They have suitable capital investment to install advanced

filtration systems. They continuously expand their biopharmaceutical area to

focus on the manufacturing of biologics and other complex therapeutics.

The contract manufacturing

organizations (CMOs) segment is expected to witness the fastest growth in the

market over the forecast period. Large pharmaceutical companies outsource their

manufacturing capabilities to CMOs to focus on their core competencies, such as

product sales and marketing. Small- and medium-sized enterprises collaborate

with CMOs as they lack specialized manufacturing infrastructure.

By Filtration Equipment Type

The filter cartridges segment

accounted for the highest revenue share of the liquid filtration for

pharmaceutical market in 2024. Filter cartridges are tube-like, structured

filtration devices that are used to trap solid debris suspended in a liquid.

Cartridge filters are designed from a variety of metallic and non-metallic

materials. Some common examples include cellulose, polypropylene, activated

carbon, and ceramic. They are used in the pharmaceutical industry to maintain

sterility and purity in the manufacturing of pharmaceuticals.

The filter capsules segment is

expected to show the fastest growth in the upcoming years. Filter capsules are

primarily used for small-scale applications and in places with space

constraints. Laboratories use them for venting and gas filtration of biopharmaceutical

processes. Filter capsules are easier to use as they are self-contained, and

the installation is straightforward and quick.

Become a valued research partner with us

– https://www.towardshealthcare.com/schedule-meeting

Top Companies and Their Contributions

to the Market

Companies

Contributions & Offerings

Avantor Sciences

Avantor offers a wide range of filtration solutions, from

filters to custom, complex filter assemblies for sterility and bioburden

reduction.

Brother Filtration

Brother Filtration is a leading manufacturer of

high-quality filtration products for diverse applications, including

biopharmaceuticals.

Parker Hannifin Corporation

Parker offers filtration solutions for complex

contaminant management issues through its Industrial Process Filtration

Division.

Koch Membrane Systems, Inc.

Koch Membrane Systems develops and manufactures spiral,

tubular, and hollow-fiber membranes.

Liquid Filtration for

Pharmaceutical Market Top Companies

• Avantor Sciences

• Brother Filtration

• Parker Hannifin Corporation

• Koch Membrane Systems, Inc.

• Pall Corporation

• Sartorius AG

• Merck KGaA

• 3M Company

• Atlas Filtri

• Pentair plc

• Dow Water & Process Solutions

Recent Developments in the

Liquid Filtration for Pharmaceutical Market

➢ In June 2025, Cytiva Life Sciences announced the completion

of its expansion projects in the U.S., Europe, and Asia through an investment

of $1.6 billion. The expansion is part of Cytiva’s long-term growth plan and

in-region manufacturing strategy.

➢ In December 2024, Ahlstrom announced the acquisition of

ErtelAlsop to strengthen its position in the life science filtration market,

allowing the company to enter the depth filtration space. ErtelAlsop will

become part of Ahlstrom’s Filtration and Life Sciences business.

➢ In June 2024, Asahi Kasei announced the launch of a

membrane system, MicrozaTM hollow-fiber membrane, to produce water for

injection (WFI). The system was developed as an alternative to conventional

distillation processes for the production of WFI for water treatment and

filtration of liquid products.

Download the Competitive Landscape market

report @ https://www.towardshealthcare.com/price/5934

Liquid Filtration for

Pharmaceutical Market Segmentation

By Type of Filtration

Technology

• Membrane Filtration

○

Microfiltration

○

Ultrafiltration

○

Nanofiltration

○

Reverse Osmosis

• Depth Filtration

○

Cellulose-based Depth Filters

○

Synthetic Depth Filters

• Pre-filtration/Coarse Filtration

• Crossflow Filtration

• Others

○

Gravity Filtration

○

Screen Filtration

By Filter Media Type

• Polyethersulfone (PES)

• Polyvinylidene Fluoride (PVDF)

• Nylon

• Polytetrafluoroethylene (PTFE)

• Cellulose Acetate (CA)

• Polypropylene (PP)

• Others

By Application

• Sterile Filtration

• Clarification Filtration

• Bioburden Reduction

• Solvent Filtration

• Cell Culture Filtration

• Others

By End-User

• Pharmaceutical Manufacturers

• Contract Manufacturing Organizations (CMOs)

• Biopharmaceutical Companies

• Research & Development Institutes

• Others

By Filtration Equipment Type

• Filter Cartridges

• Filter Capsules

• Filter Plates & Frames

• Filter Housings

• Filter Bags

• Others

By Region

• North America

○

U.S.

○

Canada

• Asia Pacific

○

China

○

Japan

○

India

○

South Korea

○

Thailand

• Europe

○

Germany

○

UK

○

France

○

Italy

○

Spain

○

Sweden

○

Denmark

○

Norway

• Latin America

○

Brazil

○

Mexico

○

Argentina

• Middle East and Africa (MEA)

○

South Africa

○

UAE

○

Saudi Arabia

○

Kuwait

Immediate Delivery

Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5934

Access our exclusive,

data-rich dashboard dedicated to the healthcare market – built specifically for

decision-makers, strategists, and industry leaders. The dashboard features

comprehensive statistical data, segment-wise market breakdowns, regional

performance shares, detailed company profiles, annual updates, and much more.

From market sizing to competitive intelligence, this powerful tool is one-stop

solution to your gateway.

Access the

Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological

solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life

sciences sector, we build strategic partnerships that generate actionable

insights and transformative breakthroughs. As a global strategy consulting

firm, we empower life science leaders to gain a competitive edge, drive

research excellence, and accelerate sustainable growth.

You can place an

order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America

Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social

platforms: LinkedIn | Twitter | Instagram

| Medium | Pinterest

Browse More of Towards Healthcare:

Gene Editing at

Bristol Myers Squibb: https://www.towardshealthcare.com/companies/gene-editing-bristol-myers-squibb-companies

Stryker &

Siemens Healthineers with Robotic Stroke Solutions: https://www.towardshealthcare.com/companies/stryker-siemens-neurovascular-robotics

Top Global Players

in the Life Sciences Market in 2025: https://www.towardshealthcare.com/companies/key-players-in-the-life-sciences-market

Top Companies Innovating

in GLP-1 Obesity Treatments in 2025: https://www.towardshealthcare.com/companies/top-companies-innovating-in-glp-1-obesity-treatments

RaySearch &

Radiology Oncology Systems to Expand Cancer Care: https://www.towardshealthcare.com/companies/raysearch-radiology-oncology-systems-partnership-companies

Eli Lilly’s Legal

Battle for Compounding Pharmacy Market: https://www.towardshealthcare.com/companies/lilly-empower-compounding-pharmacy-companies

Amgen and the GLP-1

Obesity Market: https://www.towardshealthcare.com/companies/amgen-maritide-glp1-obesity-2025-leaders

Top Companies in the

Cosmeceuticals Market: https://www.towardshealthcare.com/companies/cosmeceuticals-market-companies

Cardiovascular Drugs

Market Key Players-Business: https://www.towardshealthcare.com/companies/cardiovascular-drugs-companies

U.S. Telehealth

Companies and Market Trends Analysis: https://www.towardshealthcare.com/companies/us-telehealth-companies