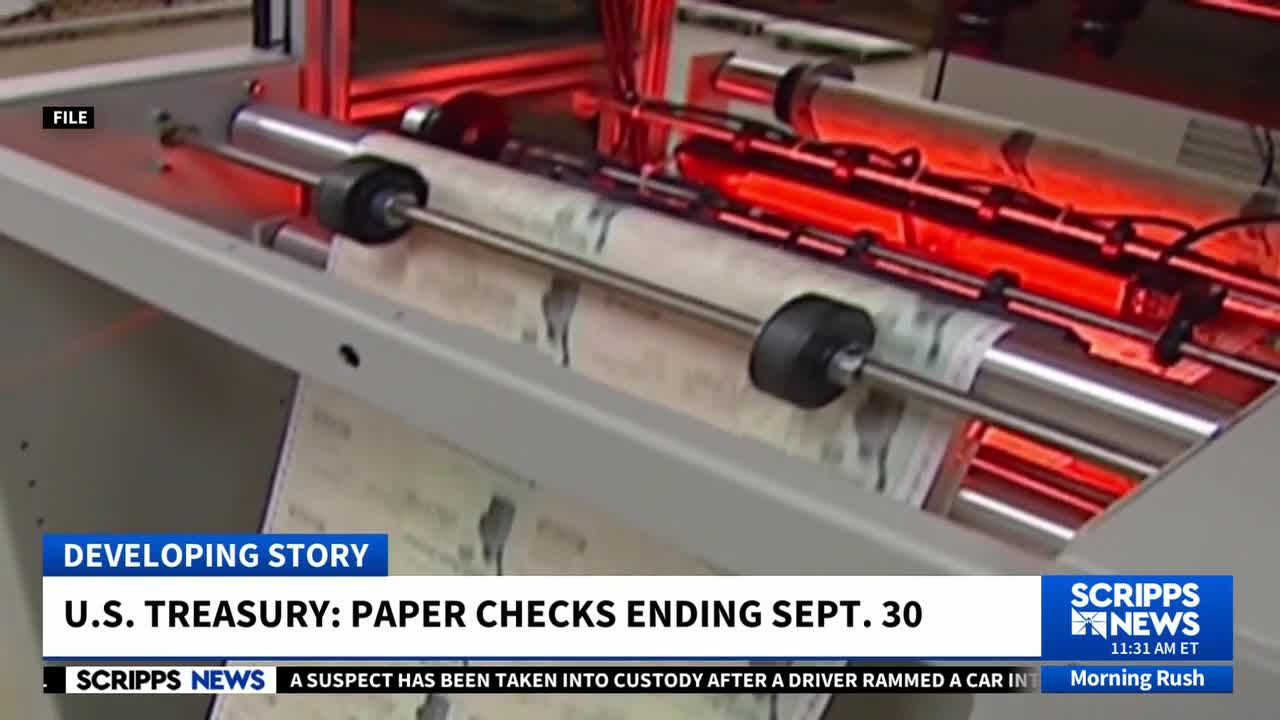

US Treasury will stop sending paper checks at the end of September

Paper checks for Social Security and tax refunds end Sept. 30. Recipients must switch to electronic payments, with few exceptions allowed.

Scripps News

- A new study finds Kansas is the third most affordable state for a comfortable retirement.

- The annual cost for a comfortable retirement in Kansas is $60,620, which includes essentials like housing and healthcare.

- Only Oklahoma and West Virginia have lower annual retirement costs than Kansas.

Retiring comfortably in Kansas costs less annually than in all other states but two, a new study says.

The annual cost of a comfortable retirement in the Sunflower State is $60,620, according to the results of the study published last week by the senior living advice website caring.com.

In an article titled “States that financially support retirement the best,” the site said that in reaching that conclusion, it took into account spending on “essentials,” including groceries and utilities, health care, housing and transportation.

What did the study look at?

The site stressed that retirement readiness isn’t just about how much a person has saved.

“It’s also about whether you own your home, how far your money goes, and how much support your state provides,” it said.

A previous caring.com study had identified the states that were best in which to retire because they were growing or had senior-friendly diversions, the site said.

“Now we’re looking at the states that financially support people’s ability to retire,” caring.com said.

Here’s how the study was conducted

The site said it conducted research for the article last July, gathering data in four different areas.

“We used Wisevoter data to find the average retirement income and combined this with data on the average retirement savings and the average amount needed to retire comfortably in each state from GoBankingRates,” caring.com said.

“Lastly, we used Census data to find the average homeownership rate by state,” it said.

The site also gave states “retirement scores.”

It published a graphic showing Delaware had the best retirement score of 7.45, followed, in order, by the following:

- Virginia.

- Connecticut.

- Minnesota.

- Illinois.

- Tie: Iowa and New Hampshire.

- Michigan.

- Maryland.

- Tie: Alabama and New Mexico.

Kansas among states where affording ‘the essentials’ is easiest

While Kansas didn’t make caring.com’s overall top 10 list or finish among the leaders in any other category, the Sunflower State placed third among states in terms of the lowest annual cost of a comfortable retirement.

The only states with lower annual costs to afford “the essentials” are Oklahoma, at $59,995, and West Virginia, at $58,190, the site said.

The cost to retire in Kansas and Oklahoma “is over 15% lower than the cost of retiring in nearby states like Colorado,” caring.com said.

What does it cost to retire in the states besides Oklahoma that adjoin Kansas?

The GoBankingRates site from which caring.com acquired its data said retiring comfortably costs less annually in Kansas than in its three other adjoining states aside from Oklahoma, which are Colorado, Nebraska and Missouri.

It identified the annual amounts needed to retire comfortably in those states as being $70,689 in Colorado, $64,856 in Nebraska and $61,454 in Missouri.

The states in which retiring comfortably costs the most annually are Hawaii at $129,926, California at $100,687 and Massachusetts at $100,201, the study said.

The average cost nationally for a comfortable retirement is $71,506, it said.

Contact Tim Hrenchir at threnchir@gannett.com or 785-213-5934.