U.S. Talc Market Summary

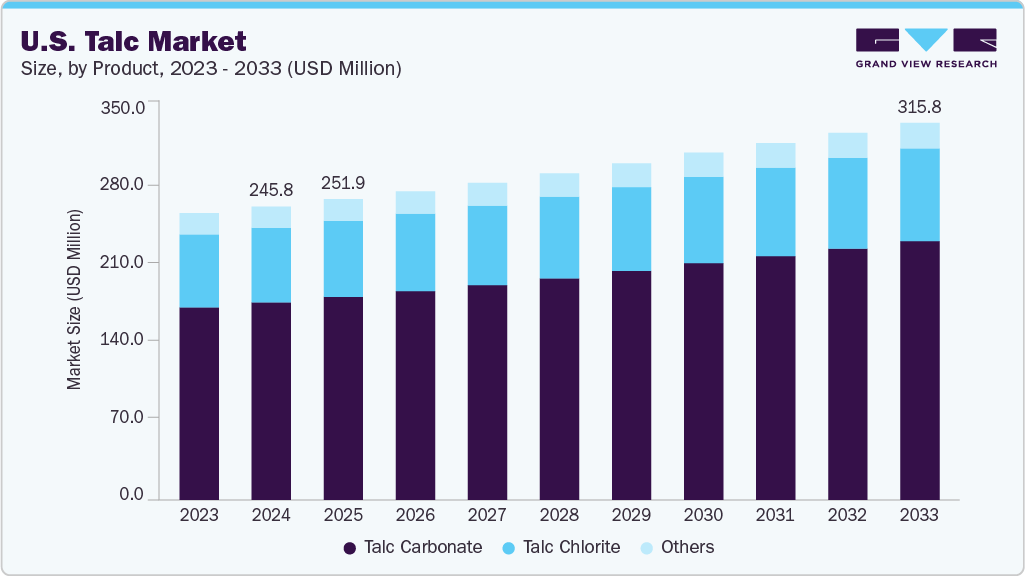

The U.S. talc market size was estimated at USD 245.8 million in 2024 and is projected to reach USD 315.8 million by 2033, growing at a CAGR of 2.9% from 2025 to 2033. The market’s growth is driven by its diverse applications across various industries, particularly its crucial role as a functional filler in plastics.

Key Market Trends & Insights

- In terms of product, talc carbonate accounted for a revenue share of 67.3% in 2024.

- Talc chlorite is expected to grow at a CAGR of 2.5% over the forecast period.

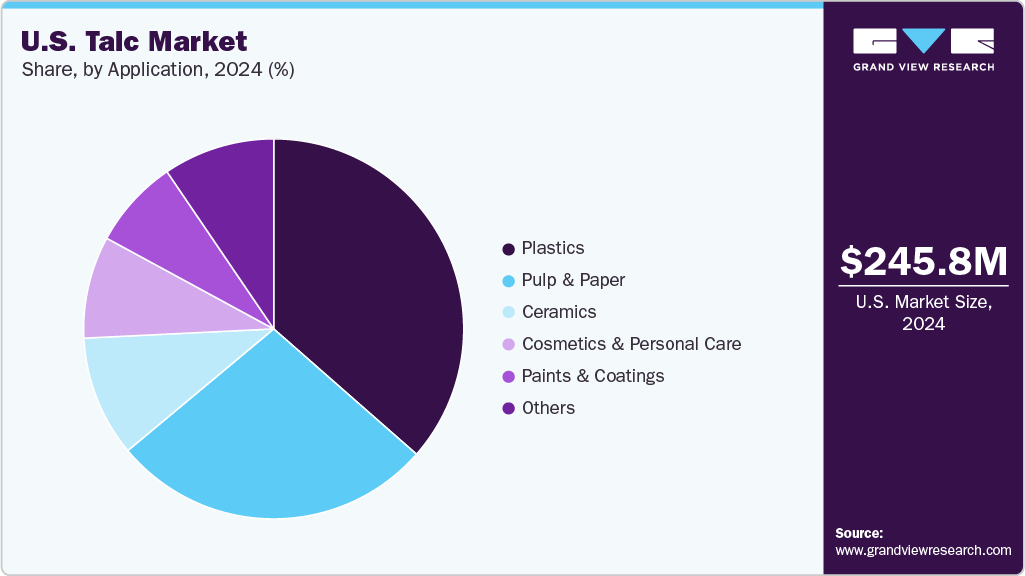

- In terms of application, plastics accounted for a revenue share of 36.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 245.8 Million

- 2033 Projected Market Size: USD 315.8 Million

- CAGR (2025-2033): 2.9%

- Europe: Largest market in 2024 Asia Pacific: Fastest growing region

The market’s growth is also supported by the continued use of talc in consumer products, such as cosmetics and pharmaceuticals, where its softness and moisture-absorbing properties are valued. Talc, when mined from the earth in its natural form, sometimes gets contaminated with asbestos, a carcinogen that can cause cancer when inhaled. This has spurred a new era of technological advancement. The numerous lawsuits alleging a link between talc and cancer have been a powerful incentive for the industry to invest heavily in rigorous testing and supply chain transparency. This has prompted companies to innovate, with some opting to remove talc in certain products and focus on developing highly purified, asbestos-free grades for high-value applications. This push for safety and accountability is a key market driver, compelling the industry to adopt stricter quality control and establish a new consumer trust foundation through verifiable safety standards.

In response to these concerns, the U.S. government, led by the Food and Drug Administration (FDA), has taken proactive steps to strengthen regulatory supervision and establish clear standards for talc purity. A major initiative is a proposed rule that requires standardized testing methods to identify and detect asbestos in cosmetic products containing talc. This proposed rule directly responds to the Modernization of Cosmetics Regulation Act of 2022 (MoCRA). It aims to protect public health by building trust in product safety and driving the U.S. talc industry towards more rigorous testing and compliance. In May 2025, the FDA hosted an independent panel of scientific experts to discuss the necessity and safety of talc as an additive in drugs, food, and cosmetics. These governmental actions create a framework for greater accountability and transparency.

Product Insights

The talc carbonate segment held the largest revenue share of 67.3% in 2024 and is expected to grow at the fastest CAGR over the forecast period. It is the dominant type of talc deposit driven by its high purity and excellent physical properties. It is a type of talc ore in which talc occurs together with carbonate minerals such as magnesite and dolomite. These deposits are commonly formed in ultramafic and metamorphic rocks through carbonation and metamorphic processes, and the resulting talc typically has a density of about 2.8 g/cm³, which supports its suitability for a wide range of industrial uses. Compared with talc-chlorite deposits, talc-carbonate usually produces lighter and higher-brightness talc because carbonates contain fewer iron impurities. This makes it more suitable for high-purity applications such as plastics, paints, paper, and coatings, while it is also used in ceramics and refractories.

The talc chlorite segment is expected to grow over the forecast period, driven by the increasing demand for materials that offer high thermal stability and durability in various applications. Talc-chlorite deposits are a type of talc ore in which talc occurs together with significant amounts of the mineral chlorite. These deposits usually form in ultramafic and metamorphic rocks, where chlorite remains stable under lower to medium metamorphic conditions. Compared with talc carbonate deposits, talc chlorite tends to have a darker color and lower brightness because chlorite often contains iron. This makes it less suitable for high-purity applications such as cosmetics or coatings. However, it can still be used in ceramics, refractories, and other industrial products where whiteness is less critical. Talc chlorite rocks are often more foliated in texture, reflecting the platy nature of both talc and chlorite, and they generally require more processing to remove impurities before use.

Application Insights

The plastics segment dominated the market with a revenue share of 36.5% in 2024. The growing demand for lightweight, durable, and cost-efficient materials across industries drives the segment’s growth. Talc is widely used as a filler and reinforcing agent in polypropylene, polyethylene, and other plastic compounds, where it enhances stiffness, dimensional stability, and heat resistance while reducing production costs. This makes it a preferred choice for automotive components such as bumpers, dashboards, and interior panels, as well as for packaging materials and household goods.

The cosmetics & personal care segment is expected to grow at the fastest CAGR over the forecast period, driven by rising consumer demand for skincare and beauty products. Talc’s softness, absorbency, and chemical inertness make it suitable for body powders, face powders, and other pressed and loose cosmetics, enhancing smoothness, spreadability, and moisture absorption. Its ability to provide a silky texture and improve product performance underpins its increasing adoption across a wide range of personal care formulations, driving the rapid growth of this application.

Key U.S. Talc Company Insights

Some of the key players operating in the market include Magris Performance Materials, Talc U.S.A., and others.

-

Magris Performance Materials is a vertically integrated materials company based in North America that produces critical minerals used in everyday industrial and consumer products. The firm supplies about 50% of North America’s talc market and approximately 10% of the global niobium market. Operations include mining, beneficiation, milling, and distribution facilities in the United States and Canada. The privately held company strongly emphasizes sustainability, safety, environmental stewardship, and long-term supply chain relationships.

-

Talc U.S.A. was established in 2008 in North Dakota to provide farmers with high-quality seed-flow solutions. A farmer started the company and grew rapidly due to its focus on locally made, reliable, and affordable talc products. Over the years, Talc U.S.A. expanded its footprint beyond the Midwest to serve farmers across the U.S. and international markets such as Canada, Mexico, Ukraine, and South Africa. In recent years, the company became part of BRANDT, a global leader in agriculture solutions, which strengthened its production capacity and distribution network while maintaining its farmer-first approach.

Key U.S. Talc Companies:

- Magris Performance Materials

- Talc U.S.A.

- Atlantic Equipment Engineers

- Sanyo Corporation of America Co., Ltd.

- AG&P Mineral Purveyors Inc.

- Reade

U.S. Talc Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 251.9 million

Revenue forecast in 2033

USD 315.8 million

Growth rate

CAGR of 2.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Magris Performance Materials; Talc U.S.A.; Atlantic Equipment Engineers; Sanyo Corporation of America Co., Ltd.; AG&P Mineral Purveyors Inc.; Reade

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Talc Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. talc market report based on product and application.

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Talc Carbonate

-

Talc Chlorite

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 – 2033)