2h agoWed 8 Oct 2025 at 5:15amMarket snapshot

- ASX 200: -0.1% to 8,947 points (live values below)

- Australian dollar: -0.3% to 65.58 US cents

- Wall Street: Dow Jones (-0.2%), S&P 500 (-0.4%), Nasdaq (-0.7%)

- Europe: FTSE (flat), DAX (flat), Stoxx 600 (-0.2%)

- Spot gold: +1.2% at $US4,029/ounce

- Brent crude: +0.7% at $US65.95/barrel

- Iron ore: +0.1% to $US104.10/tonne

- Bitcoin: -0.2% at $US121,824

Prices current at around 4:15pm AEDT

Live updates from major ASX indices:

2h agoWed 8 Oct 2025 at 5:39am

Goodbye

That is it from us today on the ABC markets blog.

Don’t forget to watch The Business program on ABC News Channel tonight at 8:45pm AEDT.

And our team of business reporters will be back with you early tomorrow morning.

Goodbye!

Loading2h agoWed 8 Oct 2025 at 5:35amSpot gold surpasses $US4,000 an ounce for first time

The $US4,000 milestone is in the rearview mirror for gold prices, with spot gold currently trading around $US4,035.

It comes after US gold futures passed through the same level earlier, with gold futures for December delivery around $US4,040.

Loading…

“There’s so much faith in this trade right now that the market will look for the next big round number, which is 5,000, with the Fed likely to continue to lower rates,” Tai Wong, an independent metals trader, told Reuters.

“There will be some bumps in the road, like a lasting truce in the Mideast or Ukraine, but the fundamental drivers of the trade, massive and growing debt, reserve diversification, and a weaker dollar, are unlikely to change in the medium term.”

Read more from business reporter Nassim Khadem:

2h agoWed 8 Oct 2025 at 5:27amLocal markets close down

The ASX 200 has closed down -0.1%, at 8,947 points.

The broader All Ordinaries index has also closed down -0.1%, at 9,244 points.

Spot gold is up 1.15%, at $4,029, maintaining its record high prices (at 4:25pm AEDT).

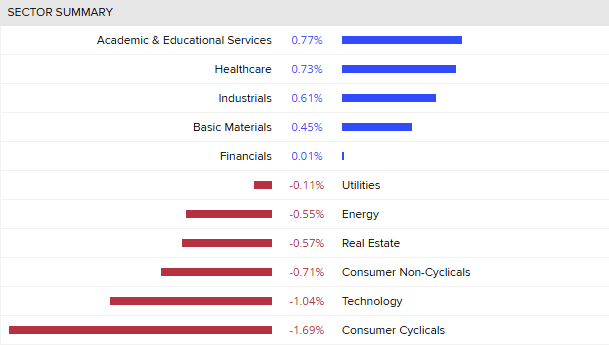

Consumer cyclicals and technology fell today, while healthcare and industrials were up.

Sector summary (Eikon)

Sector summary (Eikon)

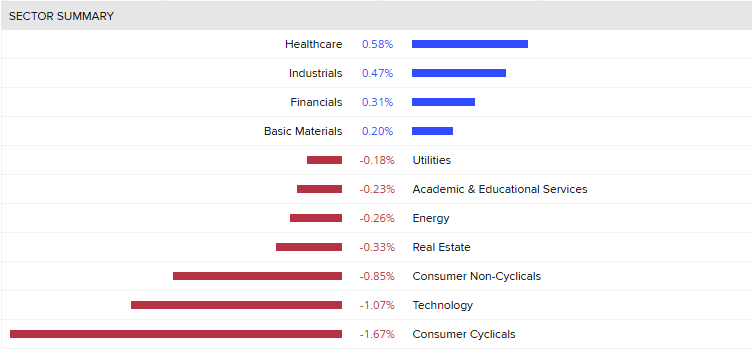

Looking at individual stocks, James Hardie topped the list, up almost 10% on good September quarter results.

Mesoblast and DroneShield were also up.

Helia Group and Lijfe360 fell more than -3%.

Top and bottom movers (Eikon)

Top and bottom movers (Eikon)

The Reserve Bank of New Zealand cut interest rates by 0.5 percentage points in a unanimous decision to 2.5%.

Economists say there could be one more cut in this cycle.

2h agoWed 8 Oct 2025 at 5:08am

Salesforce will not pay cyber hack demand

A Salesforce spokesperson told ABC News the company “will not engage, negotiate with, or pay any extortion demand”.

A cybercrime collective, Scattered Lapsus$ Hunters, has reportedly threatened to release stolen data from dozens of global firms linked to cloud software giant Salesforce — including Disney, Google, IKEA, Toyota, and airlines Qantas, Air France and KLM — unless a ransom was paid.

“There is no indication that the Salesforce platform has been compromised, nor is this activity related to any known vulnerability in our technology, rather that customer databases had been breached by hackers impersonating IT support personnel,” the spokesperson said.

Qantas says it is continuing to support customers impacted by its significant cyber breach, as a hacking group threatens to release personal data from around 40 companies to the dark web.

You can read more on this story here:

3h agoWed 8 Oct 2025 at 4:45am

Mining bailout a ‘bandaid fix’, says local business

Mining giant Glencore has accepted a $600 million support package from the Queensland and Australian governments for its Mt Isa and Townsville operations.

The Mt Isa mayor is celebrating, calling it “a great day for Mount Isa”.

However, local business owners say it’s a “bandaid fix” and are worried about each town’s long-term future.

Read more on this story here:

3h agoWed 8 Oct 2025 at 4:29am

Will NZ’s interest rates go any lower?

Economists say the Reserve Bank of New Zealand could cut rates again in November, after a unanimous decision to cut the official cash rate by 0.5 percentage points today.

The official cash rate is now 2.5%.

“The reference to ‘further reductions’ is still data dependent, and the RBNZ now appear somewhat more cautious and see two-way risk around inflation,” said UBS economists in an analyst note.

UBS is forecasting another 0.25 percentage point rate cut in November, the bank’s final meeting this year:

“We continue to expect a terminal rate of 2.25% and see an extended period of policy on hold.”

3h agoWed 8 Oct 2025 at 4:22am

Market snapshot

- ASX 200: -0.2% to 8,940 points (live values below)

- Australian dollar: -0.3% to 65.63 US cents

- Wall Street: Dow Jones (-0.2%), S&P 500 (-0.4%), Nasdaq (-0.7%)

- Europe: FTSE (flat), DAX (flat), Stoxx 600 (-0.2%)

- Spot gold: +0.9% at $US4,018/ounce

- Brent crude: +0.7% at $US65.95/barrel

- Iron ore: +0.1% to $US104.10/tonne

- Bitcoin: -0.4% at $US121,580

Prices current at around 3:20pm AEDT

Live updates from major ASX indices:

3h agoWed 8 Oct 2025 at 4:17amGas price campaign called out as a ‘distraction’

SGH, an Australian diversified operating company, says the manufacturing lobby’s campaign for direct market intervention “distracts from the real challenge”.

SGH is controlled by the billionaire Stokes family, owns Boral, WesTrac and Coates and says it’s a major investor in domestic gas and an industrial operator reliant on Australia’s energy system.

“Market intervention, particularly on prices, does not address the underlying issue and risks deterring the investment needed to expand supply,” SGH says in a statement.

It says Australia’s gas prices currently rank in the lowest quartile in the OECD and a subsidy is not justified.

“The focus should be on delivering policy certainty and supporting industry investment. Price caps and other market interventions are short-sighted, putting future energy security and jobs at risk,” it said.

“The real issue is supply. Unless this is addressed, no amount of price rhetoric or intervention will deliver the energy security we need to support Australian manufacturing.”

SGH says calling for gas prices below $10/GJ may “sound appealing” but would deter industry investment and new gas supply.

4h agoWed 8 Oct 2025 at 4:00amWhy is gold hitting record highs?

Gold is in the spotlight, hitting record high prices.

Spot gold soared past $4,000 an ounce overnight and is currently sitting at $4,010 up +0.7% (as at 2:40pm AEDT).

So what’s going on?

Well, gold has always been a “safe haven” for investors during times of uncertainty. That’s because it’s something you can see and touch and has intrinsic value and a track record.

Right now, the world’s facing a lot of uncertainty — the US government shutdown, economic and geopolitical uncertainty, as well as the potential for further interest rate cuts by the US Federal Reserve.

Then there’s central banks buying up big and a weak US dollar.

Spot gold is up 52% year to date.

“There’s so much faith in this trade right now that the market will look for the next big round number which is 5,000 with the Fed likely to continue to lower rates,” said Tai Wong, an independent metals trader.

“There will be some bumps in the road like a lasting truce in the Mideast or Ukraine but the fundamental drivers of the trade, massive and growing debt, reserve diversification, and a weaker dollar are unlikely to change in the medium term.”

A “fear of missing out” is also boosting the rally, analysts say.

“What we see now is that investors are buying gold, despite the price being high, and this is amplifying the move further,” said UBS analyst Giovanni Staunovo.

-with Reuters

4h agoWed 8 Oct 2025 at 3:19amJames Hardie shares up on strong results

Building products giant James Hardie is one of the top performers on the ASX today.

Shares are up around 10% to $33.17 (at 2:10pm AEDT), after it flagged strong September results.

CEO Aaron Erter says he’s encouraged by the second quarter results:

“Our Siding and Trim sales performance exceeded the expectations reflected in our modelling considerations.

Even as single-family new construction remains challenging, our customers’ commitment to ensuring the availability of our products demonstrates the importance of our brand and strong partnerships.”

It comes after shares tanked around 28% in August, when the company unveiled its June quarter financials, which came in well below analyst expectations.

James Hardie will hold its annual general meeting on October 29.

5h agoWed 8 Oct 2025 at 2:59amQantas says legal protections in place re stolen data

Qantas has released a statement in response to reports that hackers will soon dump all stolen personal information from around 40 companies, including Qantas.

Qantas faced a cyber attack in July when personal details of almost 6 million customers were stolen from the airline’s databases after a breach at a Manila call centre.

The data included details such as names and frequent flyer numbers, but did not include financial information.

“Ensuring continued vigilance and providing ongoing support for our customers remain our top priorities following our cyber incident in early July,” the statement quoting a Qantas spokesperson reads.

“We continue to offer a 24/7 support line and specialist identity protection advice to affected customers and through the ongoing injunction we obtained through the NSW Supreme Court we have legal protections in place to prevent the stolen data being accessed or released.”

5h agoWed 8 Oct 2025 at 2:41amWhat are the local markets doing?

Local share markets are trading lower.

The ASX200 is down -0.1% to 8,947 points, while the broader All Ordinaries is down -0.1% to 9,241 points (as at 1:33pm AEDT).

Healthcare and industrials are up, while consumer cyclicals and technologies are down.

Sector summary (Eikon)

Sector summary (Eikon)

In terms of individual stocks, James Hardie is up more than 9%, Mesoblast is also rallying.

While Life360 and Catalyst Metals lead the bottom stocks.

Top and bottom movers (Eikon)5h agoWed 8 Oct 2025 at 2:30amWould BlueScope buy cheap gas imports?

Top and bottom movers (Eikon)5h agoWed 8 Oct 2025 at 2:30amWould BlueScope buy cheap gas imports?

The economics doesn’t work on buying cheaper imported gas, BlueScope boss Mark Vassella told the National Press Club.

“Taking gas out of the ground in Australia, processing it, putting it on a ship, sending it offshore and then bringing it back, processing it again and selling it to the domestic consumers — I just don’t know how the economics work,” he said.

“My fear is that if we get to the point where we’re buying gas from import terminals, we’ve lost. Wave the white flag.”

5h agoWed 8 Oct 2025 at 2:10amBlueScope boss warns investments could go offshore

It’s question-time at the National Press Club now.

Asked about the fairest solution, Mark Vassella says uncontracted gas should be redirected to the east coast gas market.

“We do not believe domestic gas should be purchased to satisfy export contacts. That was never the intention when this industry was first set up,” he said.

“I see the pressure we incur inside our business with energy costs increasing. I see from a sovereign risk prospective, the alternatives we have as a company, in terms of where we allocate our capital. It becomes increasingly difficult to allocate your capital to a country with a cost disadvantage.“

6h agoWed 8 Oct 2025 at 2:00am

Optus triple-0 outage sent to wrong government mailbox

Department officials are appearing before Senate estimates to be questioned about the Optus triple-0 outage.

The Department of Communications says it did not find out about the Optus outage for more than a day after it occurred because an email was sent to the wrong address.

The Prime Minister, Anthony Albanese, has also appeared at a joint press conference with Singapore’s Prime Minister Lawrence Wong, where they discussed the outage.

Our colleagues over at the federal politics blog are covering this if you’d like to read more.

6h agoWed 8 Oct 2025 at 1:51am

Market snapshot

- ASX 200: -0.1% to 8,945 points (live values below)

- Australian dollar: -0.3% to 65.61 US cents

- Wall Street: Dow Jones (-0.2%), S&P 500 (-0.4%), Nasdaq (-0.7%)

- Europe: FTSE (flat), DAX (flat), Stoxx 600 (-0.2%)

- Spot gold: +0.3% at $US3,995/ounce

- Brent crude: +0.7% at $US65.89/barrel

- Iron ore: +0.1% to $US104.10/tonne

- Bitcoin: -0.1% at $US121,956

Prices current at around 12:50pm AEDT

Live updates from major ASX indices:

6h agoWed 8 Oct 2025 at 1:50amBlueScope Steel chief issues dire warning for manufacturing

The head of BlueScope steel, Mark Vassella is on his feet at the National Press Club, launching a campaign for cheaper gas prices.

He warns expensive gas is pushing the manufacturing industry towards “a dangerous crossroad”.

“This looming risk to manufacturing is the result of the long-standing dysfunction of the domestic gas market, and the lack of a fair gas price for Australian customers,” he said.

BlueScope and 11 other members of Manufacturing Australia, claim manufacturers in the eastern states face gas prices more than three times those in Australia’s main LNG competitors, the US and Qatar.

It warns Australian manufacturing could decline, similarly to UK steel (production has shrunk from 30mtpa in the 1970s to just 3m today).

Despite Australia’s large gas reserves, businesses here pay some of the highest wholesale gas prices.

“In 2024, Australian industry paid an average wholesale price of around $10.30 per gigajoule.

“This compares to LNG rivals Qatar and the United States at $2.20 and $3 per GJ respectively.”

Mr Vassella says the recent adoption of a pricing mechanism based on LNG export prices means local gas users are paying for export infrastructure they don’t use and puts local gas users at a structural disadvantage.

6h agoWed 8 Oct 2025 at 1:29amGlencore says bailout is a short-term lifeline

Glencore says it’s grateful for the $600 million government bailout for its Queensland copper operations, but hopes it’s just a short-term measure.

“This agreement provides a short-term lifeline for the copper smelter and refinery and comes after Glencore had already stepped up to absorb significant financial losses to maintain operations and jobs while working on a solution with government,” said Interim chief Operating Officer Troy Wilson.

“It is our hope that conditions improve over the next three years to a point where government assistance is no longer necessary.”

The deal has taken eight months to put together and provides certainty for the 600 workers in Mount Isa and Townsville.

6h agoWed 8 Oct 2025 at 1:08amRBNZ committee remains open to further cuts

The Reserve Bank of New Zealand says the committee debated cutting by 0.25 or 0.5 percentage points.

The case for the larger cut emphasised prolonged spare capacity in the economy.

In a statement, the committee said inflation was expected to return to around the 2% target mid-point over the first half of 2026.

The Reserve Bank remains open to further reductions as required.

The cut is larger than some in the markets had forecast and the Kiwi dollar is down almost 1%.