The Ministry of Health (MOH) was once proud of its open-door policy, providing universal health care to everyone living in Malaysia, regardless of whether they were rich or poor.

But the Madani government under Prime Minister Anwar Ibrahim now appears to be slowly shutting that door — to the so-called “maha kaya” (read: middle class) — in a bid to resolve congestion in the public health care system that has become a mainstream issue.

The government recently proposed creating a new voluntary basic medical and health insurance/takaful (MHIT) product, to be paid for from Account 2 of our Employees’ Provident Fund (EPF).

For months, ordinary Malaysians and backbencher lawmakers like Bayan Baru MP Sim Tze Tzin have been highlighting how insurance companies often deny coverage, revoke guarantee letters, and jack up premiums to the point of unaffordability, especially when policyholders hit retirement age.

Yet, the government’s solution to health insurance premium hikes is more insurance?

Worse, Anwar’s administration wants us to pay for this new MHIT product by dipping into our hard-earned retirement savings because “tak rasa pun”. We won’t feel it now maybe, but we certainly will when we hit old age.

A third of EPF contributors aged under 55, or 1.6 million members, had savings of less than RM10,000 as of August 2024. It doesn’t matter which account is used for the government’s MHIT product; Malaysians just don’t have enough to retire on.

Are our legislators so wealthy and privileged, with many eligible for multiple pensions, that they just cannot understand why we shouldn’t touch our retirement savings for anything other than retirement?

Pakatan Harapan lawmakers had (rightly) condemned then-Prime Minister Muhyiddin Yassin for allowing EPF withdrawals to manage cost of living during the Covid-19 pandemic. Now the Madani government wants to do the same thing — during normal times when we’re no longer in a global public health emergency.

When policymakers fail to understand the problem, they will come up with the wrong solutions.

The problem isn’t lack of access to health insurance — the problem is lack of access to health care itself, which isn’t the same as insurance.

The public health care system is overwhelmed, while the private health care system may be inaccessible even to the insured, either because they’re denied coverage, their coverage is drained quickly for a serious illness, or they’re forced to cancel their policy due to premium increases (age-bracket or “repricing”).

Middle class Malaysians and some of the T20, I dare say, probably can’t afford private tertiary care running into hundreds of thousands of ringgit for conditions like cancer and rare diseases. These bills exclude non-medical costs.

How does a new MHIT product, paid for from our EPF savings, solve any of these problems? There is already a wide variety of MHIT products on the market, including basic medical plans. How is the government’s new MHIT product any different?

Will the government mandate the insurance company underwriting the new EPF-linked MHIT product to cover all claims instead of rejecting as many as possible? Or limit premium hikes throughout one’s lifetime, especially upon retirement age? Or will this new product provide substantially more benefits for cheaper than other products on the market?

The MHIT proposal shows Bank Negara Malaysia’s (BNM) and the Ministry of Finance’s (MOF) proclivities toward the insurance industry and private hospital groups that count government-linked funds, including EPF, among major shareholders.

Health Minister Dzulkefly Ahmad posted on X last Friday that increasing health insurance access (and hence, access to Rakan KKM and private health care facilities) will reduce congestion in public health care facilities. “[The government’s] budget can then be focused on the B40.”

As a middle class person, I resent how the government is telling me to stay away from the public health care system — which I’m helping to fund through income tax — to solve the problem of an overcrowded public health service.

It’s like the Madani government has given up on our public health care system.

I want to go to the public health care system where the best doctors are and pay affordable sums out of pocket, not spend my life savings on private hospitals.

Why is the government taking that away from me? I don’t mind my taxpayer money funding public health care access for less privileged people (that’s the principle of taxation); I just want the same access myself.

Discriminating against the middle class and the “rich” is unfair and antithetical to the concept of universal health care. What’s next: paying for Bomba or police services in upper middle class neighborhoods?

Everyone should be able to use Malaysia’s public health care system when needed, be it a millionaire CEO, a middle class office worker, or a working class farmer. Then everyone will be invested in making sure that the public health care system works for all of us.

Perhaps one of the reasons why the government of the day (regardless of party) is apathetic towards fixing Malaysia’s public health care system is because politicians don’t use it. They may go private (like visiting IJN instead of Serdang Hospital), while the uber-rich seek treatment overseas.

When YBs or people with Datukships do use the public health service, anecdotes show that VIPs often get fast-tracked instead of waiting in line with the plebs. So lawmakers may still be ignorant of the actual conditions in government hospitals.

Limiting public hospitals and clinics to the B40 will further disincentivise elite politicians from fixing a system used only by poor people, who may be told to be grateful for “free” things provided by the government.

Instead of an EPF-linked MHIT product solely profiting the private sector, I would rather the government create a national health insurance (NHI) scheme — funded by mandatory contributions from all working Malaysians and employers — to double the public health care budget.

NHI can be used to increase the capacity of the public health care system (i.e additional and better paid staff, facilities, upgraded equipment, modern drugs, and additional services like social or aged care) and also to cover access to private health care (for example, GP clinic visits or certain procedures like cancer surgeries).

Contributions should also come from the B40 — even if it’s just RM50 a month — to create a sense of shared ownership and responsibility over our health care system. The government can provide full subsidies for those who absolutely can’t pay, like the unemployed, retired, or hardcore poor.

Of course, the government will have to justify why it needs NHI instead of using existing taxation revenue or creating a wealth tax, amid vanity projects like Kota Madani costing RM4 billion.

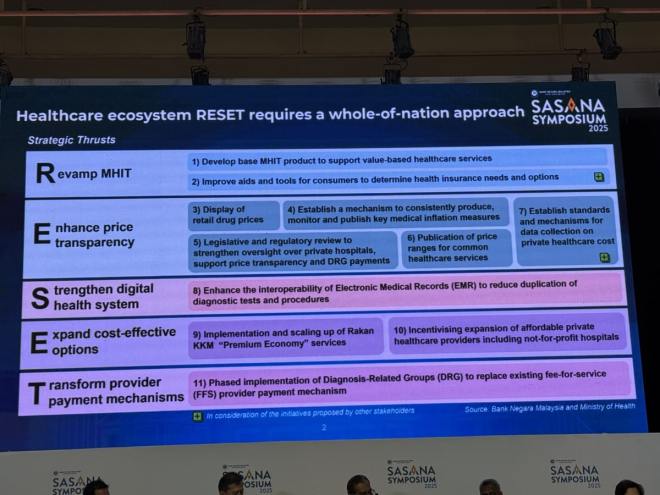

A presentation slide by Bank Negara Malaysia (BNM) on its Reset framework to tackle medical inflation, presented at the Sasana Symposium 2025 in Kuala Lumpur on June 18, 2025. Photo by Boo Su-Lyn.

A presentation slide by Bank Negara Malaysia (BNM) on its Reset framework to tackle medical inflation, presented at the Sasana Symposium 2025 in Kuala Lumpur on June 18, 2025. Photo by Boo Su-Lyn.

Health care policies take time to bear fruit. So at this mid-term point, the Madani government’s adoption of the central bank’s Reset framework as the solution to health care financing and overstretched public health care indicates an insidious shift towards privatisation.

Dressing Rakan KKM up as a “premium economy” service (which has yet to launch) ignores critical staff and equipment shortages to cater to a new queue of private customers and the fact that beds are taken away from public patients.

Anwar’s administration has chosen to pivot towards private health care instead of finding the money to expand public health care capacity, such as raising salaries for doctors and nurses to curb rising attrition rates. New health care facilities can’t be opened without sufficient staff.

Failure to increase public health care spending to 5 per cent of the country’s gross domestic product (GDP), commensurate with growing demand, means that a tax ringgit covers less and less, like butter spread over too much bread. More Malaysians will be forced to go private (if they can afford it or if their claims aren’t rejected by insurers).

BNM’s Reset framework was not discussed with the general public or all stakeholders. What is Bank Negara trying to “reset” our health care system to anyway — simpler times with fewer patients and providers?

In the “good old days”, most Malaysians relied on the public health care system. Private hospitals and health insurance were small industries, simply because there was no need for them.

Neither BNM nor MOH have the power to regulate private health care charges. Malaysia needs a new independent statutory commission with jurisdiction over the costs of private health care facilities and medical/ health insurance.

Bank Negara should stick to monetary policy instead of meddling in our health care; hospitals are not hedge funds. The MOH should fix its own “sinking ship” of a health service.

The Madani government’s Robin Hood approach to health care will cause untold harm for years to come. Ironically, Anwar’s administration is actually feeding large corporations at the expense of poor and middle class families.

Boo Su-Lyn is the editor-in-chief of CodeBlue.

- This is the personal opinion of the writer or publication and does not necessarily represent the views of CodeBlue.