Yendo Co-Founder and CEO Jordan Miller [Inset Photo via LinkedIn]

Yendo—a Dallas company that offers the “first-ever” credit card secured by its customer’s vehicles—has announced a $50 million Series B funding round. The new round includes investors Spice Expeditions, Autotech Ventures, FPV Ventures, Pelion Venture Partners, Mark Cuban, and Clocktower Technology Ventures, among others.

Yendo said the new funding will accelerate its expansion beyond secured lending, as it builds an “AI-powered digital bank” for the millions of Americans underserved by traditional financial institutions. As part of the Series B, Lyft Co-founder Logan Green and Spice Expeditions founder Nick Huber will join Yendo’s board of directors, the company said.

The new funding more than doubles the $24 million Series A round Yendo raised in 2023, which was led by FPV Ventures along with existing investors Human Capital and Autotech Ventures.

In 2024, Yendo raised a further $165 million in debt and equity to expand its platform, including $150 million in debt financing led by the i80 Group and $15 million in equity funding from undisclosed strategic investors.

Dallas billionaire investor Mark Cuban backed Yendo (which was originally known as Otto) through its seed and Series A funding rounds as the company set out to disrupt subprime lending with more affordable vehicle-secured credit products.

Founded in 2021 by Miller, George Utkov, and Daniel Ashy, Yendo allows people to borrow against the equity in their vehicles, offering Mastercard-branded credit cards with up to a $10,000 credit limit at “an affordable rate.” Its customers—among the millions of Americans who previously lacked access to the financial system because of their credit score—have an average card limit of around $4,000.

Planning ‘a wave of launches’ in Q4 2025

“We’re on a mission to transform consumer finance,” Co-Founder and CEO Jordan Miller said in a statement released today. “Our patented AI systems prove it’s possible to unlock trapped asset equity safely and affordably at scale. They cut onboarding and operating costs by orders of magnitude, opening up the most powerful credit products in the market to underserved consumers. This funding accelerates our vision of building the bank for the underserved majority, a platform that’s already saved people hundreds of millions while providing significantly higher credit access. We’re well on our way to creating equity of financial opportunity for over 65 million Americans.”

Yendo says its asset-backed credit cards are unlocking $4 trillion of “trapped equity” from cars and homes, offering access to credit products typically reserved for super-prime customers. And now Yendo says it’s preparing “a wave of launches” in Q4 2025, moving it closer to its vision of building an inclusive digital bank for those long ignored by traditional lenders.

AI automates application process ‘in seconds’

Powered by Yendo’s proprietary AI, the company says it automates underwriting, asset verification, and lien filings “in seconds,” replacing processes that typically take legacy lenders weeks and cost hundreds of dollars.

The company says its system slashes origination costs by up to 95%, making it possible to profitably serve borrowers who are often overlooked by banks. The same tech also generates “robust digital identities,” the company says, strengthening defenses against AI-powered fraud.

By leveraging Yendo’s services, customers gain access to “industry-leading rates, rewards, and credit limits up to 8x higher than traditional offerings,” the company said.

One in three people lack access to ‘meaningful credit’

Yendo says it’s addressing a “silent crisis” in American finance, citing the fact that one in three people are denied access to meaningful credit and struggle to obtain even basic banking products.

The company calls these nonprime Americans “the underserved majority.” To date, Yendo claims it has saved its customers over $200 million in interest and fees, while growing at double-digit percentages every month.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

R E A D N E X T

-

North Texas has plenty to see, hear, and watch. Here are our editors’ picks. Plus, you’ll find more selections to “save the date.”

-

D CEO and Dallas Innovates have expanded The Innovation Awards 2026 with more individual and company categories this year. Now is your chance to be part of the region’s defining recognition for innovators.

-

Data scientist Anmolika Singh put Dallas on the global AI Tinkerers map. At the first meetup, more than 30 pros—founders to Fortune 500 technologists—showed up to trade ideas, projects, and solutions.

-

The BMW Dallas Marathon is gearing up for its 2025 race weekend, to be held in a long, winding course around White Rock Lake December 12–14. One way it’s doing that is by unveiling “a bold new logo” featuring a modern take on the Pegasus—Dallas’ celebrated icon—stretching its neck out toward victory. Along with a refreshed merchandise collection, the updated visual identity “reflects the organization’s evolution as a premier running event and its deep connection to the Dallas community,” organizers said.

-

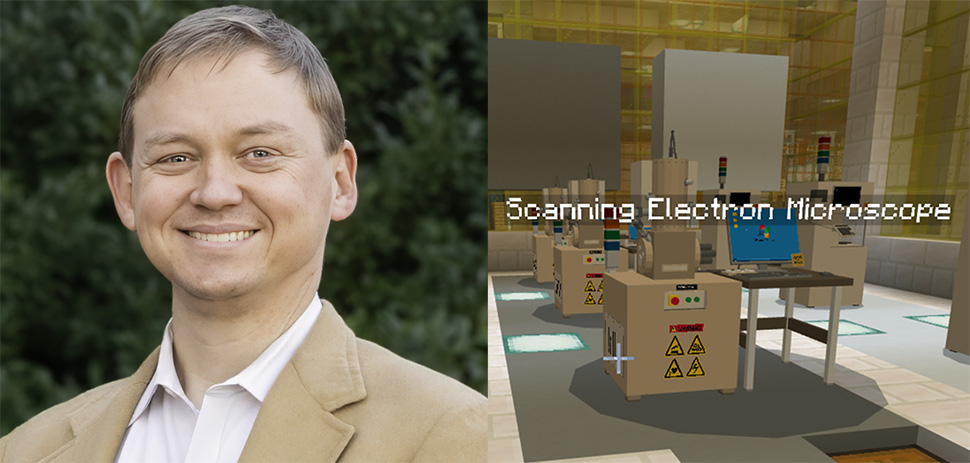

UT Dallas researcher Dr. Walter Voit transformed Minecraft’s 170-million-player universe into an advanced virtual training ground—for students and for AI agents tested by DARPA. His team’s Polycraft World uses gameplay to turn classroom theory into real-world expertise, covering topics from synthetic organic chemistry to nuclear plants to semiconductor facilities. Their new startup company, Pedegree Studios, has licensed the core technologies from the university to create a scalable digital pipeline for education and workforce development.