Across New York City, 3.53 million residents are set to receive inflation refund checks of up to $400. Have you gotten yours yet? If not, keep reading.

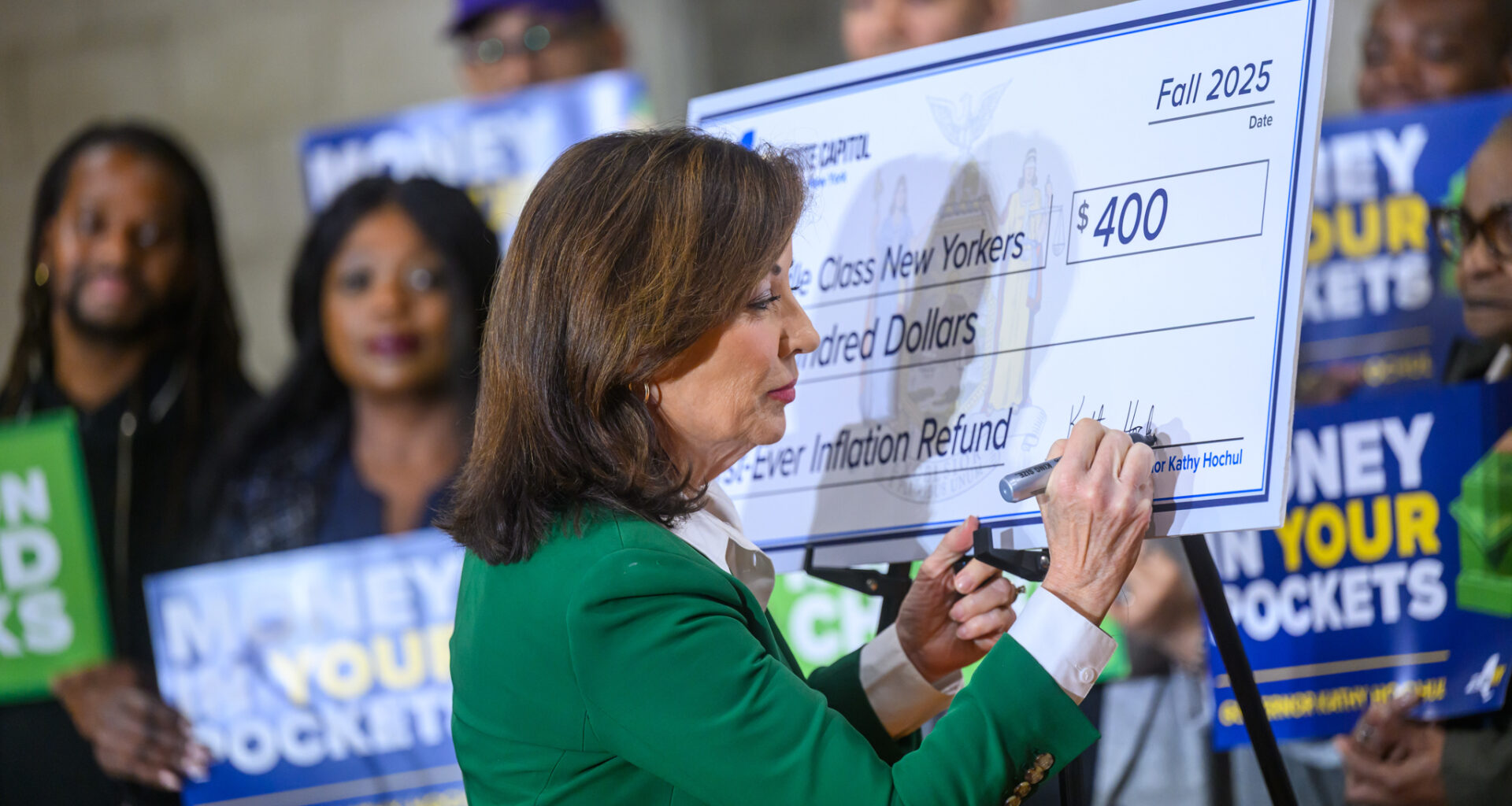

The checks are part of a statewide initiative spearheaded by Gov. Kathy Hochul to give mostly middle-class New Yorkers a boost against what she called a pandemic-driven increase in prices.

Here’s what to know about the money coming your way:

When to expect your check

They have started to hit mailboxes and will be sent over the next several weeks.

The refund checks will be mailed starting this month, and will continue to be delivered through November. Don’t worry if your neighbor got their check and you haven’t yet — mailings are not sent out based on address, according to the New York State Department of Taxation and Finance.

There is no online option to receive your money, so don’t expect a direct deposit. Paper checks will be physically mailed to the address on your 2024 state tax return, which you can find a copy of here if you misplaced it. And if you’ve moved since you filed that return, you can update your address on the New York State’s Department of Taxation and Finance website.

The state is sending out 200,000 checks a day to the 8.2 million qualifying New York State households.

Who’s eligible?

A lot of people are eligible and unless you’re earned a big salary in the last couple of years, you will probably get some kind of check.

Eligibility is based on the income you reported on your New York State Income Tax Return in 2023, so get that paperwork in order.

Not eligible are: Joint filers who made more than $300,000 that year and single filers whose income topped $150,000.

How much you receive depends on how much you earned, according to your 2023 return. Let’s break down the dollar figures:

- Your check will be $400 if you filed jointly and your household earned up to $150,000

- Your check will be $300 if you filed jointly and your household earned more than $150,000 but not more than $300,000

- Single filers who earned up to $75,000 will pocket $200

- Single tax filers who earned more than $75,000 but not more than $150,000 will receive $150.

Anyone who filed a state income tax return in 2023, was a full-year New York resident and was not claimed as a dependent on another taxpayer’s return is eligible. There are no age restrictions.

Do I need to sign up or register to get the money?

Nope! If you’re eligible, you do not need to do anything to receive the inflation refund check. It will be sent automatically by the state’s finance agency.

Do I have to pay taxes on the check?

Yes and no.

The inflation return check is not considered taxable by New York State, but it is by the federal government. Federal taxes won’t automatically be taken out of the checks, so New Yorkers will need to report them on their 2025 federal income tax returns.

I never got my check. What now?

First: Double check to see if you meet the eligibility requirements.

Everyone who is eligible should receive one, but if you believe your check went to an old address, you should contact the state’s Department of Taxation and Finance for assistance. More information can be found at www.tax.ny.gov

The tax department cannot provide a delivery schedule or check status.

Another place to look: The state comptroller’s lost money fund, where all unclaimed funds are safeguarded, sometimes for years. That includes uncashed checks mailed to wrong addresses.

Heads up: Watch out for refund scammers

Hochul has warned New Yorkers to be wary of scams tied to the refund checks. The state says fraudsters are sending fake mail, texts and phone calls to trick people into sharing their bank information.

Be warned: The state will not ask you for banking information, or any personal information, in order for you to receive a refund check.

The IRS and the New York State Department of Taxation and Finance already have your personal information from your tax returns, so if you receive a text, call, email, or physical mail asking you to submit accurate personal or payment information in order to receive the check, it is a scam.

If you think you got a scammy message, follow these instructions from the New York tax department:

- Block the sender

- Delete the message

- Report the scam to the state or IRS

Related