Market Size & Trends

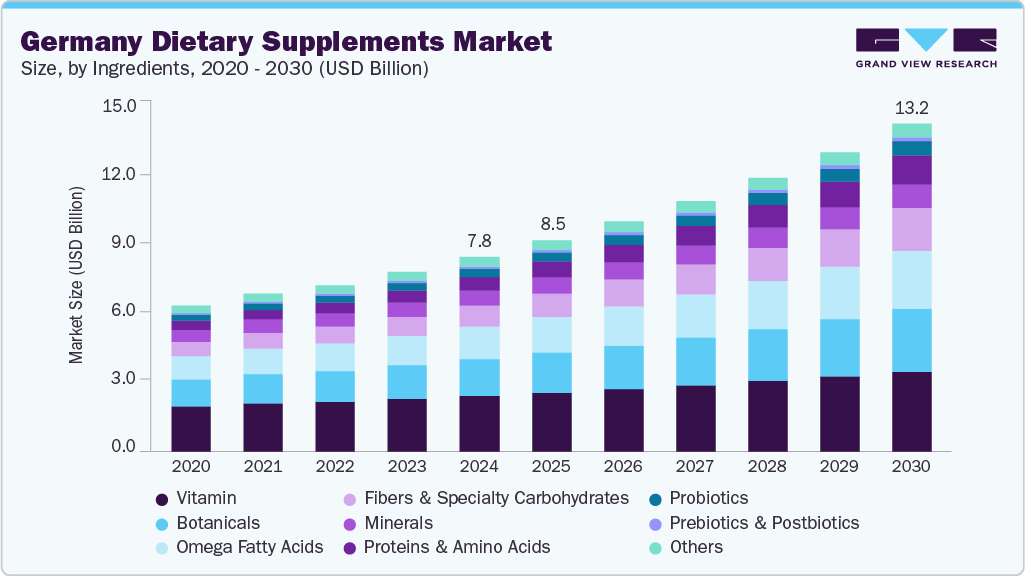

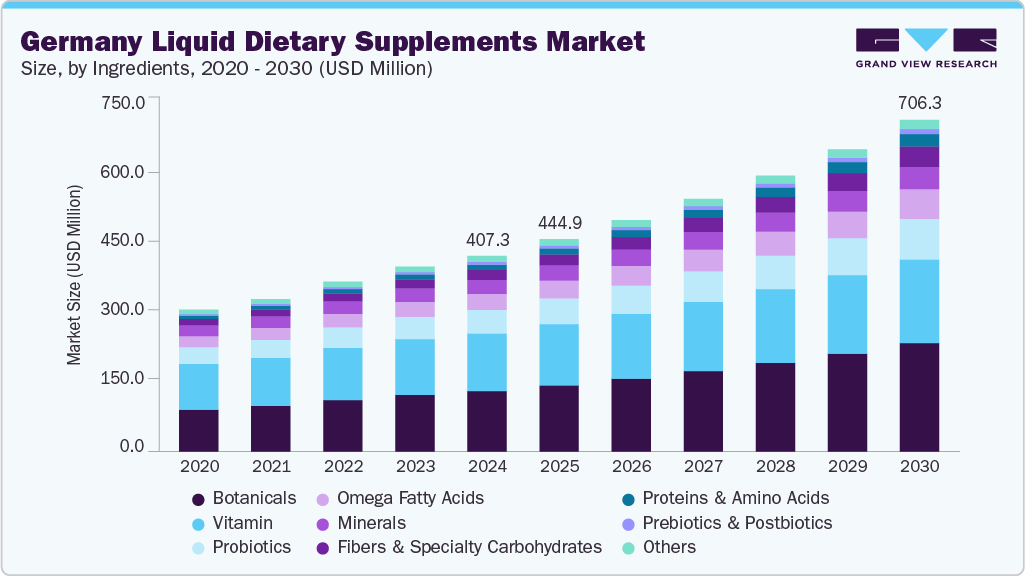

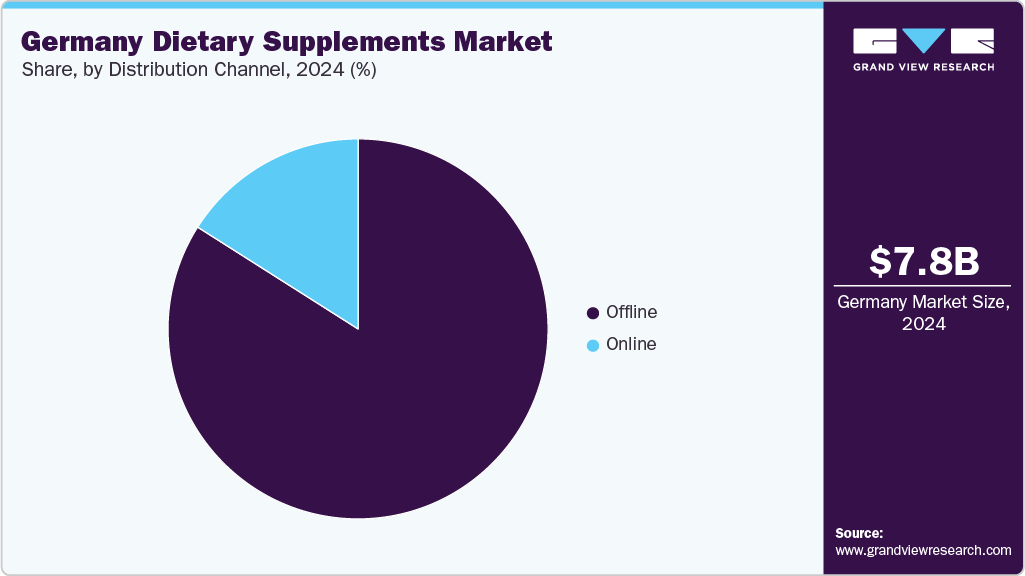

The Germany dietary supplements market size was estimated at USD 7.82 billion in 2024 and is projected to grow at a CAGR of 9.2% from 2025 to 2030. The market growth is attributed to the rising health consciousness and preventive healthcare awareness. German consumers are increasingly investing in wellness to avoid chronic conditions, especially with aging populations and heightened post-pandemic vigilance. The public’s shift toward holistic, proactive health measures encourages daily use of supplements-especially for immunity, digestion, and stress management.

The increasing prevalence of chronic conditions, particularly type 2 diabetes, is a growing concern. Projections estimate that there will be around 14.2 million cases of diabetes in Germany by 2040. This rising trend has increased the demand for chromium, magnesium, and alpha-lipoic acid supplements, which promote metabolic health and help regulate blood sugar levels. In response, companies are developing specific formulations aimed at improving glucose control and insulin sensitivity.

Product innovation and format diversification are also accelerating market momentum. Infarma 2025, held in Pritzwalk, Germany, highlighted key supplement trends, including collagen innovations, functional gummies, melatonin with added benefits, advanced digestive health solutions, and nutricosmetics.

Regulatory support and consumer trust are essential components of a thriving market economy. Germany’s stringent quality standards and transparent labeling laws foster high consumer confidence, encouraging domestic and international brands to innovate responsibly and expand their footprint. EU and national food laws regulate Germany’s dietary supplement market to ensure safety, transparency, and consumer trust.

The German market is benefiting from the rise of plant-based and organic supplements. As sustainability and clean-label preferences gain traction, consumers favor natural ingredients and eco-conscious formulations. This shift has opened the door for herbal supplements, probiotics, and vitamins from organic or non-synthetic origins. E-commerce and digital health platforms are pivotal in market expansion. Online retail not only increases accessibility to a diverse range of products but also allows for personalized supplement recommendations, subscription models, and user reviews, all of which enhance consumer trust and engagement.

Consumer Insights

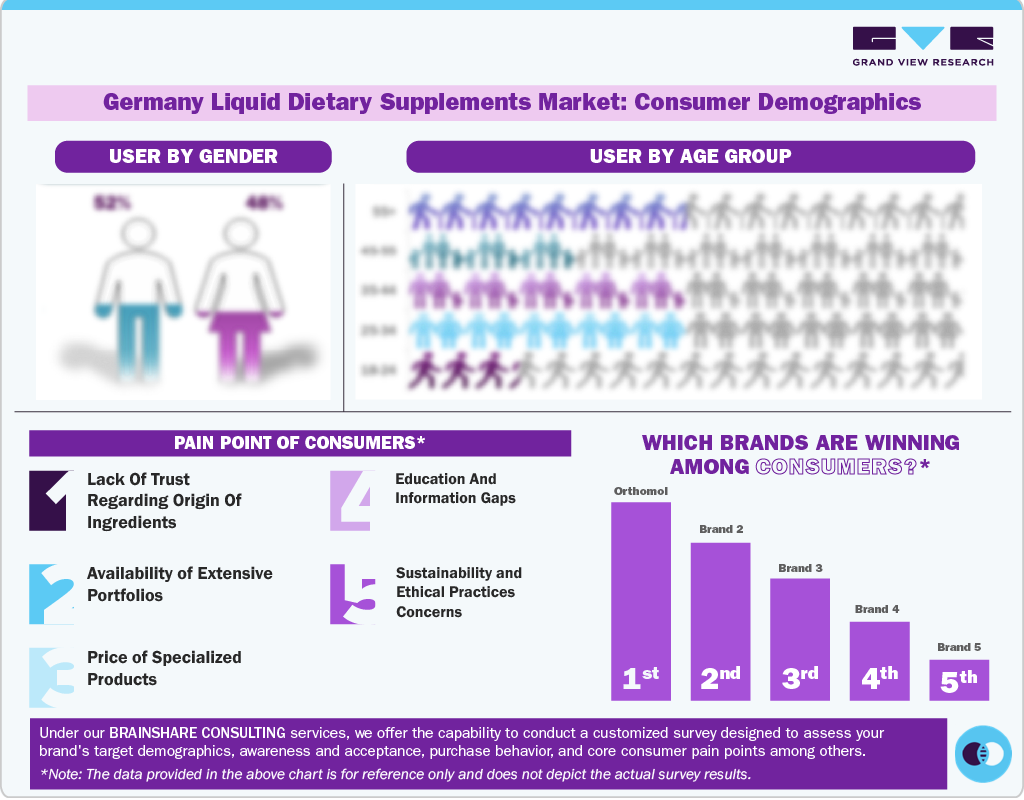

The country also has a notably mature demographic profile, with a median age of 45.5. According to the German Federal Institute for Risk Assessment (BfR), one-third of the population (~ 28 million people) consumes vitamin-based food supplements at least once a week, and about one-sixth (~14 million) prefer them daily.

In Germany, despite inflationary pressures, dietary supplement use continues to rise, with 65% of consumers using them in 2023, up 5% since 2021. The top choices include vitamin D, magnesium, and multivitamins. Increased health awareness amid declining self-perception of health is driving daily usage, particularly among cost-conscious yet health-focused consumers.

Ingredients Insights

Vitamins dominated the German dietary supplements market and accounted for a share of 28.6% in 2024, owing to widespread micronutrient deficiencies and rising preventive health awareness. The aging population also fuels demand for vitamins that support bone health, immunity, and cognitive function. Older adults seeking to maintain vitality increasingly incorporate vitamins such as B12, C, and E into their daily routines. The popularity of multivitamin complexes, often tailored by age or gender, has also contributed to this segment’s growth.

The proteins & amino acids segment is expected to experience the fastest CAGR from 2025 to 2030. In Germany’s strong sports and wellness culture, amateur and professional athletes increasingly rely on whey protein, BCAAs, and creatine to support muscle recovery and performance. Additionally, the growing popularity of plant-based lifestyles has led to a spike in demand for vegan protein sources such as pea, rice, and hemp protein. The segment is also benefiting from format innovation-with proteins now available in ready-to-drink shakes, bars, and even functional snacks-making them more accessible for busy consumers. Moreover, the aging population is turning to amino acid supplements to preserve muscle mass and mobility, further expanding the consumer base.

Form Insights

Tablets dominated the market and accounted for a share of 31.1% in 2024, owing to their cost-effectiveness, ease of storage, and precise dosing. Consumers favor tablets for their long shelf life and portability, making them ideal for daily routines. Additionally, tablets allow for high-dose formulations and multi-ingredient combinations, especially popular in multivitamin and mineral blends. Pharmaceutical familiarity also plays a role-German consumers often associate tablets with clinical efficacy and trust. Manufacturers benefit from streamlined production processes and lower packaging costs, supporting their widespread availability across pharmacies, supermarkets, and online platforms.

The powders segment is expected to experience the fastest CAGR of 10.9% from 2025 to 2030. This rapid growth is fueled by rising consumer demand for customizable, clean-label nutrition and the convenience of incorporating powders into daily routines-whether in smoothies, shakes, or meals. The segment also benefits from transparent sourcing and sustainability trends, with consumers favoring organic, non-GMO, and additive-free formulations.

Type Insights

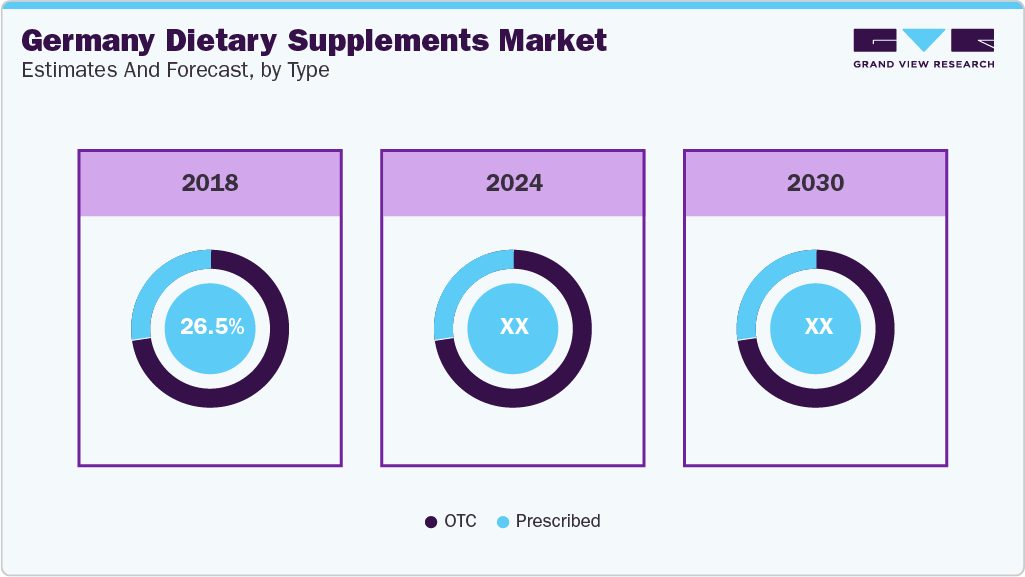

OTC supplements dominated the market and accounted for a largest revenue share in 2024, owing to growing consumer preference for self-medication, pharmacist recommendations, and easy accessibility. Amid rising healthcare costs and limited physician visits, especially post-pandemic, consumers increasingly turned to OTC products for preventive care and symptom relief. The segment’s strength is also supported by trusted retail channels, including pharmacies and expanding online platforms.

The prescribed segment is expected to experience the fastest CAGR from 2025 to 2030. The segment growth is attributed to the increasing medical endorsement and consumer trust in physician-recommended products. As awareness of preventive healthcare deepens, more individuals-especially those managing chronic conditions or undergoing specific life stages like pregnancy or aging-are turning to supplements prescribed by healthcare professionals.

Application Insights

The immunity segment held the largest market share of the German dietary supplements industry in 2024. This surge is largely driven by heightened health awareness post-pandemic, with consumers proactively seeking supplements like vitamin C, zinc, elderberry, and probiotics to bolster their immune defenses. Seasonal flu concerns, rising pollution levels, and a growing aging population have also contributed to sustained demand. Additionally, the popularity of natural and plant-based immunity boosters, coupled with Germany’s preference for clean-label and scientifically backed formulations, has further propelled this segment’s dominance in the market.

The prenatal health segment is expected to grow fastest from 2025 to 2030. Increasing awareness among expectant mothers about the importance of prenatal nutrition-particularly folic acid, iron, calcium, and DHA-has significantly boosted demand. Germany’s aging maternal demographic and rising rates of planned pregnancies have also contributed to a more proactive approach to prenatal care. Moreover, healthcare professionals are increasingly recommending supplements to bridge nutritional gaps during pregnancy, reinforcing consumer trust. The trend toward clean-label, allergen-free, and vegan-friendly formulations further aligns with the preferences of health-conscious parents-to-be.

End Use Insights

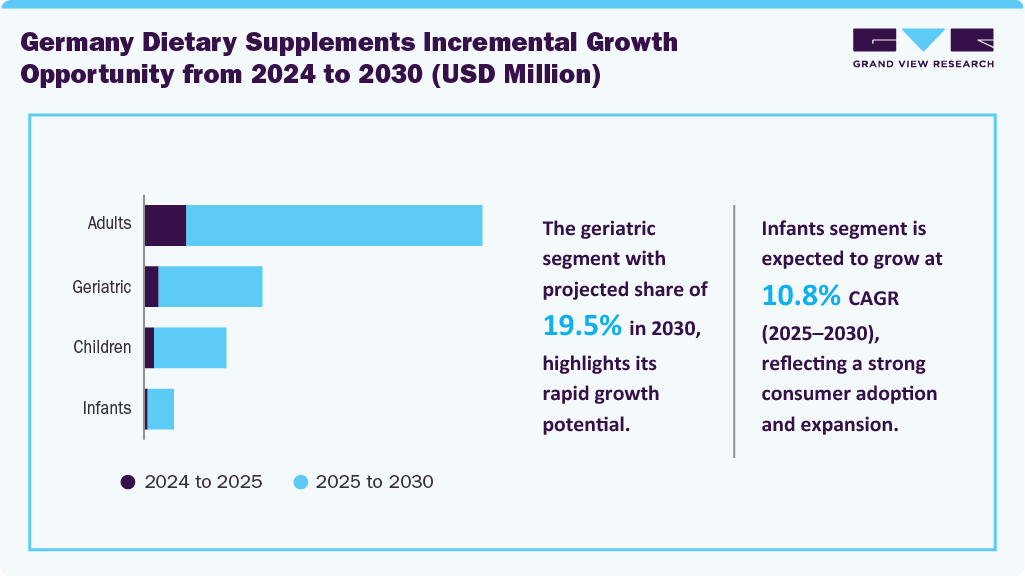

The adults segment accounted for the largest market share in 2024. The segment growth is attributed to the increasing focus on preventive health, stress management, and active lifestyles among working professionals and middle-aged consumers. Adults increasingly turn to supplements to address common concerns such as energy levels, immunity, digestive health, and nutrient deficiencies stemming from busy, modern routines. The popularity of multivitamins, probiotics, and functional blends tailored to adult wellness needs-especially those with clean-label and plant-based credentials-has further cemented this segment’s leadership.

The geriatric segment is anticipated to grow at the fastest CAGR during the forecast period. The country’s rapidly aging population and increasing focus on healthy aging. Older adults seek ways to maintain mobility, cognitive function, and overall vitality as life expectancy rises. This increases the demand for supplements targeting bone health, joint support, cardiovascular wellness, and memory enhancement. Products rich in calcium, vitamin D, omega-3 fatty acids, and antioxidants are particularly favored.

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024, owing to the enduring consumer trust in traditional retail channels such as pharmacies, health food stores, and supermarkets. This preference is rooted in the personalized guidance offered by pharmacists and in-store experts, which many consumers value when selecting health-related products. Additionally, the tactile experience of physically inspecting products and immediate availability continue to appeal to a broad demographic-especially older adults and those less inclined toward digital shopping.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2030. The distribution growth is attributed to the digital-savvy population and the growing preference for convenience and variety. The pandemic accelerated this shift, normalizing online shopping for supplements across age groups. Consumers are drawn to the ease of comparing products, accessing detailed ingredient information, and reading peer reviews-all of which enhance purchasing confidence.

Key Germany Dietary Supplements Company Insights

Some of the key companies operating in the German dietary supplements industry include Abbott, Bayer AG, Nestlé, GSK plc, and others

-

Nutraceuticals Group Europe Ltd. is a prominent supplier of high-quality nutritional and health ingredients across Europe, including Germany. The company specializes in sourcing, developing, and supplying various raw materials for dietary supplements, functional foods, and beverages.

-

Dr. B. Scheffler Nachfolger GmbH & Co. KG, part of the KRÜGER GROUP since 1987, is a well-established German company focused on developing and producing dietary supplements, over-the-counter medicines, and skincare products.

Key Germany Dietary Supplements Companies:

- Queisser

- Abbott

- Bayer AG

- Nestlé

- Nutraceuticals Group Europe Ltd.

- GSK plc.

- Dr. B. Scheffler Nachfolger GmbH & Co. KG

- Glanbia PLC

- Herbalife International of America, Inc.

Germany Dietary Supplements Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 13.17 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 – 2023

Forecast period

2025 – 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, and distribution channel

Key companies profiled

Queisser; Abbott; Bayer AG; Nestlé; Nutraceuticals Group Europe Ltd.; GSK plc.; Dr. B. Scheffler Nachfolger GmbH & Co. KG; Glanbia PLC; Herbalife International of America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 – 2030)

-

Form Outlook (Revenue, USD Million, 2018 – 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 – 2030)

-

Application Outlook (Revenue, USD Million, 2018 – 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 – 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 – 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-