Nick Edserbusiness reporter

Getty Images

Getty Images

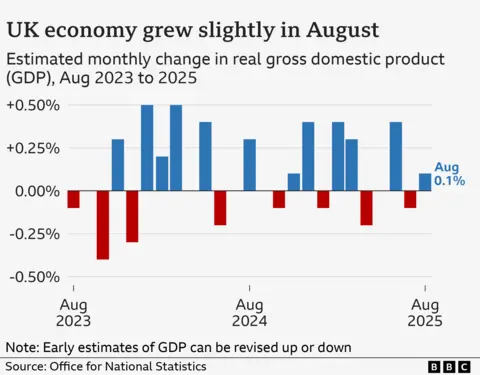

The UK economy grew slightly in August, official figures show, as focus intensifies on what measures the government might unveil in next month’s Budget.

An increase in manufacturing output helped the economy expand by 0.1%, the Office for National Statistics (ONS) said, but the figure for July was revised down from zero growth to a contraction of 0.1%.

The government has made boosting the economy a priority, but economists predict growth will remain sluggish partly due to people waiting to see what measures Chancellor Rachel Reeves announces in the Budget.

Many analysts expect that tax rises or spending cuts will be needed to meet the chancellor’s self-imposed borrowing rules.

The Institute for Fiscal Studies is projecting Reeves will need to find £22bn to bolster the government’s finances and meet her rules, and will “almost certainly” have to raise taxes.

But the influential think tank said the chancellor should be “bold” in next month’s Budget, and build up a large financial buffer to avoid future spending cuts and tax rises.

On Wednesday, Reeves said she was “looking at further measures on tax and spending, to make sure that the public finances always add up”.

Her comments were seen as the clearest sign yet that tax rises will be in the Budget, with speculation growing over what measures she might take.

The main driver of economic growth in August was the manufacturing sector, which grew by 0.7%.

However, the key services sector – which covers businesses in sectors such as retail, hospitality and finance – saw no growth during the month.

Monthly growth figures can be volatile, as seen by the downgrade for July, and the ONS is focusing on growth over a rolling three-month period.

In the three months to August the economy expanded by 0.3%, which was a small improvement on the 0.2% growth in the three months to July.

“Economic growth increased slightly in the latest three months. Services growth held steady, while there was a smaller drag from production than previously,” said Liz McKeown, ONS director of statistics.

Yael Selfin, chief economist at KPMG UK, said that while the economy had returned to growth in August, the “outlook remains weak”.

She said households were facing higher costs for essentials such as food, while uncertainty about potential Budget tax rises was “expected to weigh on activity for both households and businesses”.

“As a result, we anticipate growth to remain sluggish over the coming months.”

Ruth Gregory, deputy chief UK economist at Capital Economics, called August’s growth “meagre”.

She said the increases in taxes for businesses that took effect in April – such as the rise in employers’ National Insurance contributions – were “undoubtedly playing a part in restraining growth”.

“There is little reason to think GDP growth will accelerate much from here,” she said.

“The disruption to the auto sector caused by the Jaguar Land Rover cyber-attack probably meant the economy went backwards in September.”

Despite weak growth in the economy, analysts are not expecting the Bank of England to cut interest rates when it meets next month, as inflation in the UK remains high at 3.8%.

Earlier this week, the International Monetary Fund (IMF) predicted that the UK would be the second-fastest-growing of the world’s most advanced economies this year.

However, it also said the UK would face the highest rate of inflation among G7 nations both this year and next, as result of rising energy and utility bills.

A Treasury spokesperson said: “We have seen the fastest growth in the G7 since the start of the year, but for too many people our economy feels stuck.

“The chancellor is determined to turn this around by helping businesses in every town and High Street grow, investing in infrastructure and cutting red tape to get Britain building.”

Shadow chancellor Mel Stride said the latest figures show that “growth continues to be weak and Rachel Reeves is now admitting she is going to hike taxes yet again, despite all her promises”.

“If Labour had a plan – or a backbone – they would get spending under control, cut the deficit and get taxes down.”

Daisy Cooper, Liberal Democrat Treasury spokesperson, said the government was “simply not doing enough to kickstart growth”.

“The chancellor must quit her slowcoach approach to the economy and finally drop her damaging National Insurance hike.”