North America Thermoplastic Elastomer Market Summary

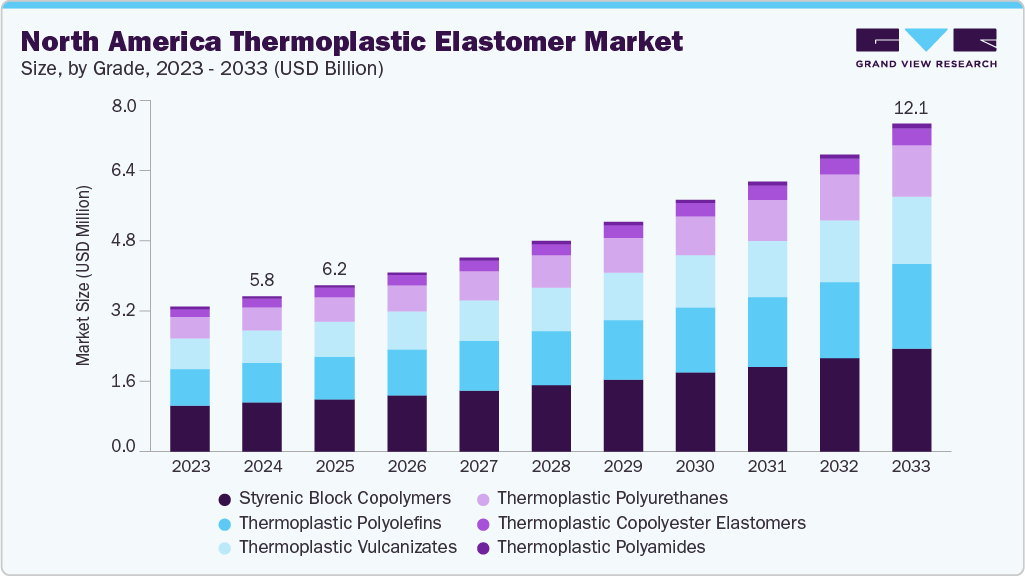

The North America thermoplastic elastomer market size was estimated at USD 5.76 billion in 2024 and is projected to reach USD 12.14 billion by 2033, growing at a CAGR of 8.8% from 2025 to 2033. The growing demand from the automotive, electrical & electronics, medical, and consumer goods industries is driving the North America thermoplastic elastomer (TPE) market.

Key Market Trends & Insights

- U.S. dominated the North America thermoplastic elastomer market with the largest revenue share of 71.47% in 2024.

- The thermoplastic elastomer market in Mexico is expected to grow at the fastest CAGR of 9.5% from 2025 to 2033.

- By grade, the thermoplastic polyurethanes segment is expected to grow in revenue at the fastest CAGR of 9.7% from 2025 to 2033.

- By application, the medical segment is expected to grow at a considerable revenue CAGR of 9.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.76 billion

- 2033 Projected Market Size: USD 12.14 billion

- CAGR (2025-2033): 8.8%

- U.S.: Largest market in 2024

The North America thermoplastic elastomer (TPE) market by grade is characterized by a diverse range of material formulations tailored to meet specific performance and processing requirements across key industries such as automotive, consumer goods, construction, medical, and electronics. The market encompasses various grades including standard, specialty, and high-performance TPEs, each offering distinct advantages in terms of flexibility, chemical resistance, and durability. The regional demand is driven by the growing preference for lightweight, recyclable, and cost-efficient materials, coupled with advancements in compounding technologies that enable enhanced mechanical and thermal properties.

Drivers, Opportunities & Restraints

The market for thermoplastic elastomers (TPE) in North America is fueled by the rising need for lightweight and recyclable materials in the production of automotive and consumer goods. The movement towards sustainable material options, along with strict regulations on fuel efficiency and emissions, is encouraging the substitution of traditional rubber and thermoset materials with TPEs. Furthermore, innovations in polymer blending and compounding techniques have enhanced the performance features of TPEs, facilitating their use in applications that demand excellent flexibility, weather resistance, and chemical durability.

In North America, an increasing emphasis on circular economy principles and the development of bio-based products provides substantial opportunities for the TPE market. The introduction of advanced grades made from renewable resources and post-consumer recycled materials corresponds with the changing sustainability objectives across various industries. The growing applications in sectors such as electric vehicles, medical devices, and consumer electronics are creating fresh avenues for growth, bolstered by innovations in TPE formulations that deliver improved performance, design versatility, and processing efficiency.

Even with significant growth potential, the TPE market in North America encounters obstacles due to varying raw material prices and lower heat resistance relative to traditional elastomers. Relying on petroleum-based resources raises environmental issues and price fluctuations, and the steep initial costs for processing and tooling may hinder entry into cost-sensitive markets. Additionally, established alternatives like thermoset rubbers in specific heavy-duty and high-temperature uses continue to limit wider acceptance.

Market Concentration & Characteristics

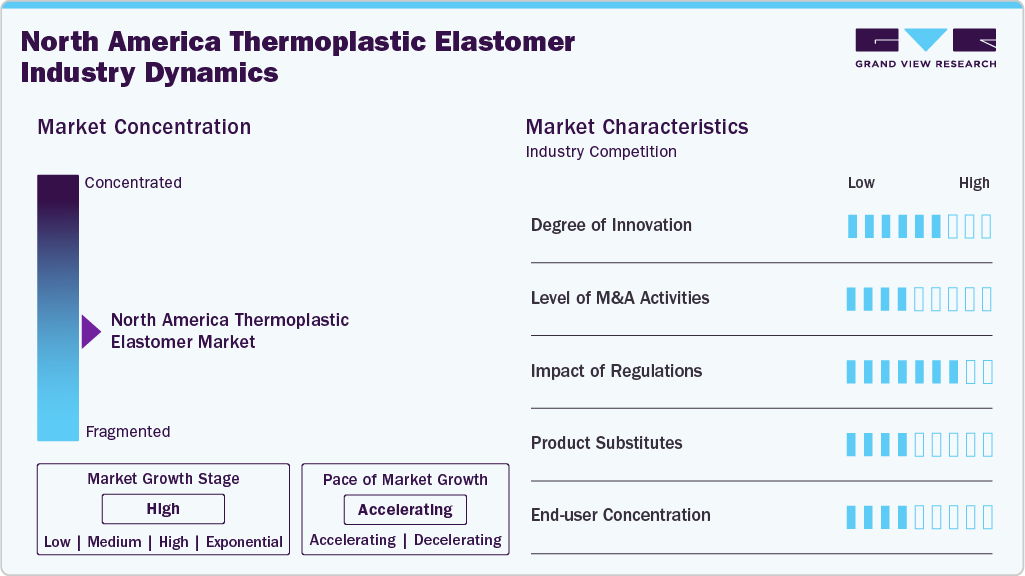

The market for North America thermoplastic elastomer is fragmented owing to the presence of key companies, such as ExxonMobil Chemical, Hexpol TPE, Mitsui Chemicals, Teknor Apex, Lubrizol Advanced Materials, Celanese Corporation, DIC Corporation, BASF SE, DSM-Firmenich, KRAIBURG TPE GmbH & Co. KG, and others. These companies have adopted various strategies, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their market presence.

The thermoplastic elastomer (TPE) market in North America demonstrates a moderate to high level of innovation, propelled by ongoing advancements in materials, improvements in processes, and research and development focused on sustainability. Companies are focusing on the creation of hybrid and bio-based TPE grades that offer superior mechanical, thermal, and chemical attributes to satisfy changing industry demands. Strategic partnerships and mergers & acquisitions (M&A) are influencing the market dynamics, as leading companies aim to broaden their product ranges, enhance their presence in various regions, and gain access to cutting-edge compounding technologies. Significant consolidation efforts are being observed among polymer manufacturers and compounders who are working to enhance value chain integration and expedite innovation in specialized TPE grades.

The evolution and acceptance of thermoplastic elastomers in North America are greatly affected by regulatory frameworks. Strict environmental policies aimed at limiting volatile organic compounds (VOCs) and encouraging recyclability along with a lower carbon footprint are prompting industries to transition towards sustainable TPE options. Adhering to FDA, REACH, and automotive standards such as UL and SAE is essential for obtaining product approval in important sectors, especially in medical, food contact, and automotive applications. These regulations have also led to increased investments in eco-friendly, phthalate-free, and low-emission TPE formulations throughout the region.

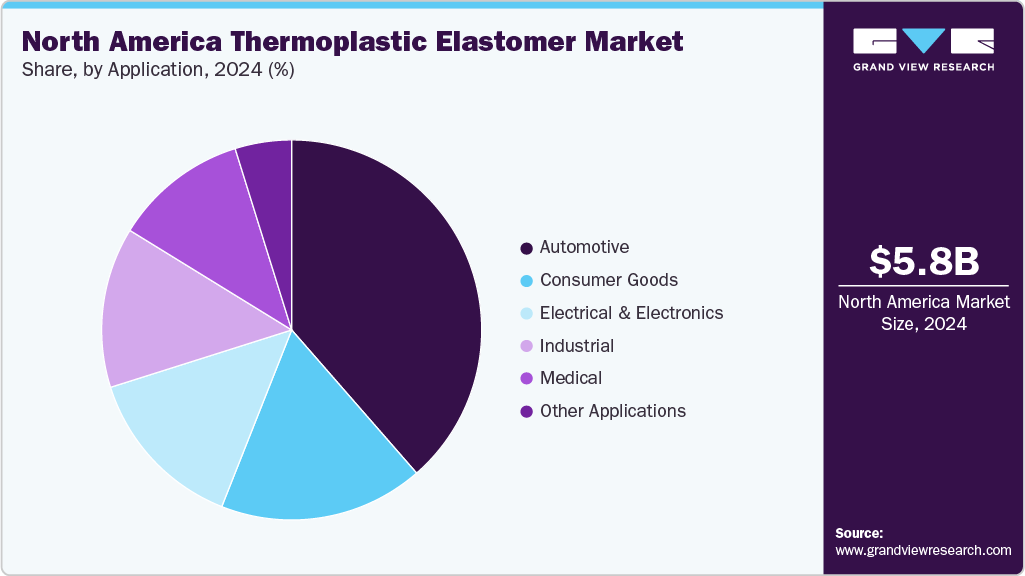

TPEs encounter competition from materials like thermoset rubbers, silicones, and engineering plastics, which can provide comparable or even superior performance in specific demanding applications. Although thermoset rubbers are prevalent in high-temperature and high-pressure situations, TPEs are progressively gaining traction due to their ability to be reprocessed and their design adaptability. The market shows moderate concentration in end-use sectors, with the automotive industry making up a considerable portion of demand, followed by sectors such as consumer goods, construction, and medical applications. Nonetheless, the increasing diversification into emerging fields like wearable electronics and electric mobility is gradually lessening reliance on traditional end-user categories.

Grade Insights

Styrenic Block Copolymers dominated the North America thermoplastic elastomer market across the grade segmentation in terms of revenue, accounting for a market share of 31.57% in 2024, and are forecasted to grow at a 8.8% CAGR from 2025 to 2033. Styrenic blocks deliver hardness and processability, while the elastomeric midblock delivers flexibility and tactile feel; hydrogenation to SEBS greatly improves UV and thermal stability for outdoor and automotive use. SEBS-based TPEs command premium pricing because they combine soft-touch aesthetics with broad processing latitude across injection molding, extrusion, and co-extrusion.

The Thermoplastic Polyolefins segment is expected to expand at a substantial CAGR of 9.7% through the forecast period. Thermoplastic Polyolefins are gaining ground in North America, especially in automotive and construction applications. TPOs are typically blends of polypropylene (PP) with rubber phases like ethylene-propylene rubber (EPR or EPDM), giving them a unique combination of rigidity and elasticity. Their light weight, cost-effectiveness, UV resistance, and recyclability make them well-suited for North America’s growing automotive OEM base, particularly for bumpers, instrument panels, and exterior trims. TPOs are increasingly chosen over traditional materials due to their compliance with lightweighting trends driven by fuel efficiency and emission norms.

Material Insights

Styrene dominated the North America thermoplastic elastomer market across the material segmentation in terms of revenue, accounting for a market share of 32.13% in 2024. It is forecasted to grow at a considerate CAGR from 2025 to 2033. Styrenic thermoplastic elastomers (TPE-S) are among the most commonly utilized material categories in the North American thermoplastic elastomer market, thanks to their remarkable combination of performance, ease of processing, and cost-effectiveness. Mainly produced from styrene-butadiene-styrene (SBS) and styrene-ethylene-butylene-styrene (SEBS) block copolymers, these substances merge the flexibility of rubber with the moldability of thermoplastics. Their adaptability makes them suitable for uses in automotive interiors, footwear, consumer goods, and adhesives & sealants. The increasing demand for TPE-S is also bolstered by their recyclability, lightweight nature, and the possibility of being easily colored or enhanced with additives, allowing for tailored solutions for various applications.

Propylene and polypropylene form the backbone of olefinic TPE families such as thermoplastic olefins and polyolefin elastomers. In these materials, a PP matrix or PP-based block provides stiffness and heat resistance while the olefin elastomer phase supplies flexibility and impact recovery. Olefinic TPEs are attractive commercially because they are lower density, often easier to recycle with polyolefin streams, and generally more cost competitive versus styrenic or polyurethane elastomers for large-volume automotive and consumer applications.

Application Insights

Automotive dominated the Thermoplastic Elastomer market across the end-use segmentation in terms of revenue, accounting for a market share of 38.58% in 2024. North American vehicle programs continue to be the largest volume driver for TPEs, as OEMs specify elastomers for seals, overmolding, cable sheathing, and under-hood parts that require low density, chemical resistance, and design flexibility. Government data shows that the automotive sector will experience a significant employment boost in 2024. Manufacturing added an average of approximately 9,000 jobs per month, supporting production recovery and program investments that increase the TPE content per vehicle. Suppliers should favor TPV, SEBS, and olefin TPE grades that meet heat, flame, and oil resistance requirements while offering weight savings for lightweighting programs.

The packaging segment is expected to expand at the fastest CAGR of 9.4% through the forecast period. Demand for TPE for medical devices is driven by an aging population, higher procedural volumes, and stricter device safety requirements. These favor validated, low-extractability elastomers for seals, tubing, and wearable components. Healthcare spending in the U.S. increased sharply in 2024. The U.S. Centers for Medicare & Medicaid Services (CMS) estimates that national healthcare spending grew by approximately 8.2% in 2024 and is expected to increase again in 2025. This leads to higher procurement budgets and increased device production, which benefits certified TPE suppliers.

Country Insights

U.S. Thermoplastic Elastomer Market Trends

U.S. held the largest share of 71.47% in terms of revenue of the North America thermoplastic elastomer market in 2024. The growth in TPEs is strongly supported by the resilience of e-commerce and omni-channel retail in the U.S. According to the U.S. Census Bureau, total e-commerce sales reached approximately USD 1,192.6 billion in 2024, accounting for 16.1% of overall retail sales. This steady rise in digital commerce is creating structural demand for lightweight, flexible, and durable materials, particularly in packaging and consumer goods shipped directly to households.

Mexico Thermoplastic Elastomer Market Trends

Mexico’s TPE demand is primarily driven by its robust automotive manufacturing sector. According to INEGI, light-vehicle production totaled about 3.99 million units between January and December 2024, with the majority of output destined for export markets. This automotive hub effect directly stimulates demand for TPE in vehicle systems and export-oriented parts production, reinforcing Mexico’s role as a strategic supplier in the North American value chain.

Key North America Thermoplastic Elastomer Market Company Insights

The market for North America thermoplastic elastomer is fragmented owing to the presence of key companies, such as ExxonMobil Chemical, Hexpol TPE, Mitsui Chemicals, Teknor Apex, Lubrizol Advanced Materials, Celanese Corporation, DIC Corporation, BASF SE, DSM-Firmenich, KRAIBURG TPE GmbH & Co. KG, and others. These companies have adopted various strategies, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their market presence.

Key North America Thermoplastic Elastomer Companies:

- ExxonMobil Chemical

- Hexpol TPE

- Mitsui Chemicals

- Teknor Apex

- Lubrizol Advanced Materials

- Celanese Corporation

- DIC Corporation

- BASF SE

- DSM Engineering Materials (DSM-Firmenich)

- KRAIBURG TPE GmbH & Co. KG

Recent Developments

-

In June 2025, Teknor Apex, a global player in plastic material science, acquired Danimer Scientific, a bioplastics company known for biodegradable materials.

-

In April 2025, DuPont de Nemours, Inc. launched the Liveo Pharma TPE Ultra-Low Temp Tubing designed for biopharmaceutical processing that requires exposure to very low temperatures, down to -86 °C. The tubing is sterilizable, weldable, and sealable with high toughness and chemical resistance. It meets strict biocompatibility and purity standards, including USP Class VI and ISO certifications.

North America Thermoplastic Elastomer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.17 billion

Revenue forecast in 2033

USD 12.14 billion

Growth rate

CAGR of 8.8% from 2025 to 2033

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Grade, material, application, region

Country Scope

U.S.; Canada; Mexico

Key companies profiled

ExxonMobil Chemical; Hexpol TPE; Mitsui Chemicals; Teknor Apex; Lubrizol Advanced Materials; Celanese Corporation; DIC Corporation; BASF SE; DSM Engineering Materials (DSM-Firmenich); KRAIBURG TPE GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Thermoplastic Elastomer Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the North America thermoplastic elastomer market report on the basis of grade, material, application, and region:

-

Grade Outlook (Revenue, USD Million; Volume, Kilotons; 2021 – 2033)

-

Styrenic Block Copolymers

-

Thermoplastic Polyolefins

-

Thermoplastic Vulcanizates

-

Thermoplastic Polyurethanes

-

Thermoplastic Copolyester Elastomers

-

Thermoplastic Polyamides

-

-

Material Outlook (Revenue, USD Million; Volume, Kilotons; 2021 – 2033)

-

Butadiene

-

Styrene

-

Propylene / Polypropylene

-

Ethylene

-

Plasticizers, Oils, Additives, Fillers

-

Other materials

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2021 – 2033)

-

Automotive

-

Electrical & Electronics

-

Industrial

-

Medical

-

Consumer Goods

-

Other Applications

-

-

Country Outlook (Revenue, USD Million; Volume, Kilotons; 2021 – 2033)