According to data from Sports Innovation Lab, connected fitness is settling into a new normal while low-price gyms continue to win big

As the fitness industry settles into a post-pandemic flow, a couple of trend lines appear to be emerging: first, connected fitness probably won’t ever be as popular as it was at the height of the pandemic, but it’s still a strong segment.

Second, high-value, low-price (HVLP) gyms are dominating, winning over new members and getting their existing members to shell out more cash for premium services like wellness and recovery offerings.

Sports Innovation Lab co-founder and CEO Josh Walker shined a light on these trends at the ATN Innovation Summit 2025, using proprietary data from consumer spending habits to back up the assertions. Sports Innovation Lab, which has worked with some of the world’s top sports, media and entertainment properties, including the NFL and ESPN, recently began analyzing the fitness industry through a partnership with Athletech News. The firm tracks and analyzes consumer spending data, painting a picture of what it calls the “fluid fan.”

At the Innovation Summit, Walker noted that while the figures Sports Innovation Lab pulls only cover “a fraction of the U.S. population,” the firm’s data is accurate and is indicative of broader trends in the industry.

“I am not saying these are the numbers you would report to (Wall Street), but these are absolutely directionally correct,” Walker said.

Connected Fitness Finds New Normal After Pandemic Boom

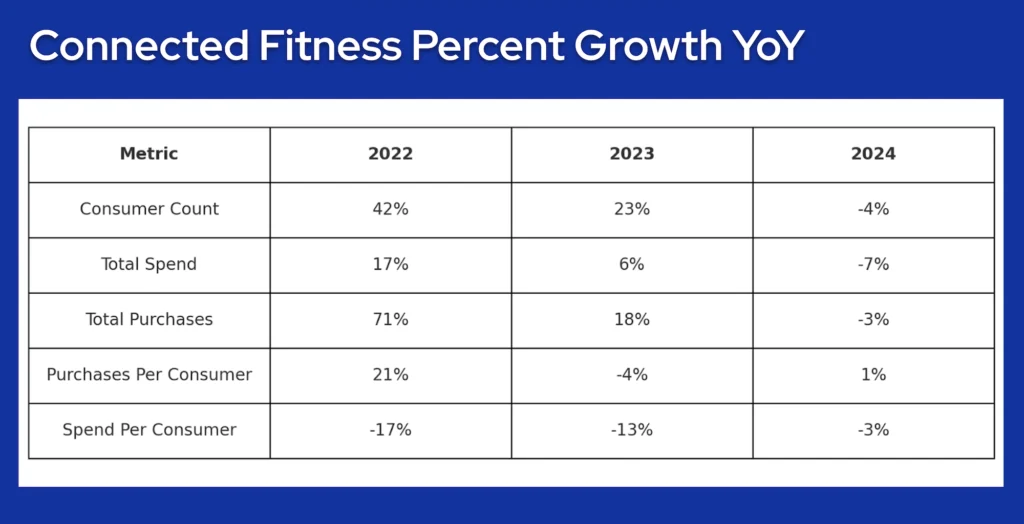

When it comes to connected fitness, Sports Innovation Lab believes the sector is settling into something of a new normal post-pandemic. Demand for connected fitness is still fairly strong following the COVID boom, but top brands aren’t experiencing the same type of double-digit year-over-year growth they were during the pandemic.

“I think we’re returning to a sort of normal – not that there was a normal before – but this seems to be more of the baseline in this industry,” Walker summarized.

source: Sports Innovation Lab

source: Sports Innovation Lab

He also urged fitness and wellness industry leaders to think more broadly about what it means to be a “connected fitness” company in 2025. Brands like Peloton and Tonal undoubtedly fall into this category, but health and fitness wearables should too, Walker believes.

Garmin, for example, is increasingly playing in the “connected fitness” sector with its smartwatches. In Q1 of 2024, Garmin reported that its fitness category revenue increased by 40% to $343 million, a new first-quarter record that the company says was led by strong demand for advanced wearables.

Oura has also seen a significant increase in sales, according to Sports Innovation Lab data.

“Connected fitness consumers love data,” Walker said of why wearables are growing in popularity among this segment.

HVLP Gym ‘Dominance’ Is Real, Data Shows

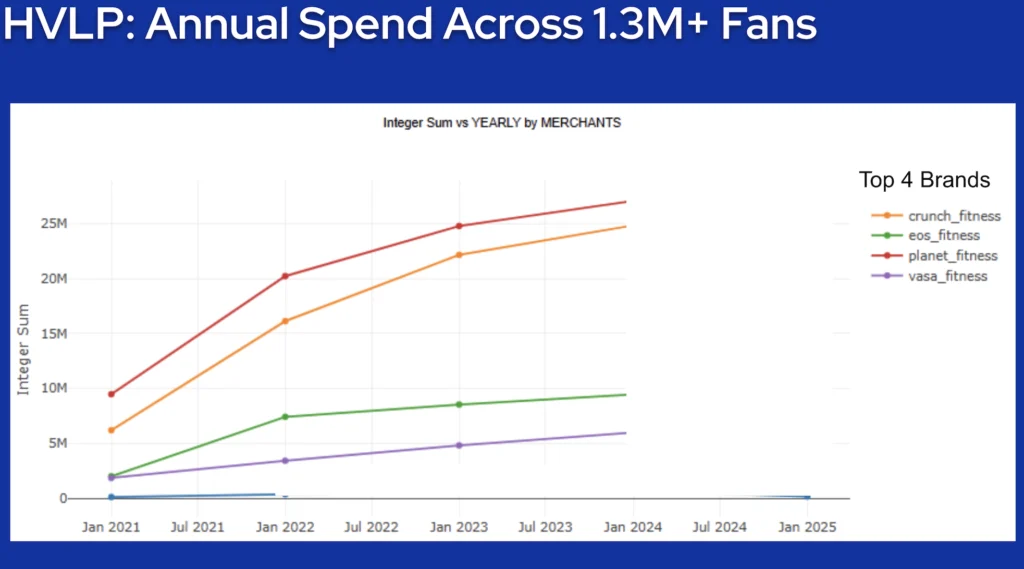

The rise of HVLP gym brands isn’t exactly news to anyone plugged into the fitness and wellness industry, but the extent to which they’re outpacing the market might be.

See Also

“HVLP dominance is real,” Walker said. “We see it in our data.”

According to consumer purchases tracked by Sports Innovation Lab, top HVLP brands are doing significantly better than they were in 2021, with annual spend tripling and even quadrupling for some brands.

- Planet Fitness: $9 million annual spend in 2021 to $27 million in 2024

- Crunch Fitness: $6 million in 2021 to $25 million in 2024

- EōS Fitness: $2 million in 2021 to $9 million in 2024

- Vasa Fitness: $2 million in 2021 to $6 million in 2024.

source: Sports Innovation Lab

source: Sports Innovation Lab

Spend-per-purchase is also increasing for HVLP gym brands, according to Sports Innovation Lab, meaning gym members are spending more on their memberships and add-on services than they did in the past. This might be due to the rise of wellness and recovery amenities inside low-price gyms, making premium memberships more attractive.

For example, Planet Fitness’ spend-per-customer has increased from $14 in 2021 to $21 in 2025, a jump that’s likely due to increased sales of premium-level Black Card memberships combined with the gym chain’s decision to increase the price of its base-level membership from $10/month to $15/month last summer.

“Planet Fitness is a clear indicator of what’s happening in the sector. … The Black Card is having an impact, and we’re seeing that their highest spend per customer was last year,” Walker said. “And it seems to be holding this year in 2025 so far.”

Stay tuned for more proprietary data from Sports Innovation Lab in partnership with ATN, including an upcoming look at the state of boutique fitness.