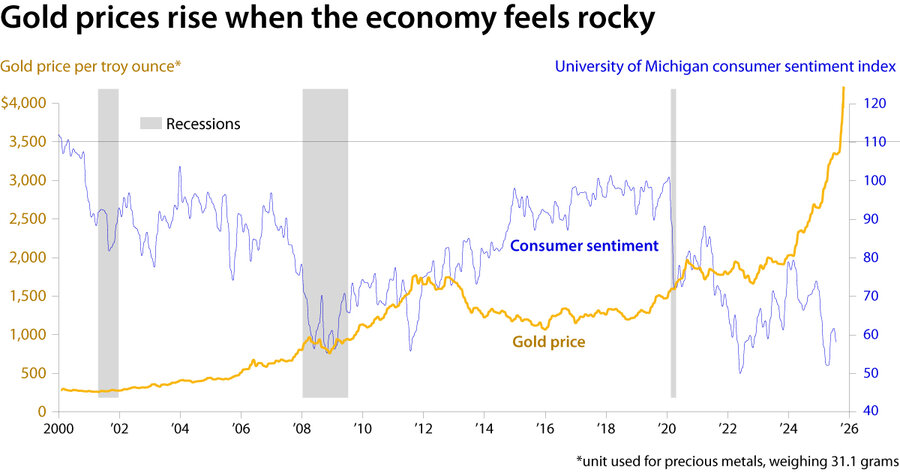

While stock markets are soaring as optimistic investors pour money into artificial intelligence companies, so is the price of gold.

It breached $4,000 an ounce for the first time in early October, and some analysts predict it could hit $5,000 next year, almost double the price since this past January.

That doesn’t seem like a good sign for the optimists. Gold, a safe-haven asset that holds its value, traditionally thrives when pessimism and uncertainty are on the rise. Given a slowing but still-growing economy, gold may be flashing a warning signal.

Why We Wrote This

Market changes and a shifting world order in the last 20 years have chipped away at the dollar’s credibility. That’s seen as one reason gold is gaining new ground. But a weaker dollar has other consequences as well.

What’s behind the recent price surge?

Several factors influence gold prices.

Many analysts point to rising doubts about the resilience of the U.S. economy, the dollar’s value when federal debt and deficits are so high, and the independence of America’s central bank. Add in the threat of rising tariffs, which raise inflation and reduce growth, and the intensifying trade war with China among other geopolitical risks, and the future looks iffy at best. When things look this uncertain, people and organizations tend to buy gold to protect themselves from a fall in financial markets, which hasn’t happened, and inflation, which is starting to tick up.

SOURCE:

Bloomberg, Datastream, ICE Benchmark Administration, World Gold Council, University of Michigan consumer sentiment index

|

Jacob Turcotte/Staff

But “nobody knows for sure” why gold prices are rising, Dirk Baur, a finance professor at the University of Western Australia Business School, writes in an email. “There is no data on why investors or central banks buy gold.”

Should Americans be worried about the economy?

Whenever a growing number of investors gets nervous about the economy, take note. But there are better recession predictors than rising gold prices, analysts say. The supply of gold is so limited – and mining adds so little every year – that small changes in demand can translate into big changes in prices, says Campbell Harvey, a finance professor at Duke University’s Fuqua business school. Investors wanting some insurance against a potential plunge in stocks or other assets might want to buy gold, he adds.

But stocking up on the yellow metal expecting prices to keep rising is riskier. Historically, in the decade after a big run-up in gold prices, returns on gold have been very low or even negative, Professor Harvey points out in a new paper.

Could gold prices keep rising in the short term?

Some analysts think so. Several analysts predict gold will rise to $5,000 an ounce by next year.

How about the long term?

It’s possible, not so much because investors and central banks love gold, but because they’re increasingly skeptical about the dollar’s role as a stable reserve currency.

Historically, traders and investors have used gold because it’s durable, easy to turn into coins or jewelry, and accepted by nearly everyone as a form of payment. Because so little gold can be produced each year, this precious metal has held its value over time.

Since World War II, the U.S. dollar has played much the same role. It has proved a stable currency (at least compared with other currencies) issued by a stable government with an independent Federal Reserve, and it is a highly liquid form of payment, readily acceptable to just about everyone. In crisis times, U.S. government bonds denominated in dollars were the safe haven that worried investors snapped up.

But structural changes in markets and various crises over the last 20 years have chipped away at the dollar’s credibility.

What changes suggest the price of gold might not go back down?

The structural change started in the mid-2000s, when financial firms began introducing gold exchange-traded funds. These ETFs made it as easy for people to buy gold as to buy mutual funds, and investors started to pile in.

The growth of those ETFs can explain most of the rise in gold prices from 2005, when the average price was about $445 an ounce, until about 2023, points out Professor Harvey. (Investing in ETFs was so easy that in the run-up to the world financial crisis of 2008-09, gold prices doubled to $1,000 an ounce.) Prices kept rising after the financial crisis, as central banks began to reduce their dollar holdings and buy gold instead, reversing decades of gold-selling.

In 2020, gold prices rose sharply again to $2,000, when the pandemic-driven shutdown of businesses briefly caused stocks to plunge. Then around 2023, flows of money into gold ETFs leveled off, but, strangely, gold prices kept rising.

The likely trigger, according to Dr. Harvey, was the West’s sanctions against Russia after it invaded Ukraine. When China saw how effectively the U.S. could punish Moscow by cutting off its access to the dollar-dominated financial system, it sped up its sales of dollars and boosted gold purchases.

Could these changes create a new normal of higher-priced gold?

Maybe not, Dr, Harvey says, because at the moment there’s no real alternative to the dollar as a reserve currency. (The market for dollars dwarfs the euro and other currencies. In the future, if they’ve established more of a reliable track record, cryptocurrencies like bitcoin might play that role.) That reserve status props up the dollar’s value.

But if governments allow other entities, such as commercial banks and insurance companies, to hold gold as emergency reserves, then that extra demand could prove even more game-changing than the introduction of gold ETFs. Already, earlier this year, China allowed its insurance companies to hold 1% of their reserves in gold.

“There’s a lot of upside here,” Professor Harvey says. But “I want to make it clear that there’s many things that could lead to a lower price, also.”