For the first time in more than three decades, San Antonio city leaders are considering raising the property tax rate for the 2026 fiscal year.

For the average home within city limits, valued at $235,000 with a homestead exemption, the change would cost the homeowner an extra $57 to $67 on their next property tax bill.

“The city has not raised the tax rate since I was in college, so it’s been some time,” City Manager Erik Walsh told the City Council at a budget goal-setting session on Friday. “I suspect it won’t be a positive reaction.”

City Council will approve a tax rate and budget in September, and have already been looking at spending cuts to stave off a potentially ballooning deficit.

Walsh alerted council members in May that low consumer confidence was negatively impacting many facets of city revenue, including hotel occupancy tax, the airport development services and residential and commercial building permits.

But property taxes, which account for more than a quarter of the city’s general fund, have been a relatively predictable revenue source in recent years.

Texas law caps the amount of property tax revenue cities can collect at 3.5% overall growth from the previous year, not including new construction, and San Antonio easily hit that amount as property values grew by 22% in 2022, 15% in 2023 and 2.4% in 2024.

“We’ve had the luxury of having an upward market for several years now, so taxing units could keep tax rates the same and still get more revenue from an increased market values,” said Bexar County’s Chief Appraiser Rogelio Sandoval.

This year, however, higher interest rates and general consumer uncertainty have contributed to a cooling housing market, and property values have stagnated to the point that San Antonio won’t meet the state’s 3.5% growth cap without a rate increase.

Sandoval estimated residential properties in San Antonio had only risen in value by about 1.5% this year — a number that will decrease even further as homeowners appeal their valuations.

“The bottom line is, we’re experiencing a flat market, and that has really put a lot of pressure on taxing jurisdictions,” Sandoval said. ” … When you’re seeing a stagnant market like we have seen lately, they’re put in a position where if they’re going to try to generate more revenue, they would have to consider raising that tax rate.”

Homestead exemption here to stay

Texas’ revenue cap meant that as property values soared in recent years, cities needed to reduce their tax rates to comply, or find other ways to shed revenue through other targeted exemptions.

From the taxpayer’s perspective, property tax bills were still rising with their valuations. But the city got to take a victory lap on lowering its rate multiple times in recent years, and offering targeted property tax relief to certain groups, such as seniors, disabled veterans and people claiming a homestead exemption on their primary residence.

San Antonio, which already had a property tax freeze in place for seniors, created its first homestead exemption in 2022, allowing homeowners to reduce the taxable value of their primary residence — and later increased it to the maximum 20%.

Despite the change in financial situation, Walsh told reporters earlier this year that San Antonio’s increased homestead exemption had been a valuable tool to keep families in their homes, and there were no plans to reverse that part of the city’s revenue-shedding measures.

“I think it was impossible not to do the homestead exemptions,” he said. “It would not have made sense to us, structurally, just to change the rate.”

San Antonio’s tax rate, however, is likely to come back up after decreasing in 2023 and 2024 and staying even in 2025.

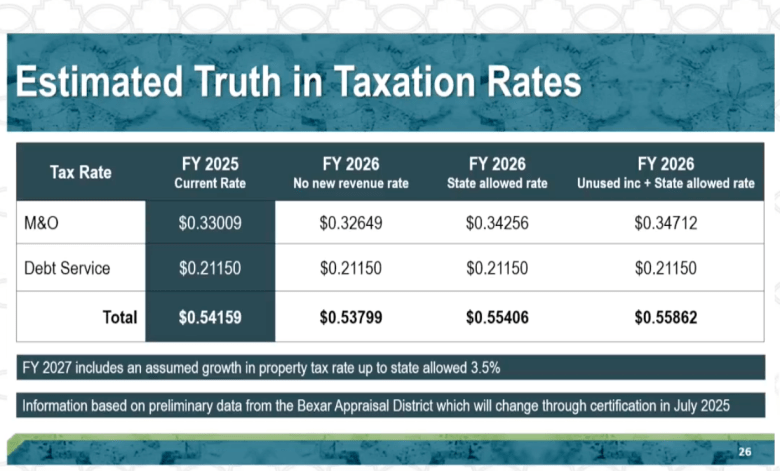

To get the 3.5% growth rate, the city projects it would need to raise it from the current 54.159 cents per $100 of valuation to 55.406 cents.

It could legally raise it even higher, to 55.862 cents per $100 of valuation, by rolling over some of the increase it didn’t use in previous years — known as the unused increment.

Those estimates are subject to change based on appeals to residents’ property valuations, which will continue to lower the city’s taxable values throughout the summer.

“There’s a lot of work going on with the Appraisal District right now,” Walsh told the council on Friday. “But as it stands, we’re are anticipating negative growth in our base taxable values, which hasn’t occurred since the aftermath of the 2009 recession.”

CPS Energy revenue

According to the city’s latest projections, slight improvements in sales tax revenue and CPS Energy revenue had helped ease the urgent need for cuts in this fall’s budget.

But without big forecasting changes, the city estimates that it could have a more than $150 million deficit by fiscal year 2027.

To address that issue, city leaders said Friday that they wanted to press pause on a recent plan to reinvest CPS Energy revenue into capitol projects at the city-owned utility — instead reserving that money for the city’s own operating expenses.

CPS Energy’s ability to sell energy onto the Texas grid has been one bright spot in the city’s revenue model, and last year city leaders crafted an agreement to use some of that money to help the utility company stave off future rate increases.

In its first year the city returned about $26 million to the utility company under that policy, but in a dramatic about-face, the city’s Chief Financial Officer Ben Gorzell said Friday that it should hold off on such reinvestments for the next two years.

Doing so could provide roughly $60 million to help the city fill gaps in its budget, according to city projections.

“We always want to look at our own financial position, impact to services, [and the] impact to the community,” Gorzell said. “Given that policy and the way we structured it, we are recommending … to reserve this $59.3 million to help us address the gap — the significant gap — that we have in FY 2027.”