Market Size & Trends

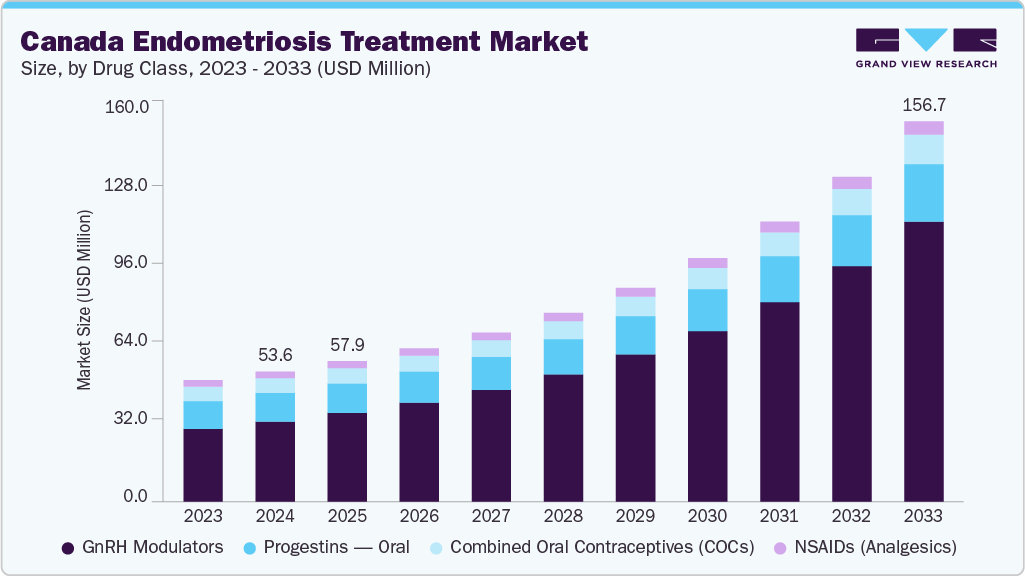

The Canada endometriosis treatment market size was estimated at USD 53.58 million in 2024 and is projected to reach USD 156.71 million by 2033, growing at a CAGR of 13.26% from 2025 to 2033. The growth is driven by increasing awareness, advancements in treatment options, improved healthcare access, and rising demand for effective endometriosis management solutions, contributing to significant growth across all segments.

Endometriosis affects approximately 10% of Canadian women of reproductive age, equating to hundreds of thousands of individuals experiencing chronic pelvic pain, painful menstruation, and fertility challenges. This significant prevalence has created a substantial demand for effective treatment options across Canada, including hormonal therapies, non-hormonal pain management, and surgical interventions. Growing awareness among Canadian healthcare providers and patients has led to earlier diagnosis and treatment, expanding the utilization of existing therapies while encouraging the adoption of innovative treatments within the Canadian market.

The chronic and recurring nature of endometriosis in Canada drives ongoing treatment requirements. Women often need long-term management through GnRH agonists/antagonists, oral contraceptives, and minimally invasive surgical procedures. Canadian healthcare systems are responding by increasing access to specialized care and approved therapies. Rising patient consultations and prescription rates contribute to steady market growth, particularly for pharmaceutical companies offering solutions in women’s health. The continued demand for effective symptom relief and fertility preservation directly strengthens the Canada endometriosis treatment industry.

High prevalence also attracts pharmaceutical investment and innovation in Canada. With a significant patient population, the country represents an important market for emerging therapies such as oral GnRH antagonists, selective progesterone receptor modulators, and combination hormone treatments. Clinical trials conducted in Canadian healthcare settings generate robust local data, supporting the adoption of new therapies. Pharmaceutical companies actively pursue regulatory approval and commercialization in Canada, directly linking the prevalence of endometriosis to research, development, and market expansion of advanced treatment options.

Awareness about endometriosis has significantly increased across Canada due to the proactive efforts of patient advocacy groups and healthcare organizations. Groups such as Endometriosis Network Canada organize workshops, seminars, and educational programs to inform women about symptoms, complications, and available treatment options. These initiatives provide patients with resources to understand their condition, recognize early signs, and seek timely medical care. By addressing common misconceptions and reducing social stigma around menstrual and reproductive health, these programs empower women to discuss their symptoms openly with healthcare providers, leading to earlier diagnosis and improved management of the disease.

Market Concentration & Characteristics

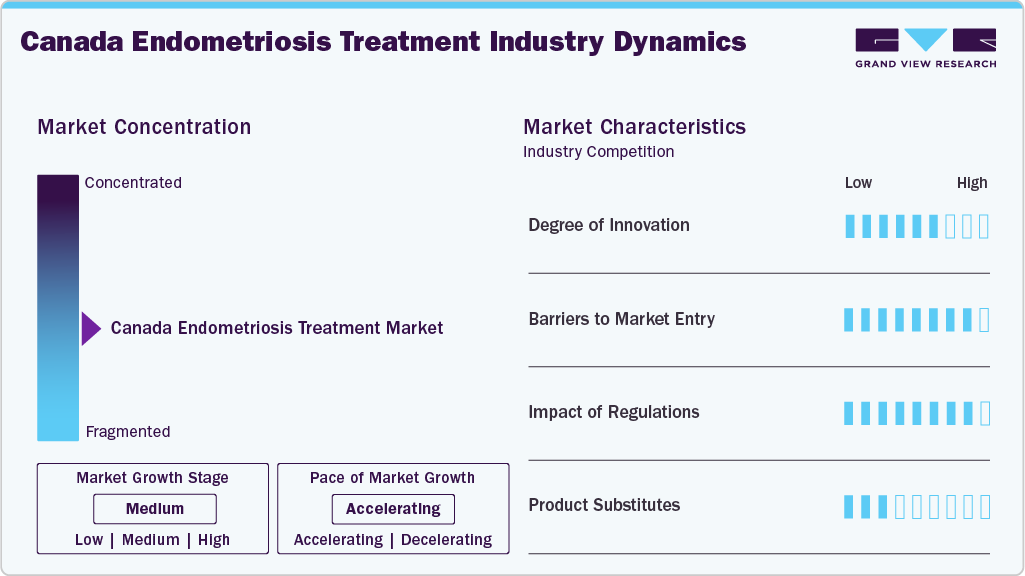

The Canada endometriosis treatment market reflects steady innovation through the development of hormone-based therapies, minimally invasive surgical procedures, and targeted biologic treatments. Companies are investing in research focused on improving treatment efficacy and patient adherence. Advancements in diagnostic tools and personalized medicine are influencing product development. Strategic collaborations between research institutions and pharmaceutical manufacturers support innovation across clinical and commercial applications.

Entry barriers remain high due to significant R&D expenditure, multi-phase clinical trials, and complex approval pathways regulated by Health Canada. Established products and brand familiarity create competitive resistance for new entrants. Intellectual property protections and patent exclusivity limit generic participation. The market’s dependence on specialized gynecological expertise and healthcare infrastructure further restricts entry.

Regulatory policies under Health Canada govern product approvals, safety monitoring, and clinical evaluation. Compliance with drug labeling, manufacturing, and pharmacovigilance standards is mandatory. Regulations related to reproductive health and hormone-based treatments influence the speed of market authorization. Companies are required to align with evolving regulatory guidance to maintain market access and ensure patient safety.

Non-pharmacological options, such as physical therapy, dietary management, and surgical interventions, serve as substitutes for pharmacological treatments. Within drug-based therapy, different classes-such as GnRH agonists, progestins, and oral contraceptives-compete based on clinical outcomes and cost. Availability of generics and self-management approaches influences overall drug utilization patterns.

Drug Class Insights

The GnRH modulators segment led the Canada endometriosis treatment industry with the largest revenue share of 61.48% in 2024, due to their effectiveness in reducing estrogen levels and managing endometriosis symptoms, making them the preferred treatment choice for many patients. Their established efficacy and usage in long-term management contribute to their dominance in the market, supported by strong clinical adoption, favorable physician preference, and ongoing development of next-generation oral formulations enhancing patient convenience, treatment adherence, and overall therapeutic outcomes across care settings.

The oral progestins segment is projected to grow at a moderate CAGR over the forecast period. Oral progestins have emerged as a key treatment in Canada for managing endometriosis-related symptoms, including chronic pelvic pain and heavy menstrual bleeding. These medications suppress ovulation, reduce estrogen levels, and limit the growth of endometrial tissue outside the uterus, helping minimize pain recurrence and improve quality of life. For instance, in January 2024, StatPearls Publishing released an overview on progestins in the NCBI Bookshelf, explaining their use in contraception, hormone replacement therapy, and endometriosis management. The review reported a 7% failure rate for COCs and over 7% for progestin-only pills, highlighting efficacy differences across formulations.

Treatment Type Insights

The hormonal suppression therapy segment led the Canada endometriosis treatment industry with the largest revenue share of 94.93% in 2024, due to its central role in managing endometriosis by regulating hormonal imbalances, which helps reduce symptoms and prevent disease progression. The widespread use of hormonal therapies as a first-line treatment drives its dominant market share, supported by consistent clinical recommendations, accessibility through prescription channels, strong physician confidence, and expanding availability of advanced formulations improving patient compliance and therapeutic effectiveness.

The pain management segment is projected to grow at a moderate CAGR over the forecast period. Pain management plays a central role in treating endometriosis in Canada, a chronic condition where endometrial-like tissue grows outside the uterus, causing severe pain and discomfort. For many patients, alleviating pain remains the primary goal, especially when surgical or hormonal treatments are unsuitable or used as adjunct therapy. Effective pain control helps improve quality of life, enabling individuals to maintain daily routines and overall well-being. Canadian healthcare providers emphasize individualized treatment plans that consider severity, patient preference, and comorbidities, highlighting the importance of accessible and effective analgesic options across the country.

Route of Administration Insights

The oral segment dominated the Canada endometriosis treatment market with the largest revenue share of 55.49% in 2024, due to its convenience, ease of use, and patient preference. Oral therapies, including NSAIDs, hormonal contraceptives, progestins, GnRH antagonists (such as Elagolix/Orilissa and Relugolix combo/Myfembree), and aromatase inhibitors, offer patients the ability to manage symptoms at home without frequent hospital visits. The non-invasive nature of oral medications enhances adherence and allows for flexible dosing, which is particularly important for chronic conditions like endometriosis, where long-term management is required. This convenience has made oral treatments increasingly preferred by both patients and healthcare providers.

The injectable route of administration is witnessing steady growth, primarily driven by the effectiveness and sustained action of injectable therapies. Injectable medications, including GnRH agonists like Leuprolide (Lupron Depot), Goserelin (Zoladex), and Triptorelin (Trelstar), provide long-acting symptom control by suppressing ovarian estrogen production. This suppression reduces the growth of endometriotic lesions and alleviates chronic pelvic pain, dysmenorrhea, and associated inflammation. The long-acting nature of injectables minimizes dosing frequency, enhancing adherence and ensuring consistent therapeutic effects, which is particularly important for managing moderate to severe endometriosis in Canadian patients.

Distribution Channel Insights

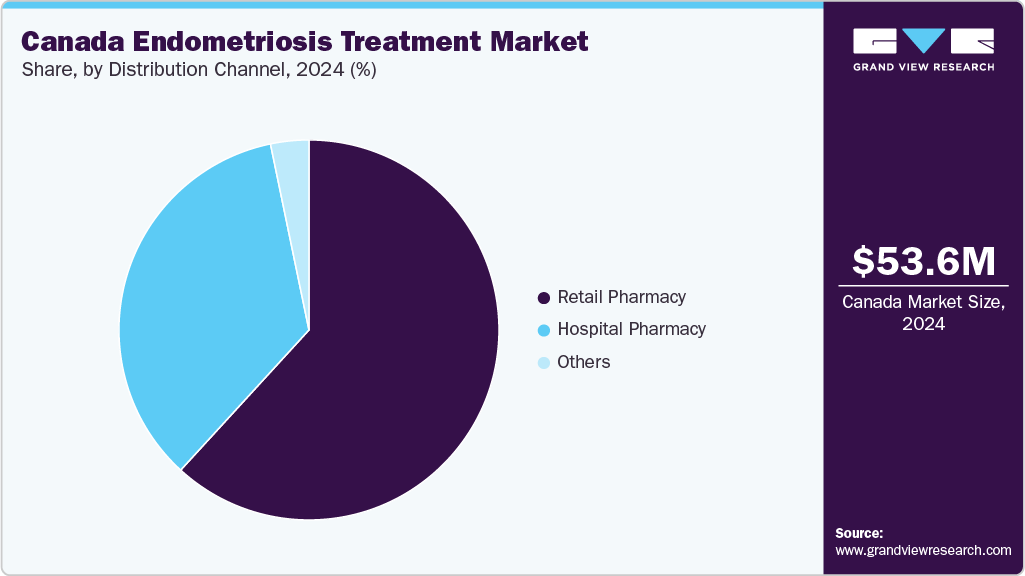

The retail pharmacy segment held the largest market share of 61.80% in 2024, due to increased accessibility, convenience for patients, and the availability of a wide range of endometriosis treatments. Retail pharmacies offer easy access to medications, allowing patients to manage their treatment without hospital visits. This segment’s growth is further supported by extended pharmacy networks across urban and semi-urban areas, integration with digital prescription services, enhanced patient counseling, availability of both branded and generic options, and partnerships with healthcare providers to ensure continuous medication supply and adherence to prescribed therapy.

The others segment of the Canada’s endometriosis treatment market, which includes online pharmacies, pharmaceutical manufacturers, Group Purchasing Organizations (GPOs), and research institutions/clinical trials, is witnessing steady growth due to increasing demand for convenient and innovative medication access. Online pharmacies provide patients with the ability to order medications such as oral GnRH antagonists (Elagolix/Orilissa, Relugolix combo/Myfembree), NSAIDs, and hormonal therapies from home, offering faster delivery and enhanced privacy. This convenience appeals to patients seeking discreet, accessible, and efficient ways to manage chronic endometriosis symptoms, particularly in regions with limited local pharmacy access.

State Insights

Ontario Endometriosis Treatment Market Trends

Ontario dominated the Canada endometriosis treatment industry with a share of 38.12% in 2024, due to its well-developed healthcare infrastructure, higher population density, and greater awareness of women’s health issues. The region also benefits from access to advanced treatment options and specialized healthcare providers, driving its marketdominance.

Quebec Endometriosis Treatment Market Trends

Quebec represents a significant share of the Canadian endometriosis treatment market due to high healthcare accessibility and established gynecological services. Provincial health policies support early diagnosis and reimbursement of hormonal and surgical therapies. Urban centers like Montreal provide specialized care facilities, increasing patient access to pharmacological and non-pharmacological treatments. Clinical awareness programs, partnerships with healthcare providers, and the adoption of new therapies, including GnRH modulators and hormonal suppression options, support market growth. Investments in research and regional initiatives further influence treatment adoption and revenue generation.

British Columbia Endometriosis Treatment Market Trends

British Columbia contributes to market growth through a well-developed healthcare infrastructure and increasing diagnosis rates. Key urban centers, including Vancouver, host specialized clinics and healthcare programs focusing on women’s health. The provincial insurance system ensures coverage for approved endometriosis treatments, supporting the adoption of hormonal therapies, GnRH modulators, and surgical interventions. Expansion of awareness campaigns, improved access to gynecologists, and patient education programs drive utilization of prescription medications. Local distribution networks and collaborations with national pharmaceutical companies enhance the availability of treatment options, influencing overall market revenue and regional growth.

Alberta Endometriosis Treatment Market Trends

Alberta’s endometriosis treatment market is influenced by rising patient awareness and access to specialized gynecological care. Major cities like Calgary and Edmonton host clinics that provide pharmacological and minimally invasive surgical options. Provincial reimbursement policies for approved therapies support market adoption, while healthcare campaigns promote early diagnosis. Pharmaceutical companies leverage local networks for the distribution of hormonal suppression therapies, GnRH modulators, and non-hormonal treatments. Investment in research collaborations and regional clinical trials contributes to innovation and adoption of advanced treatment modalities, strengthening Alberta’s share of the Canadian market.

Key Canada Endometriosis Treatment Company Insights

Key players in the Canada endometriosis treatment market include AbbVie Inc., Bayer AG, TerSera Therapeutics, Sumitomo Pharma/Myovant, Pfizer Inc., Knight Therapeutics, Searchlight Pharma, Apotex Inc., Teva Canada Limited, and Sandoz Group AG. AbbVie and Sumitomo Pharma/Myovant lead the market with GnRH modulators and targeted hormonal therapies. Bayer and Pfizer contribute through hormonal and non-hormonal treatment options. TerSera and Searchlight Pharma focus on newer formulations and niche therapies, while Knight Therapeutics, Apotex, Teva Canada, and Sandoz primarily support the market with generic and widely accessible treatments. Strategic partnerships, clinical development, and national distribution networks strengthen their market presence and influence adoption across Canada.

Key Canada Endometriosis Treatment Companies:

- AbbVie Inc.

- Bayer AG

- TerSera Therapeutics

- Sumitomo Pharma / Myovant

- Pfizer Inc.

- Knight Therapeutics

- Searchlight Pharma

- Apotex Inc.

- Teva Canada Limited

- Sandoz Group AG

Recent Developments

-

In June 2025, Knight Therapeutics Inc. and Sumitomo Pharma America Inc. announced exclusive licensing agreements for MYFEMBREE, ORGOVYX, and vibegron in Canada. Knight acquired commercialization rights for USD 18.2 million, with potential milestone payments up to USD 11.3 million. The portfolio generated USD 8.0 million in revenue for the year ending March 2025, with MYFEMBREE sales of USD 2.1 million in 2024.

-

In July 2025, Bayer announced that Health Canada granted marketing authorization for Lynkuet (elinzanetant) to treat moderate to severe vasomotor symptoms. Phase III OASIS trials showed significant reductions in symptom frequency and severity at weeks 4 and 12. In Canada, over 10 million women experience menopause-related symptoms, with 95% reporting hot flashes, 25% facing daily disruptions, and 10% leaving the workforce.

-

In May 2024, TerSera Canada Inc. announced that Health Canada approved ZOLADEX LA (goserelin acetate) 10.8 mg every 12 weeks for managing estrogen receptor-positive breast cancer in pre- and perimenopausal women. Approximately 5,000 young Canadian women are diagnosed annually, with breast cancer being the leading cause of death among women aged 30-49. ZOLADEX LA is approved in over 60 countries.

Canada Endometriosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 57.87 million

Revenue forecast in 2033

USD 156.71 million

Growth rate

CAGR of 13.26% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, treatment type, route of administration, distribution channel, state

State scope

Ontario; Quebec; British Columbia; Alberta; Rest of Canada

Key company profiled

AbbVie Inc.; Bayer AG; TerSera Therapeutics; Sumitomo Pharma / Myovant; Pfizer Inc.; Knight Therapeutics; Searchlight Pharma; Apotex Inc.; Teva Canada Limited; Sandoz Group AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Endometriosis Treatment Market Report Segmentation

This report forecasts revenue growth at the state level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Canada endometriosis treatment market report based on drug class, treatment type, route of administration, distribution channel, and state:

-

Drug Class Outlook (Revenue, USD Million, 2021 – 2033)

-

Treatment Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Route of Administration Outlook (Revenue, USD Million, 2021 – 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

-

Retail Pharmacy

-

Hospital Pharmacy

-

Others

-

-

State Outlook (Revenue, USD Million, 2021 – 2033)

-

Canada

-

Ontario

-

Quebec

-

British Columbia

-

Alberta

-

Rest of Canada

-

-