A new study by a Tempe real estate data service challenges the common belief that big investment companies dominate the single-family housing market and are competing with average homebuyers.

“Wall Street isn’t the dominant force” and 90% of investors are landlords who own no more than 11 properties, according to the study by BatchData, which said investors are now a stabilizing force in the market.

BatchData is one of five data-related services started in 2018 by a trio of real estate investors who saw a need for more comprehensive information and tools related to the real estate market. Today it boasts of being “the cutting edge of real estate data and technology innovation.”

Its quarterly “Investor Pulse” report examines trends in the single-family home market during the second quarter of this year and found that investors accounted for a third of all home purchases in that period – “the highest in at least five years” – and that investors “own one in five U.S. houses.”

“Landlords with 1–50 properties hold 95% of the inventory, confirming that the market is dominated by entrepreneurs rather than Wall Street institutions,” BatchData reported.

Breaking that down further, it said 87% of investors own only one to five homes while less than 4% own anywhere between 101 and over 1,000 houses.

Calling that “far more than a cyclical shift,” it said, “investors have become essential market stabilizers rather than speculative disruptors.”

That’s because traditional buyers have been “sidelined by financing constraints that doubled monthly payments compared to recent norms,” according to the report.

BatchData identified several trends that have given investors a significant role in the real estate market:

• “Mortgage rate shock: 6.7% average rates effectively priced out over 50% of traditional middle-income households while leaving cash-rich investors unaffected.”

• “First-time buyer collapse: Participation dropped to just 24% – an eight percentage point decline from 2023, marking the most dramatic buyer retreat in recent history.”

• “Affordability crisis deepens: Six-figure incomes are now required in over half of U.S. markets, with nearly 60% of households unable to afford a $300,000 home.”

• “Large investors pulled back for the sixth consecutive quarter, demonstrating sophisticated risk management rather than market abandonment.”

BatchData called the investor market share “extraordinary” and suggested the second quarter data may point to “a fundamental shift in housing market dynamics.”

“Mortgage rates averaging 6.7% represent a doubling from the 3.3% historical norm that defined homebuying in the post-COVID years, creating an immediate $800-1,000 monthly payment premium that has systematically excluded traditional buyers,” BatchData said.

“Whether or not this higher share of investor purchases continues depends largely on the dynamics of the market: home price appreciation, mortgage rates, and wage growth.”

The study says a household income of more than $100,000 is needed to buy a median-priced home in 54% of all markets in the nation.

“First-time buyer participation collapsed to 24% in Q2 – the lowest level since tracking began – as the combination of elevated rates and limited inventory created insurmountable barriers,” BatchData said.

“The typical first-time buyer now faces monthly payments of $2,400-$2,800 for starter homes that cost $1,600-$1,900 monthly just two years ago.”

It said 60% of investors paid in cash, providing “essential transaction volume when financial constraints paralyze traditional buyers.

“Without this investor participation, many markets would face severe illiquidity and potentially destabilizing.”

It pegged the average price a small investor pays for a home is $455,481 – compared to the national average purchase price for a private buy of $512,600. Large investors pay an average $279,899 for a house.

While that large-investor price is low, BatchData also said large investors typically “target properties requiring significant capital investment, often transforming distressed assets into quality rental housing. This creates genuine economic value while addressing housing quality issues that constrain supply in many markets.”

But small investors have major advantages over big investment groups, BatchData said, explaining:

“Their ability to quickly identify and execute value-add strategies—from cosmetic improvements to strategic repositioning—creates genuine economic value rather than merely extracting existing wealth.”

Hannah Jones, senior economic research analyst at Realtor.com, said, “Traditional homebuyers are looking for the right house in the right place at the right price.

“Investors have more flexibility,” Jones said. “They are not constrained by their household’s needs, but are rather looking for a good investment opportunity, which could come in various forms.

“Investors often have more access to capital as well, which allows them to navigate today’s high-priced market more effectively.”

The report states that 17 million of the nation’s 86 million single-family homes and townhouses are owned by investors and that “these homes primarily serve as rentals or short-term rentals, providing essential housing supply in markets where new construction cannot meet demand.”

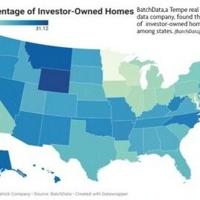

It places Arizona midway among states with the highest and lowest percentages of investor-owned homes.

It also found the highest ratio of investor-owned homes – roughly a third – can be founded in Maine, Montana, Alaska and Hawaii because their standing as tourist destinations make short-term rentals a good investment.

On the other hand, Minnesota, Colorado and Connecticut have the lowest ratio of investor-own homes – roughly 10% – partly because unlike Arizona, communities can impose strict regulations on the short-term rental industry.

BatchData also suggests another reason why individual investors own 41% of rental homes – and no more than three.

“These small investors deploy local market knowledge, operational efficiency advantages, and personal capital that large institutions cannot match, often achieving superior returns through hands-on management and strategic market timing.” It said.