EPIC CEO Brandon Hall [Composite photo; Source: Epic/DI Studio]

Dallas-based auto industry financial technology company EPIC has raised $10 million in Series A funding in a round led by FM Capital, with participation from Automotive Ventures and other strategic industry investors.

EPIC, which calls itself “the loan payoff clearinghouse for the automotive ecosystem,” said the funding will support continued market expansion and platform innovation.

“This funding lets us reach more partners and further improve how dealers, lenders, and insurers manage loan payoffs and title releases,” EPIC Brandon Hall said in a statement. “Faster, more efficient processing helps our partners save time, reduce errors, and boost profit opportunities.”

Legacy processes for loan payoffs and title releases create friction, delay, and financial risk for the automotive industry. EPIC says it replaces that with a modern financial infrastructure—a secure, digital clearinghouse that streamlines every step, from payoff quote to title release.

“EPIC is eliminating one of the industry’s most stubborn bottlenecks,” Chase Fraser, managing partner at FM Capital, said in a statement. “Its digital network for loan payoff and title release replaces outdated manual processes with the speed and precision today’s automotive ecosystem demands.”

Steve Greenfield, general partner of Automotive Ventures, said the platform helps solves issues that cost time and money.

“Our investment in EPIC reflects a shared vision to digitize a key segment of the automotive transaction process that has been unsolved,” Greenfield said. “The EPIC platform reduces errors, saves time, and moves the industry toward a unified, digital workflow, saving dealerships thousands every month in holding and processing costs.”

EPIC partners with automotive dealers, vehicle lenders, and automobile insurers across the nation to help them drive efficiency and improve overall profitability.

EPIC said it plans to expand its reach to additional markets, including powersports and RV markets, in its next growth phase.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

R E A D N E X T

-

The innovative material, called Hostaform POM XAP3, is designed to significantly reduce vehicle cabin emissions in new cars and is being commercialized in cabin components of Li Auto’s upcoming vehicle models in China.

-

Palo Alto, California-based Fiddler AI said its $18.6 million Series B extension brings the round’s total funding to $50 million. The company said the funds will help it “continue to build momentum in AI observability and AI safety.”

-

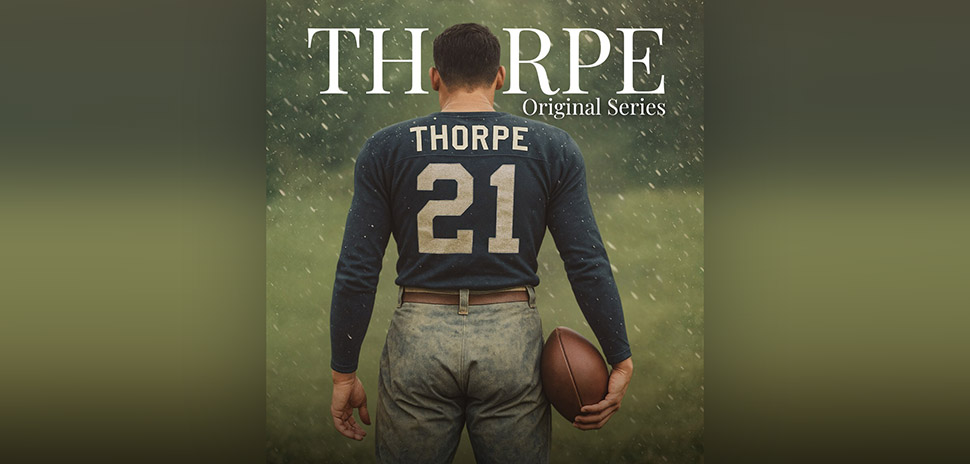

Verily Storyworks has deployed a crowdfunding model to develop “THORPE,” a planned 3-season scripted drama series about the life of legendary Native American athlete Jim Thorpe. The studio and IP company’s founder is working with Thorpe family members on the project—and is inviting the public to become “capital ambassadors” for the series.

-

![FieldPulse founder and CEO Gabe Pinchev (center) celebrates with his Dallas team after announcing the company’s $50 million Series C funding round, led by Fulcrum Equity Partners with Catalyst Investors joining as a new backer. [Photo: FieldPulse]](https://www.europesays.com/us/wp-content/uploads/2025/08/FieldPulse-Series-C.jpg)

Founded in 2015, the company reports fourfold growth in 21 months while rolling out new AI-powered management tools for trade businesses. Fulcrum Equity Partners returns to lead the round, joined by new backer Catalyst Investors.

-

Mortgage services software provider Sagent said its new 10,000 square-foot Dallas facility opened its doors Monday. It will serve as a key hub for associates in the area as the company works to expand adoption of its “revolutionary” Dara platform.