CEO Jeff Hirsch said Starz sees a place for itself in the current M&A landscape by picking off linear networks that aren’t valuable to giant owners but could be repositioned to add value to the newly independent company.

He didn’t name names but the company had been, maybe still is, looking at A+E Global Media, parent of A&E, History and Lifetime, as the Disney-Hearst JV explored a potential sale.

Hirsch has hinted possible deals before but expanded on a call after quarterly earnings today that Starz wants to diversify from pure SVOD (streaming) to AVOD (streaming with ads) but can’t “because of the nature of the adult nature of our content and the amount of content we have” relative to the giant players. “The one way we can do that is [with] marooned linear networks — where consumers have moved to the digital side, but the brands are stuck on the linear side. We can use our tech platform to reposition those brands into the digital world.”

He means brands that are complementary to Starz content. “I do think as these large companies continue to consolidate, pieces of those businesses that become less important to them … some of the networks that may strategically fit with Starz may become available. And I think we are uniquely positioned because of what we’ve done in terms of transitioning from 100% linear to 70% digital, doing that profitably, owning our own tech stack, having our own customer acquisition team, having our own data stack. We [can] give that expertise to those networks and put the businesses together,” Hirsch said.

The company saw revenue dip and net losses widen last quarter as it continued to add streaming customers but shed linear subscribers. Revenue for the three months through September of $320.9 million was in line with Wall Street forecasts but down from $346.9 million the year before.

Net losses grew to $52.6 million from $30.6 million. Adjusted ebitda (earnings before interest, taxes, depreciation and amortization and a metric analysts favor) of $21 million was lower than forecasts but the company reaffirmed its guidance of $200 million for the year.

Hirsch focused on a string of new shows and on on enhanced ownership of shows since splitting in May with former parent Lionsgate Studios.

Starz is working towards a steady pipeline of shows to string them together and longer seasons of 18-22 episodes to keep viewers engaged and reduce churn.

The company ended the quarter with 12.3 million U.S. OTT subscribers, representing a sequential increase of 110,000. Total U.S. subs were 17.5 million, down by 130,000 from the prior quarter – in line with forecasts.

Including Canada, total North American subscribers stood at 19.2 million, a sequential increase of 120,000. Canadian subscribers increased by 250,000 due to the resolution of a carriage dispute in Canada

Hirsch said on the call that Starz has been aggressively working toward delivering our previously stated goal of owning half of its slate. It opened several writers’ rooms just weeks after the separation from Lionsgate. A couple of weeks after that, it greenlit its first Starz-owned original Fightland from Curtis “50 Cent” Jackson. The series is currently in production in London and “we are thrilled with how the show is coming along,” he said, and plan to have it ready to premiere next year.

Starz in the late stages of bringing on a co-commission partner on Fightland which will improve the economics of the series. He didn’t name the partner but said the agreement has the potential to expand to additional Starz-owned originals.

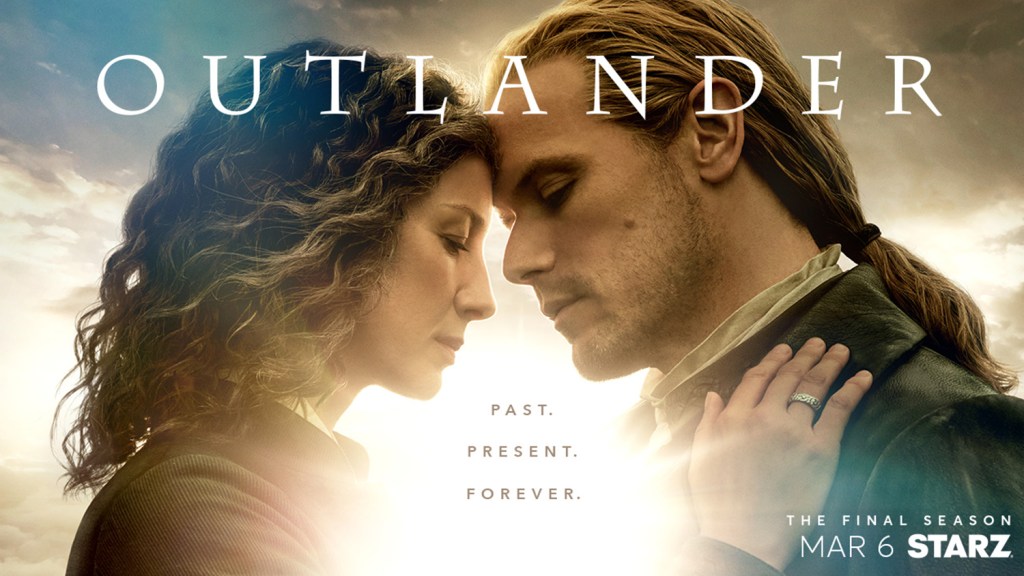

The company recently set a March, 2026 premiere date for the finale season of long-running hit Outlander.

On the call, Hirsh unveiled a structural change to the company’s Canadian operation, moving from a joint venture model “to a stable, consistent content licensing agreement” with partner Bell Canada. Under this new simplified structure, he said, the Starz-branded service will continue to be available in Canada and Starz will generate international licensing revenue, while Bell will assume full operational responsibility in the territory. He said the approach is consistent with a strategy “of owning our content and creating incremental licensing revenue without the need to operate international services directly.”