In late 2017, a new kind of token quietly entered the crypto market. Few could have predicted that Binance Coin (BNB), initially launched as a utility token for discounted trading fees, would go on to become a central pillar in one of the largest ecosystems in blockchain. Fast forward to 2025, and BNB isn’t just a token—it’s a multifaceted asset that drives entire infrastructures from exchanges to smart contracts and decentralized applications.

Understanding BNB today means going far beyond price. In this article, we unpack current market data, historical trends, and evolving use cases, equipping you with a complete view of BNB’s trajectory in 2025 and beyond.

Editor’s Choice

- BNB’s market cap reached $53.6 billion in Q1 2025, making it the fourth-largest cryptocurrency by market capitalization.

- The BNB token price rose to $352.17 as of April 2025, reflecting a 24% increase year-over-year.

- Binance handled over $12.8 billion in daily BNB trading volume across its exchange platforms in March 2025.

- More than 1.2 million active wallets currently hold BNB, showing a 19.4% growth in the user base since 2024.

- BNB fuels over 75% of smart contract activity within the Binance Smart Chain.

- In Q1 2025 alone, over 2.3 million BNB tokens were permanently removed from circulation via the burn mechanism.

- The BNB/USDT pair continues to dominate, accounting for 40.2% of the total BNB trade volume across centralized exchanges.

Binance Coin (BNB) Price Prediction: 2025 to 2031

- The forecast suggests a consistent upward trend in Binance Coin’s price from 2025 through 2031.

- In 2025, BNB is expected to range between $750 (Minimum) and $1,100 (Maximum), with an average price of $950.

- By 2026, the projected price grows to a minimum of $1,400, an average of $1,650, and a maximum of $1,900.

- In 2027, BNB may trade between $2,100 and $2,600, with an average price of $2,350.

- The 2028 outlook sees a rise to $2,700 (Min), $2,950 (Avg), and $3,200 (Max).

- For 2029, the price prediction hits a minimum of $3,400, an average of $3,600, and a maximum of $3,850.

- Entering 2030, the coin could reach between $4,200 and $4,600, averaging at $4,400.

- By 2031, BNB is forecasted to climb to $4,950 (Minimum), $5,100 (Average), and $5,400 (Maximum) — nearly 5x growth from 2025’s minimum estimate.

(Reference: CoinStats)Current BNB Market Capitalization and Price Trends

(Reference: CoinStats)Current BNB Market Capitalization and Price Trends

- As of April 2025, BNB’s total market capitalization stands at approximately $53.6 billion, up from $43.2 billion in April 2024.

- The BNB price peaked at $381.45 in February 2025 before stabilizing at around $350 in April.

- Binance Coin remains within the top 5 cryptocurrencies by market cap, behind Bitcoin, Ethereum, Tether, and USD Coin.

- The market dominance of BNB has hovered near 3.4% in Q1 2025, slightly higher than its 3.1% mark last year.

- BNB’s 90-day volatility has decreased by 12.7%, indicating growing maturity in its investor base.

- Institutional holdings of BNB rose by 21% YoY, totaling over $4.6 billion held across crypto hedge funds and custodians.

- In January 2025, Binance Coin recorded a 30-day average trading volume of $10.1 billion, placing it behind only BTC and ETH.

- BNB’s market cap surpassed that of Ripple (XRP) and Solana (SOL) by over $12 billion as of March 2025.

- The token’s relative strength index (RSI) remained between 45 and 60, suggesting a neutral-to-bullish sentiment.

- BNB’s fully diluted valuation reached $70.4 billion, assuming the total max supply is in circulation.

BNB Price & Volume Changes

- From January to April 2025, the BNB price rose from $287.90 to $352.17, a 22.3% increase in just four months.

- Daily trading volume for BNB averaged $10.8 billion in Q1 2025, up from $8.2 billion during the same period in 2024.

- The highest daily volume in Q1 2025 was recorded on February 10, reaching $14.7 billion.

- The BNB/BTC trading pair gained traction, contributing 6.9% of the total BNB exchange activity in March 2025.

- Binance Smart Chain recorded 7.4 million BNB transfers in Q1, representing a 16.5% increase YoY.

- Monthly volatility has dropped from 6.3% in Q1 2024 to 5.1% in Q1 2025, indicating more stable investor behavior.

- BNB is now traded on more than 500 exchange pairs, with BNB/ETH, BNB/USDT, and BNB/FDUSD among the top five.

- In decentralized exchanges (DEXs), BNB trading volumes hit a record $1.9 billion in March 2025.

- PancakeSwap remains the largest DEX for BNB, accounting for 62% of all BNB swaps in Q1 2025.

- BNB’s average daily price change was +2.3%, placing it among the top 10 most actively traded altcoins this year.

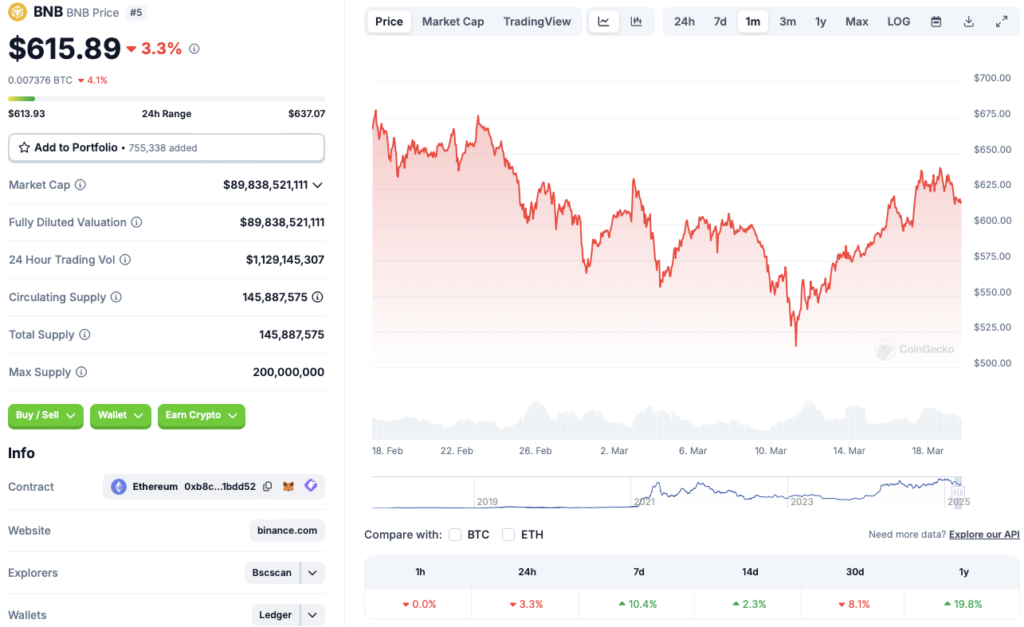

Binance Coin (BNB) — Latest Market Snapshot

- Price: $615.89

- 24h Change: -3.3%

- 24h Range: $613.93 – $637.07

- Market Cap: $89,838,521,111

- Fully Diluted Valuation: $89,838,521,111

- 24h Trading Volume: $1,129,145,307

- Circulating Supply: 145,887,575 BNB

- Total Supply: 145,887,575 BNB

- Max Supply: 200,000,000 BNB

- 1h Change: 0.0%

- 7d Change: +10.4%

- 14d Change: +2.3%

- 30d Change: -8.1%

- 1y Change: +19.8%

(Reference: CryptoRank)BNB Markets

(Reference: CryptoRank)BNB Markets

- BNB is listed on over 300 cryptocurrency exchanges worldwide, including Binance, Coinbase, Kraken, and KuCoin.

- Binance accounts for over 58% of all BNB-related transactions globally.

- US-based platforms like Coinbase and Kraken have increased BNB listings, contributing to a 32% rise in US user volume.

- Asian markets dominate BNB trading, with Japan, South Korea, and Vietnam making up 40% of daily activity.

- Peer-to-peer BNB trading in Nigeria and Kenya has surged by 71% YoY, driven by DeFi access and remittance use.

- BNB has the second-highest liquidity score among exchange tokens, behind only Ethereum’s ETH.

- Futures markets show BNB open interest reaching $3.1 billion, a 14% rise since Q4 2024.

- In 2025, the top BNB perpetual contracts will be listed on Binance Futures and Bybit, trading at a leverage of up to 125x.

- Over $1.2 billion in BNB options contracts were traded in Q1 2025, up from $780 million last year.

- BNB-based ETFs are currently in proposal stages across Hong Kong and Switzerland, signaling growing institutional demand.

BNB Converter

- As of April 2025, 1 BNB equals approximately $352.17, fluctuating with a daily volatility range of ±1.5%.

- On popular converter tools like CoinGecko and CoinMarketCap, real-time conversion rates are updated every 60 seconds.

- The most commonly used fiat pairs for BNB are USD, EUR, GBP, INR, and JPY.

- BNB-to-stablecoin conversions (BNB/USDT, BNB/USDC) make up nearly 64% of all fiat conversion volumes.

- Mobile crypto wallets with built-in converters like Trust Wallet and MetaMask report over 1.1 million monthly BNB conversions.

- On Binance, users converted over $7.6 billion worth of BNB into various fiat currencies in Q1 2025 alone.

- BNB’s average slippage rate for high-volume trades remains under 0.7%, showcasing efficient liquidity.

- Conversion APIs offered by platforms like CoinAPI and Messari see over 20 million BNB conversion requests monthly.

- Peer-to-peer BNB conversion via Binance P2P has expanded to 70+ fiat currencies globally.

- Cross-border remittances using BNB conversions grew by 34% year-over-year, particularly in Latin America and Southeast Asia.

Public Expectations: Cryptocurrency Market Performance in 2025

- Among current crypto owners, a strong 83% believe the market will increase, while 13% think it will stay the same, and only 3% expect a decline.

- For non-owners (those who have never owned or no longer own crypto), 56% anticipate an increase, 31% say it will stay the same, and 13% predict a decline.

- Looking at all informed adults, 67% expect the market to grow, 24% think it will remain stable, and 9% foresee a drop in value.

- The data suggests that current crypto owners are the most optimistic while non-owners are more cautious about the market’s future.

(Reference: Security.org)How BNB Works

(Reference: Security.org)How BNB Works

- Binance Coin is a native utility token operating on the BNB Chain, which comprises the BNB Beacon Chain and BNB Smart Chain.

- BNB supports both BEP-2 and BEP-20 token standards, enabling interoperability within the Binance ecosystem.

- It acts as gas fees for transactions on BNB Smart Chain, which averages 4.1 million transactions per day.

- Validators on the BNB Chain stake BNB and validate transactions via a Proof-of-Staked-Authority (PoSA) consensus model.

- BNB is used to pay for transaction fees on the Binance exchange, with users enjoying a 25% trading fee discount when paid in BNB.

- BNB’s governance role allows holders to vote on protocol upgrades and funding decisions via Binance Chain proposals.

- On-chain data shows over $14.3 billion in total value locked (TVL) across dApps using BNB for operations.

- BNB powers over 2,200 decentralized applications (dApps) on the BNB Smart Chain network.

- The average gas fee using BNB is around $0.11 per transaction, significantly lower than Ethereum’s $2.14 average.

- In 2025, BNB-based protocols handle roughly 7.8% of global DeFi transactions, a substantial increase from 5.6% last year.

What is BNB Used For

- Trading fee discounts remain the primary use case, accounting for 32% of BNB utility volume on Binance.

- BNB is used for staking and earning passive rewards across 30+ DeFi platforms.

- Holders use BNB for NFT purchases and auctions on Binance NFT Marketplace and other Web3 platforms like Treasureland.

- In 2025, BNB will be integrated into over 75 payment gateways, including NOWPayments and CoinPayments.

- Over 12 million travel bookings have been made with BNB via platforms like Travala and XcelTrip.

- BNB is accepted in retail outlets through crypto debit cards (e.g., Binance Card, Crypto.com Card) in over 60 countries.

- Gaming and metaverse platforms such as MOBOX, SecondLive, and BinaryX use BNB for in-game assets and entry tokens.

- BNB is used in Binance Launchpad, where users commit tokens to new projects and IDOs.

- BNB powers Binance Pay, enabling instant, feeless crypto transactions for users worldwide.

- In 2025, over 460 decentralized autonomous organizations (DAOs) accepted BNB for membership access and voting rights.

When Did People First Buy Crypto? Insights from Current Owners

- 15% of current owners bought crypto in 2016 or earlier.

- Only 8% made their first purchase in 2017.

- 10% entered the crypto market in 2018.

- 11% first bought in 2019.

- A peak 22% of current owners made their first purchase in 2020, the most popular year.

- 14% began investing in 2021.

- Another 8% started in 2022.

- Just 5% made their first crypto purchase in 2023.

- 7% of owners bought for the first time in 2024, suggesting a slight rebound.

(Reference: Digital Information World)BNB Historical Performance Overview

(Reference: Digital Information World)BNB Historical Performance Overview

- In 2017, BNB launched at $0.11 per token, gaining over 319,000% in value by its all-time high in 2021.

- BNB hit its historical peak at $686.31 on May 10, 2021, during the bull run.

- Despite a slump in 2022, BNB rebounded in 2023 with a year-end price of $312.45, gaining 18.6% in 2024.

- The token maintained a five-year average ROI of 147%, among the top 10 performing assets in crypto.

- BNB ranked #1 among exchange tokens for annual growth in 2020, 2021, and 2023.

- From 2020 to 2025, BNB’s average yearly low was $215, and its yearly high was $422, indicating a strong bullish bias.

- Historical average daily transaction volume has been $7.9 billion over the past three years.

- Over the last five years, BNB’s correlation with Bitcoin has averaged 0.72, indicating moderate alignment with BTC market trends.

- BNB’s market capitalization first crossed $10 billion in February 2021, then $50 billion by early 2025.

- Price data from CoinMarketCap shows BNB outperformed Ethereum in 2021 Q2 and has maintained a tighter range since 2023.

Distribution of BNB Holders and Wallet Data

- As of April 2025, BNB is held in over 1.2 million unique active wallets, a 19.4% increase YoY.

- The top 10 BNB wallets control approximately 32.8% of the circulating supply.

- Whale addresses (holding >10,000 BNB) account for 11.3% of wallet distribution.

- Mid-tier holders (100–1,000 BNB) have grown by 16.9%, now comprising 29% of total holders.

- Retail wallets (47.2% of total BNB holders.

- Over 620,000 wallets have interacted with BNB staking contracts as of Q1 2025.

- Binance Custody holds more than $6.1 billion worth of BNB, safeguarding institutional assets.

- Non-custodial wallet usage (e.g., Trust Wallet, Ledger) has increased to 51% of total wallet activity.

- The number of daily active BNB wallets peaked at 87,000 in March 2025, a record high.

- Cross-chain bridge usage (BNB to Ethereum, Polygon, etc.) reached $980 million in Q1 2025, a 33% YoY growth.

Crypto Growth Forecast by 2040

- Initial Investment: $579.33

- Additional Contributions: $0 (no ongoing deposits)

- Contribution Frequency: Monthly (set, but no actual added contributions)

- Annual Rate of Return: 11.13%

- Investment Duration: 16 years (until 2040)

- Future Value: The investment is projected to grow to $3,134.92 by 2040.

- Total Growth: The portfolio will gain a total profit of 81.5% over time.

- Starting Amount Portion (in 2040): 18.5% of final value

- Total Contributions Portion: 0%, as no further contributions were made

(Reference: CoinCodex)BNB Use Cases in the Binance Ecosystem

(Reference: CoinCodex)BNB Use Cases in the Binance Ecosystem

- Binance Smart Chain (BSC) depends on BNB for transaction fees, smart contract execution, and validator rewards.

- BNB is used in Binance Launchpool for yield farming, with over $5.3 billion in total rewards distributed since 2020.

- Binance NFT Marketplace processes over 60% of NFT payments using BNB.

- The BNB token is used for dual investment products and liquidity farming on Binance Earn.

- Auto-Invest services on Binance allocate BNB automatically into diversified portfolios.

- BNB is eligible for use in VIP Tiers on Binance, offering lower fees and higher API limits.

- BNB Vault allows users to earn yield from staking, Launchpool, and Flexible Savings simultaneously.

- Binance Gift Cards, customizable and available in over 50 fiat denominations, are primarily denominated in BNB.

- Binance Pay supports global merchant payments using BNB, with over 1 million transactions per month.

- The Binance Bridge 2.0 supports seamless BNB wrapping into ERC-20 assets for broader Ethereum compatibility.

BNB Burn and Deflation Metrics

- As of Q1 2025, Binance has burned a cumulative total of 169.7 million BNB, equating to over $58.5 billion in token value.

- In the most recent burn (January 2025), Binance removed 2.3 million BNB from circulation—valued at $797 million.

- The BNB Auto-Burn mechanism uses real-time price and supply metrics to automatically adjust quarterly burn amounts.

- BNB burn rates increased by 12.6% YoY, reflecting higher network usage and trading volume.

- Binance has committed to capping the total supply at 100 million BNB, meaning 50% of all BNB will eventually be burned.

- Since 2021, BNB’s circulating supply has declined from 170 million to 152 million as of April 2025.

- The BEP-95 upgrade introduced a real-time burn model where a portion of gas fees is destroyed on every transaction.

- Over 38,000 BNB were burned via BEP-95 in March 2025 alone.

- Token burns help reduce inflation pressure, contributing to BNB’s 24% annual price increase in 2025.

- The cumulative burn history is transparently tracked via the Binance Burn Portal, updated every quarter.

Staking and Yield for BNB

- BNB offers average APYs of 2.3%–7.5% across various staking platforms, depending on duration and protocol.

- Over 9.4 million BNB are currently staked across DeFi and CeFi platforms as of Q1 2025.

- Binance Earn alone holds 4.1 million BNB staked through Flexible and Locked Staking products.

- Liquid staking solutions like pSTAKE and Stader Labs now account for 14% of the total BNB staking volume.

- On-chain BNB staking increased by 28% YoY, with rising adoption in non-custodial wallets like Trust Wallet.

- Yield aggregators like Beefy Finance and Autofarm offer optimized BNB farming pools with boosted returns.

- BNB is integrated into dual investment products offering structured APYs up to 11%, depending on market movements.

- Staking-as-a-service providers report BNB among the top 5 most staked exchange tokens globally.

- Over $2.7 billion in rewards have been distributed to BNB stakers since 2020.

- The average lock-up duration for BNB staking is 32 days, with longer terms yielding higher bonuses on Binance.

BNB vs. Other Exchange Tokens

- As of 2025, BNB remains the #1 exchange token by market cap, ahead of OKB, CRO, LEO, and GT.

- BNB’s market cap is 3.2x higher than OKB, the second-largest exchange token.

- In trading volume, BNB leads with $10.8 billion daily, while CRO and OKB average under $1.5 billion.

- Unlike most exchange tokens, BNB is integrated into both Layer 1 smart contracts and centralized services.

- BNB’s burn mechanism is more aggressive compared to OKB and HT, which use fixed-rate models.

- BNB supports a broader ecosystem, fueling DeFi, NFTs, payments, and governance, whereas others remain CEX-focused.

- BNB is listed on over 300 exchanges, while competitors like LEO and GT are limited to fewer than 30.

- BNB’s real-world utility (travel, retail, remittance) outpaces rivals with 600+ merchant integrations.

- Institutional adoption of BNB is growing, with Grayscale and Bitwise reportedly exploring BNB-based investment vehicles.

- On a 5-year return basis, BNB outperformed all major exchange tokens by an average of 126%.

CEX Market Volume Share Breakdown

- Binance leads with a dominant 41.68% market share.

- OKX holds the second-largest share at 16.19%.

- Bybit follows with 12.50% of the volume.

- Bitget captures 10.28%, showing strong momentum.

- MEXC Global maintains a 4.10% share.

- Gate.io contributes 2.44% to the market.

- Crypto.com rounds out the list with 2.40%.

(Reference: Mitrade)Adoption Rate and User Growth

(Reference: Mitrade)Adoption Rate and User Growth

- In 2025, BNB saw a 19.4% YoY increase in active users, now totaling over 1.2 million wallet holders.

- Binance reported over 170 million registered users, with 56% of them interacting with BNB in some form.

- New user registrations tied to BNB rewards campaigns increased by 41% in Q1 2025.

- Google Trends shows a 15% increase in global BNB search interest over the past 6 months.

- Trust Wallet, the official Binance wallet, saw over 800,000 new BNB wallet activations this year.

- Binance Academy tutorials on BNB use cases saw 2.1 million views in Q1 2025, indicating rising education and awareness.

- BNB adoption in gaming and NFTs drove 14% of total token transactions across Binance Smart Chain in March 2025.

- Crypto debit cards supporting BNB reported a 37% increase in user spending in Q1 2025.

- Binance Launchpad and Launchpool participation grew 23% YoY, with BNB required to access these features.

- Community-run BNB user groups expanded to 92 countries, reflecting global user growth and localization efforts.

BNB in Decentralized Finance (DeFi)

- BNB powers over $14.3 billion in TVL across DeFi platforms in the Binance ecosystem.

- PancakeSwap remains the dominant DEX, with $4.9 billion in BNB-paired liquidity.

- BNB is integrated into major DeFi protocols like Venus, Alpaca Finance, and Wombat Exchange.

- BNB-backed synthetic assets like BNBx and stkBNB have gained over $600 million in market cap.

- Nearly 7.8% of global DeFi transactions now occur on BNB-powered platforms.

- BNB is used as collateral in lending protocols, with $2.1 billion in active loans backed by BNB in April 2025.

- DeFi aggregators like 1inch and OpenOcean handle $1.3 billion in monthly BNB routing volume.

- Insurance protocols on BNB Chain, such as InsurAce, provide over $90 million in coverage for BNB DeFi users.

- Stablecoin swaps using BNB pairs reached $3.7 billion in Q1 2025, with growth in cross-chain integrations.

- BNB staking in DeFi offers APYs as high as 10.2%, depending on market demand and protocol boosts.

Geographic Distribution of BNB Usage

- Asia leads BNB usage with 42% of wallet activity, driven by users in China, Japan, Vietnam, and South Korea.

- North America accounts for 18% of BNB trades, with growing interest in New York, Texas, and Ontario.

- Europe represents 21% of wallet creation, especially in Germany, France, and the Netherlands.

- Africa’s P2P BNB volume surged 66% YoY, particularly in Nigeria, Kenya, and South Africa.

- Latin America’s adoption rose to 9.2%, with hotspots in Brazil, Argentina, and Colombia.

- Middle Eastern usage of BNB expanded via Web3 initiatives in the UAE and Saudi Arabia, now at 4.7% of the global share.

- Oceania, led by Australia, contributes to 3.1% of global BNB wallet activity.

- Cross-border payment platforms using BNB saw 60% YoY growth in remittance activity across Asia and Africa.

- The number of BNB meetups and Web3 developer events doubled in India and Vietnam in the last 12 months.

Recent Developments and Strategic Partnerships

- Binance partnered with Google Cloud in 2025 to enhance BNB Chain’s AI-powered smart contract analysis.

- BNB joined forces with Stripe to support BNB payments for online merchants globally.

- BNB Green Tokens were launched to promote eco-conscious staking and reward validators for low-carbon footprints.

- Binance announced a $100 million BNB Ecosystem Fund to support new dApps and startups building on BNB Chain.

- Partnership with Travala expanded, now offering 1.6 million hotels and flights purchasable via BNB.

- Mastercard’s crypto pilot in Latin America added BNB as a supported token for card transactions.

- Integration with Solana’s Wormhole Bridge opened cross-chain BNB swaps across eight blockchain ecosystems.

- Samsung’s Galaxy Wallet added native support for BNB in its latest firmware update.

- Binance Pay integrated with Glovo and Uber Eats in select regions, enabling BNB food delivery payments.

- BNB Builder Grants launched in March 2025, are already funding 112 Web3 projects across gaming, education, and finance.

Conclusion

BNB has proven itself to be more than just a utility token—it’s a cornerstone of one of the most expansive ecosystems in blockchain. From powering millions of DeFi transactions to unlocking real-world use cases in payments, staking, and NFTs, BNB continues to evolve with strategic partnerships and relentless innovation.

As 2025 unfolds, BNB is positioned not just for price growth but for deeper integration across industries, regions, and user demographics. Whether you’re a developer, investor, or everyday user, BNB’s data-driven rise offers a clear message: It’s not just a coin. It’s an infrastructure.