New York City’s “Bernie Madoff of landlords” has defaulted on nearly $170 million in loans — and is facing foreclosure on a whopping 35 or so Manhattan properties, new court records show.

Steven Croman, a longtime notorious landlord and convicted fraudster — who did a stint on Rikers Island more than a decade ago — is facing another reckoning, but this time in civil court.

A bevy of lawsuits filed recently filed against Croman in Manhattan Supreme Court claim he is in default on $168 million worth of real estate loans.

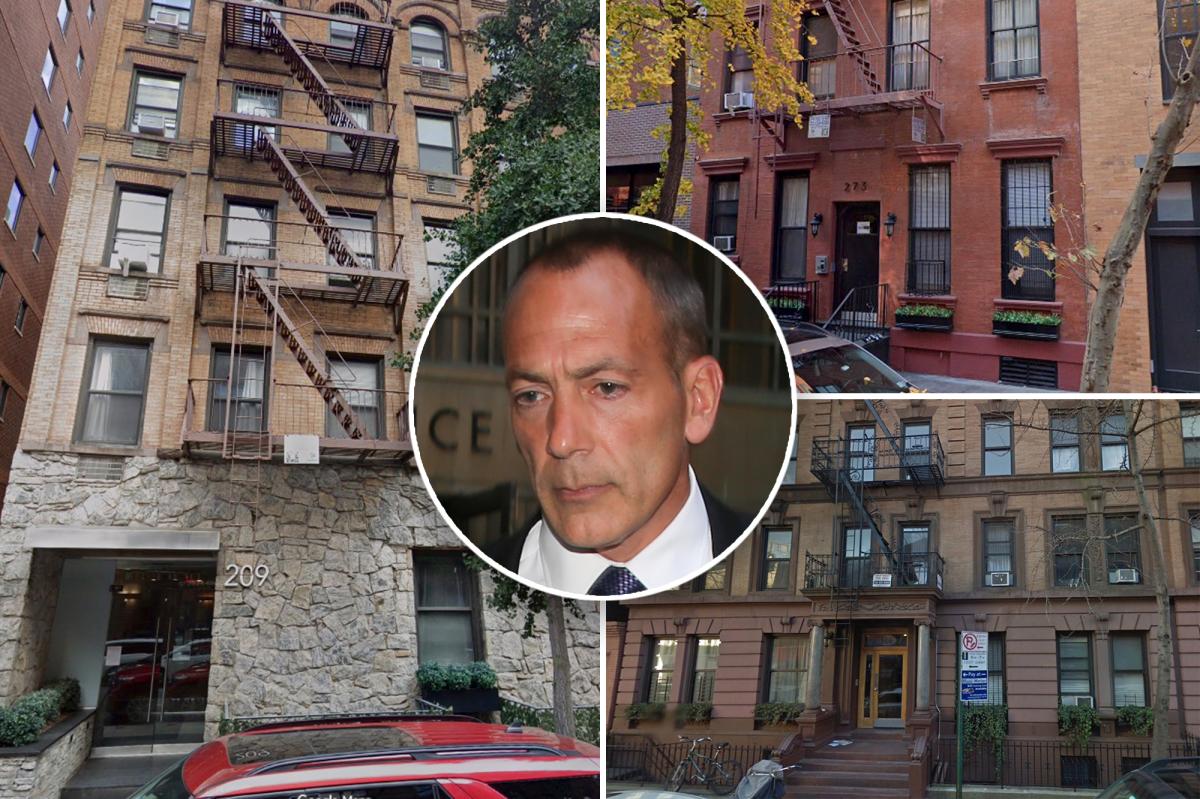

Steve Croman, who pleaded guilty to mortgage fraud a decade ago, now faces default notices totaling nearly $170 million. Stephen Yang

Croman initially took the loans from New York Community Bank, then to Flagstar Bank after a 2022 merger, but they were reassigned last month to a new lender Orange Owner LLC.

They allege that the real estate tycoon for months has failed to make payments at many of his properties, and owes millions on some of the buildings.

Croman held a massive portfolio of 140 buildings when he was busted in 2016 for filing fraudulent paperwork to receive tens of millions in illicit bank loans, according to prosecutors at the time.

Dubbed “the Bernie Madoff of landlords” by then-state Attorney General Eric Schneiderman, Croman was also accused of using a former NYPD officer to harass tenants into leaving their units — allowing him to jack up the rent on unwitting New Yorkers.

He pleaded guilty to mortgage fraud in 2017, and spent a year behind bars on Rikers Island.

Croman is facing default on his $12.4 million loan at 209 E. 25th St., where rents can reach nearly $5,500 a month. Google Maps

Last week, Crain’s reported that Croman was being sued by Orange Owner for allegedly defaulting on a total of $71.5 million in loans tied to five different buildings.

But the amount Croman is alleged to be in default has since grown by nearly $100 million, according to the now-20 lawsuits filed this month.

Those include a $12.4 million loan at 209 E. 25th St., a 44-unit building in Kips Bay where rents can reach nearly $5,500 a month, the bank claimed.

One of the city’s most notorious landlords, Croman was sent to Rikers Island for a year.

Croman allegedly fell two months behind on his mortgage payments on that property, totaling $493,845 — with over half due to late fees and other charges, the bank claimed in an October notice.

The lawsuit also demands that Croman repay the full $10.37 million mortgage on 346 E. 18th St. in Gramercy Park, where rents range from $7,500 to nearly $10,000 a month.

Croman allegedly fell behind on his October loan payment on that property, owing $362,332 with late fees, filings claim.

The bank claims that Croman is in default of his $10.37 million mortgage at 346 E. 18th St. in Gramercy Park, where rents can reach nearly $10,000 a month. Google Maps

Croman’s largest default is $21.4 million for a pair of Christopher Street buildings in the West Village.

That suit claims the convicted fraudster ceased making payments back in August, with arrears totaling $1.2 million at the end of October.

Earlier this year, Crain’s reported that Croman has faced a number of other foreclosure actions, with roughly an additional allegedly $45.5 million in defaults.

Lawyers for both Croman and Orange Owner did not respond to requests for comment.