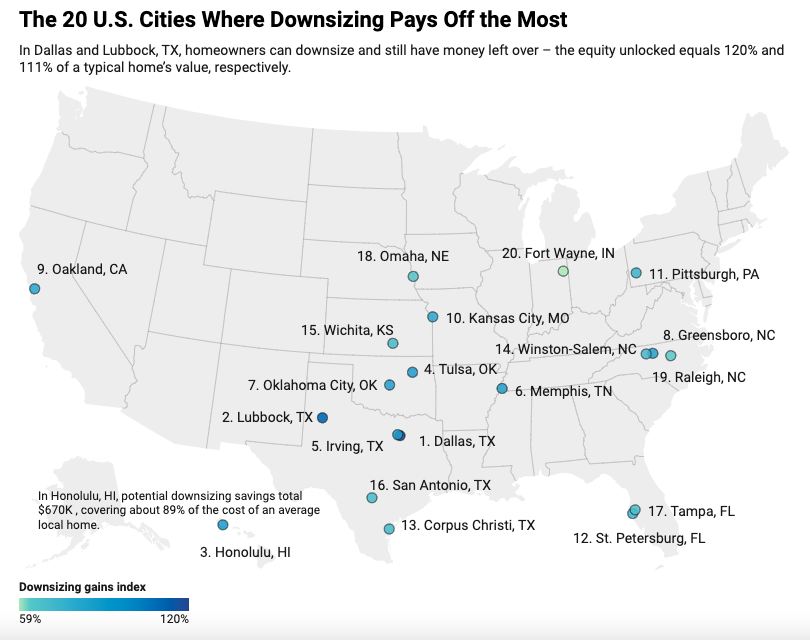

Whether they are seniors struggling to keep up with maintenance and property taxes or empty nesters with just too much room, homeowners in Dallas appear to be best positioned to downsize and net the most equity from the sale of their home.

A recent study by StorageCafe looked at the possible financial gains of moving from a four-bedroom home to a two-bedroom within the nation’s 90 biggest cities, and sure enough, Big D came out on top.

Credit: StorageCafe

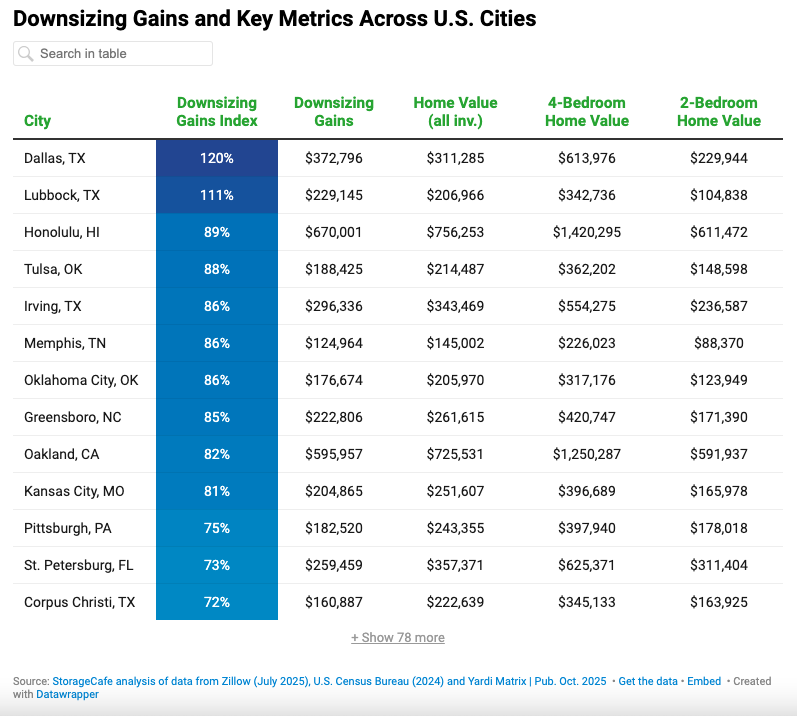

Credit: StorageCafe

The ranking is based on a Downsizing Gains Index devised by subtracting estimated closing costs, 10 years of self-storage expenses, and 10 years of property-tax differentials from the sales price difference between the four-bedroom and the two-bedroom. The index expresses those savings as a percentage of the average home’s value in each market to show how the gains in a local context.

Dallas’ index gains were 120% with $372,796 in unlocked equity. Another Texas city came in second. Lubbock clocked 111% in index gains and $$229,145. And still another, this time a neighbor in D-FW, came in fifth. Irving logged 86% and $296,336.

Credit: StorageCafe

Credit: StorageCafe

High property taxes and the costs and labor of proper home maintenance make downsizing a natural part of the housing market life cycle in Texas, if not life itself for homeowners. That being said, those who don’t own their homes outright might think twice if they borrowed when mortgage rates were under the 5% mark between 2010 and 2021. Even still, some say it might make sense to pull the trigger anyway.

“A significant reduction in home size and cost can often offset the impact of higher mortgage rates compared to staying in a larger, more expensive home that costs more to maintain and carries higher property taxes,” said Fernando Ferreira, chair of the real estate department at The Wharton School of the University of Pennsylvania, according to StorageCafe.

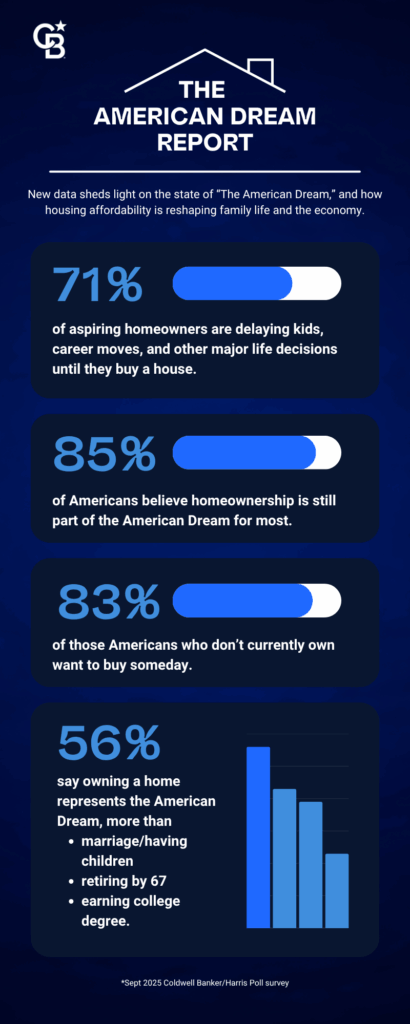

Many observers have blamed interest rates for limiting activity in the housing market, with reluctant homeowners feeling locked in place with 2-4% rates on the 30-year mortgage. However, there’s also the very serious issue of how high home prices have risen over the years. The dynamic has left Generation Z feeling like home ownership is just a pipe dream rather than a cornerstone of the American dream.

Studies suggest the housing affordability crisis could further decrease the nation’s birth rate. The latest Coldwell Banker 2025 American Dream Report seems to strengthen the correlation, with 71% of aspiring homeowners polled saying they are delaying major life decisions like getting married or having children until they can afford to purchase a home. For zoomers, that percentage is 84%.

Credit: Coldwell Banker

Credit: Coldwell Banker

Locked in with a great mortgage rate or not, baby boomers don’t appear to be helping the situation, with more than 60% signaling their intention to die in their current homes (not necessarily literally), a decent uptick from the 54% who said the same in a Clever Offers survey last year. Less home turnover means less inventory at any given time.

Growing households might want to keep an eye on cities like Dallas. Downsizing gains could just motivate some empty nesters to settle into more modestly-sized digs.