3h agoWed 26 Nov 2025 at 5:27amMarket snapshot

- ASX 200: +0.8% to 8,606 points

- Australian dollar: +0.6% at 65.05 US cents

- Wall Street: Dow Jones (+1.4%), S&P 500 (+0.9%), Nasdaq (+0.7%)

- Europe: FTSE (+0.8%), DAX (+1%), Stoxx 600 (+0.9%)

- Spot gold: +0.8% to $US4,165/ounce

- Oil (Brent crude): +0.4% to $US62.72/barrel

- Iron ore: +0.8% to $US105.90/tonne

- Bitcoin: +0.5 at $US87,511

Prices current at 16:27pm AEDT

Live updates on the major ASX indices:

3h agoWed 26 Nov 2025 at 5:42am

Goodbye

That’s it from us today.

Tune in to The Business program from 8.45pm AEDT for all the latest business and finance news.

We’ll be back bright and early tomorrow morning.

Goodbye!

Loading

3h agoWed 26 Nov 2025 at 5:40am

Size of superannuation assets continues to rise

Australians continue to pump money into their super funds, according to the latest statistics released from the regulatory authority, APRA.

Total superannuation assets are up 9.4%, to $4.5 trillion in the September quarter.

About $1 trillion are in self-managed super funds.

Total contributions were up almost 12% to $215 billion in the year ending September 2025.

Employer contributions increased by 8.8% to $153 billion,however member contributions were up almost 24% to $62 billion.

The annual rate of return was -3.3% to 10.1%.

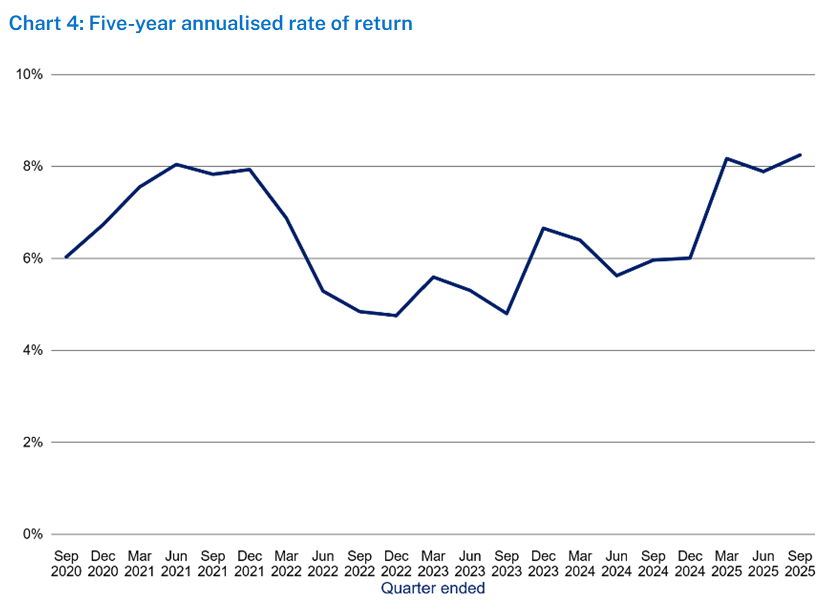

However, the five-year annualised rate of return was up to 8.3% (see the chart below).

5 year annualised rate of return (APRA)3h agoWed 26 Nov 2025 at 5:36amLocal markets are now closed

5 year annualised rate of return (APRA)3h agoWed 26 Nov 2025 at 5:36amLocal markets are now closed

Local share markets have closed up, despite higher-than-expected inflation figures dampening sentiment.

The ASX200 closed up 0.8% to 8,606 points, after rallying as much as 1.2% in morning trade.

The broader All Ordinaries closed up 0.85% to 8,899 points.

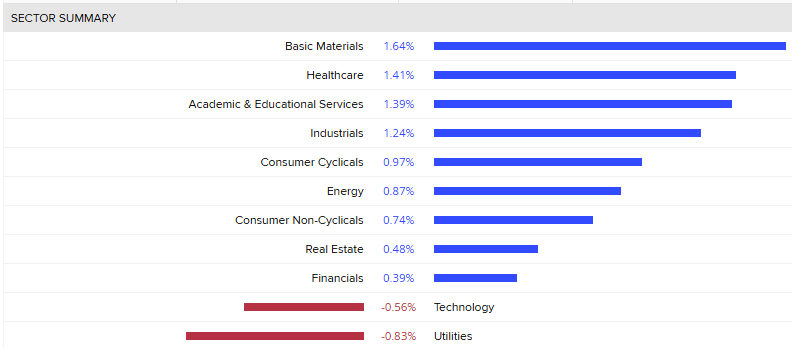

Most sectors were in positive territory today, led by basic materials and healthcare.

Utilities and technology closed down.

Sector summary (LSEG)

Sector summary (LSEG)

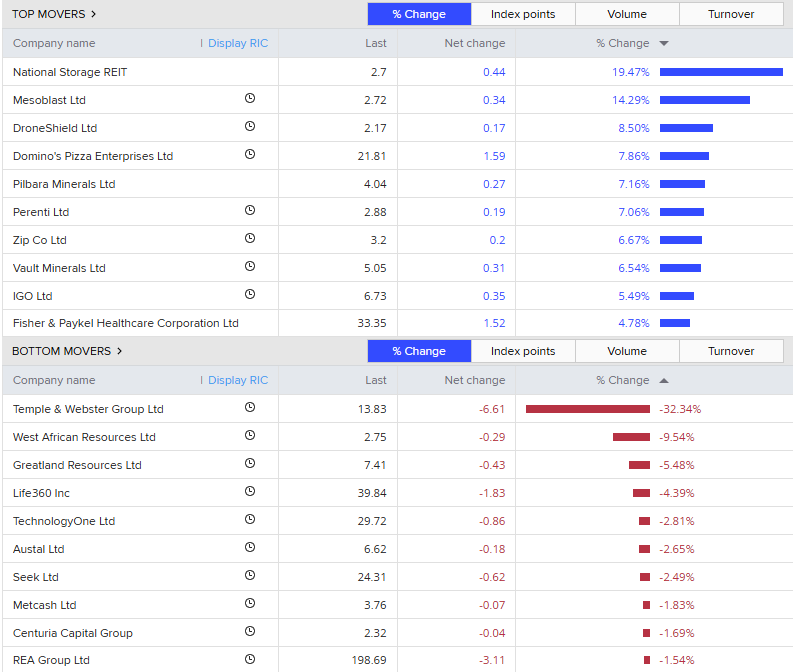

Online homewares store Temple and Webster had a disastrous day, falling 32%, on weaker than expected growth.

National Storage REIT closed up almost 20%, following the announcement of a $4 billion takeover offer from a consortium including Brookfield and GIC Investments.

Under the offer, the consortium has proposed to pay National Storage shareholders $2.86 in cash per share, a 26.5% premium to the stock’s close on Tuesday.

3h agoWed 26 Nov 2025 at 5:26am

Fuel price and inflation

Why won’t you acknowledge the fuel price discussion in relation to inflation?

You make a post about how there will be a global oversupply of fuel in 2026 and 2027, putting pressure on prices. But then refuse to acknowledge that news when discussing inflation for the remainder of the day. What is going on i feel like I am in the wizard of Oz? Do we only listen to quotes from experts, are we not allowed to look at the news/data ourselves and see the glaring contradictions?

– Matthew

Hi Matthew,

There’s no big conspiracy around why we haven’t mentioned fuel prices.

It’s simply because fuel prices are not a major driver of inflation at the moment.

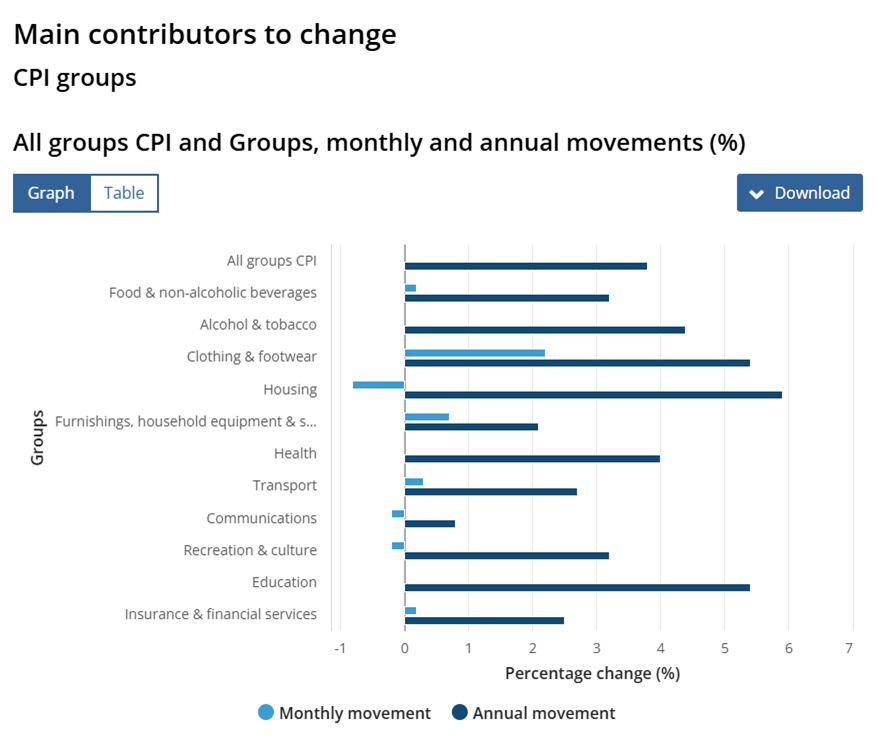

If you take a look at the ABS CPI main contributors to change chart below, as a category, transport prices are up 2.7% compared to a year ago.

Automotive fuel prices come under transport and fell 0.9% in the month of October. Fuel prices are up 1.9% higher compared to 12 months ago.

CPI contributors to change (ABS)

CPI contributors to change (ABS)

3h agoWed 26 Nov 2025 at 5:10am

Economic abuse costing nearly $11b a year, affecting 2.4m Australians

The federal government wants to crack down on economic abuse that it says is affecting more than 2.4 million Australians at a cost to the economy of nearly $11 billion per year.

Data shows that 16 per cent of women and 8 per cent of men have experienced economic abuse from a current or previous partner since the age of 15.

As business reporter Nassim Khadem explains, major reforms being considered include making it harder for directors to be appointed without clear consent.

3h agoWed 26 Nov 2025 at 4:53amMore economists say next interest rate move is up

We’ve already reported that JP Morgan is forecasting rates to rise in 2027.

Here’s what other bank economists think:

HSBC’s chief economist Paul Bloxham says a debate could be had about whether the RBA has already cut its cash rate too far.

“Our central case sees the RBA on hold through 2026, with the rate hikes beginning in early 2027. Today’s print adds to the risk that rate rises could be needed earlier than that,” he said.

UBS economist Stephen Wu says there is now a ‘trend’ of higher inflation, which is becoming concerning.

“CPI remains too high relative to RBA target. UBS now see the next RBA move is up, most likely fromQ4-26.”

4h agoWed 26 Nov 2025 at 4:30am

Temple and Webster shares continue to spiral

Yikes, TPW growth slowed but still hit 18%. Yet share price has gone off a cliff. Market has high expectations!

– Dominic

Indeed Dominic!

RBC Capital Markets analyst Wei-Weng Chen says top-line growth is tracking behind consensus expectations for 23 per cent growth in the first half of the year to date.

“With December typically a quieter month for Temple & Webster, and the business yet to cycle the key [Black Friday/Cyber Monday] sales period, we see potential risk for further deceleration over the remainder of the half.”

The online retailer’s shares have absolutely tanked today, currently down almost 32%.

4h agoWed 26 Nov 2025 at 4:23am

Market snapshot

- ASX 200: +0.7% to 8,598 points

- Australian dollar: +0.4% at 64.9 US cents

- Wall Street: Dow Jones (+1.4%), S&P 500 (+0.9%), Nasdaq (+0.7%)

- Europe: FTSE (+0.8%), DAX (+1%), Stoxx 600 (+0.9%)

- Spot gold: +0.7% to $US4,160/ounce

- Oil (Brent crude): +0.4% to $US62.75/barrel

- Iron ore: +0.8% to $US105.90/tonne

- Bitcoin: flat at $US87,082

Prices current at 15:20pm AEDT

Live updates on the major ASX indices:

4h agoWed 26 Nov 2025 at 4:10am

Cbus says fine won’t increase member fees

So CBUS has been fined $23.5 Million and is paying compensation of $32 Million to victims which they deserve to get as well as what was originally owed. But where is the money coming from? if it is from CBUS earnings does that mean members are missing out on extra Super, if it coming from insurance companies they will be trying to recoup their losses in higher premiums over coming years. strikes me that the members are becoming the victims again and the perpetrators are not getting prosecuted.

– Don

Thanks for your question Don.

In court on Tuesday, Justice O’Callaghan did actually address what this would mean for members of Cbus (Cbus’s trustee is United Super).

He noted because United Super’s trustee risk reserve is funded by fees charged to members, “the imposition of a pecuniary penalty will impact members insofar as it may give rise to the need for future fees to replenish the reserve”.

In a statement released yesterday, Cbus says it won’t cost members.

“Cbus has established reserves to pay the penalty imposed by the Court and a provision for an expected penalty was made in our financial accounts. Member administration fees have not been increased to cover the penalty.”

4h agoWed 26 Nov 2025 at 3:53am

Mistrust in child care affecting women’s financial equality

The Financy Women’s index (which measures financial gender equality), rose to a new high in the September quarter.

It was up 0.12 points to 79.44 points (out of 100).

While growth is up, it is still more subdued compared to previous quarters.

There are signs of a compositional shift in the workforce, with women’s full-time employment falling slightly in the September quarter and participation rates retreated from recent highs, coinciding with a drop in childcare usage.

Rhiannon Yetsenga from Deloitte Access Economics says recent abuse cases in the childcare sector has lowered trust.

“When families can’t trust the childcare system, women step back from work and men stay out of the care workforce – reinforcing the idea that caregiving is ‘women’s work’,” said Ms Yetsenga.

Other areas of progress towards financial equality have been mixed.

The superannuation sub-index gained 0.6 points, showing a narrowing of the gender gap in lifetime super savings due to improved wages, maturity of the super guarantee and increasing female workforce participation.

Consequently, the estimated timeframe to close the gender gap in super savings has fallen to 13.9 years from 17 years.

However, the ASX200 boards sub-index remained stalled, meaning there was no growth in gender diversity in leadership positions in Australia’s largest companies.

5h agoWed 26 Nov 2025 at 3:37am

Calls for more funding for financial counselling

41 community sector organisations are calling for the Victorian Government to quadruple investment in frontline financial counselling and capability over ten years.

This follows the publication of research into the social and economic return on investment in financial counselling, which shows that the ROI is $3.70 – $5.30 for every dollar spent.

Financial counsellors are in high demand due to the cost of living crisis. They work with individuals and families to navigate debt, negotiate with creditors and other financial problems.

Financial Counselling Victoria says there are currently only 300 financial counsellors in Victoria and it would take 32 years to meet current need.

The community organisations want the state government to commit $921.7 million in funding over 10 years, which would enable the workforce to grow to 1,200.

5h agoWed 26 Nov 2025 at 3:20am

Harvey Norman shares hit record high in wake of strong sales

Shares of Australian retailer Harvey Norman hit a record high on Wednesday.

Reuters reports that its shares rose by over 4% to $7.70 before slipping back to $7.36 later in the day.

The bump was its highest single day gain since the beginning of September.

It comes after Harvey Norman reported a 9.1% rise in aggregated sales revenue from July 1st to November 20th this year compared with the same period in 2024.

Compared with the previous corresponding period this year, there was a 8.1% increase.

Since July, Harvey Norman has opened two more stores Asia — in Singapore and Malaysia — to brings its number of company owned overseas outlets to 121.

5h agoWed 26 Nov 2025 at 3:06am

Confusion around CPI figures

Could someone explain for us lay people how the monthly figure for “housing” can be a negative when all we hear is the cost of housing is rising ?

– Phillip

Thanks Phillip.

The CPI figures are all a bit confusing today, not only because this is the first complete set of monthly CPI figures, but also because some of our reporting mentions the changes in prices from September to October (which is the housing figure you refer to at -0.8%) and others look at the change in prices compared to this time last year (where housing is +5.9%).

As the Treasurer Jim Chalmers said, the flat CPI read in October was due to “falls in electricity and fuel prices, and a moderation in housing costs.”

But that’s only in the month-to-month comparison!

AMP Economist Diana Mousina explains that given most items actually have big seasonal factors, it’s better to look at changes in prices compared to a year ago.

In that case, price growth in housing is up 5.9%, mostly due to electricity prices as the rebates rolled off.

6h agoWed 26 Nov 2025 at 2:47am

Business group calls for plan to reduce energy prices

The Australian Chamber of Commerce and Industry (ACCI) says today’s inflation figure of 3.8 per cent is uncomfortably high for households and businesses, which are hurting from increasing energy costs.

ACCI chief executive officer Andrew McKellar said it was inevitable that when state and territory energy rebates ended, it would have an impact on inflation.

“Electricity for example has gone up by 37 per cent in the twelve months to October,” Mr McKellar said.

“Those chickens were always going to come home to roost and we can’t expect rebates to continue indefinitely.”

Mr McKellar said there was a need for a plan to bring energy costs down.

“What we need is a clear plan to meet the short, medium and long term demands of households and businesses so that prices will eventually come down.”

6h agoWed 26 Nov 2025 at 2:47am

J.P.Morgan puts date on possible RBA rate hike

JPMorgan economist Tom Kennedy has penned a note on the new monthly CPI figures from the ABS.

He describes the inflation print as “strong”.

“The RBA’s forecast is for headline inflation to finish the year at 3.3%oya, an outcome consistent with zero price growth in the next two monthly readings,” Mr Kennedy said.

“Today’s upside surprise means there’s clearly a risk of a stronger number, though we don’t think this is sufficient for rate hikes to creep into the RBA’s internal discussion.

“We continue to see the RBA on hold through 2026, with hikes likely from early 2027.”

6h agoWed 26 Nov 2025 at 2:37am

Business group calls for plan to reduce energy prices

The Australian Chamber of Commerce and Industry (ACCI) says today’s inflation figure of 3.8 per cent is uncomfortably high for households and businesses which are hurting from increasing energy costs.

ACCI chief executive officer Andrew McKellar said it was inevitable that when state and territory energy rebates ended it would have an impact on inflation.

“Electricity for example has gone up by 37 per cent in the twelve months to October,” Mr McKellar said.

“Those chickens were always going to come home to roost and we can’t expect rebates to continue indefinitely.”

Mr McKellar said there’s a need for a plan to bring energy costs down.

“What we need is a clear plan to meet the short, medium and long term demands of households and businesses so that prices will eventually come down.”

6h agoWed 26 Nov 2025 at 2:31am’Double-edged sword’ for rural property market in 2026

Less prosperous times could be ahead for Australia’s rural property market, despite an “exceptional five-year run”, real estate giant Ray White has warned.

Ray White’s head of research, Vanessa Rader, says rural Australia is poised to enter a consolidation phase, with the threat of drought always in the sector’s minds.

“The extended period of beneficial seasonal conditions has been a double-edged sword for the sector,” she wrote in a release, entitled’ A Period of Consolidation Ahead for the Rural Market’.

“Five consecutive years of good rainfall have supported strong agricultural production, with cattle prices expected to rise as pasture conditions remain positive.

“However, grain markets face a different trajectory, with excessive supply likely to pressure prices as bumper harvests continue to flood the market.”

She added that the “statistical probability of drought” has increased, with the market’s memory of the devastating 2018–2019 still fresh.

6h agoWed 26 Nov 2025 at 2:19amTreasurer calls Coalition’s energy policy ‘bonkers’

Jim Chalmers has been speaking in Canberra, where he was asked about the possibility of extending subsidies for households battling higher power bills.

The latest inflation figures show electricity prices are source of problem, as state and federal subsidies for households end.

He had this to say about Labor’s energy policy.

“The best chance to get power bills down over the medium term is to replace this ageing, increasingly unreliable fleet of coal fired power stations with cleaner, cheaper, more renewable, more reliable energy. And that’s our policy,” he said.

“And it is absolutely bonkers that the Coalition want to abandon an orderly transition and abandon net zero. That would push power prices up not down. It would swing a wrecking ball through the budget and throughout the economy because it would destroy investor confidence.

“And we know why they’re taken that position. It’s just to appease the most right wing elements of their party room.”

For more on the Coalition’s policy, here’s an explainer from my colleague Joanna Lauder, who reports on the climate.

6h agoWed 26 Nov 2025 at 2:15amTreasurer says energy subsidies important but not permanent

Jim Chalmers is currently speaking in Canberra after the latest inflation figures were released.

They showed inflation picking up, and that electricity costs for consumers soared by 37.1 per cent in the year to October .

“The annual rise in electricity costs is primarily related to state government electricity rebates being used up by households,” the ABS noted.

“The timing of the rollout of the Commonwealth Energy Bill Relief Fund (EBRF) rebates also impacted electricity costs.”

The treasurer acknowledged this impact, and was asked by reporters if energy subsidies were being phased out prematurely.

“They are a really important part of the budget but they are not a permanent part of the budget and we have made this clear,” he told reporters.

He noted that the government was set for a mid-year budget update in December, and they would wait to make decisions before that when more data like national accounts came in.

“We’ll take a decision about electricity rebates in the context of finalising that mid year update,” he said.