Home ownership still remains a challenging goal for many renters in D-FW, but a new study shows that a particular ZIP code in southeast Dallas is one of the most affordable in the country for a neighborhood resident to become a homeowner.

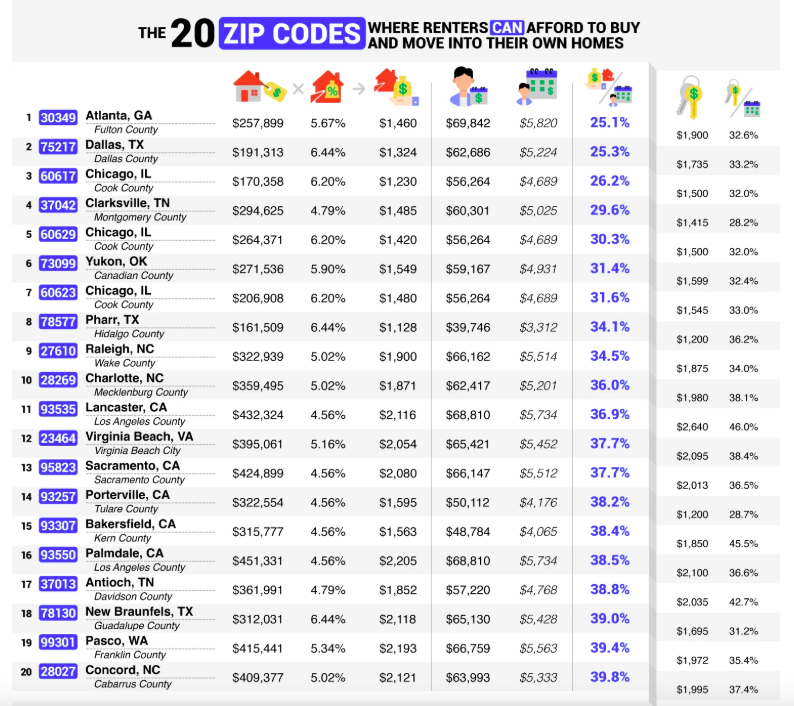

MovingPlace looked at the 150 most populous ZIP codes in the United States, calculating a mortgage-to-income ratio by comparing the average monthly mortgage payment to the average renter’s income. ZIP codes with lower ratios were considered more affordable for renters to buy.

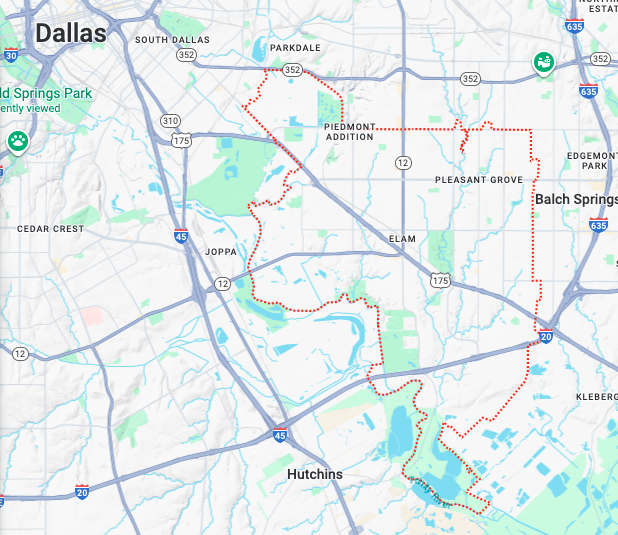

Southeastern Dallas ZIP code 75217 came in at No. 2 in the nation with a mortgage-to-income ratio of 25.3%. Comprising the broader Pleasant Grove area, 75217 is one of only a handful of ZIP codes with a ratio under the 28% threshold of that golden 28/36 rule.

“The 28/36 rule indicates that you should spend no more than 28% of your gross monthly income on housing costs and no more than 36% on total debt payments, including housing expenses. With only 3 of the 150 most populous ZIP codes meeting this standard, the U.S. housing market shows little affordability,” the study reads.

Amid rising home valuations and rents, housing affordability has been a pressing issue in D-FW, the Lone Star State, and really the country as a whole. Earlier this year, Mayor Eric Johnson went to Washington, D.C., to testify before the Senate Committee on Banking, Housing, and Urban Affairs. He argued for more emphasis on facilitating the construction of housing stock rather than subsidizing the demand side of the equation.

The most affordable ZIP codes were overwhelmingly concentrated in the Sun Belt, with a good many located in the South, Texas, and southern California, according to MovingPlace’s data. Chicago, however, was a noticeable outlier, with 60617 and 60629 coming in at No. 3 and No. 5, respectively. The No. 1 affordable ZIP code was 30349 in southern Atlanta.

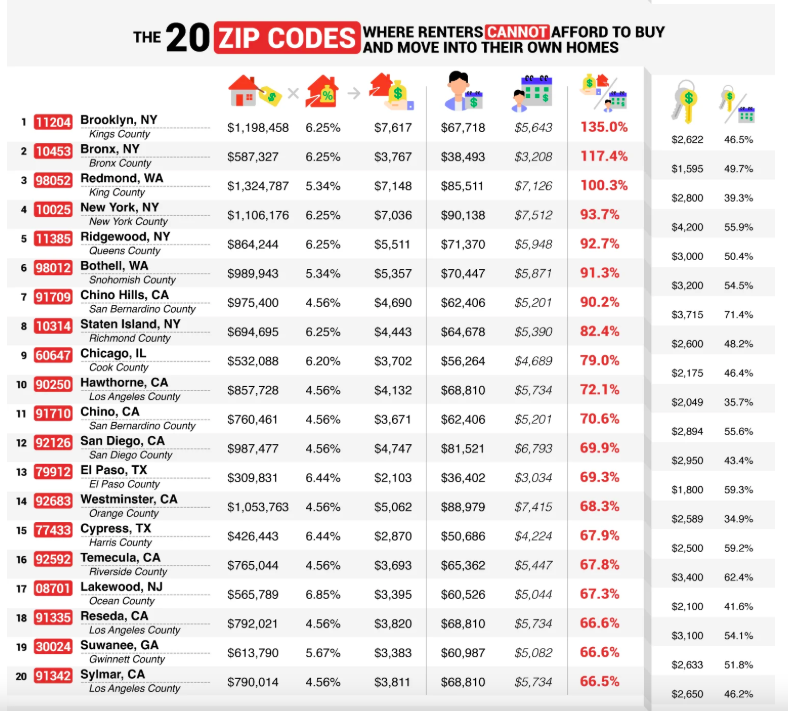

At the other end of the affordability spectrum, New York City dominated the top five with four ZIP codes, and southern California was well represented behind those in the top 20.

“With a median home value of $1,198,458, you could buy nearly five homes in Fulton County, Georgia, for the price of one in Brooklyn,” Moving Place’s study reads.

The high cost of single-family houses these days has pretty much reshaped the landscape when it comes to home ownership. Many in Generation Z, for instance, have expressed significant disillusionment with even the prospect. Meanwhile, baby boomers appear locked in when it comes to existing stock, leaving fewer options for prospective homebuyers.