CHICAGO (WLS) — Property tax bills in Cook County are due on Monday night, and the I-Team is investigating the sticker shock and the extreme hikes on many of those bills.

The median residential property tax bill jumped to its highest point in three decades, according to a study from the Cook County Treasurer’s Office. Now, the I-Team is hearing from people who say they’re fighting the assessor over the spikes.

ABC7 Chicago is now streaming 24/7. Click here to watch

Richard Dal Santo has lived in his West Roseland family home all his life. But he says he’s never seen his tax bill like this before.

“I almost fainted. The hike on it is ridiculous,” Dal Santo said.

The I-Team is hearing from people who say they’re fighting the Cook County assessor over the spikes.

Dal Santo’s bill more than doubled for the entire year, and he’s one of many seeing a big spike in second installment Cook County property tax bills.

According to a recent study by the county treasurer, taxes went up by a median of more than 16% citywide. Dal Santo’s neighborhood, in the Roseland community area, went up by 2%. Many other areas on the South and West sides saw increases close to 100%.

RELATED | Chicago residents worry over Cook County property tax increases as payment due soon

“And then, they tell me that my house is worth more, which it isn’t, and they raise the taxes,” Dal Santo said.

Dal Santo’s assessed value of his property recently went up from just under $13,000 to more than $251,000.

“Oh, yeah, I got slammed. Then, it says value, which the house ain’t worth that much,” Dal Santo said.

Dal Santo thinks his home could be worth $60,000. Redfin says it’s worth about $155,000.

“This house is over 100 and something years old, and these siding, windows, furnace,” Dal Santo said.

SEE ALSO | Cook County assessor, Board of Review blame each other for skyrocketing Chicago property tax bills

But the Cook County assessor says property taxes increased because this coach house saw an assessment increase, and only one structure on property can qualify for the senior freeze. Dal Santo says the structure is unlivable and empty and that it’s over assessed.

“You can’t charge us all this money like this. You can’t just jack it up for thousands of dollars,” Dal Santo said.

Cook County Assessor Fritz Kaegi says homeowners are taking on more of the tax burden because the Board of Review granted a high percentage of commercial property appeals.

The Board of Review says commercial properties were cut because they were over assessed. The treasurer says its recent study shows that homeowners take on more of the burden because of too many vacant office and retail spaces, which haven’t recovered fast enough since the COVID-19 pandemic.

In Park Ridge, John Sopata is helping his mother, Barbara, to dispute her bill and an assessment increase.

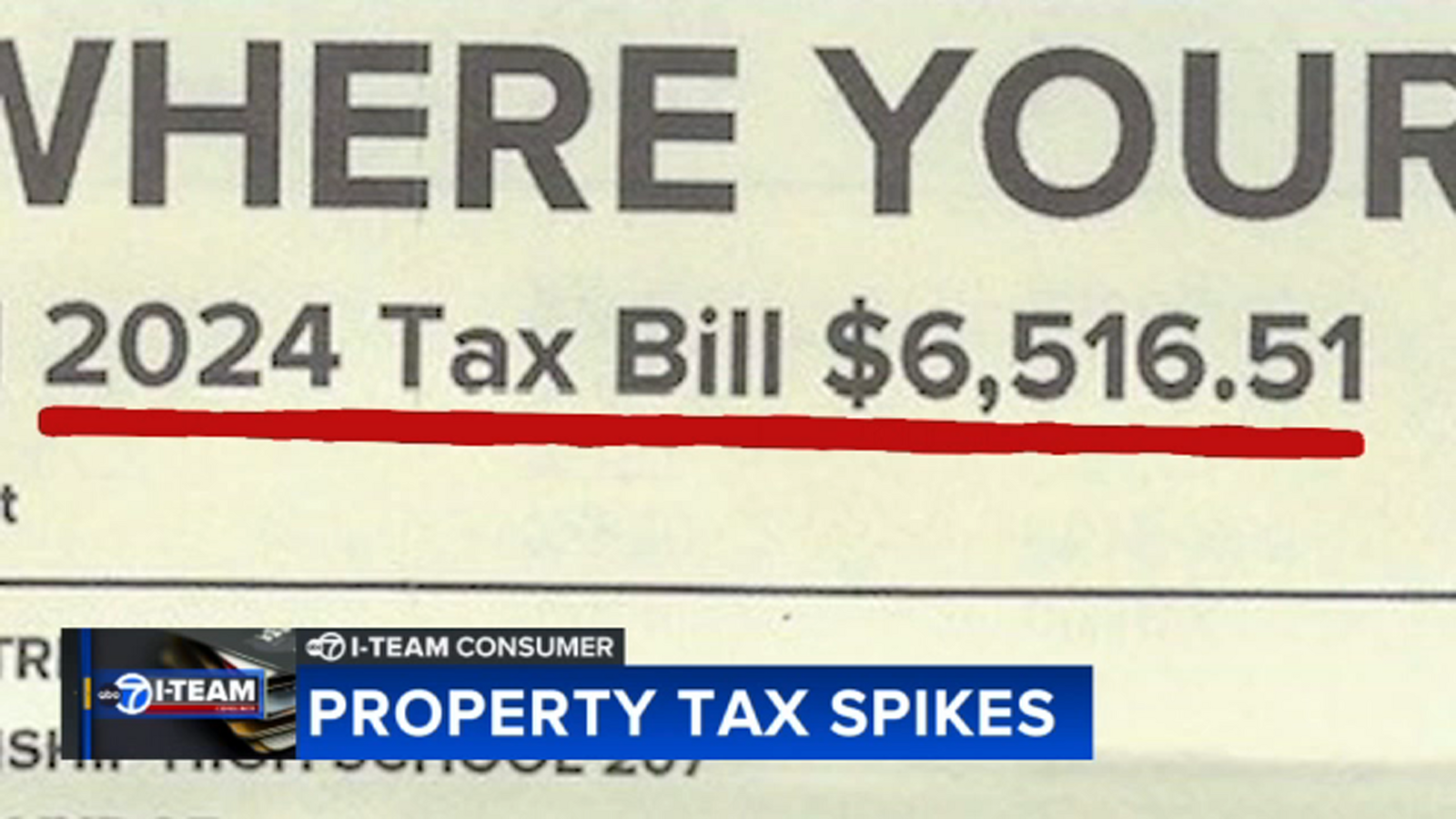

“It stresses my mom. You know, this is the stage of her life where she shouldn’t have stresses such as property taxes,” Sopata said. “So, her taxes had been between about $2,100 and $2,500 per year, which was manageable with her fixed income. This year, they went to over $6,500, so, more than tripled.”

READ MORE | Cook County assessor faces angry questions from West Side homeowners over sharp property tax hikes

Sopata was also told by the assessor’s office that the increase was mainly due to a computer error which had been lowering his mother’s previous bills. The assessor’s office said, “during a previous administration, the property’s square footage was corrected. After the correction was made, the old mainframe computer system applied the wrong Senior Freeze value to the property.”

The assessor’s office says it was legally required to correct that mistake. However, it will review both Sopata’s and Dal Santo’s assessed values on their properties.

“I’m sick. I get sick. You know, they raised it too much at one time,” Dal Santo said of his bill.

If you think your bill is too high, you still need to pay it or enter a payment plan. You can apply to get a certificate of error and try to get a refund if you think you overpaid, but if you are appealing high assessments, you must do that when the assessment comes out, not when the tax bill comes.

To appeal, you should first gather evidence of an overassessment. If your appeal fails with the assessor, you can further appeal with the Cook County Board of Review, and then the state.

If you believe there was a mistake made, like a square footage error, you can file for a certificate of error, which is different than disputing a high assessment.

RELATED | Cook County Board of Review reopening tax appeals for 24 townships after dramatic bill increases

Copyright © 2025 WLS-TV. All Rights Reserved.