The latest tranche of Texas Business Outlook Surveys from the Federal Reserve Bank of Dallas was released the last week in November.

The outlook self-described — at least among the Texas manufacturing, services and retail sectors surveyed — is not one of unbridled optimism.

Some 310 businesses responded to the survey, which includes five “special questions” aimed at the measuring the economic pulse of Texas business. The survey was taken between Nov. 10 and Nov. 18. For reference, the federal shutdown officially ended Nov. 12.

Related

The special questions were specific, relating to revenue and employment. The answers, mixed at best, leaned negative.

Business Briefing

The first question was simply about earnings: How has your firm’s operating margin, defined as earnings before interest and taxes (EBIT) as a share of total revenue, changed over the past six months?

Only 21% of respondents answered that their EBIT had increased slightly or significantly. Only 2% of that 21% cited a significant increase in EBIT. About a third (33%) said their EBIT was unchanged, while 47% said it had decreased, with 13% saying their pre-tax and interest earnings had decreased “significantly.”

That’s worse than November 2024, when 36% reported declines EBIT, and on a par with 2022 (49%) and 2023 (48%) during the worst periods of the post-pandemic inflation.

Asked what they expect from the next six months, 29% of respondents said they expect a decline in EBIT. That’s a higher negative than 2024, when only 18% said they expected a decline.

There was also a decline in optimism. Only 37% said they expect an increase in EBIT compared to 47% just one year ago. And when asked what changes they expected in demand for their goods and/or services, only 44% said they expected an increase, an answer unchanged from a similar question asked in August 2025 (44%), but down significantly from the optimism of February 2025 (59%) and that November 2024 (60%) and the lowest measure of optimism since the 47% registered in August 2024.

Kevin Henderson, a founding partner of SMB Law, says he suspects much of the pessimism was related to the government shutdown.

“But that’s just a guess,” Henderson said. His small business client base, which includes a wide range of business sectors, he said, has shown some of the anxiety reflected in the Dallas Fed survey.

“We still see a ton of M&A activity in the SBA space, but when talking to current business owners, things are definitely not as rosy as they have been in the past in terms of excitement on outlook. People are nervous about tariffs and overall economic impact and how it will affect their businesses. So, I’m definitely seeing some of that out there.”

About 40% of the Texas businesses measured said they are currently understaffed, with only 14% saying they intend to hire for new positions, and another 13% saying they intend to hire replacements to maintain their current levels of employment. Note: The 14% of businesses intending to hire for new positions is the lowest percentage in that category in seven such surveys taken since October 2022.

But Henderson said some of that anxiety is being offset by several government initiatives that are beginning to percolate through the bureaucracy.

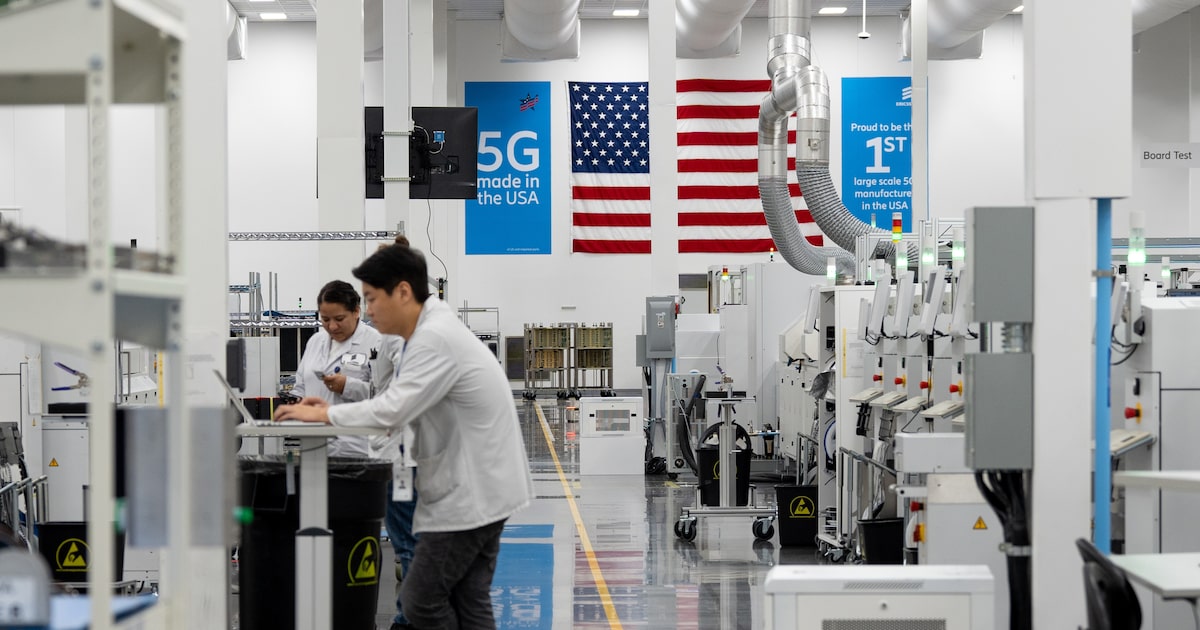

“On the manufacturing side, at least in my end of the world, there’s some cause for hope with the SBA’s new MARC program that adds a dedicated revolving credit and term loan option just for manufacturers,” said Henderson.

The SBA loan program, Manufacturer’s Access to Revolving Credit, was announced Sept. 3. The program, for which 98% of all U.S. manufacturers are classified as eligible, allows lines of credit to be structured as either revolving or term and, under another initiative current before the Senate, doubles the loan limits available.

Henderson notes that SBA loan activity in Texas is “way up” ($3.2 billion in SBA 7(a) loans were awarded in fiscal 2024; $4.07B in fiscal 2025).

“Of course, loans could be backstopping distressed situations,” said Henderson, “but at a minimum it shows a lot of business activity out there this past year. Also doesn’t mean outlook is still high, but it’s an interesting dataset to see the massive jump.”

The Texas Lawbook is an online news publication focused on business law in Texas.

AT A GLANCE

Survey says …

The Dallas Fed survey included the opportunity for comments. Survey comments, like letters to editors, tend to skew negative. Here are a few offered from the survey along with the business sector they represent:

From a chemicals manufacturer: “The business of chemicals is arguably in its worst decline since 2008-09.”

Computer and electronics: “Our business activity has increased. We are seeing more activity with urgency from our defense customers, but we are not yet sure how we will manage this if all of the programs become firm orders.

Administrative and support services: “Current productivity is not cutting it in this market. Compensation plans for 2026 are going to include a reduction in commission rates and incentives only for high-producing individuals. We cannot have another year like 2025.”

Food services: “I tell my staff that our community appears to be undergoing a quiet period of folks moving out, so we need to prepare for hard times ahead no different than the COVID-19 pandemic. If companies wait too long to react to the disappearing act, it’ll be too late.”

Professional services: “The use of AI in our company is increasing. However, there may be too much time and ‘planning’ to get work done versus ‘getting work done.’”

Real estate: “Faster, smarter and cheaper used to be goals. Now we do these things just to survive.”

Merchants, wholesalers, nondurable goods: “We are adding new business, and we will hire for growth in the next six months.”

Transportation: “At this point, it’s been such a roller coaster of a mess, with the American trucking industry in dire straits due to reduced volumes and overcapacity, that I don’t even know what to say other than simply: It’s dismal.”

Texas Stock Exchange, Toronto Stock Exchange resolve trademark suit

Texas Stock Exchange, Toronto Stock Exchange resolve trademark suit

The Canadian exchange said the Texas Stock Exchange’s “TXSE” branding was too close to its own “TSX.”

The art of the complicated deal: Texas corporate lawyers level up

The art of the complicated deal: Texas corporate lawyers level up

Cash and stock are passé in the increasingly complex M&A world.