Apartment hunting got a little bit tougher in 2025 as the delivery of new units struggled to keep up with demand and more renters decided to renew their leases than in the previous year, according to a recent RentCafe study of activity in the sector.

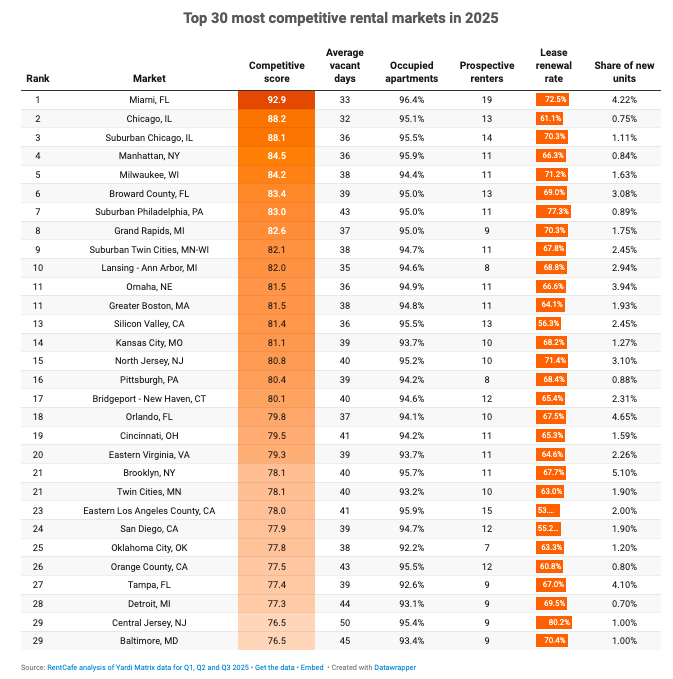

Nationally, the lease renewal rate ticked up to 63% and the occupancy rate rose to 93.3%. New units only made up 2.83% of the market, up from 2.59% last year, but not enough to decrease the average number of apartment hunters per unit, which stood at nine.

In the Lone Star State, the big-city markets largely followed the national trend but with one exception: Dallas. The Big D managed to shift gears to see its RCI dip compared to last year, clocking a score of 72.3 and placing outside the top 30 most competitive markets.

Now, apartment hunting in Dallas only got slightly easier. More renters actually ended up renewing their leases in 2025 for a renewal rate of 60.7%, and the occupancy rate reached 91.6%. However, new construction saw a pretty significant spike compared to 2024, jumping from 2.8% to 3.7% of the total apartment supply reviewed. That’s a 32% year-over-year increase in deliveries for the nine months under review.

That should come as no surprise, with D-FW on track over the summer to deliver the second biggest number of units out of the nation’s metro areas. Relatedly, Dallas proper has been a top producer of office-to-apartment conversions, with a lot of downtown developers in particular trading cubicles for condos.

Unlike Dallas, RentCafe had the Austin, Fort Worth, Houston, and San Antonio rental markets all becoming more competitive. New construction slowed in Fort Worth and Houston, but in Austin, it actually shot up to a whopping 8.2%. Even still, that wasn’t enough new product to keep the capital city’s RCI from ticking up by 0.3% from last year. That being said, Austin was still way less competitive than Dallas, clocking an occupancy rate of 91.1% and a renewal rate of 54.6%.

Zooming back out, Miami retained its title as the most competitive market with an RCI of 92.9, despite a share of new units exceeding 4.2%. The city’s occupancy rate hit 96.4%, and there were 19 apartment hunters per vacant unit on average. Chicago and the Chicago suburbs came in at No. 2 and 3, respectively, though mostly due to the limited share of new units — 0.75% and 1.11%, respectively.

RentCafe’s research team looked at data from the 139 biggest rental markets in the United States between January and September, focusing on market-rate multifamily properties with at least 50 units. Rental Competitiveness Index (RCI) scores were assigned based on weighted metrics that included occupancy rate, lease renewal rate, average number of days vacant, prospective renters per vacant unit, and share of new units on the market. Markets were then ranked by their RCI score to identify the most competitive rental environments.