The woman’s granddaughter says the altered check exposes how bank reporting deadlines can leave customers — especially seniors — without reimbursement.

DALLAS — Billie Young wrote a check to pay off her car loan.

“$14,952.52. Never will forget it,” Young said, taking a deep breath.

The check was cashed — but not by the finance company.

The 83-year-old Dallas resident said her bank later notified her that she had missed a 30-day deadline to file a claim.

“To them, she’s just another customer, but to me, she’s my grandmother,” her granddaughter, Kecia Byars, said.

Byars wrote letters to Wells Fargo on her grandmother’s behalf, attempting to get the missing funds returned.

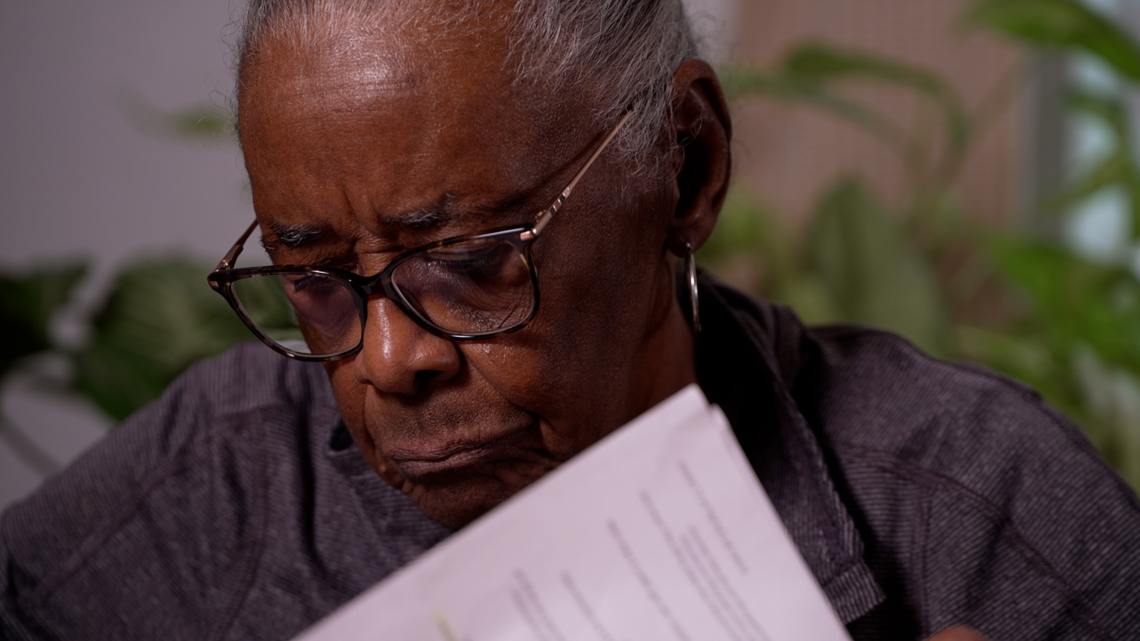

“It’s been very sad, and more so to see we can’t get through a bank visit without her vomiting or being in tears,” Byars said.

Young has spent the past three years caring for her husband, a Navy veteran with prostate cancer.

“At the time this hit me in 2024. 2024. I had to do everything for my husband. Everything,” Young said.

In August 2024, Young wrote two checks — one for her electric bill and another to pay off her car.

When her utility company sent her a cutoff notice, Young said she called Wells Fargo on Sept. 6, 2024. She said she recorded the date in her checkbook.

“This was way before 30 days,” she said.

Young said the Wells Fargo customer representative told her the check for the electric bill had not cleared.

“I said, ‘Well put a stop payment on that one,’” she said.

Young said she told the banker who the other check was made out to. She said he told her that check had cleared, but did not indicate it had been cashed by someone different than the intended payee.

The following month, when she received a bill from her car lender, Young said she realized something was wrong.

“So now I’m upset at my car dealer because the money came out of my account,” she said.

Young said it was not until she obtained a copy of the cashed check that she discovered the payee had been changed to someone she did not know.

The name listed on the check was someone online records show is a local credit analyst. It is unknown whether that person actually cashed the check.

Young said that by the time she realized someone else had cashed the check, several more weeks had elapsed. She filed a fraud complaint in mid-October 2024, which the bank denied. Her granddaughter filed an appeal on her behalf with the bank.

The family also filed a police report with the Dallas Police Department.

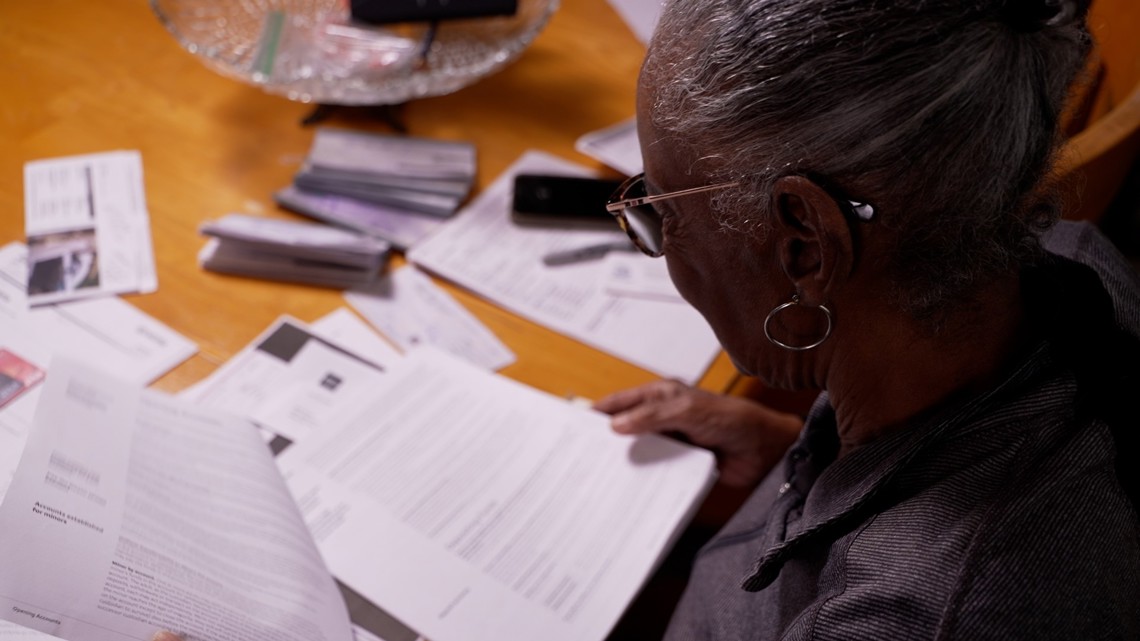

Young provided WFAA copy of her account statement, which lists only the check number and amount — not the name of the person who ultimately cashed the check.

She also said her signature had been altered on the check for reasons she cannot explain.

Byars said she later learned the person who attempted to cash the check initially went to one bank, which refused to process it, believing it was fraudulent. Another bank ultimately cashed it.

In a May 2025 letter, Wells Fargo wrote that under the deposit account agreement, “the customer is responsible for reviewing their monthly account statements and letting us know within 30 days about any errors or unauthorized transactions. The claim will remain denied, and we will not reimburse you for the disputed transactions.”

Byars said Wells Fargo needs to reevaluate its policies, particularly in cases involving elderly customers.

Wells Fargo told us Monday that it is re-reviewing the case.

Young, who had banked with Wells Fargo since 1996, has since closed her account.