Exceptional TSP Performance for 2025: Highest TSP Return Ever Reached?

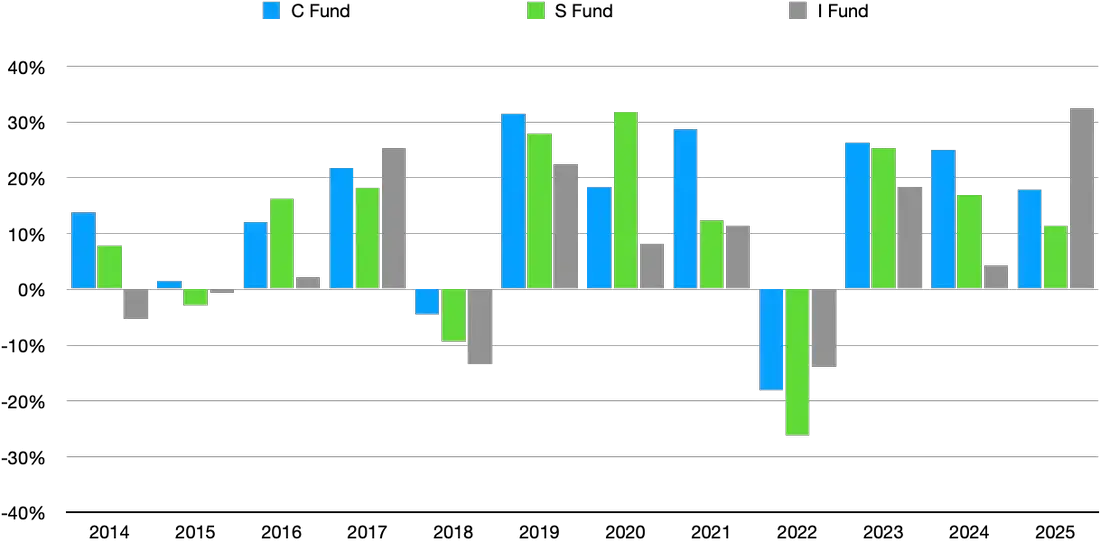

In 2025, annual returns for all TSP funds were up. This is not the first time this has happened, but it is good news for all TSP investors when it does occur. This is the second year in a row that all TSP Funds were up for the year.

The I Fund has been rolling in 2025. It had the best return of any TSP Fund in 2025 with an annual return of 32.45%!

Some readers will conclude, based on their recent memories, that this I Fund return for 2025 is the best any TSP Fund has ever had. That is not the case.

The last time any TSP fund had an annual return of 32.45% or higher prior to the I Fund’s 32.45% in 2025 was in 2013, when the C Fund also posted a 32.45% return, and the S Fund delivered a 38.35% return that year.

No TSP fund achieved ≥32.45% from 2014 through 2024, making 2013 the most recent instance before 2025’s exceptional I Fund performance driven by global (ex-U.S.) market strength.

The highest TSP return ever achieved was the S Fund. It returned 42.92% in 2003. It achieved this return due to a powerful rebound in small- and mid-cap U.S. stocks following the 2000-2002 bear market, triggered by the dot-com bubble burst, the 9/11 attacks, and a brief recession ending in November 2001.

Because of the G Fund, which always has a positive return, there have not been any years in which every TSP Fund had a negative return.

TSP Returns in 2025

Tracking Best TSP Performance

The stock-based funds (C, S, and I) are the only ones capable of reaching such high returns in a single year, as the G Fund typically yields low single digits and the F Fund rarely exceeds mid-teens but, while a distant memory, the F Fund had five years with returns of more than 10%. L Funds, being blends, have even lower peaks.

- C Fund (S&P 500 tracker): Its 2013 return was exactly 32.45%; other notable highs include 37.41% (1995) and 33.17% (1997)

- S Fund (small/mid-cap U.S. stocks): Highest is 42.92% in 2003; also 38.35% (2013) and several years above 32% in strong small-cap rallies

- I Fund (international stocks): I Fund (international stocks, since May 2001): Highest return ever was in 2025 with 32.45%. It hit 30.04% in 2009 (global post-financial crisis rebound)

- F Fund (Fixed Income Index Investment Fund) invests in bonds tracking a broad-based fixed-income index representing intermediate-term U.S. investment-grade bonds. Its highest returns ever were 18.31% in 1995 and 15.75% in 1991. These strong performances were primarily driven by significant declines in interest rates, which boost bond prices (and thus total returns) through capital appreciation, in addition to the coupon income. Bond returns are inversely related to interest rates: Lower inflation expectations, economic slowdowns or recessions prompting Federal Reserve rate cuts, and shifts in investor sentiment toward safer assets (flight to quality) were key catalysts.

- G Fund (government securities): Always low single digits (max ~8-9% in high-rate 1980s); no risk of investor principal so often considered the safest TSP Fund.

Small-cap stocks, which the S Fund tracks via the Dow Jones U.S. Completion Total Stock Market Index, often lead market recoveries because they are more sensitive to economic cycles, were deeply undervalued after the prior downturn (having fallen more sharply than large-cap stocks), and benefited from early-cycle dynamics where higher-risk assets rally first.

The stock-based funds (C, S, I) produce the highest returns during bull markets, with the S Fund holding the record due to small-cap outperformance in certain recoveries.

TSP stock fund returns: 2014-2025

TSP stock fund returns: 2014-2025

Conclusion

The TSP stands as a valuable component of federal employee retirement benefits. The TSP Funds frequently deliver exceptional performance for investors, and the funds are easy to understand, featuring a fund that never has a negative return (G Fund), catering to the most conservative investors seeking minimal risk.

Congratulations to all TSP investors after a great year for your stock funds!

© 2026 Ralph R. Smith. All rights reserved. This article

may not be reproduced without express written consent from Ralph R. Smith.