-

Taiwan Semiconductor Manufacturing (TSM) controls advanced packaging capacity that determines which AI chipmakers can scale production.

-

Google reportedly cut its 2026 TPU production target from 4 million to 3 million units due to limited access to Taiwan Semiconductor’s CoWoS packaging.

-

Nvidia secured over half of Taiwan Semiconductor’s CoWoS capacity through 2027.

-

A recent study identified one single habit that doubled Americans’ retirement savings and moved retirement from dream, to reality. Read more here.

The artificial intelligence (AI) revolution has expanded rapidly since 2023, powering applications from chatbots to autonomous systems and driving trillions in market value. Tech giants have invested heavily in data centers and specialized hardware to meet surging demand for training and inference tasks. However, constraints are emerging that cap this growth rate.

Supply chain bottlenecks, particularly in advanced manufacturing, limit how quickly new AI capabilities can scale. Power availability and component shortages further hinder expansion. It could be that Taiwan Semiconductor Manufacturing (NYSE:TSM) is one of the key linchpins determining how far and fast AI expands.

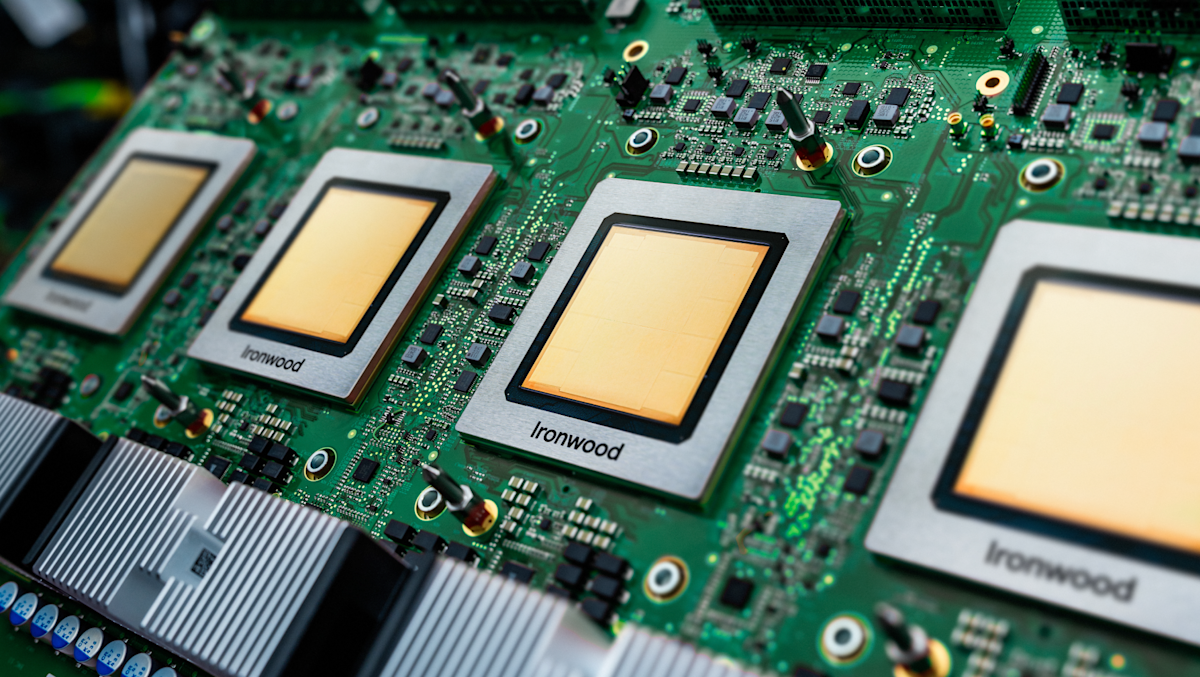

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) has reportedly reduced its 2026 production target for Tensor Processing Units from around 4 million to 3 million units. According to a report by Korea Economic Daily, this adjustment stems from limited access to Taiwan Semiconductor’s CoWoS advanced packaging capacity, which Nvidia (NASDAQ:NVDA) secured through priority allocations. CoWoS integrates processors with high-bandwidth memory on a silicon interposer, essential for high-performance AI accelerators. Without sufficient capacity, finished chips cannot deploy at scale. Other outlets have reported on production caps previously.

Taiwan Semiconductor dominates CoWoS technology, but explosive AI demand has outpaced its expansions. Nvidia has locked in over half of its available capacity through 2026 and 2027, leaving competitors like Google constrained. This forced Google to cut its production target despite strong internal needs for its custom silicon.

The issue underscores how supply allocation now influences the AI hardware landscape more than design or demand alone.

Chipmakers and designers are competing intensely for positions in Taiwan Semiconductor’s production queue. Google’s experience highlights this scramble, where securing advanced packaging determines output volumes. Nvidia’s dominance in allocations gives it an edge in scaling AI accelerators, while others face delays.

Story Continues

This dynamic parallels energy constraints limiting data center buildouts. Power grids struggle to support massive, expanding AI infrastructure, capping expansion opportunities. Yet Taiwan Semiconductor Manufacturing controls the core components inside those centers, from logic dies to packaged accelerators. Its role as the primary foundry for leading-edge nodes makes it central to AI progress. Without its capacity ramps, even abundant energy would not translate to deployable hardware.

Taiwan Semiconductor is accelerating capacity expansion through 2028, doubling its advanced wafer capabilities. It is also repurposing 200 mm fabs for advanced packaging, which could increase its returns. If fully utilized, it would not be surprising to see revenue double by 2028.

Yet the CoWoS shortage could end up boosting the competition, which moves in to fill the void created. Intel (NASDAQ:INTC), for example, is aiming to rival Taiwan Semiconductor in foundry services. Google has explored alternatives like Intel’s EMIB packaging for future TPUs, such as the v9 accelerator expected around 2027. Broadcom (NASDAQ:AVGO) also is said to have placed orders with Intel, while Apple could tap Intel’s 18A process for its entry-level M-series chips starting in 2027.

The foundry’s focus on custom ASICs and advanced packaging puts it in step with industry needs for efficient AI compute. Its 18A and 14A nodes, plus EMIB, position it to capture business from hyperscalers seeking alternatives. Intel is scaling its New Mexico facility’s capacity by 30% for EMIB and 150% for Foveros, its own advanced 3D packaging technology.

Yet Nvidia reportedly reviewed and passed on using Intel’s facilities, though both Google and Apple are reportedly also sounding out Samsung‘s two facilities in Texas to meet their needs. Samsung is offering advanced packaging as a “turnkey” solution bundled with DRAM and foundry services to hyperscalers such as Google, Advanced Micro Devices (NASDAQ:AMD), and Amazon (NASDAQ:AMZN).

So, while Taiwan Semiconductor remains dominant, its capacity issues create openings for its competitors to gain traction and, in Intel’s case, validate its turnaround strategy.

While Nvidia seems to have the inside track on commanding priority, boosting its long-term dominance in the space, Taiwan Semiconductor Manufacturing is increasingly the key to whether other chipmakers and designers thrive. As advanced packaging becomes the new industry bottleneck, its CoWoS capacity can determine who scales compute.

This kingmaker capability — Taiwan Semiconductor deciding where the players stand in line — can ultimately decide the AI market’s winners and losers.

Most Americans drastically underestimate how much they need to retire and overestimate how prepared they are. But data shows that people with one habit have more than double the savings of those who don’t.

And no, it’s got nothing to do with increasing your income, savings, clipping coupons, or even cutting back on your lifestyle. It’s much more straightforward (and powerful) than any of that. Frankly, it’s shocking more people don’t adopt the habit given how easy it is.