Plenty of financial and regulatory hurdles still need to be cleared, but a fuels pipeline project that may lead to lower gas prices in San Diego and Southern California has received a healthy amount of interest from other companies.

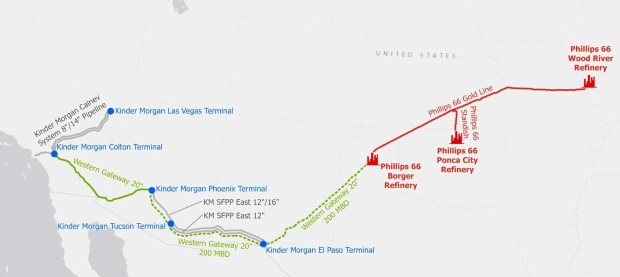

Phillips 66 and Kinder Morgan have proposed building what they’ve dubbed the Western Gateway Pipeline that would use a combination of existing infrastructure plus new construction to establish a corridor for refined products that would stretch 1,300 miles from St. Louis to California.

If completed, one leg of the pipeline would be the first to deliver motor fuels into California, a state often described as a fuel island that is disconnected from refining hubs in the U.S.

The two companies recently announced the project “has received significant interest” from shippers and investors from what’s called an “open season” that wrapped up on Dec. 19 — so much so that a second round will be held this month for remaining capacity.

“That’s a strong indicator that people would be willing to commit to put volume on that pipeline to bring it west long enough for them to be able to pay off their investment and provide a return for their investors,” said David Hackett, president of Stillwater Associates, a transportation energy consulting company in Irvine. “They won’t build this thing on spec. They’ll need commitments from shippers to do this.”

The plans for the Western Gateway Pipeline include constructing a new line from the Texas Panhandle town of Borger to Phoenix. Meanwhile, the flow on an existing pipeline that currently runs from the San Bernardino County community of Colton to Arizona would be reversed, allowing more fuel to remain in California.

The entire pipeline system would link refinery supply from the Midwest to Phoenix and California, while also providing a connection into Las Vegas.

The proposed route for the Western Gateway Pipeline, a project announced by Phillips 66 and Kinder Morgan designed to bring refined products like gasoline to states such as Arizona and keep more supplies within California. (Phillips 66)

The proposed route for the Western Gateway Pipeline, a project announced by Phillips 66 and Kinder Morgan designed to bring refined products like gasoline to states such as Arizona and keep more supplies within California. (Phillips 66)

A spokesperson for Kinder Morgan told the Union-Tribune in October that there are no plans for the project to construct any new pipelines in California and the proposal “should put downward pressure” on prices at the pump.

“With no new builds in California and using pipelines currently in place, it’s an all-around win-win — good for the state and consumers,” Kinder Morgan’s director of corporate communications, Melissa D. Ruiz, said in an email.

The second round of “open season” will include offerings of new destinations west of Colton that would allow Western Gateway shippers access to markets in Los Angeles.

Even with sufficient investor support, the project would still have to go through an extensive regulatory and permitting process that would undoubtedly receive pushback from environmental groups.

Should the pipeline get built, Hackett said it’s hard to predict what it would mean at the pump for Southern California drivers. But he said the project could ensure more fuel inventory remains inside California, thus reducing reliance on foreign imports, especially given potential political tensions in the South China Sea.

“I’d much rather have our gas come from Texas or Missouri than from Asia, at least from a geopolitical strategic standpoint,” Hackett said.

This past summer, Reuters reported that California’s fuel imports hit their highest levels in four years.

About 70% of the imports — roughly 187,000 barrels per day — came from South Korea and other Asian countries that have long been top trading partners for California and other states along the West Coast, according to Kpler, an international firm that tracks global shipping and trade.

Fuel supplies and gasoline prices have received greater focus in the wake of a pair of refinery closures in California.

Phillips 66 planned to shutter operations at its twin refinery in the Los Angeles area by the close of 2025, and Valero is scheduled to close down its 145,000-barrel-per-day facility in the Northern California city of Benicia in April. The Valero and Phillips 66 facilities combine to account for about 18% of the state’s crude oil capacity.

The average price for a gallon of gasoline is higher in California than in any other state in the continental U.S., according to AAA.

On Tuesday, the average price in the Golden State was $4.254 while the national average came to $2.815. Hawaii had the highest average in the country, at $4.423 per gallon.