The Bay Area and California both had robust job gains in November 2025 that represented rebounds from months of dismal employment trends, a new federal report released Wednesday shows.

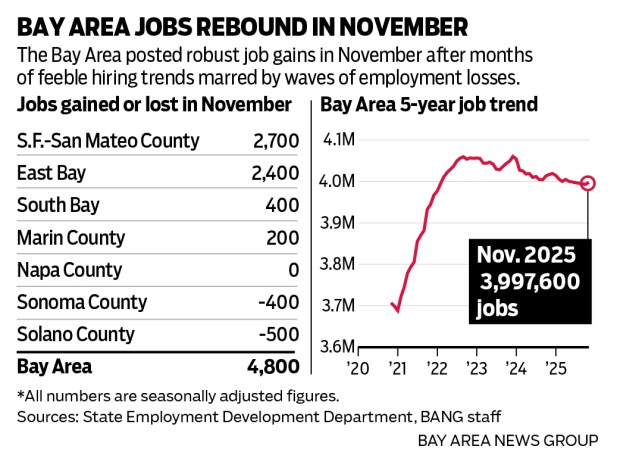

Delayed by a weeks-long government shutdown last year, the latest jobs report from the U.S. Bureau of Labor Statistics revealed that the Bay Area gained 4,800 jobs, snapping six consecutive months of employment losses for the region.

“It’s nice to finally see a jobs report for the region that has employment gains,” said Jeff Bellisario, executive director of the Bay Area Council Economic Institute. “Much of the region’s struggle has been linked to downsizing in tech firms and other knowledge-based sectors. Our hope is that much of this downsizing has run its course.”

California added 32,500 jobs in November after gaining 1,500 jobs the previous month, the federal agency reported.

“The Bay Area and California economies showed encouraging signs of labor market stabilization in November,” said Scott Anderson, chief U.S. economist for BMO Capital Markets.

The statewide unemployment rate was 5.5% in November, down from 5.6% in September. The government didn’t report an October rate due to the timing of the federal shutdown.

“A convincing return to net job growth and the first tick down in the state unemployment rate since March provided some tangible reasons for optimism,” Anderson said.

California still has the nation’s highest unemployment rate and is only one of five states with a rate of 5% or higher. New Jersey has the next-highest at 5.4%.

The South Bay gained 400 jobs in November, an upswing that ended four consecutive months of job losses.

The South Bay gained 400 jobs in November, an upswing that ended four consecutive months of job losses.

The East Bay added 2,400 jobs in November, marking the third straight month of surging employment. The region had lost jobs for four straight months from May through August of 2025.

The San Francisco-San Mateo region gained 2,700 jobs in November on the heels of an increase of 1,100 positions in October. But the job market picture may not be as rosy as it appears.

“The job gains are certainly better than more losses, but are less than they seem if the California data is an indicator for the Bay Area,” said Steve Levy, director of the Center for Continuing Study of the California Economy. “At the state level, nearly 90% of the November gains were in health care, leisure and hospitality, and government. The manufacturing sector lost jobs.”

Some upcoming turbulence outside of the control of California’s employers could pose problems ahead, Levy warned.

“The federal freeze on funding for social services and the expected news about the state deficit should temper any enthusiasm,” Levy said.

Despite gains in November, the first 11 months of 2025 were dismal for the Bay Area and California. From January through November, California lost 7,500 jobs while the Bay Area shed 21,300.

The three largest urban sectors in the Bay Area also suffered a sour January-through-November job market – the South Bay shed 9,200 jobs, the East Bay lost 6,600, and the San Francisco-San Mateo region suffered a decline of 3,300.

“We would need to see a string of improved monthly job growth numbers to materially lift our 2026 economic outlook for California and the Bay Area,” Anderson said.

The Bay Area’s decades-long role as the primary engine of California’s economy appears to have dwindled, warned Michael Bernick, an employment attorney with law firm Duane Morris and a former director of California’s labor agency.

“For most of the time since the early 2000s, the Bay Area has powered the state’s job growth, with an outsized number of the new jobs,” Bernick said. “In the post-pandemic period, the Bay Area’s job contribution has decreased.”

This unsettling pattern for the Bay Area emerged again during November, according to Bernick.

“The Bay Area, with 3.9 million jobs, has around 21% of the state’s total,” Bernick said. “Yet, in November, the Bay Area contributed only 13.7% of the state job gains.”

The U.S. job market is growing three times faster than California’s employment sector. Over the one-year period that ended in November, nonfarm payroll job totals grew 0.6% in the nation but only by 0.2% in California.

Job totals fell 0.5% in the Bay Area and the East Bay, declined by 0.7% in the South Bay, and dropped 0.4% in the San Francisco-San Mateo region over the yearlong period ending in November.

But Russell Hancock, president of Joint Venture Silicon Valley, a San Jose-based think tank, says the newest numbers are a good sign.

“The Bay Area is basically a cocktail of multiple interacting forces, which is keeping our economy stationary right now and for the foreseeable future,” Hancock said. “There’s nothing wrong with that. It beats the alternative.”

The tech industry remains in a cautious state and appears reluctant to hire workers, a sharp contrast to the growth after the COVID-19 pandemic fueled demand for tech services to enable remote work.

“At the front end of 2025, folks were still right-sizing after the pandemic, at which point our major employers shifted into efficiency mode,” Hancock said.

Tech companies also began to chase potential opportunities arising from cutting-edge industries.

“Into all of that you introduce artificial intelligence, which adds jobs in one place and subtracts them from another,” Hancock said. “AI is growing and is creating opportunity and profitability, but it looks to be a wash on the job front.”

Despite short-term gains for the Bay Area, Bellisario warned the region still faces nagging woes that remain unsolved.

“One month is far from a trend,” Bellisario said. “The high costs of doing business in the Bay Area and limited regional population growth remain unchanged. Both act as a cap on our potential for growth going forward.”