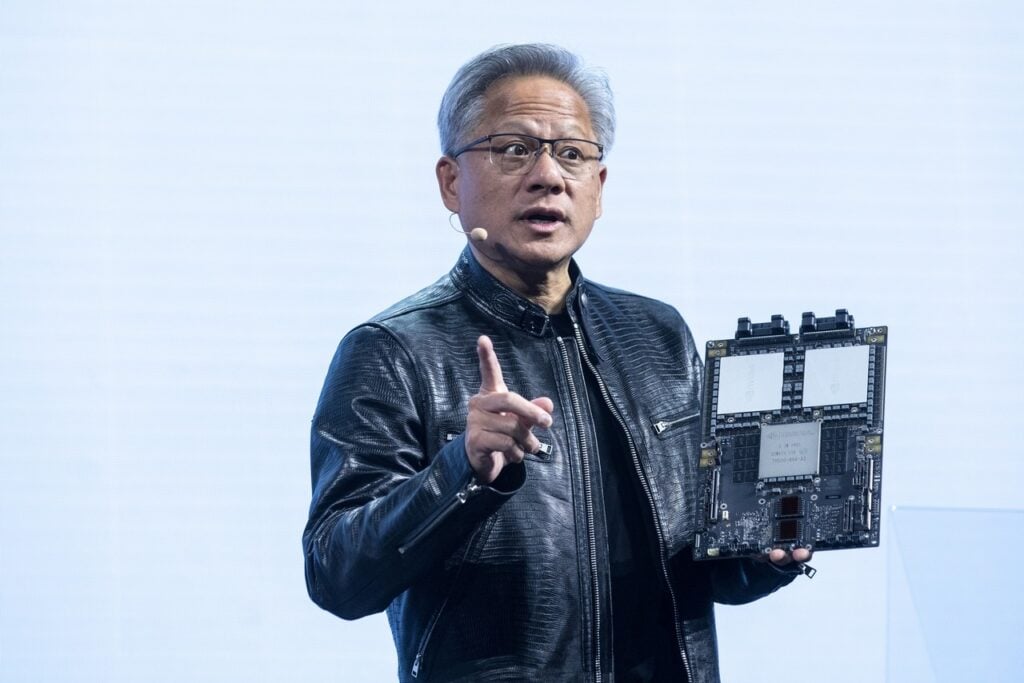

On Tuesday, Nvidia Corp (NASDAQ:NVDA) CEO Jensen Huang said the chipmaker’s $500 billion AI demand outlook won’t be revised quarter by quarter, even as new developments continue to push expectations higher.

Huang told Kif Leswing, CNBC’s tech reporter, that he does not plan to regularly update the $500 billion visibility figure for AI-related demand, according to a post on X by Kristina Partsinevelos, a correspondent for the network

Huang said the number reflects what Nvidia can already see on its books across 2025 and 2026, but added that “many new developments should increase our expectation,” signaling upside beyond the headline figure.

NEW: $NVDA CEO tells @kifleswing he won’t update the $500B visibility figure regularly but “many new developments should increase our expectation.” Notes Anthropic joining $NVDA is “big news”. Says open models (DeepSeek, Qwen, Llama) were a major surprise generating 1 in 4 tokens https://t.co/4GQXAhmie9

Don’t Miss:

The $500 billion visibility includes demand for Nvidia’s Blackwell GPUs, next-generation Vera Rubin chips and related systems and networking hardware.

In another post, Partsinevelos noted that Nvidia CFO Colette Kress reinforced that message, saying the $500 billion visibility has increased since the company’s GTC conference in October.

“So yes, that $500 billion has definitely gotten larger,” Kress said, noting that Nvidia is already seeing orders for Vera Rubin as customers plan full-year volumes.

Those customers include major cloud service providers, AI model developers and so-called neoclouds, signaling that demand for Nvidia’s next-generation platforms is being locked in well ahead of launch.

NEW: Nvidia CFO says the $500B visibility through 2026 (Blackwell + Rubin shipments) grew since GTC in October. “So yes, that $500B has definitely gotten larger.” Seeing orders for Vera Rubin as customers plan full-year volumes across CSPs, model makers, neoclouds. $NVDA https://t.co/afqDpcgsSg

See Also: An EA Co-Founder Shapes This VC Backed Marketplace—Now You Can Invest in Gaming’s Next Big Platform Before the Raise Ends 1/19

Huang also pointed to the rapid rise of open-source AI models as a surprise driver of demand, saying models such as DeepSeek, Qwen and Meta Platforms, Inc.’s (NASDAQ:META) Llama are now generating roughly one in four tokens.